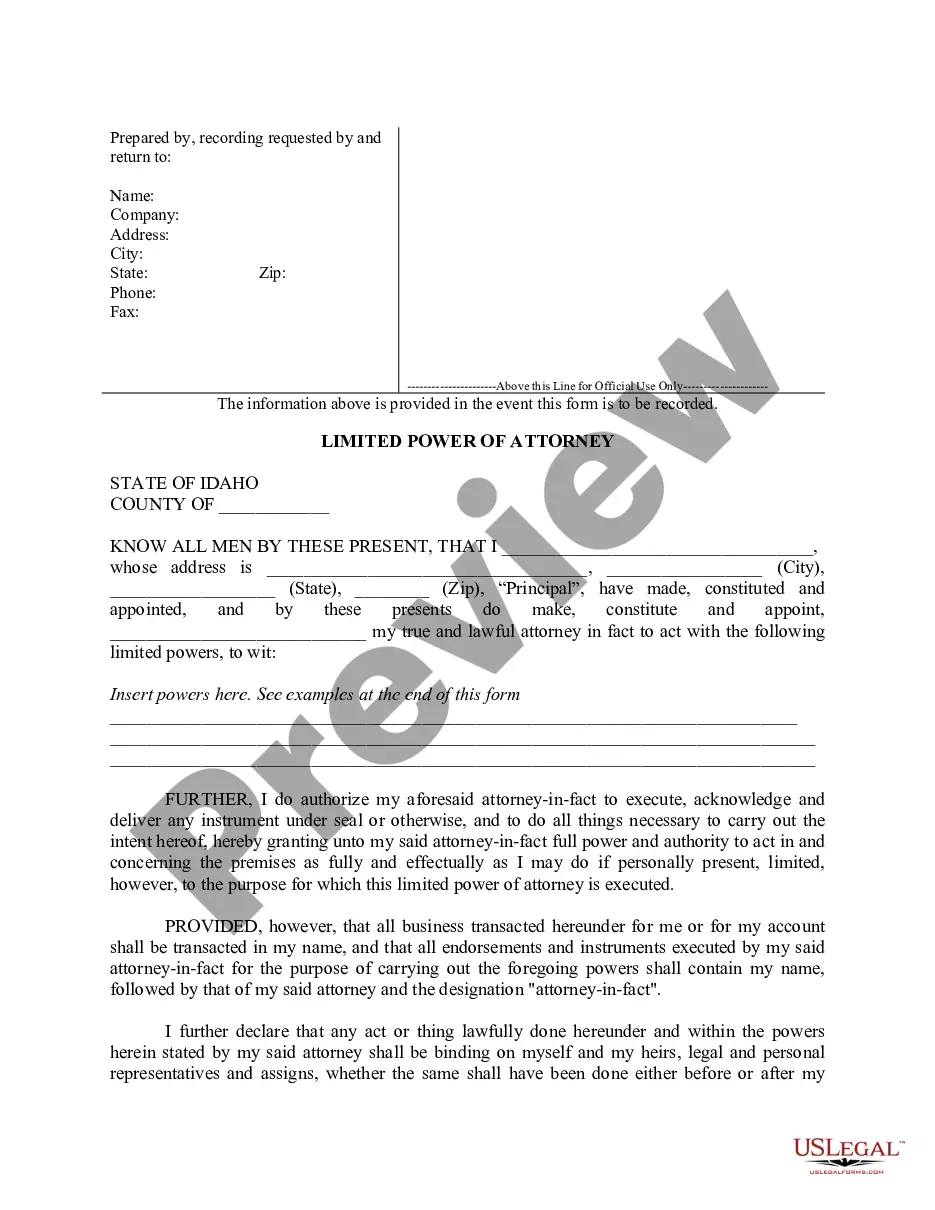

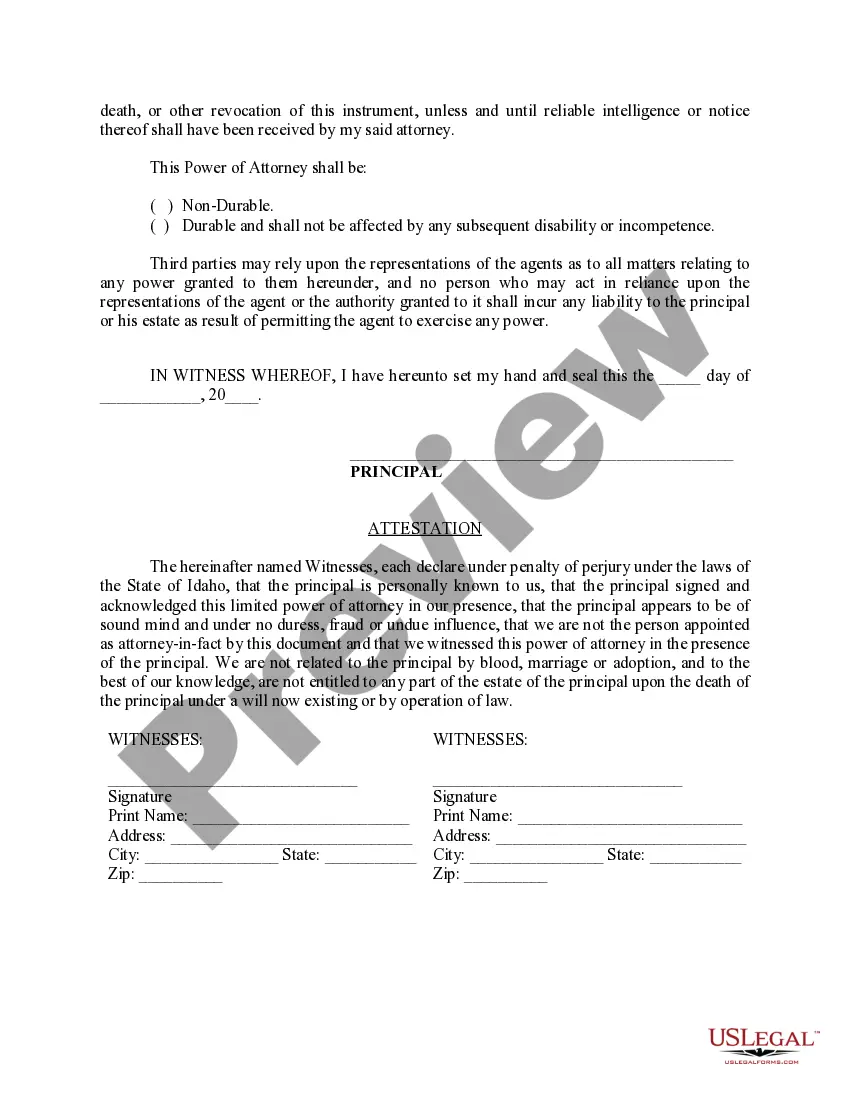

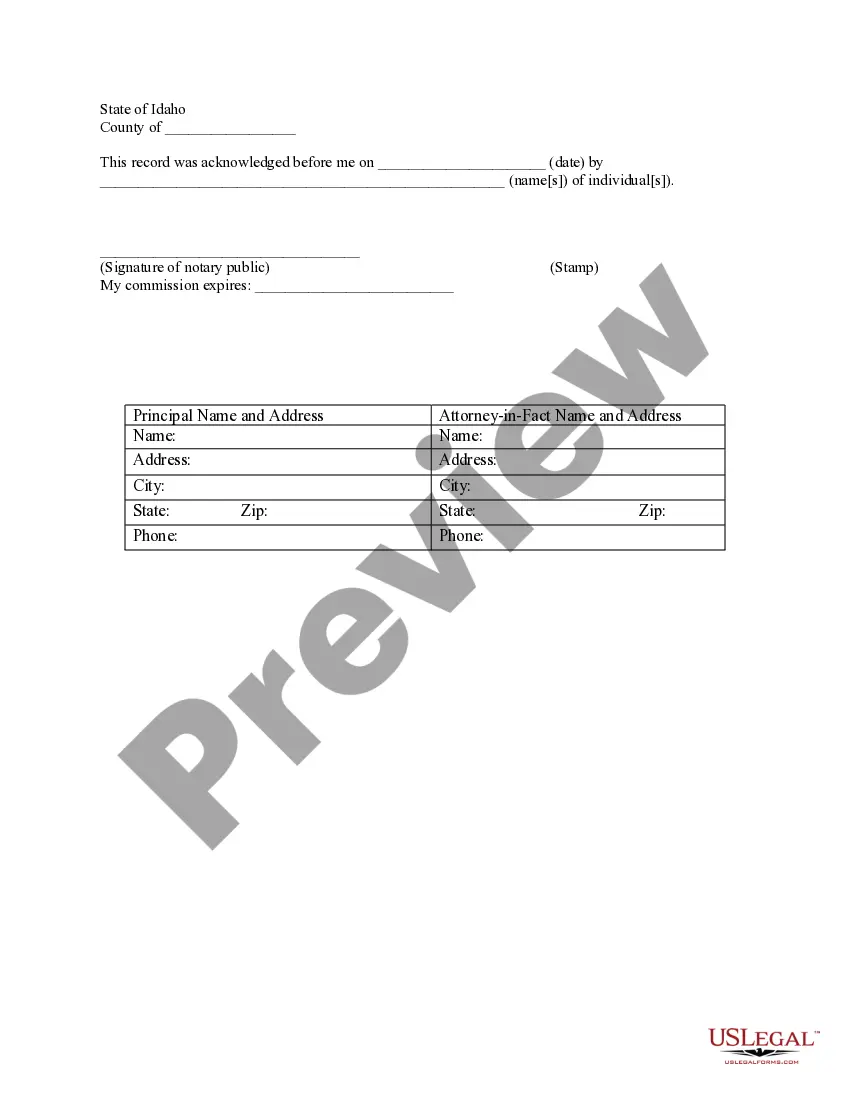

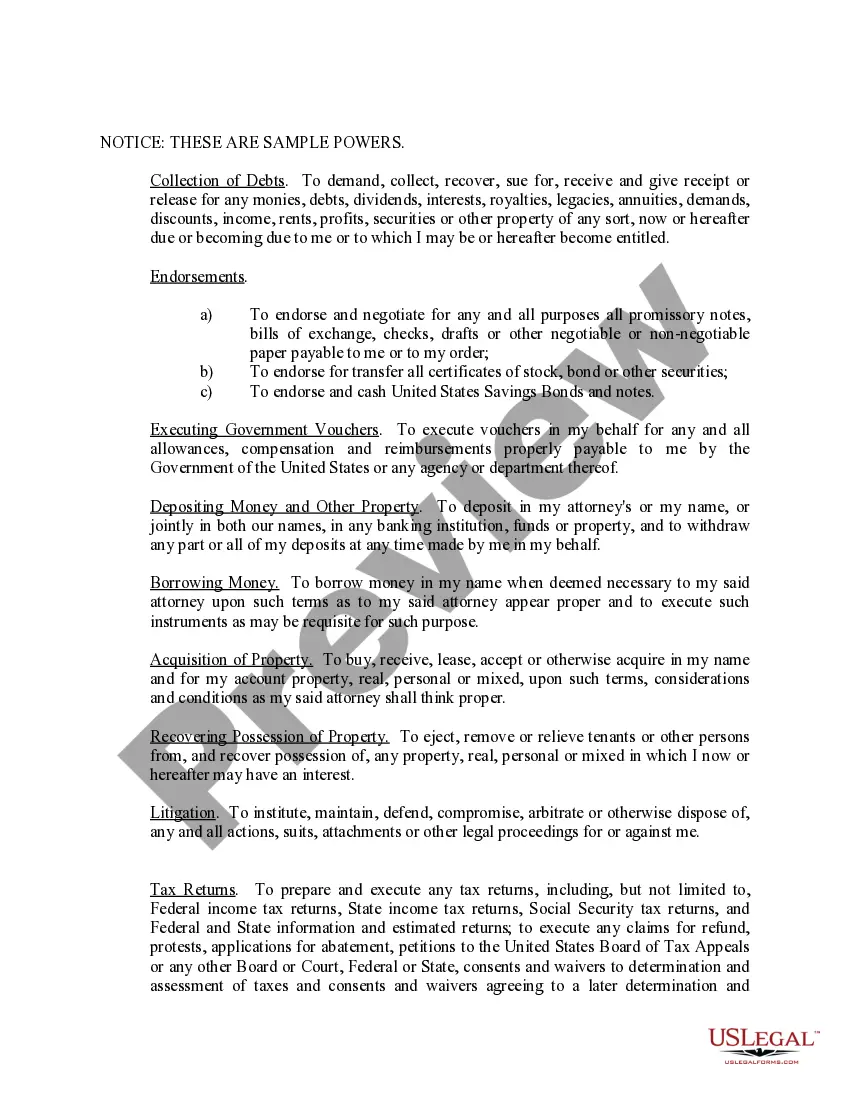

This is a limited power of attorney for Idaho. You specify the powers you desire to give to your agent. Sample powers are attached to the form for illustration only and should be deleted after you complete the form with the powers you desire. The form contains an acknowledgment in the event the form is to be recorded.

Limited Power Of Attorney With Irs

Description

How to fill out Limited Power Of Attorney With Irs?

Properly composed official documentation serves as a crucial safeguard against issues and legal disputes; however, acquiring it independently may require time. If you need to promptly find an updated Limited Power Of Attorney With Irs or other templates for work, family, or business events, US Legal Forms is readily available to assist.

It is an intuitive platform featuring over 85,000 legal documents curated by state and area of application, validated by professionals for adherence to local laws and regulations.

The procedure is even more straightforward for existing members of the US Legal Forms library. If you have an active subscription, you simply need to Log In to your account and click the Download button beside the chosen document. Moreover, you can access the Limited Power Of Attorney With Irs at any time in the future, as all documentation previously obtained on the platform is stored under the My documents section of your profile. Save time and finances on creating official documents. Experience US Legal Forms today!

- Confirm the form is appropriate for your needs and locality by examining the description and preview.

- Search for an alternative sample (if necessary) using the Search bar located in the header.

- Press Buy Now upon finding the relevant template.

- Choose a pricing option, Log Into your account, or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Pick either PDF or DOCX format for your Limited Power Of Attorney With Irs.

- Hit Download, then print the document to complete it by hand or upload it to an online editor.

Form popularity

FAQ

The process to mail or fax authorization forms to the IRS is still available. Signatures on mailed or faxed forms must be handwritten. Electronic signatures are not allowed.

I want to highlight one option in particular the electronic signature. The Taxpayer First Act (TFA) of 2019 requires the IRS to provide digital signature options for Form 2848, Power of Attorney, and Form 8821, Tax Information Authorization.

As for the Internal Revenue Service, Menashe says the IRS accepts a durable power of attorney when the document authorizes the named decision-maker to handle tax matters. Even so, the person will be required to execute IRS Form 2848 and file an affidavit before being recognized by the IRS.

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.

During the past year, the average time the IRS took to process a POA fluctuated from 22 days to over 70 days and is currently 29 days.