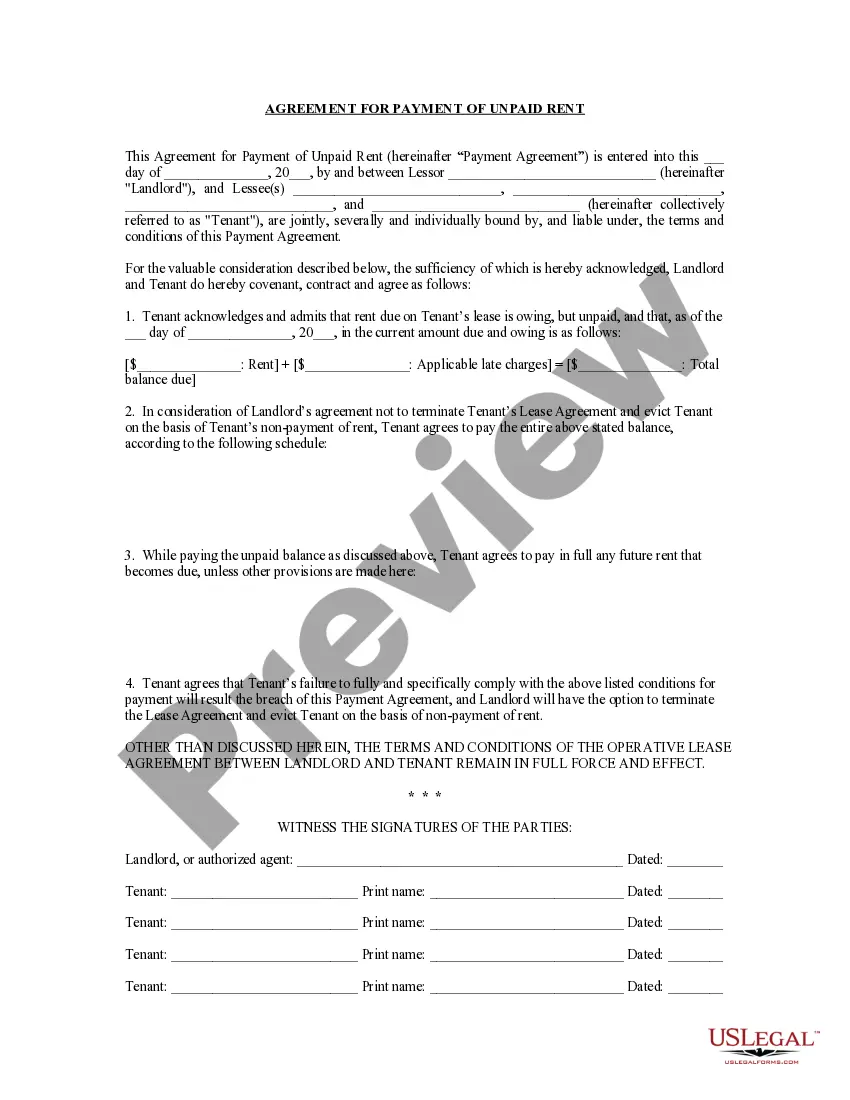

This Agreement for Payment of Unpaid Rent is an agreement between a landlord and tenant. An Agreement for Payment of Unpaid Rent provides for the structuring and deadlines for a tenant's payment of overdue rent in return for landlord agreeing not to have tenant evicted. This form meets all state law specifications.

Idaho Agreement Form Withholding Payment

Description

How to fill out Idaho Agreement Form Withholding Payment?

When you must finalize the Idaho Agreement Form Withholding Payment that adheres to your local state's statutes and regulations, there may be numerous options available. There’s no need to sift through every document to ensure it fulfills all the legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any subject.

US Legal Forms has the largest online collection with an archive of over 85,000 ready-to-use documents for both business and personal legal matters. All templates are verified to align with each state’s regulations.

Pay for a subscription (PayPal and credit card options are available). Download the template in your preferred file format (PDF or DOCX). Print the document or complete it electronically using an online editor. Obtaining correctly drafted official documents becomes effortless with US Legal Forms. Moreover, Premium users can also take advantage of powerful integrated tools for online document editing and signing. Try it today!

- Therefore, when downloading the Idaho Agreement Form Withholding Payment from our site, you can be assured that you possess a legitimate and current document.

- Acquiring the necessary template from our platform is exceedingly straightforward.

- If you already have an account, just Log In to the system, verify your subscription is active, and save the selected file.

