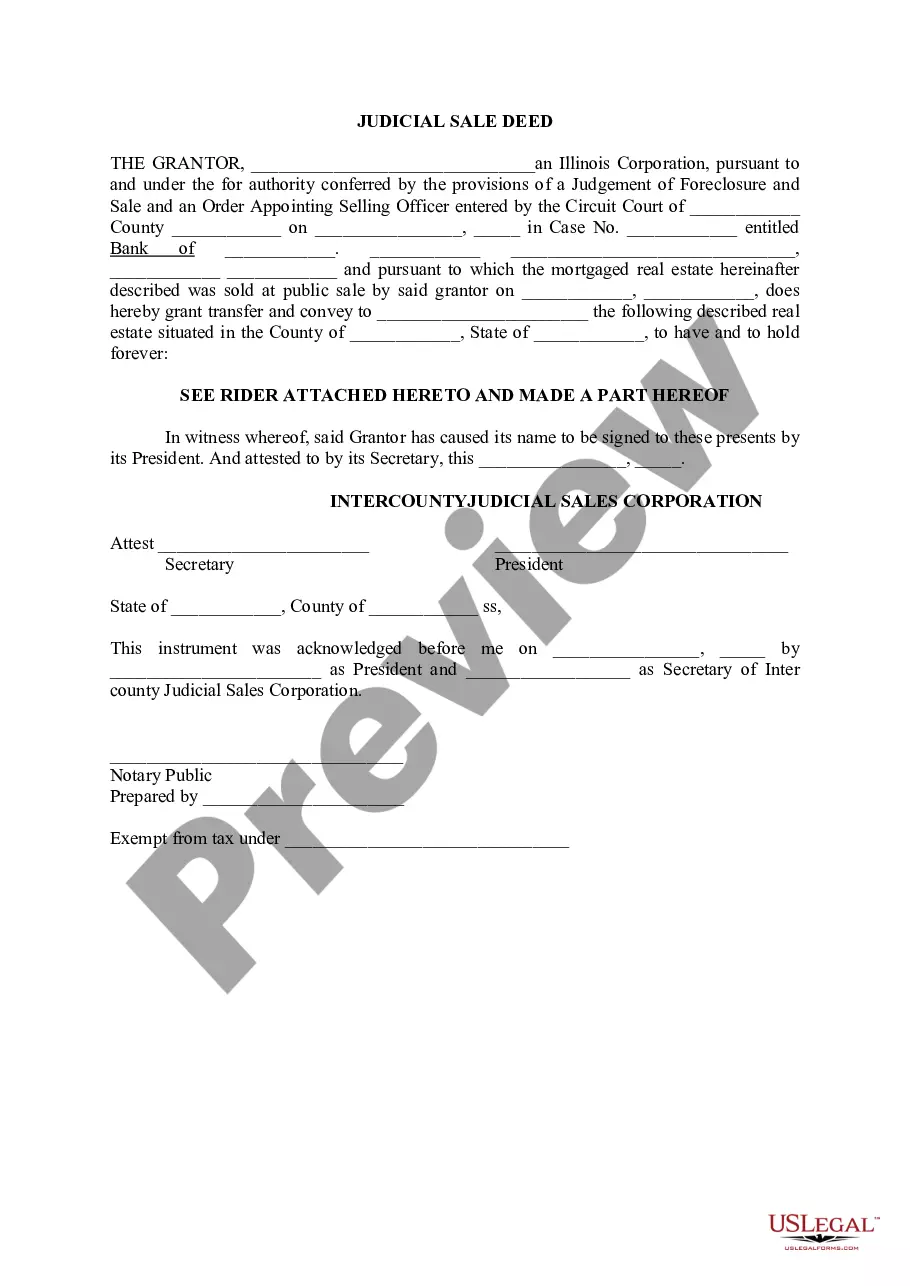

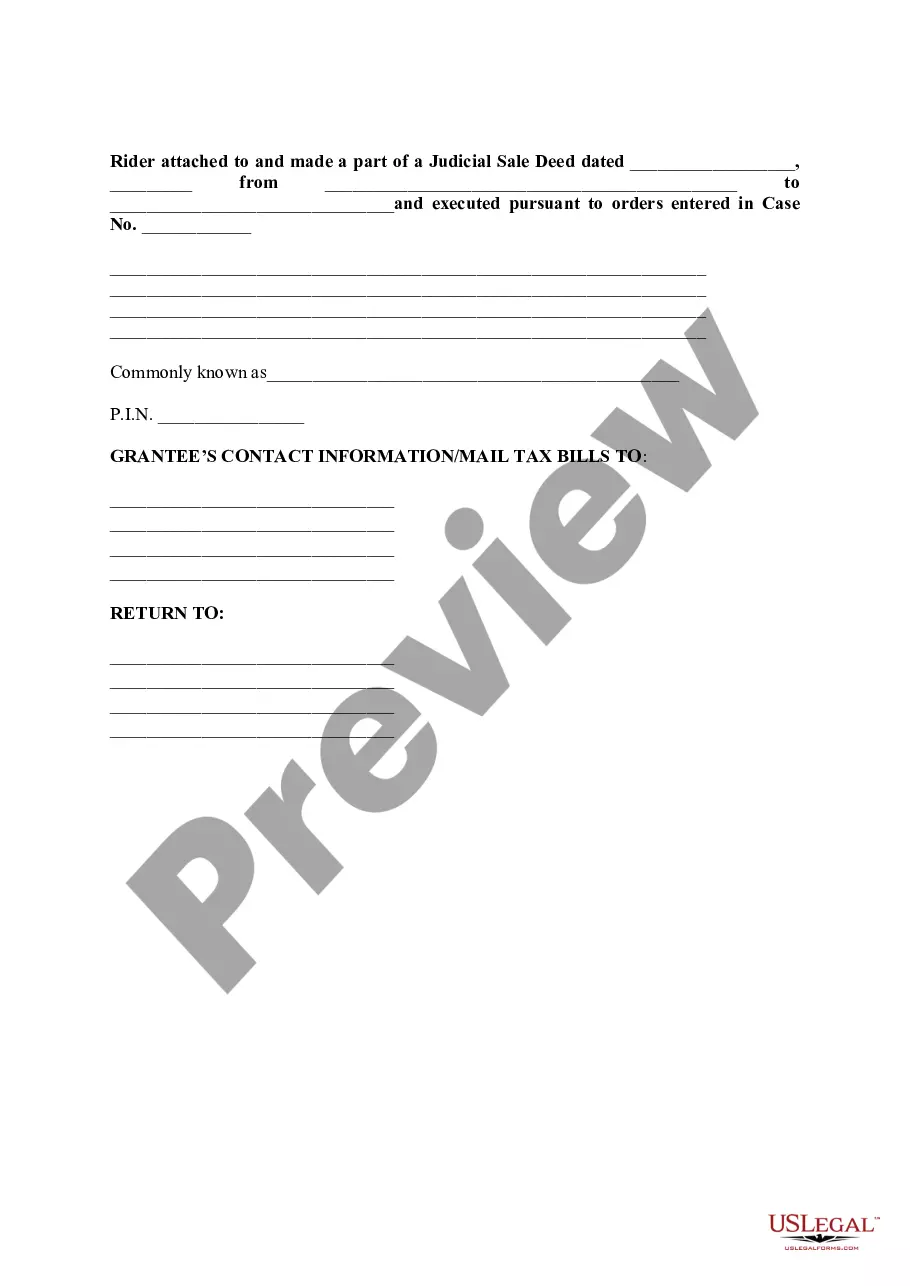

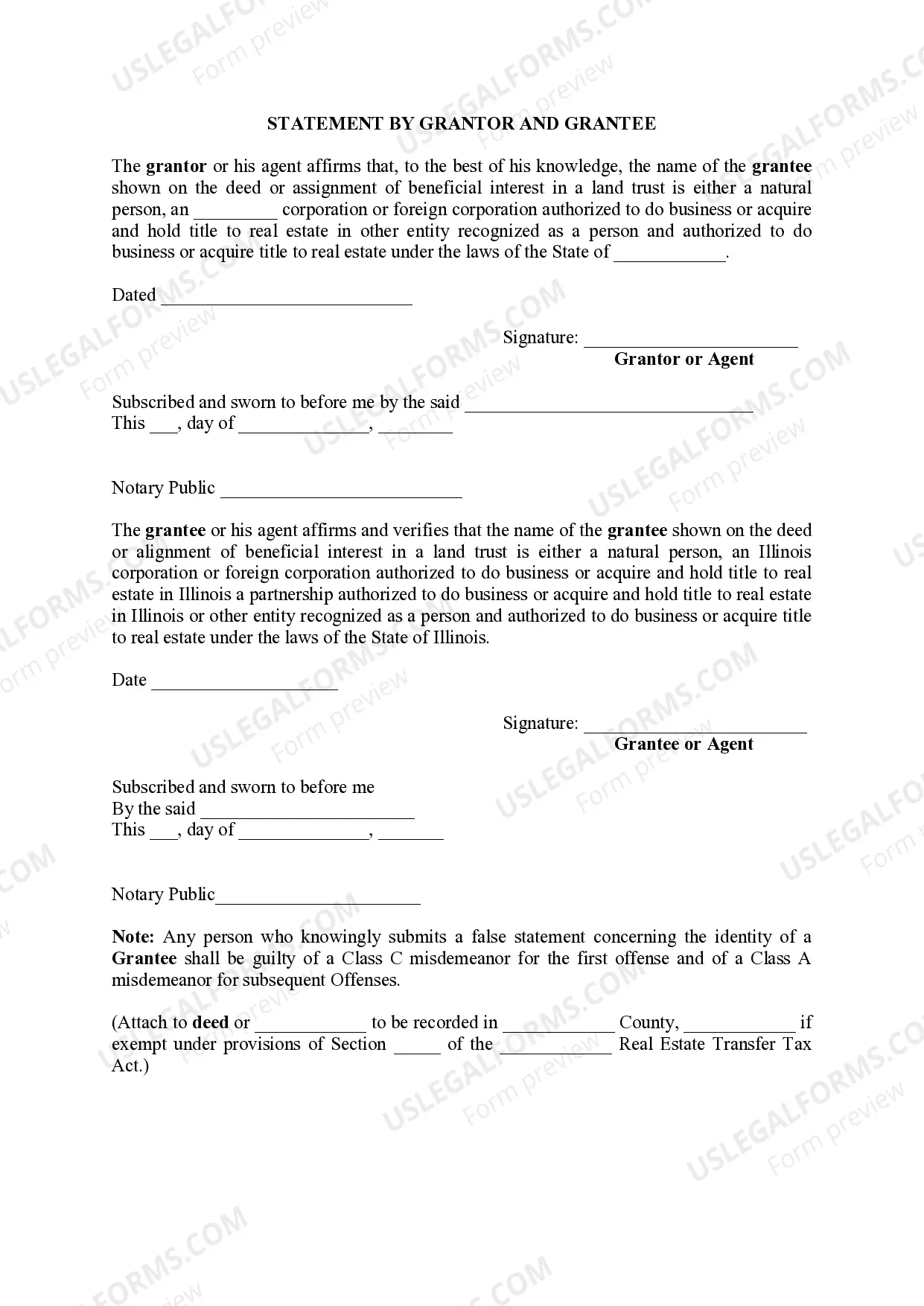

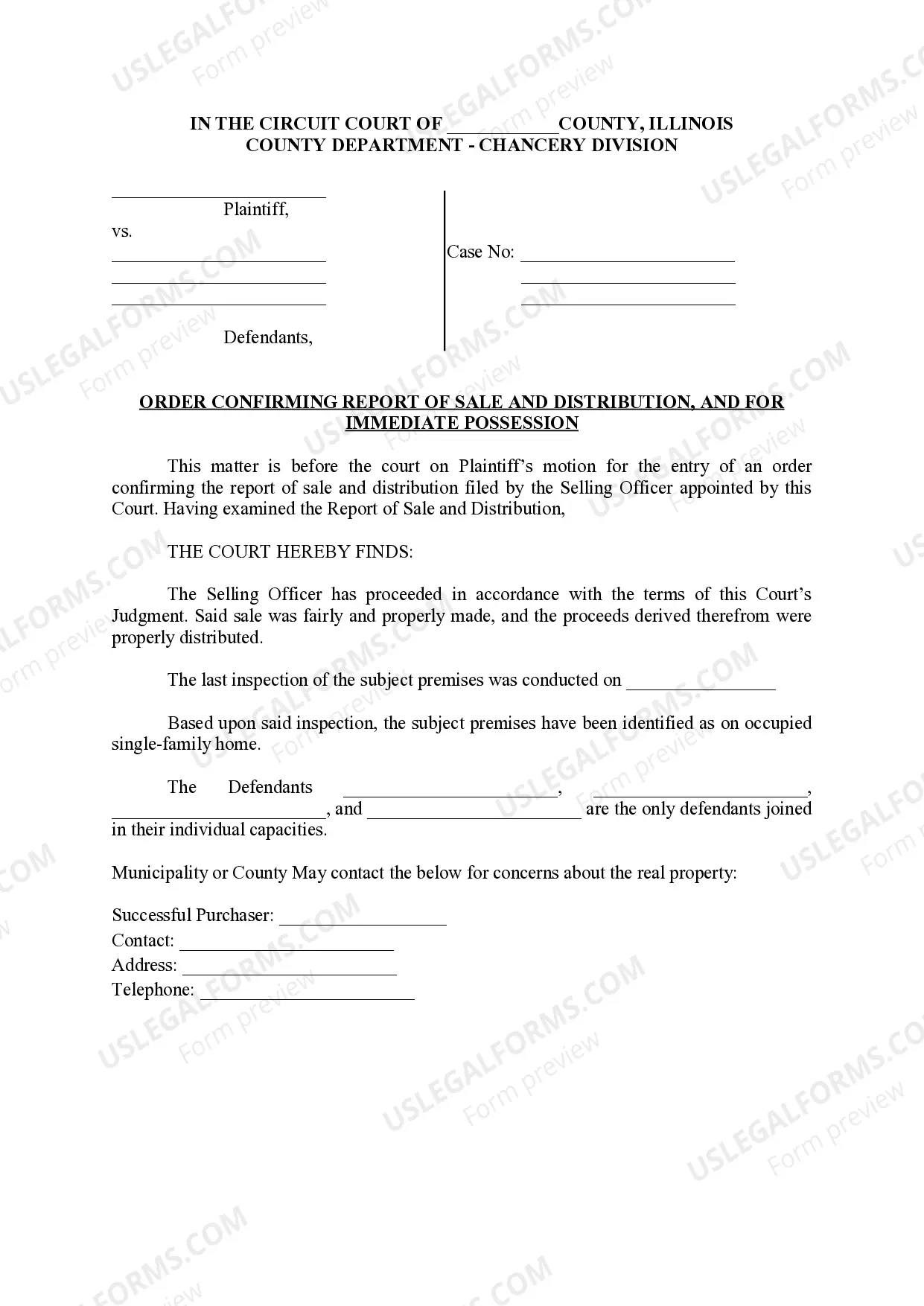

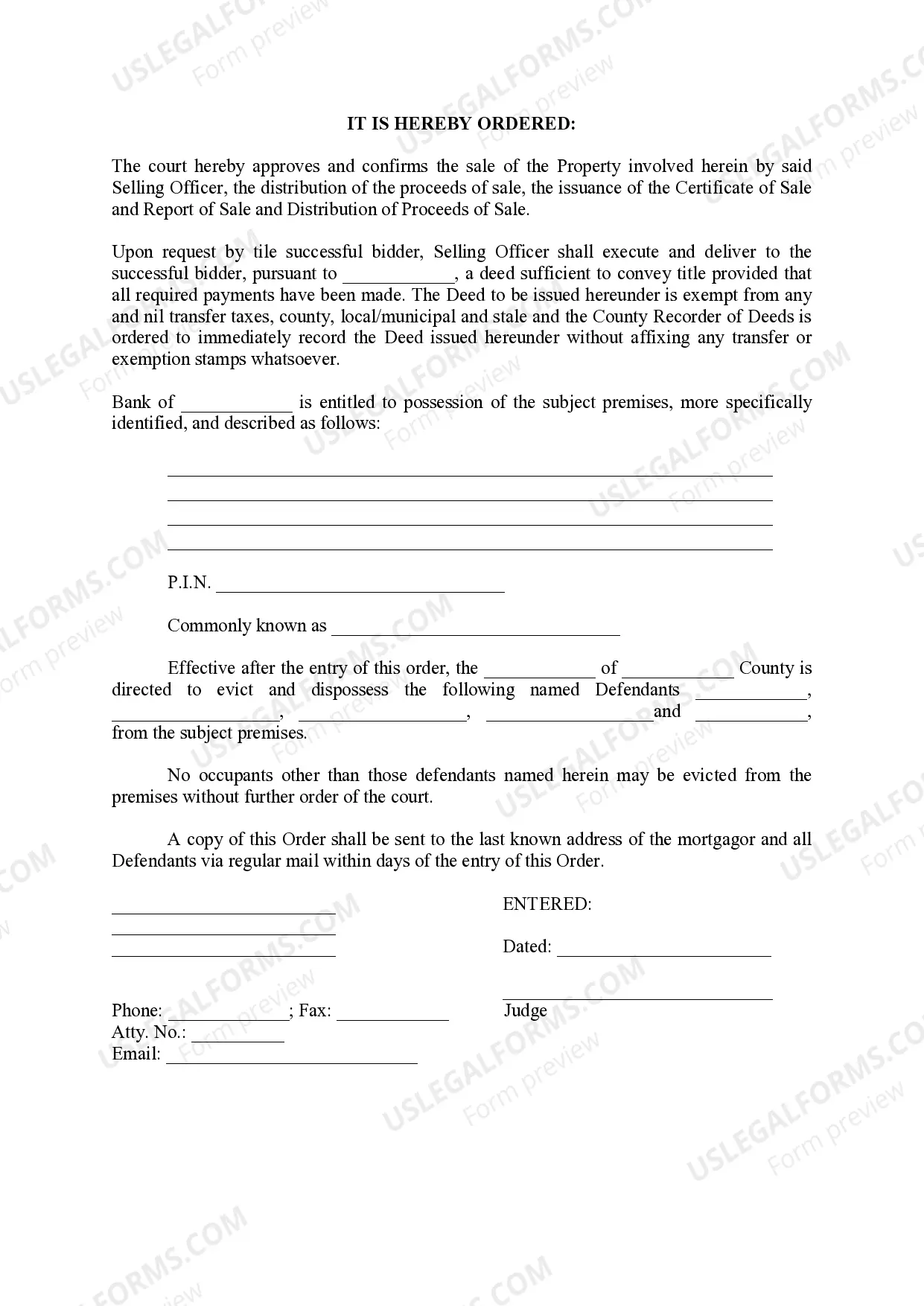

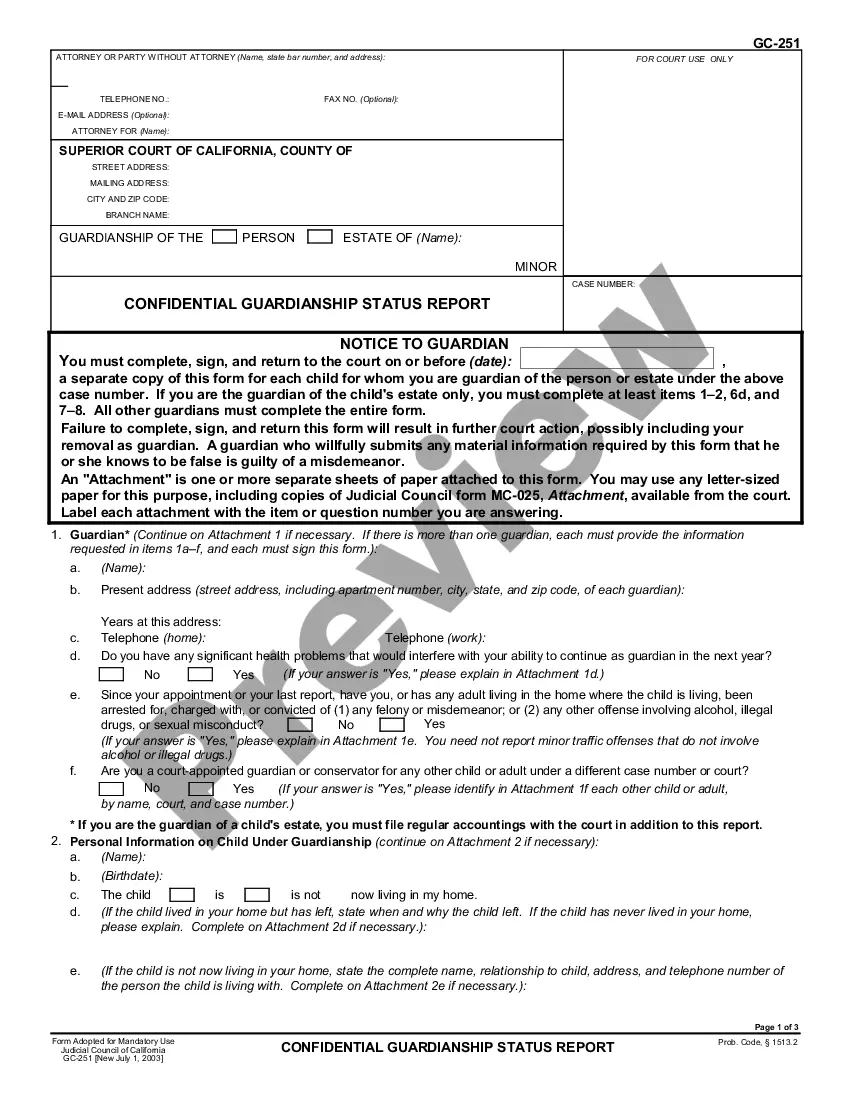

Tax deeds sales in Palm Beach County are a legal process through which properties with unpaid property taxes are auctioned off to the highest bidder. These sales provide an opportunity for individuals to purchase real estate at discounted prices. The Palm Beach County tax deed sales follow