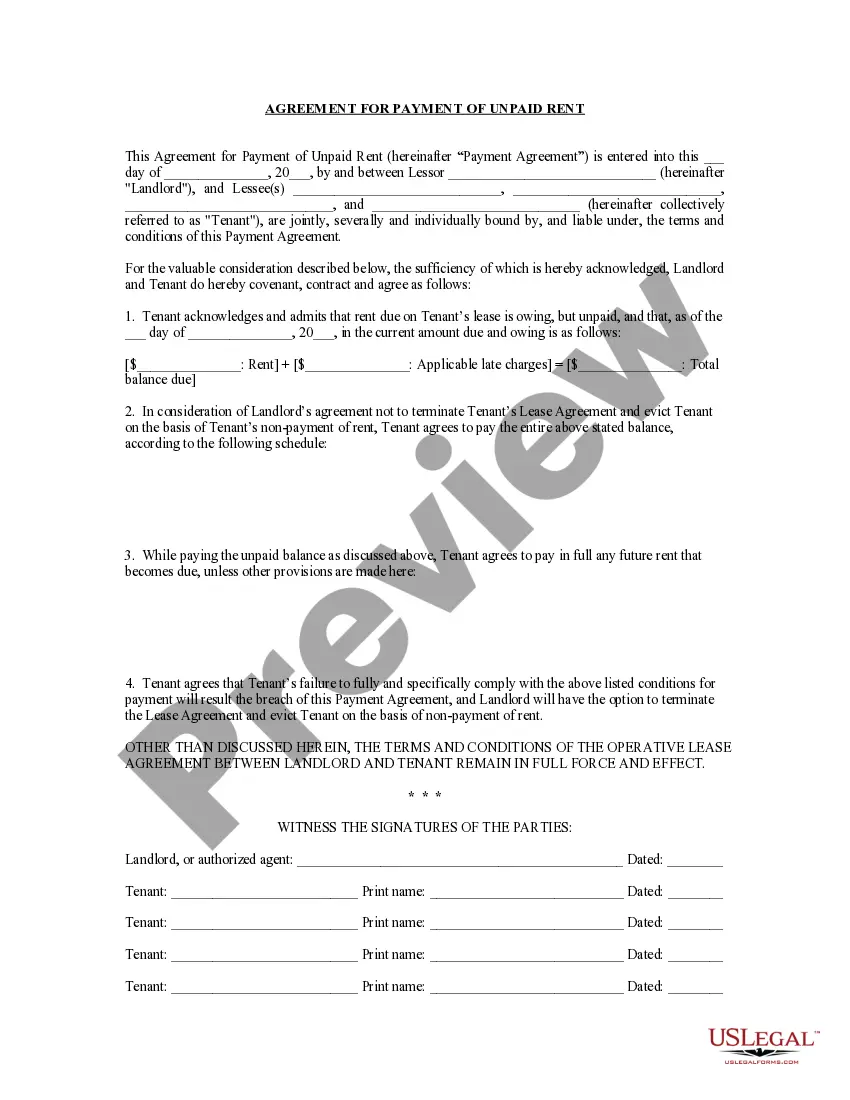

This Agreement for Payment of Unpaid Rent is an agreement between a landlord and tenant. An Agreement for Payment of Unpaid Rent provides for the structuring and deadlines for a tenant's payment of overdue rent in return for landlord agreeing not to have tenant evicted. This form meets all state law specifications.

Idaho Agreement Form Withholding

Description

How to fill out Idaho Agreement Form Withholding?

Well-structured formal documentation is one of the crucial assurances for preventing issues and legal disputes, but obtaining it without a lawyer's help may require time.

Whether you need to swiftly locate an updated Idaho Agreement Form Withholding or any other templates for employment, family, or business scenarios, US Legal Forms is always available to assist.

The process is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected file. Moreover, you can access the Idaho Agreement Form Withholding anytime later, as all documents ever obtained on the platform are accessible within the My documents section of your profile. Save time and resources on preparing official documentation. Try US Legal Forms now!

