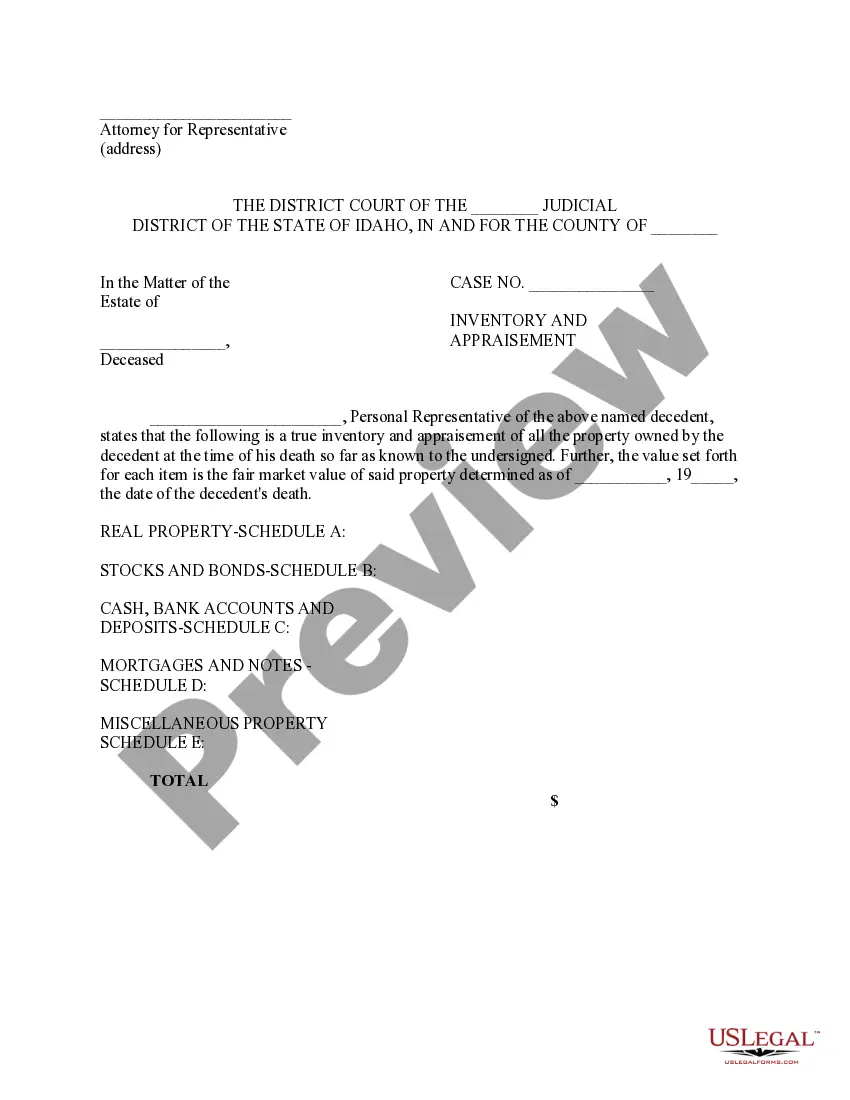

Inventory and Appraisement: An Inventory and Appraisement is filed by the Personal Representative of an estate. It lists in detail all of the estate's assets, as well as its debts. This form is available in both Word and Rich Text formats.

Probate Inventory Form Without

Description

Form popularity

FAQ

An inventory lists all assets and property in the estate, detailing what is owned and its value. On the other hand, accounting includes a record of transactions, showing how assets and funds have been managed over time. Understanding this distinction is crucial when using a Probate inventory form without, as it helps ensure that you accurately report both current assets and any financial activities related to the estate.

Creating an inventory list for an estate involves assessing and listing all assets owned by the deceased. Begin by identifying real estate, personal belongings, and financial accounts. Utilizing a Probate inventory form without makes this task straightforward and efficient, as it provides a template to work from, allowing you to focus on compiling comprehensive details.

To create an inventory list, start by gathering all assets that belong to the estate. Document each item or asset clearly, noting details such as descriptions, values, and locations. Using a Probate inventory form without provides a structured way to organize this information. This form simplifies the process and ensures you capture everything accurately.

An asset inventory should encompass various items such as real estate, vehicles, bank accounts, and personal belongings. It should also account for debts and liabilities to provide a complete picture of the estate's financial status. Utilizing a probate inventory form without capturing all relevant details may lead to incomplete assessments. Resources like uslegalforms can guide you through creating a comprehensive inventory tailored to your needs.

Inventory refers to items held in stock that are ready for sale or use. In the context of probate, it includes assets owned by the deceased that can be liquidated or transferred. While inventory is often viewed as a current asset for businesses, in probate, it signifies the tangible items to be evaluated. Utilizing a probate inventory form without proper documentation can lead to confusion, so clarity is key.

Understanding the values of inventory is crucial for your financial planning. Inventory represents the items owned by an estate and is computed based on their fair market value. When managing a probate inventory form without addressing these values, you risk overlooking potential assets. By accurately accounting for inventory, you ensure clarity in the estate’s total worth.

Inventory form J243 is a specific legal document used in certain jurisdictions to record the inventory of a decedent's estate. This form outlines the assets and their estimated values, ensuring transparency throughout the probate process. If you need help with managing your estate's assets, using a Probate inventory form without can provide a clear pathway to produce the necessary documentation for form J243.

The inventory of assets of the deceased is a systematic catalog of all items and property the individual owned when they passed away. It aids estate executors and beneficiaries by ensuring that all assets are accounted for during the probate process. By filling out a Probate inventory form without, you can simplify the process and maintain transparency among heirs about what belongs to the estate.

Inheritance inventory is essentially a detailed record of items and assets inherited from a deceased person. It serves as a guide for beneficiaries to understand what they have received and provides essential information for the estate settlement process. Completing a Probate inventory form without helps clarify the specifics of the inheritance inventory and supports a smoother transition of assets.

Assets of a deceased estate typically refer to everything the deceased owned, including physical property, investments, and bank accounts. These assets play a vital role during the probate process, as they determine the estate's value and how it will be distributed. To streamline this process, using a Probate inventory form without can help create an organized presentation of these assets.