Husband Wife Llc With Baby Quotes

State:

Illinois

Control #:

IL-09-77

Format:

Word;

Rich Text

Instant download

Description Limited Liability Company Il

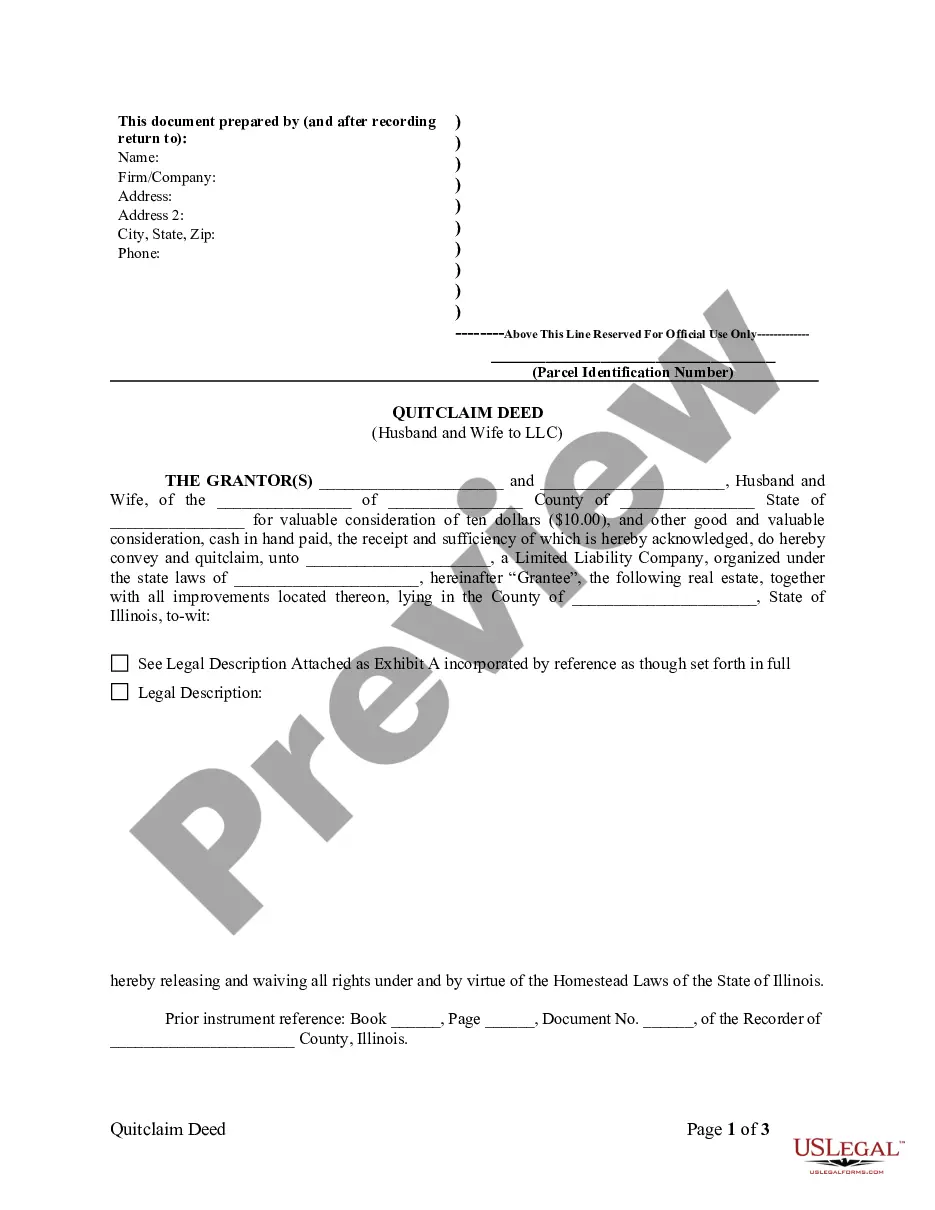

