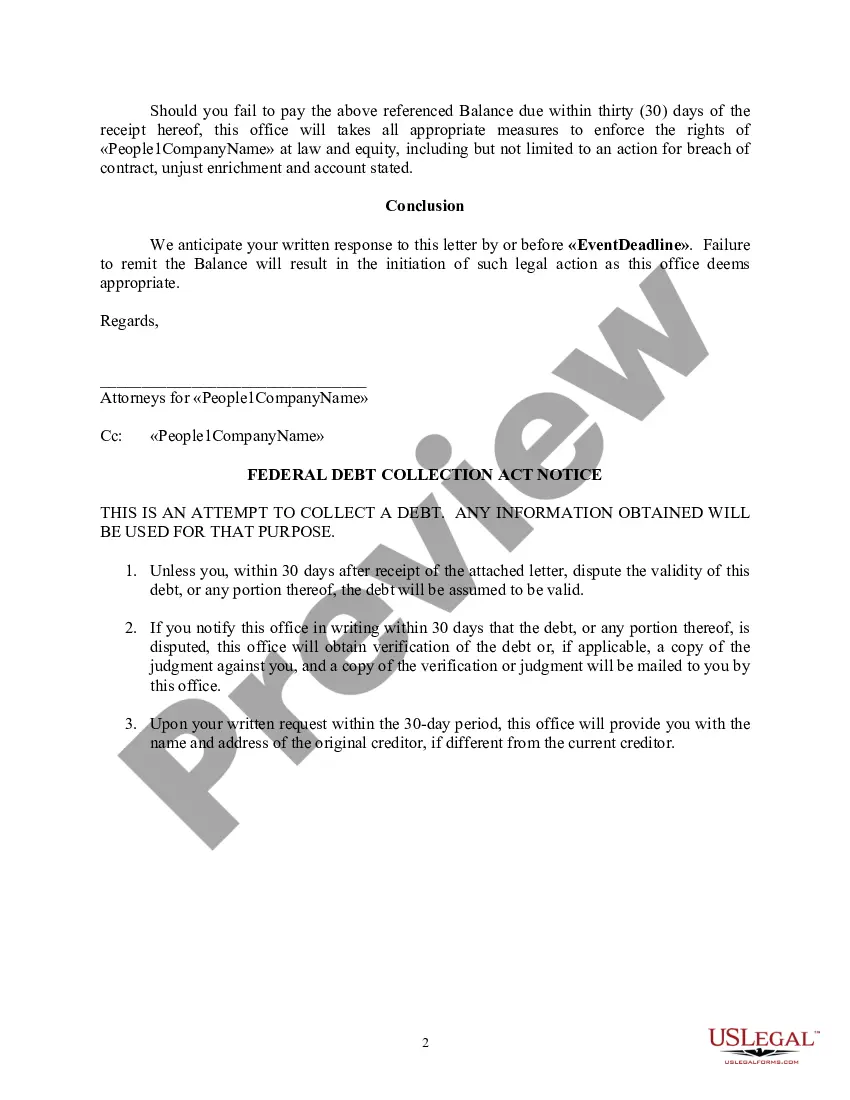

A dispute letter template for a collection agency is a pre-written document that helps individuals communicate their concerns or disagreements regarding a debt collection to a collection agency. It provides a structured format for disputing and addressing issues related to the debt collection process. The use of relevant keywords in the content helps improve its visibility and search engine optimization. Key elements in a dispute letter template for a collection agency may include: 1. Contact Information: Begin by including your full name, address, phone number, and email address. This information is crucial for the collection agency to identify the person raising the dispute. 2. Collection Agency Information: Include the collection agency's name, address, and contact details. This ensures a clear line of communication and allows the collection agency to reference your account accurately. 3. Account Details: State the account number and any other information specific to your debt. This aids in identifying the specific account under dispute and facilitates a more efficient resolution process. 4. Dispute Explanation: Clearly explain the reason for your dispute. Provide a detailed explanation of why you believe the debt collection is not valid or why there may be an error in the collection process. Ensure your arguments are concise, factual, and supported by any relevant evidence or documentation. 5. Request for Verification: Often, it is essential to request that the collection agency provides verification or validation of the debt. Ask them to provide additional information, such as the original creditor's name, the amount owed, and the date of last activity. This verification ensures that you are dealing with a legitimate debt and not a case of mistaken identity or fraud. 6. Request for Communication Cease: If you desire the collection agency to stop contacting you regarding the debt, include a request for communication cessation. This does not absolve your responsibilities towards resolving the debt but stops the collection agency from making further communication attempts. 7. Supporting Documentation: Attach copies of any supporting documents that validate your dispute or contradict the validity or accuracy of the debt. These documents may include proof of payment, billing statements, or any correspondence between you and the original creditor. Different types of dispute letter templates for collection agencies may include: 1. Debt Validation Dispute Letter: This template is used when requesting evidence or verification from the collection agency to ensure that the debt is legitimate and accurate. 2. Cease and Desist Dispute Letter: This template is used to request the collection agency to stop contacting you regarding the debt. It aims to limit communication to written correspondence only. 3. Credit Reporting Dispute Letter: When disputing a debt inaccurately reported to credit bureaus, this template is used to request the correction or removal of the information from your credit report. By using relevant keywords throughout the content, such as "dispute letter template," "collection agency dispute," "debt validation," "cease and desist," and "credit reporting dispute," individuals can easily find and utilize these templates when addressing their concerns related to debt collections.

Dispute Letter Template For Collection Agency

Description dispute letter for collections

How to fill out Dispute Collection Letter?

The Dispute Letter Template For Collection Agency you see on this page is a reusable legal template drafted by professional lawyers in compliance with federal and regional laws. For more than 25 years, US Legal Forms has provided individuals, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Dispute Letter Template For Collection Agency will take you only a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or review the form description to verify it fits your needs. If it does not, make use of the search option to get the appropriate one. Click Buy Now once you have found the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Pick the format you want for your Dispute Letter Template For Collection Agency (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a eSignature.

- Download your papers one more time. Make use of the same document again whenever needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

example of a dispute letter Form popularity

example of dispute letter Other Form Names

how do you write a dispute letter example FAQ

Within 30 days of receiving the written notice of debt, send a written dispute to the debt collection agency. You can use this sample dispute letter (PDF) as a model. Once you dispute the debt, the debt collector must stop all debt collection activities until it sends you verification of the debt.

This first collection letter should contain the following information: Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not ?in the next 7 business days? as this can be vague.

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected.