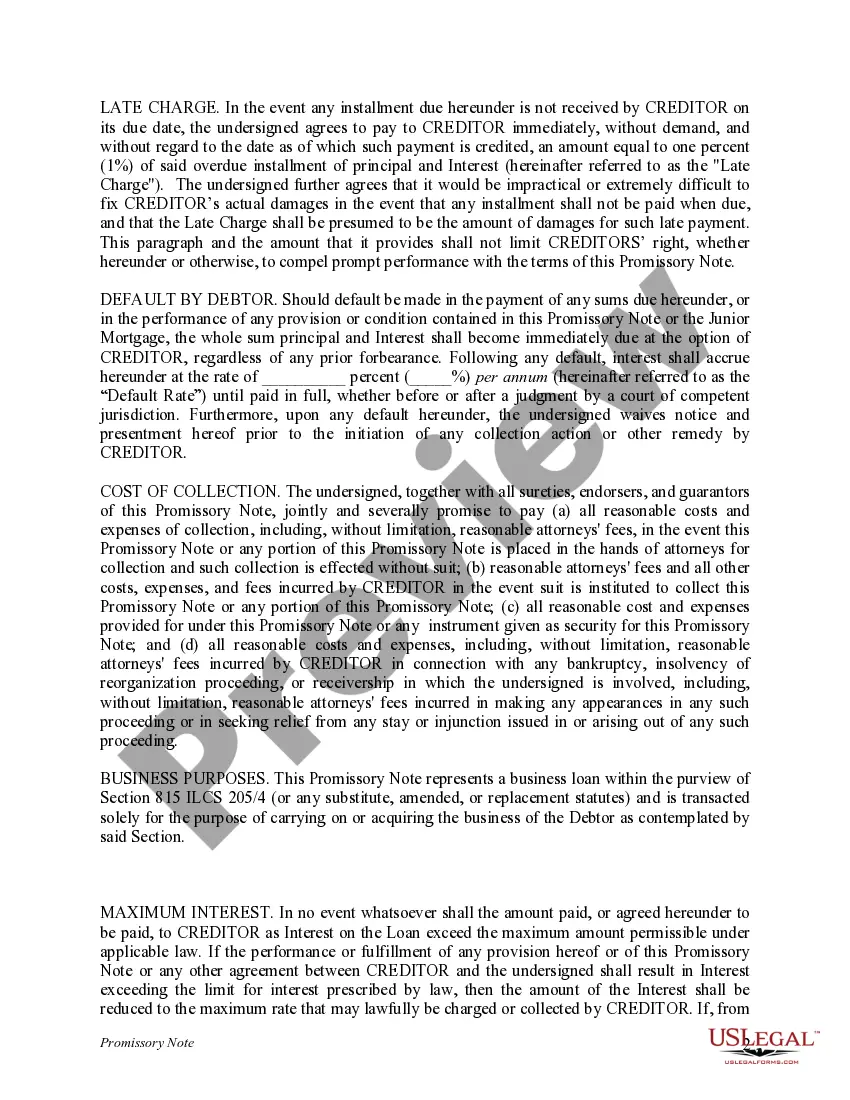

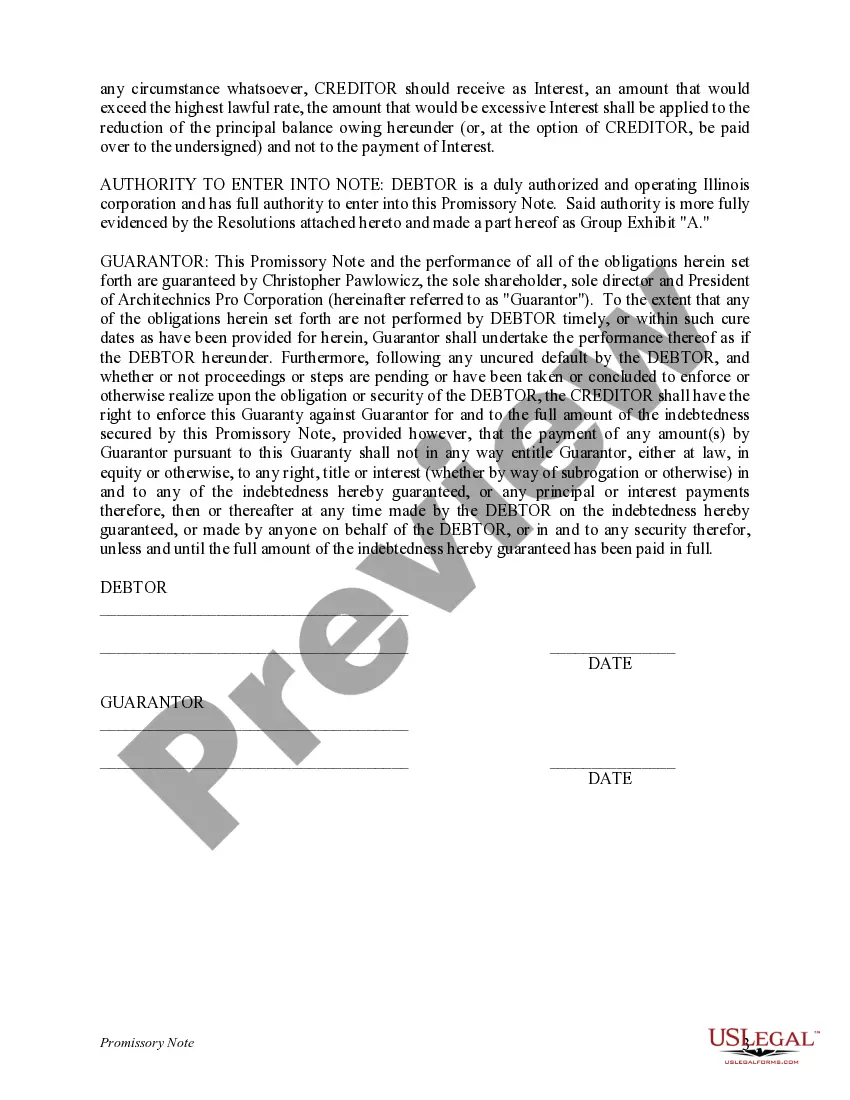

A promissory note example for a loan is a legal document that outlines the terms of a loan agreement between two parties: the lender and the borrower. In this document, the borrower promises to repay a certain amount of money borrowed from the lender within a specific timeframe, with or without interest, and according to predetermined conditions. Here are a few different types of promissory notes commonly used for loans: 1. Simple Promissory Note: This is the most basic type of promissory note for a loan. It includes essential details such as the loan amount, interest rate (if applicable), repayment terms, due date, and signatures of both parties. 2. Installment Promissory Note: Used when the borrower agrees to repay the loan in regular installments, usually monthly, rather than in a lump sum. This type of note typically includes the amount of each installment, the number of installments, and the repayment schedule. 3. Secured Promissory Note: In this type of note, the borrower pledges collateral as security for the loan. If the borrower fails to repay the loan as agreed, the lender is entitled to claim the collateral to recover their losses. 4. Unsecured Promissory Note: Unlike the secured note, this type of promissory note does not require any collateral. The borrower's promise to repay the loan is solely based on their creditworthiness and trustworthiness. 5. Demand Promissory Note: This note allows the lender to demand repayment of the loan at any time they choose. There is usually no fixed due date mentioned in this note, and the repayment period is determined by the lender's request. 6. Revolving Promissory Note: This type of note is similar to a credit card agreement, where the borrower can borrow, repay, and borrow again within a predetermined credit limit. The borrower is required to make regular payments based on their outstanding balance. In summary, a promissory note example for a loan is a vital legal document that sets forth the terms and conditions of a loan agreement. Whether it's a simple, installment, secured, unsecured, demand, or revolving promissory note, it is crucial to include all relevant information to ensure both parties are aware of their obligations and rights.

Promissory Note Example For Loan

Description

How to fill out Promissory Note Example For Loan?