- Later, you can access the My documents section in your profile and keep access to the Idaho Agreement Form Withholding Payment at any time.

- If this is your initial experience with our website, please follow the guidelines below.

- Browse through the suggested page and ensure it satisfies your criteria.

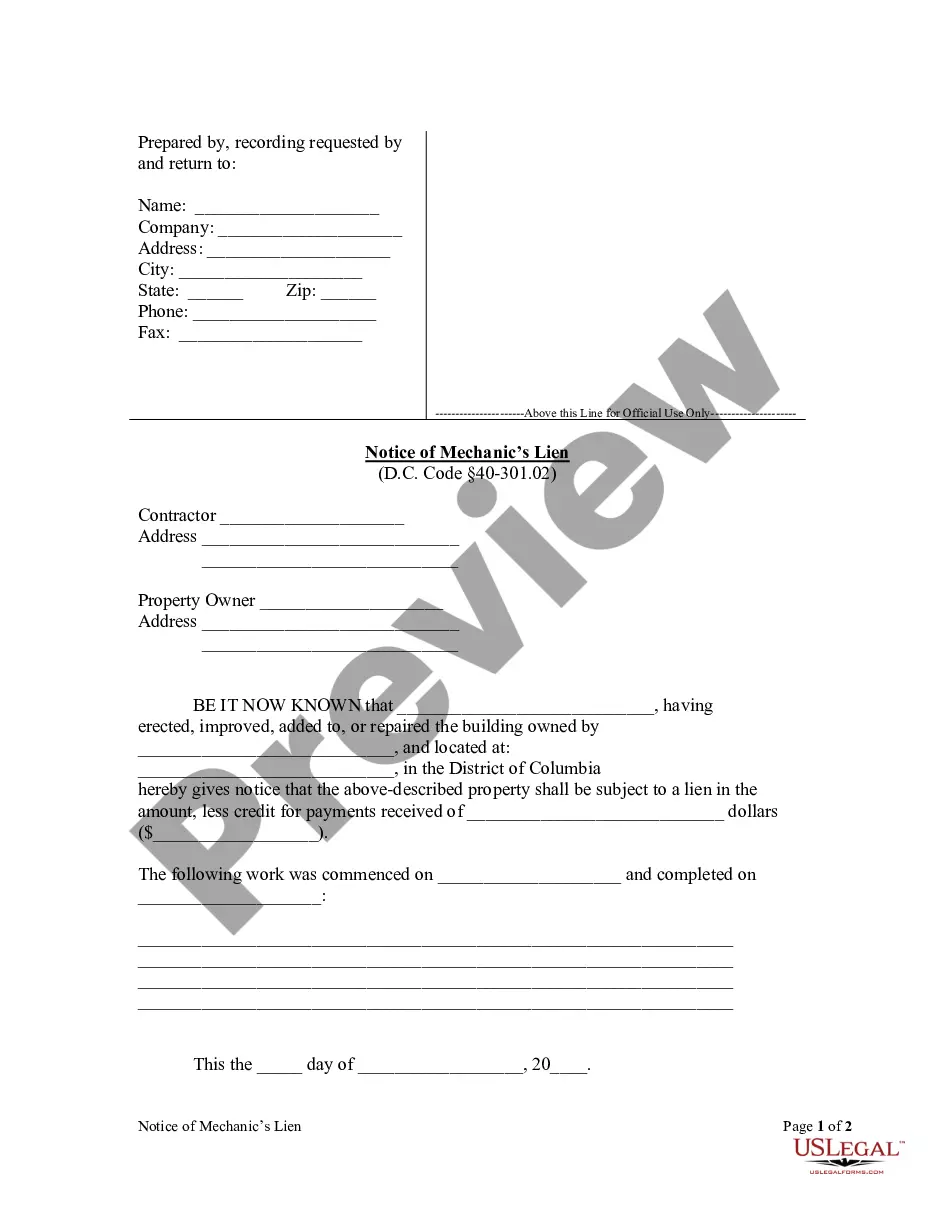

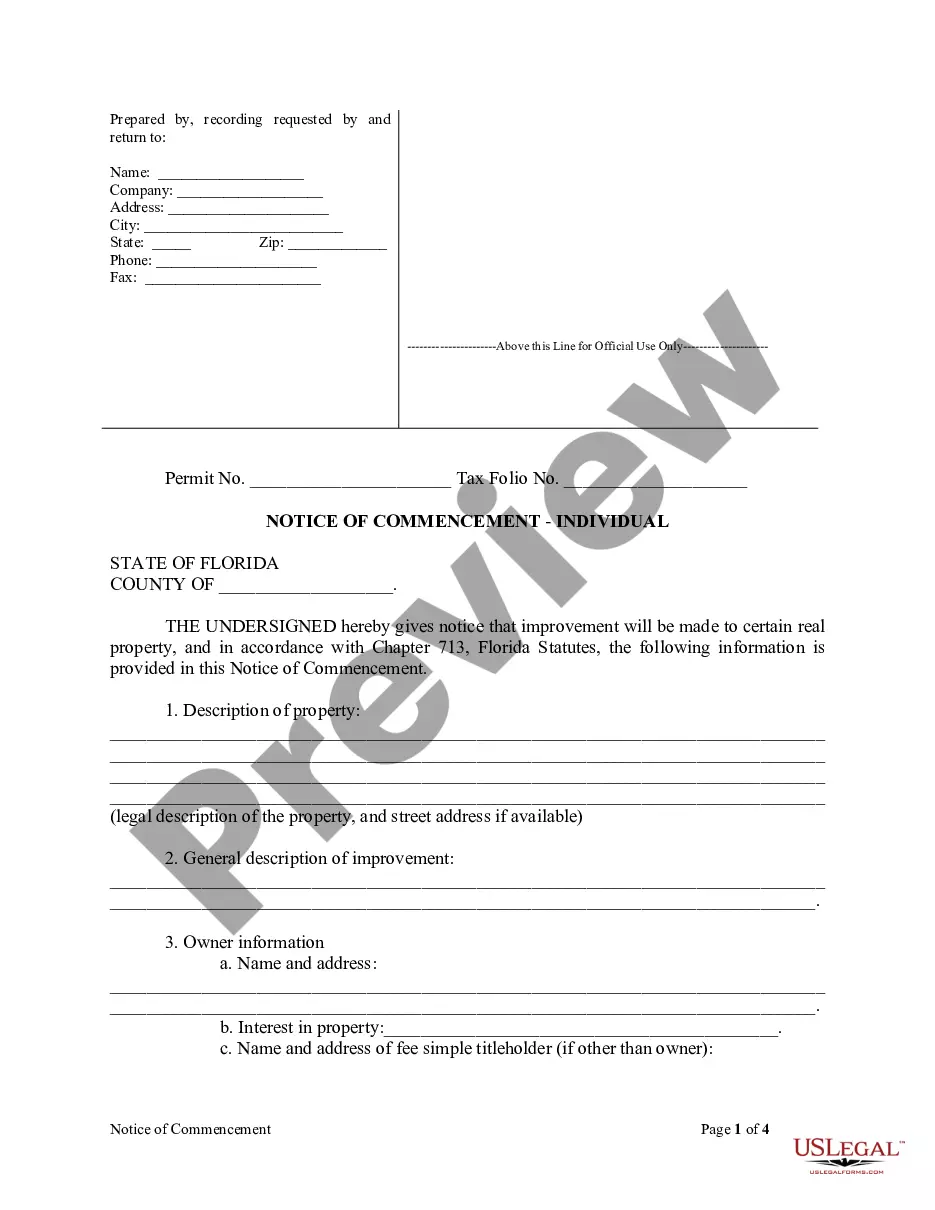

- Use the Preview mode and review the form description if available.

- Search for another template via the Search bar at the top if needed.

- Click Buy Now once you find the suitable Idaho Agreement Form Withholding Payment.

- Choose the most suitable subscription plan, Log Into your account, or create a new one.

Form popularity

FAQ

You must have a federal Employer Identification Number (EIN) before you apply for an Idaho withholding account. Apply for an EIN with the IRS. After you have your EIN, visit our Idaho Business Registration Information guide. Follow the instructions to register for an Idaho withholding account.

You can claim fewer allowances but not more. If you're married, claim your allowances on the W-4 for the highest-paying job for the most accurate withholding. If you're married filing jointly, only one of you should claim the allowances. The other should claim zero allowances.

Multiply the wages for the pay period by the number of pay periods in the calendar year. Subtract the Idaho Child Tax Credit allowances from the gross wages to determine the amount subject to withholding. Use this figure and the annual tables to compute the amount of withholding required.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

Complete Form ID W-4 so your employer can withhold the correct amount of state income tax from your paycheck. Sign the form and give it to your employer. Use the information on the back to calculate your Idaho allowances and any additional amount you need withheld from each paycheck.