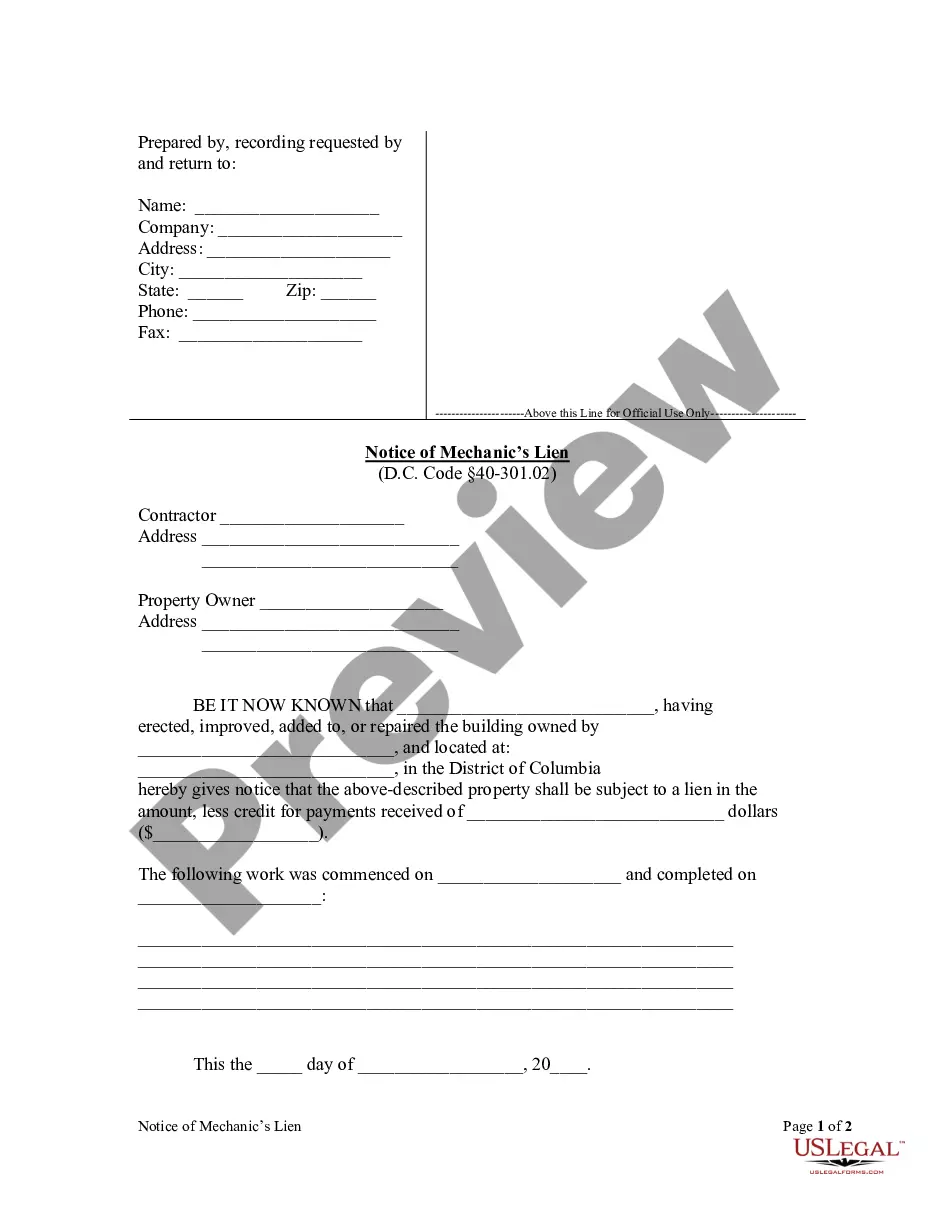

- Ensure that the form is appropriate for your situation and jurisdiction by reviewing the description and preview.

- Search for another example (if required) using the Search bar in the header of the page.

- Click Buy Now when you discover the suitable template.

- Choose a pricing plan, Log Into your account, or create a new one.

- Select your preferred payment method to purchase the subscription plan (either by credit card or PayPal).

- Choose PDF or DOCX file format for your Idaho Agreement Form Withholding.

- Click Download, then print the template to fill it out or upload it to an online editor.

Form popularity

FAQ

Claim allowances for you or your spouse.If you're married filing jointly, only one of you should claim the allowances. The other should claim zero allowances. If you work for more than one employer at the same time, you should claim zero allowances on your W-4 with any employer other than your principal employer.

Here's your rule of thumb: the more allowances you claim, the less federal income tax your employer will withhold from your paycheck (the bigger your take home pay). The fewer allowances you claim, the more federal income tax your employer will withhold from your paycheck (the smaller your take home pay).

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Steps to take NOW:Use the withholding estimator at IRS.gov to estimate your federal withholding. Update the federal Form W-4 with that information.Use page 2 of the Form ID W-4 to estimate your Idaho withholding. Fill out Form ID W-4 with that information.Give both W-4 forms to your employer.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.