specific procedures and are overseen by the Palm Beach County Clerk & Comptroller's Office. There are two primary types of tax deed sales in Palm Beach County: the Tax Deed Application Sale and the Tax Deed Auction Sale. 1. Tax Deed Application Sale: This type of sale occurs when a property owner fails to pay their property taxes for a minimum of two years. Once this happens, the Palm Beach County Tax Collector places a tax lien on the property. Interested buyers can then submit an application to purchase the tax lien through the Palm Beach County Clerk & Comptroller's Office. The Clerk & Comptroller's Office evaluates these applications and determines the winning bidder based on a competitive bidding process. 2. Tax Deed Auction Sale: If the tax lien remains unpaid for a specified period (typically two years), the property will proceed to a public auction. The Palm Beach County Clerk & Comptroller's Office advertises the auction sale date, time, and location in local newspapers and on its website. Interested buyers can attend the auction and bid on the tax deed properties. The highest bidder in the auction is awarded the tax deed and becomes the new owner of the property. Participating in a tax deed sale can be an attractive investment opportunity. However, it is important to conduct thorough research on the properties of interest before participating in the auction. Potential bidders should assess the property's market value, condition, and potential risks associated with its ownership. To participate in the tax deed sales, interested buyers must register with the Palm Beach County Clerk & Comptroller's Office