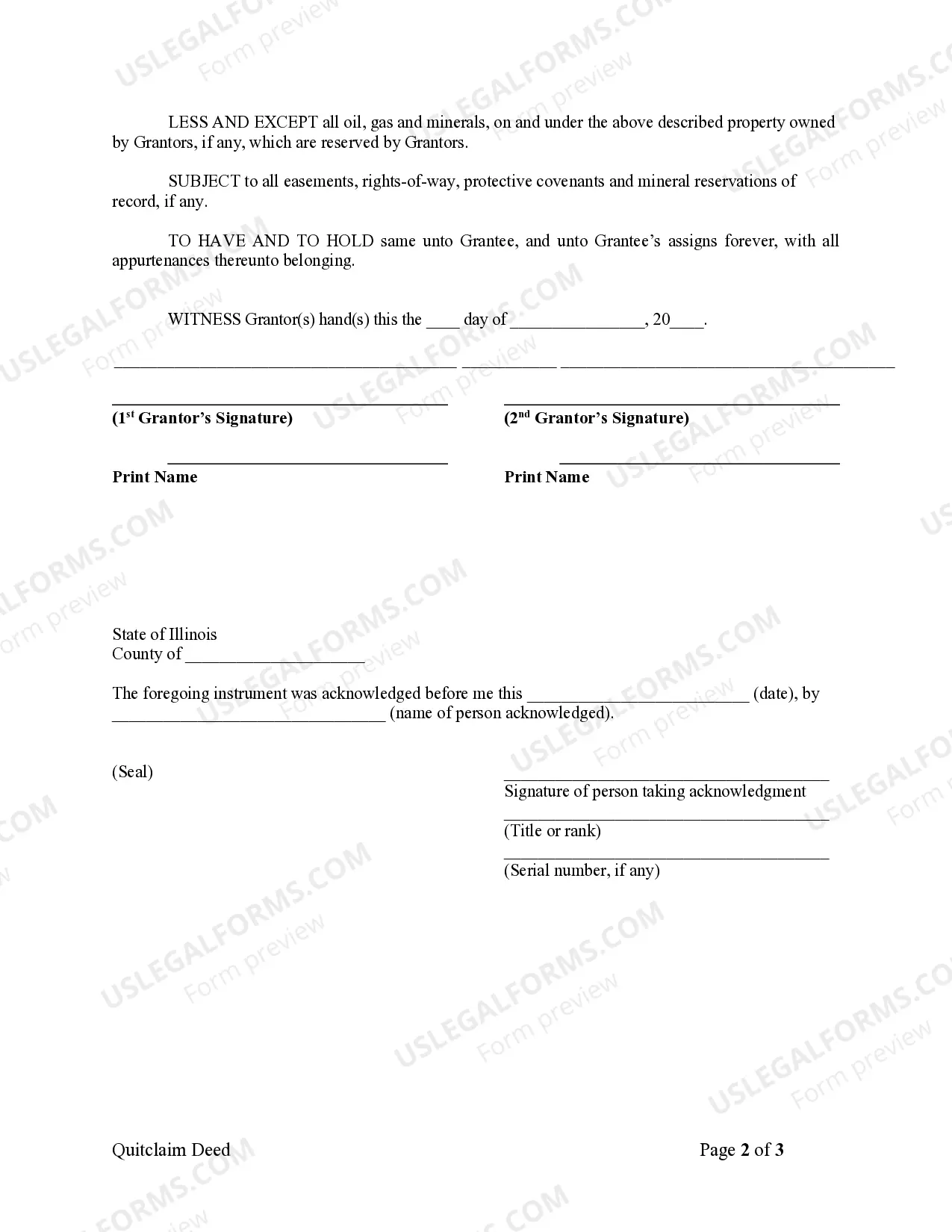

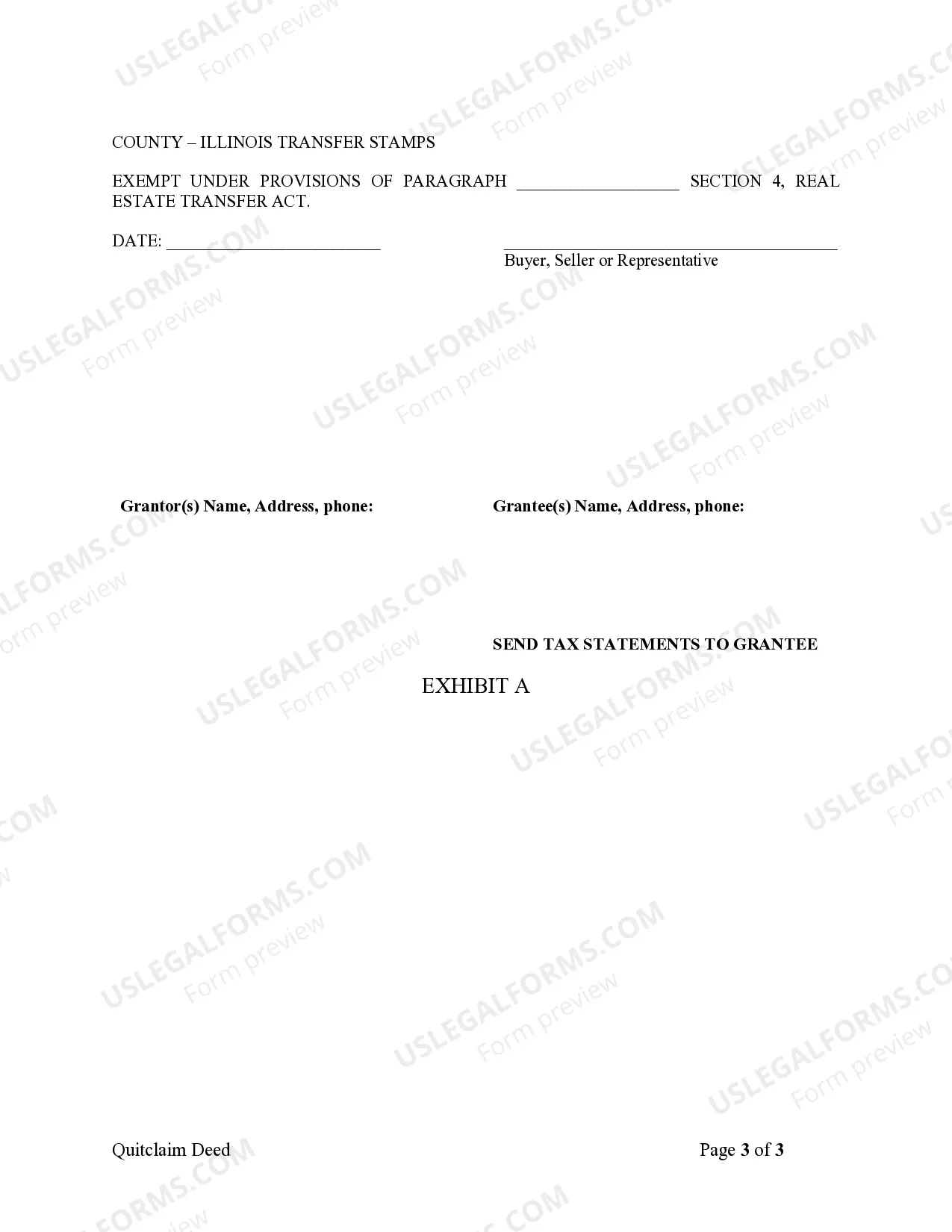

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Free preview Illinois Quitclaim Deed