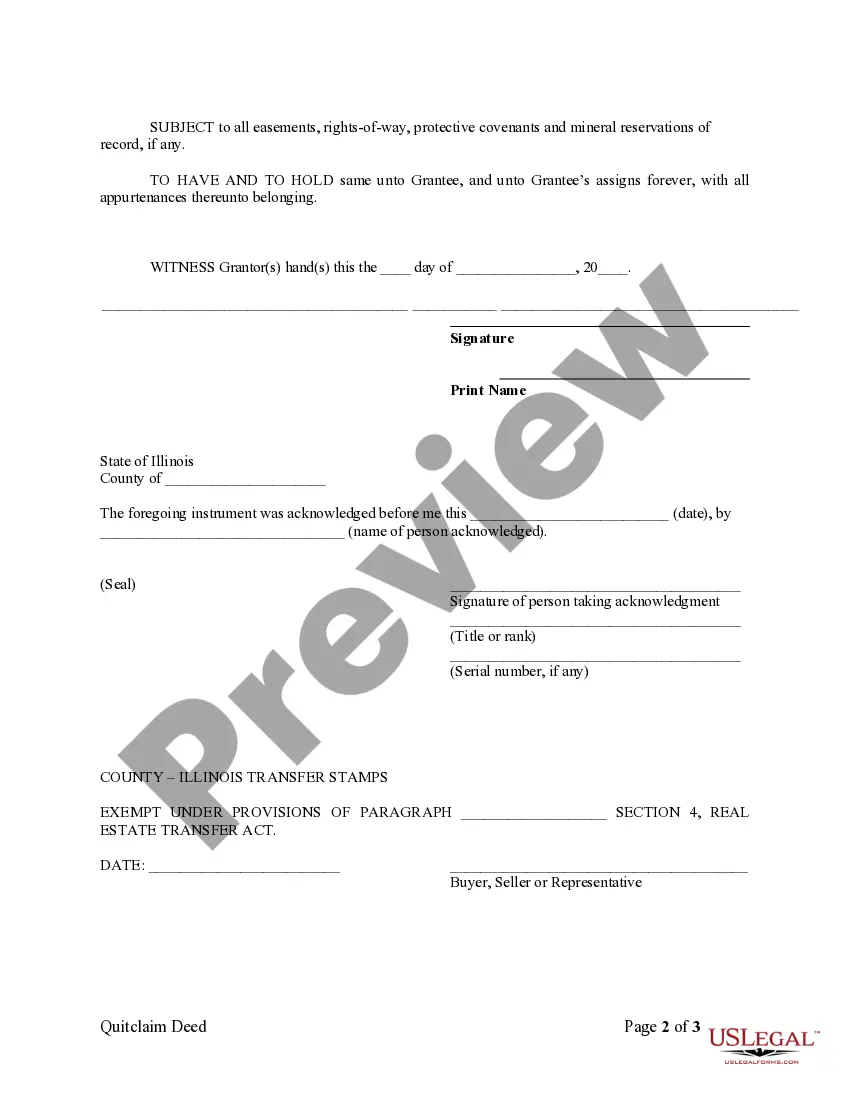

A Quit claim deed form in Illinois Cook County is a legal document that transfers the ownership of a property from one party to another. It is commonly used in situations where the transfer is made without any guarantees or warranties regarding the title of the property. This means that the person transferring the property (granter) is giving up any rights or claims to the property. The Quit claim deed form in Illinois Cook County is specific to the county and state, ensuring that it complies with the local laws and regulations. It includes important details such as the names and addresses of both the granter and the grantee, a description of the property being transferred, and the terms of the transfer. There are different types of Quit claim deed forms in Illinois Cook County, each serving a specific purpose. Some common variations include: 1. General Quit claim deed form: This is the most common form and is used when the property is being transferred without any specific guarantees or warranties. 2. Gift Quit claim deed form: This form is used when the transfer of the property is made as a gift, often between family members or close friends. It may be subject to specific tax considerations. 3. Quit claim deed form with life estate: This form is used when the granter wants to transfer the property but retain the right to live in it until their death. After the granter's passing, the property automatically transfers to the grantee. 4. Quit claim deed form for divorce: This form is used in situations where the transfer of property is part of a divorce settlement. It is often used to transfer ownership from one spouse to another without any financial considerations. When completing a Quit claim deed form in Illinois Cook County, it is crucial to ensure accuracy and completeness. It is highly recommended consulting with a real estate attorney or utilize online legal services to ensure that the form is correctly filled out and complies with all applicable laws. In conclusion, a Quit claim deed form in Illinois Cook County is a legal document used to transfer property ownership. The form should be specific to the county and state, and there are various types available depending on the specific circumstances of the transfer. Seeking legal advice when completing the form is important to ensure its validity and compliance with the law.

Quit Claim Deed Form Illinois Cook County

Description quitclaim deed illinois cook county

How to fill out Quit Claim Deed Form Illinois Cook County?

Working with legal papers and procedures could be a time-consuming addition to your entire day. Quit Claim Deed Form Illinois Cook County and forms like it often require that you look for them and understand how you can complete them correctly. As a result, if you are taking care of financial, legal, or personal matters, having a thorough and hassle-free online library of forms on hand will greatly assist.

US Legal Forms is the number one online platform of legal templates, featuring over 85,000 state-specific forms and a number of resources to help you complete your papers easily. Explore the library of appropriate papers accessible to you with just one click.

US Legal Forms gives you state- and county-specific forms available at any time for downloading. Safeguard your papers managing procedures having a top-notch service that allows you to put together any form within minutes without having extra or hidden charges. Just log in to the account, identify Quit Claim Deed Form Illinois Cook County and download it immediately in the My Forms tab. You can also gain access to formerly downloaded forms.

Is it your first time using US Legal Forms? Sign up and set up a free account in a few minutes and you’ll have access to the form library and Quit Claim Deed Form Illinois Cook County. Then, follow the steps below to complete your form:

- Ensure you have discovered the right form using the Review option and reading the form information.

- Choose Buy Now as soon as ready, and choose the monthly subscription plan that meets your needs.

- Select Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of experience supporting users control their legal papers. Discover the form you require right now and enhance any operation without breaking a sweat.

Form popularity

FAQ

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The fee is $150 (or $160 if paid by credit card). It will be your responsibility to get the transfer stamps (if necessary) and get the deed recorded with the County Recorder. There is nothing legal about obtaining the municipal stamp and recording the deed.

Form PTAX-203, Illinois Real Estate Transfer Declaration, is completed by the buyer and seller and filed at the county in which the property is located. Form PTAX-203-A, Illinois Real Estate Transfer Declaration Supplemental Form A, is used for non-residential property with a sale price over $1 million.

If you're preparing the quitclaim deed yourself, make sure to enter the property description just as it appears on an older deed of the property. If you can't find an old deed, check with the County Recorder of Deeds in the county where the property is located. They can tell you where to get a copy of an earlier deed.

In order to file a deed in Cook County, the necessary documents are as follows: (1) Tax Declaration (MyDec); (2) Tax Stamps (or ?Zero Stamps? if an exempt transfer); (3) A Grantor/Grantee Affidavit (exempt transfers); (4) The Deed to be Filed (which must contain PIN number, complete legal description, commonly known ...

Before you file the deed, get a tax stamp from the local municipality where the property is located. When you're ready to file the deed, bring it to the County Recorder of Deeds, where they will stamp and file the deed. You'll have to pay a fee for recording, or filing, the deed.