before the auction. Additionally, successful bidders are required to pay the full bid amount in cash, cashier's check, or money order immediately after winning the auction. Failure to make payment could result in forfeiture of the deposit and prohibit the bidder from participating in future auctions. It is essential to note that purchasing a property at a tax deed sale does not guarantee clear and marketable title. Buyers are responsible for conducting their own due diligence and should seek legal advice to ensure a smooth transfer of ownership. In summary, Tax Deed Sales in Palm Beach County present an opportunity to acquire properties at discounted prices. The two primary types of tax deed sales are the Tax Deed Application Sale and the Tax Deed Auction Sale. Participating buyers must be prepared to conduct thorough research on the properties and fulfill their financial obligations promptly.

Tax Deed Sale In Palm Beach County

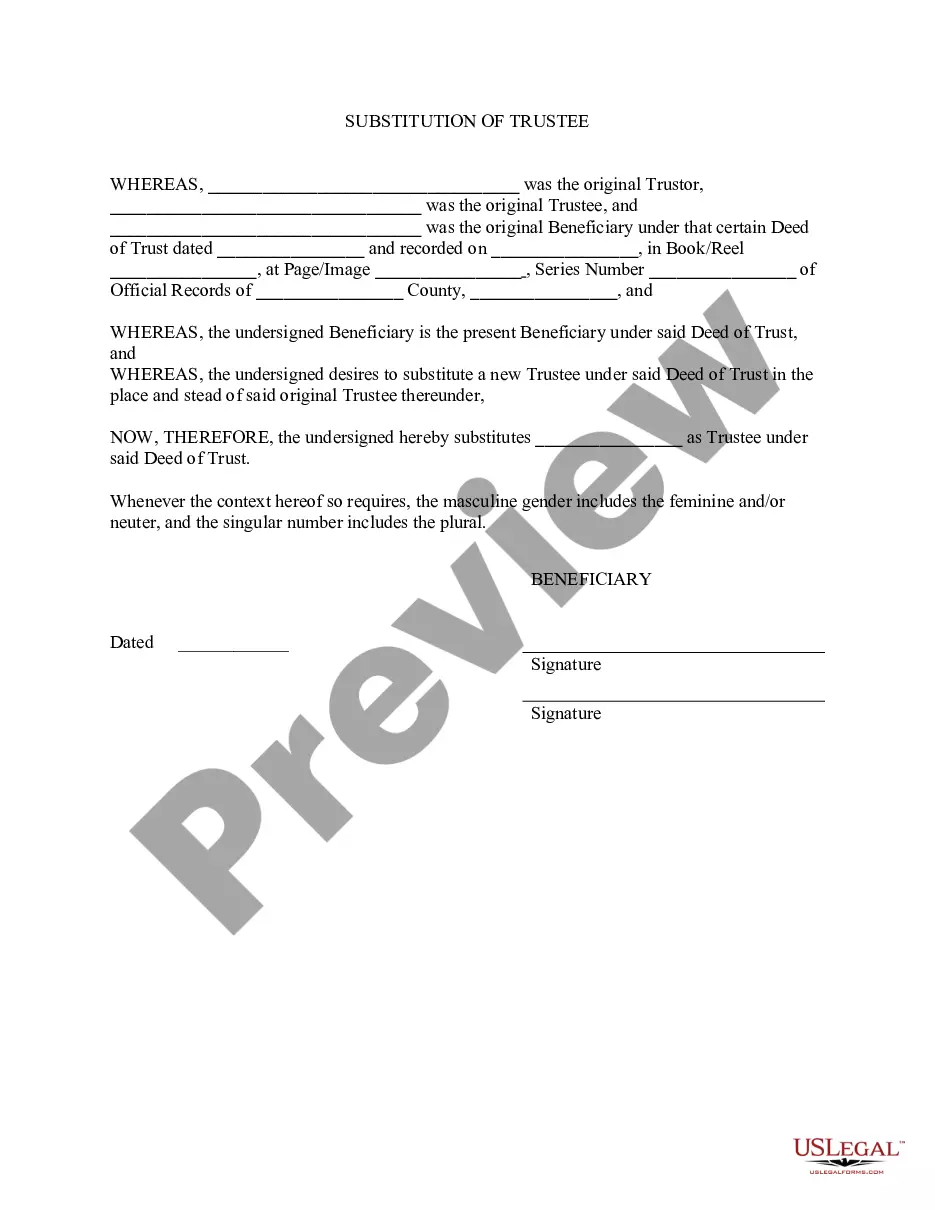

Description palm beach tax deed auction calendar

How to fill out Tax Deed Sale In Palm Beach County?