Accessing legal templates that comply with federal and local laws is a matter of necessity, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the correctly drafted Promissory Note Example For Loan sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal case. They are simple to browse with all files grouped by state and purpose of use. Our professionals stay up with legislative updates, so you can always be sure your paperwork is up to date and compliant when obtaining a Promissory Note Example For Loan from our website.

Getting a Promissory Note Example For Loan is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, adhere to the steps below:

- Take a look at the template utilizing the Preview feature or via the text outline to make certain it meets your requirements.

- Locate a different sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the suitable form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Promissory Note Example For Loan and download it.

All templates you find through US Legal Forms are reusable. To re-download and fill out previously purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

For general immigration help, the hourly rate is often between $150 and $300. If you are seeking help filling out and filing forms, the average total cost is between $250 to $800. The total cost of green card assistance usually ranges from $800 to $5,000.

There are also ways to get a green card without a US company sponsor. Two of these ways are: (1) the EB1A visa; and (2) the National Interest Waiver. Through both of these options, you do not need a job offer and you do not need a company to file an immigrant visa petition on your behalf.

Submitting your application online provides you with several benefits. Get helpful instructions and tips from USCIS as you complete your form using our secure online filing system, avoid common mistakes, and pay your fees online.

Tips for Filing Forms Online Step 1: Create a USCIS online account if you don't already have one. ... Step 2: Select ?File a Form Online.? Step 3: Complete all sections of your form. ... Step 4: Upload evidence. ... Step 5: Review and digitally sign your form. ... Step 6: Pay the filing fee. ... Step 7: View appointment notices.

USCIS forms and USCIS online accounts are always free.

If you already know what forms you need, you can download them from our Web site at .uscis.gov. You can also order forms by calling our forms request line at 1-800-870-3676.

$640. (Add the $85 biometric fee for a total of $725, where applicable. See exceptions below.) If you file your Form N-400 online, you may pay your fee online.