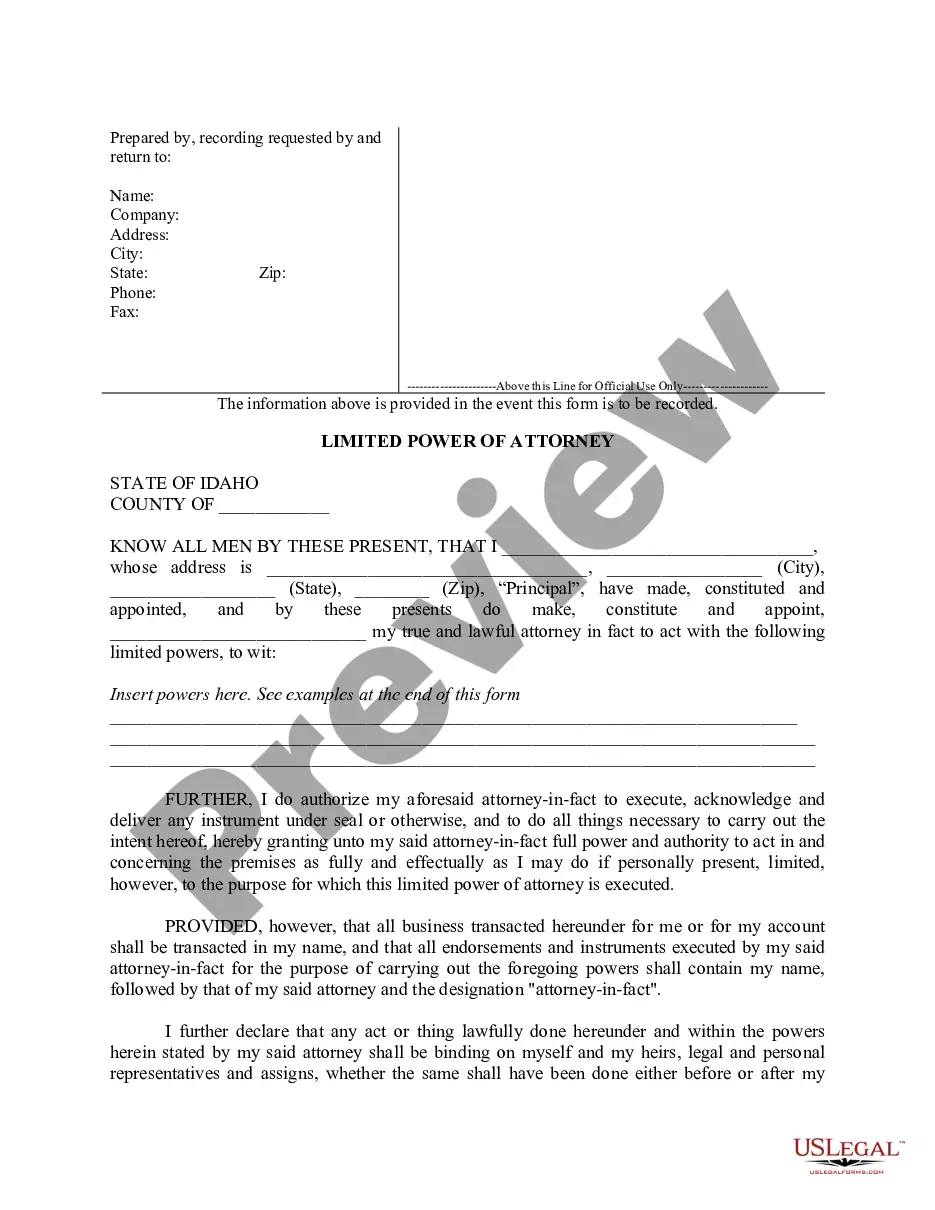

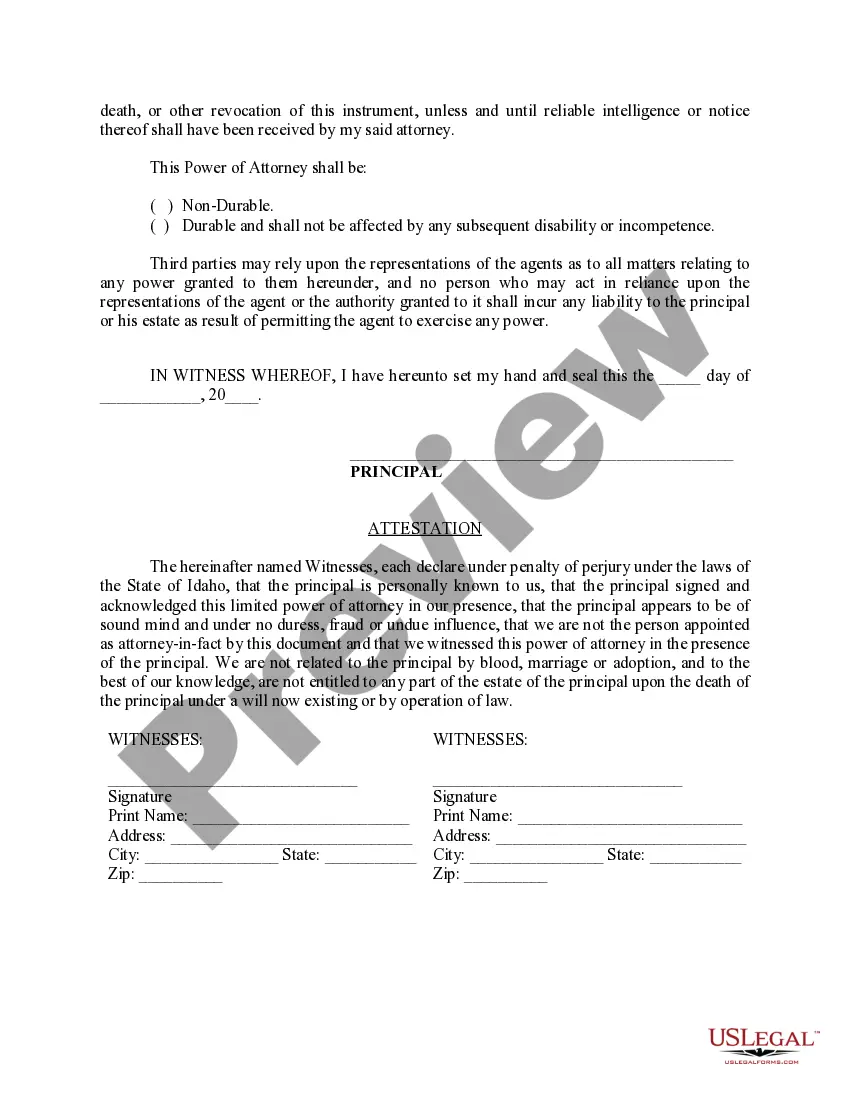

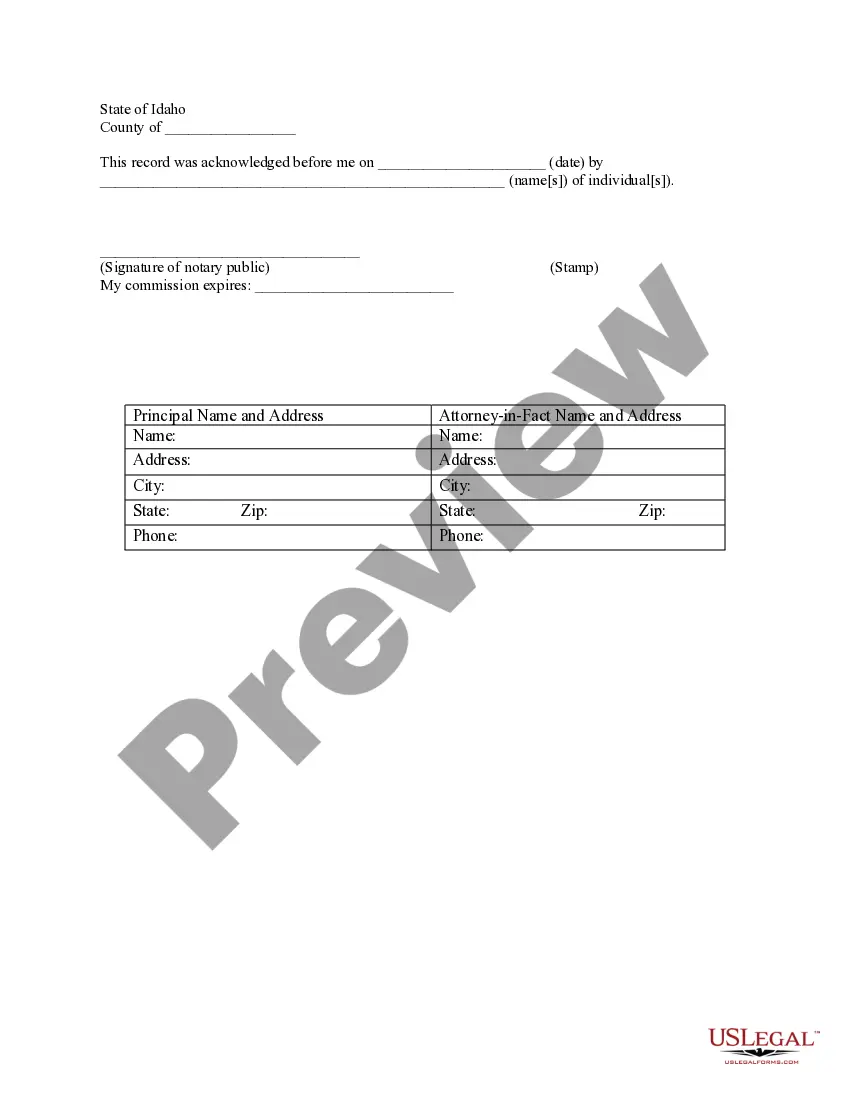

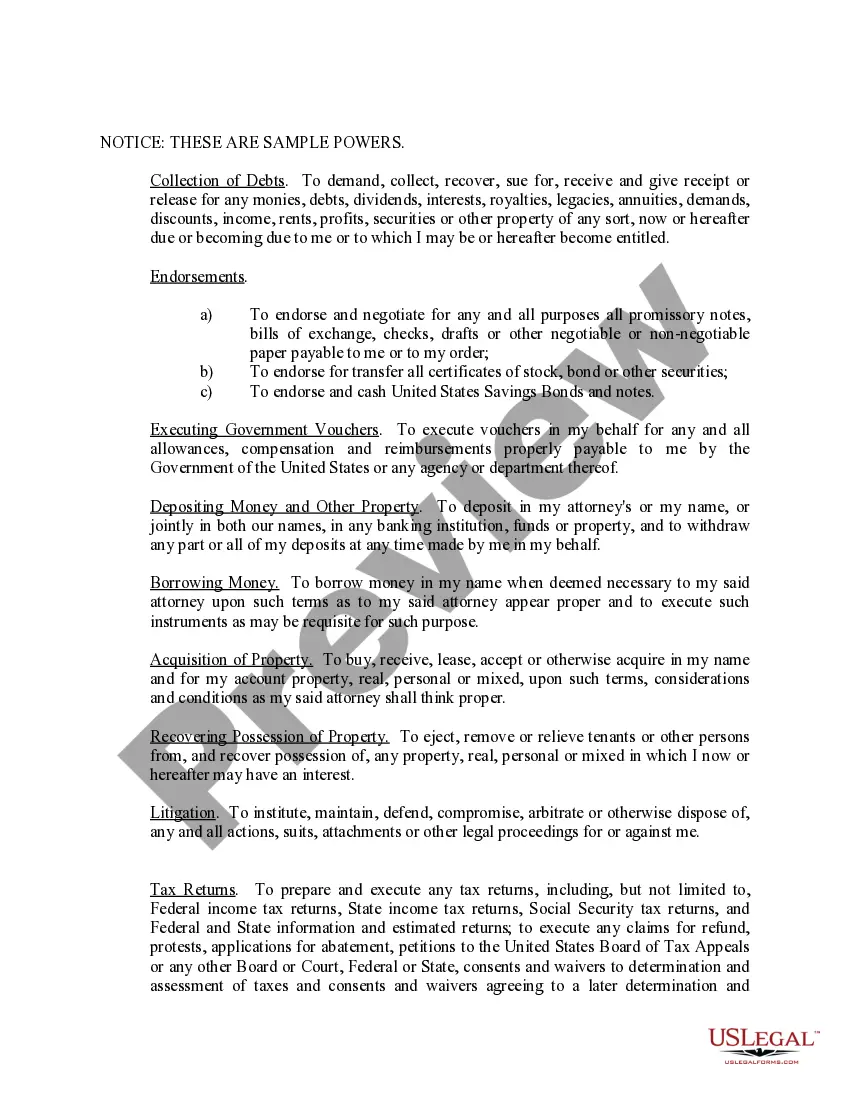

This is a limited power of attorney for Idaho. You specify the powers you desire to give to your agent. Sample powers are attached to the form for illustration only and should be deleted after you complete the form with the powers you desire. The form contains an acknowledgment in the event the form is to be recorded.

Power Of Attorney Irs

Description

How to fill out Power Of Attorney Irs?

- Start by checking the Preview mode and description to ensure the selected Power of Attorney form meets your requirements.

- If the form is not suitable, utilize the Search tab to find a different template that aligns with your needs.

- Proceed to purchase the correct document by clicking the Buy Now button and selecting your preferred subscription plan.

- Create an account to gain access to US Legal Forms library for your legal resources.

- Complete the transaction by entering your payment details, either via credit card or PayPal.

- Once your purchase is complete, download the form to your device for easy completion, and access it anytime through the My Forms menu.

By following these simple steps, you can take advantage of US Legal Forms' extensive library, which offers more legal templates than its competitors. This service empowers both individuals and attorneys by providing easy access to quality legal documents.

Don't hesitate to leverage this valuable resource for all your legal documentation needs. Start your journey with US Legal Forms today!