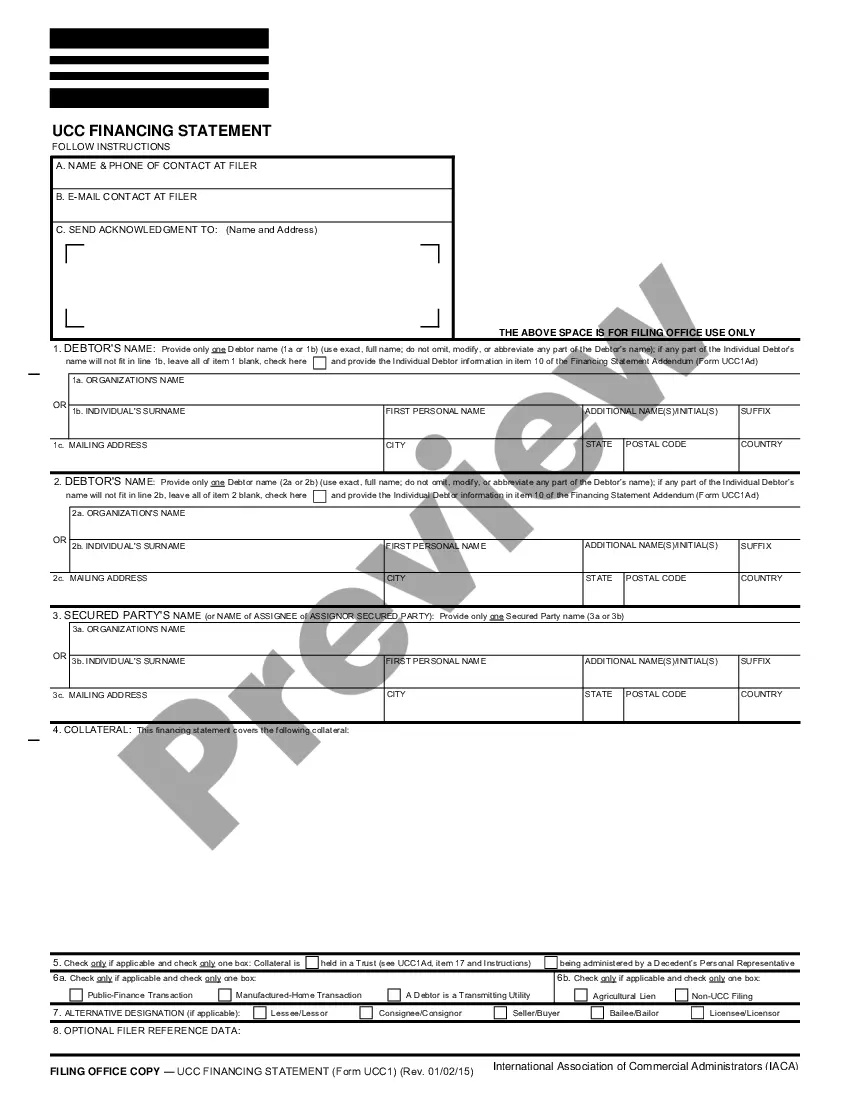

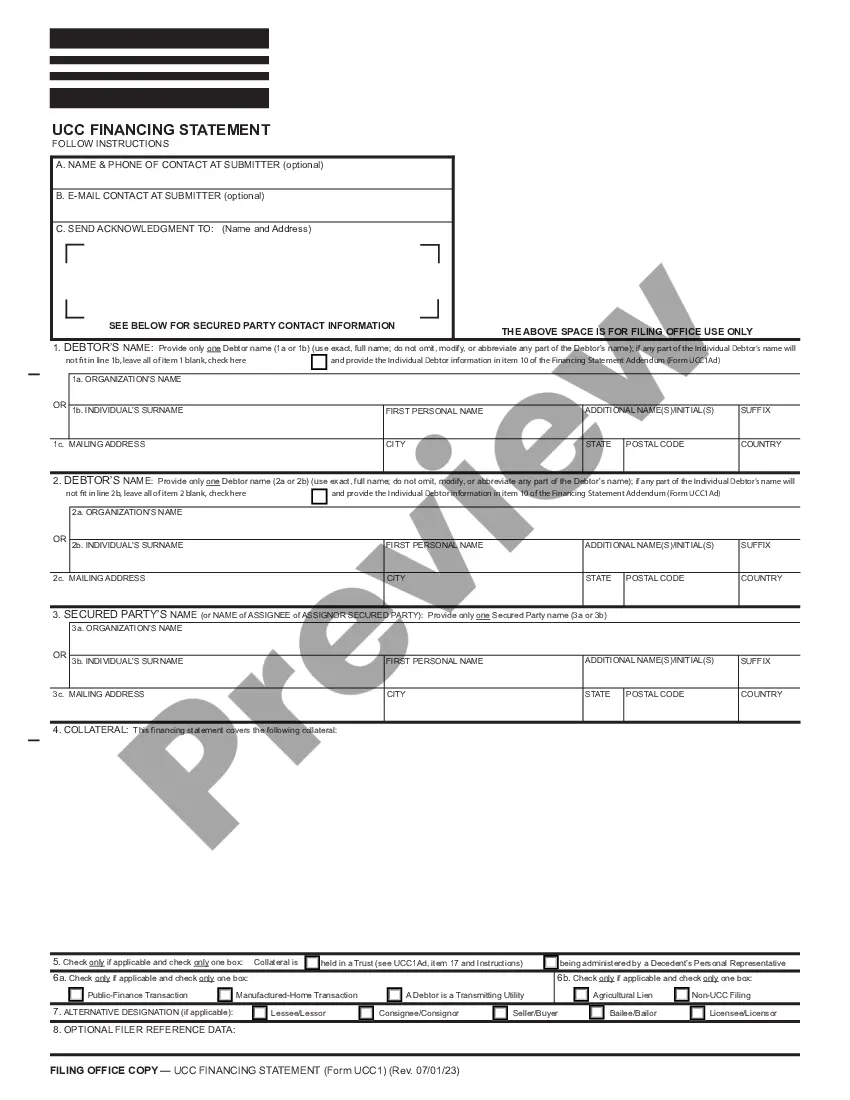

Legal managing might be frustrating, even for the most experienced professionals. When you are interested in a Tax Deed Sale In Palm Beach County and don’t get the time to spend looking for the correct and up-to-date version, the operations may be nerve-racking. A strong online form catalogue could be a gamechanger for anybody who wants to deal with these situations effectively. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you can:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any needs you might have, from personal to organization papers, all in one place.

- Employ advanced tools to accomplish and control your Tax Deed Sale In Palm Beach County

- Access a useful resource base of articles, guides and handbooks and resources connected to your situation and needs

Help save effort and time looking for the papers you need, and utilize US Legal Forms’ advanced search and Preview tool to find Tax Deed Sale In Palm Beach County and acquire it. In case you have a subscription, log in in your US Legal Forms account, search for the form, and acquire it. Take a look at My Forms tab to see the papers you previously downloaded and also to control your folders as you see fit.

Should it be the first time with US Legal Forms, create a free account and obtain unrestricted use of all advantages of the library. Listed below are the steps to take after downloading the form you need:

- Confirm it is the right form by previewing it and looking at its information.

- Ensure that the sample is acknowledged in your state or county.

- Pick Buy Now once you are ready.

- Select a monthly subscription plan.

- Find the format you need, and Download, complete, sign, print and send out your papers.

Enjoy the US Legal Forms online catalogue, backed with 25 years of experience and reliability. Enhance your day-to-day papers management in to a smooth and easy-to-use process right now.

Form popularity

FAQ

Florida Law A tax certificate sale is not a sale of land, but rather a lien against the subject property. Delinquent taxes are advertised in a local newspaper prior to the tax certificate sale. The tax certificate sale is open to the public and participants purchase the certificates as investments.

Property may be redeemed any time prior to the issuance of a tax deed but cannot be redeemed once the Clerk has received full payment for the tax deed. The redemption amount (subject to change) is listed on the "Notice of Application for Tax Deed" mailed prior to the sale.

A tax deed sale is a public auction where property is sold to the highest bidder to recover delinquent taxes. Once notice has been given to everyone, the Clerk of the Circuit Court holds a Tax Deed Sale (Auction) to determine the new property owner.

Florida will issue the bidder a tax deed, usually within 30, possibly 40 days. Once you have the deed, you can legally sell the property.

Delinquent tax defaulted properties are sold at public auctions that anyone can attend and to qualify is simple. Register at the door. If you're buying tax deeds in Florida, some auctions may require that you demonstrate you have funds to bid, while others may not ask you.