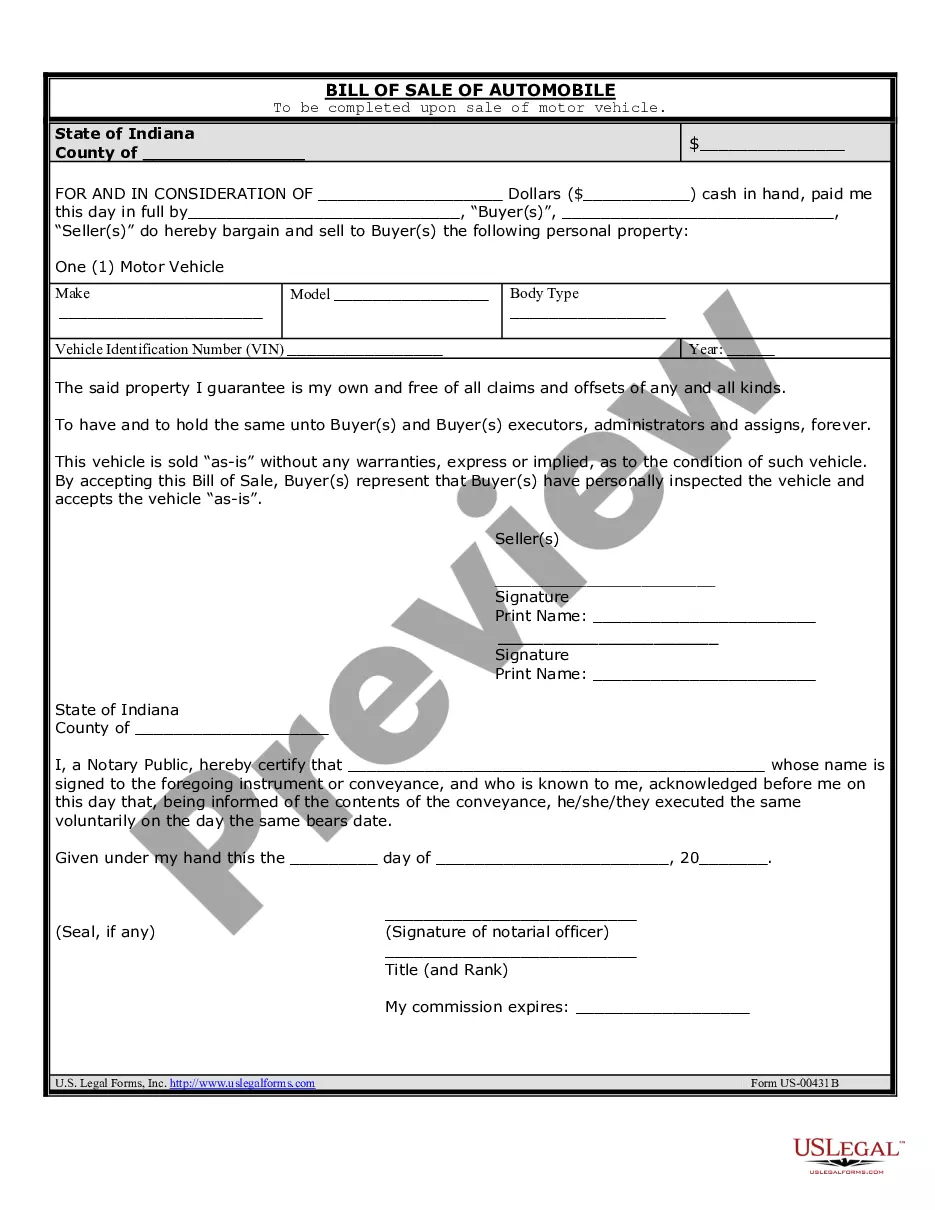

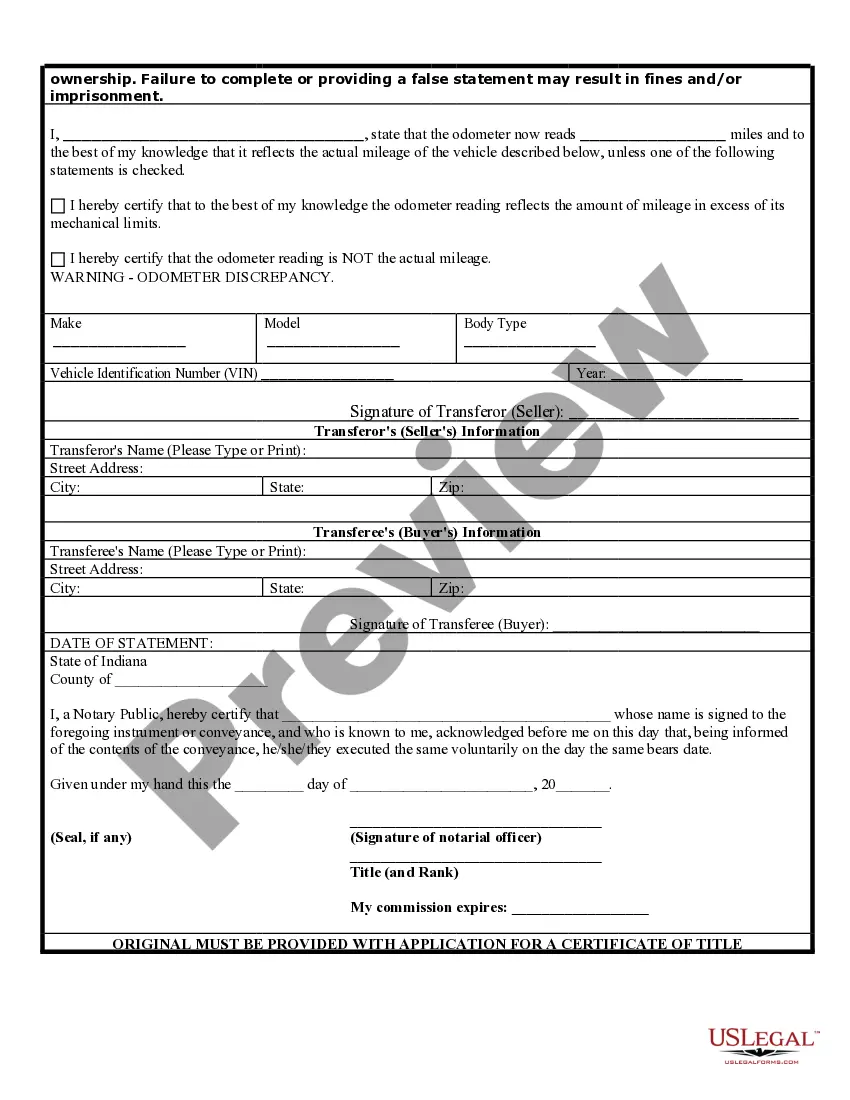

This form is a bill of sale of an automobile. The seller(s) guarantees that the automobile is his/her/their property and is free of all claims and offsets of any kind. The bill of sale also states that the automobile is sold "as-is" without any warranties, express or implied. A separate Odometer Disclosure Statement is included with the bill of sale.

The Indiana odometer statement with notary signature is a legal document that acts as a statement or declaration regarding the mileage of a motor vehicle at the time of sale or transfer. It is a requirement in Indiana for both private sellers and dealerships to provide this statement to the buyer as part of the vehicle registration process. The purpose of the Indiana odometer statement is to prevent odometer fraud and ensure that the buyer receives accurate information about the vehicle's mileage. This statement must be completed accurately and signed by both the seller and a notary public to validate its authenticity. There are different types of Indiana odometer statements available depending on the transaction type and vehicle status. Here are some notable ones: 1. Indiana Odometer Statement (Form 43230): This is a standard odometer statement used for most vehicle sales and transfers. It includes fields to fill in essential information such as the vehicle's make, model, year, VIN (Vehicle Identification Number), and the buyer and seller information. The statement must be notarized to be considered valid. 2. Indiana Odometer Disclosure Statement (Form 44049): This form is specifically designed for vehicles that are exempt from odometer reporting requirements, such as certain antique vehicles or vehicles with a gross weight rating of more than 16,000 pounds. It still requires a notary signature to ensure the accuracy of the disclosed information. 3. Indiana Dealer Reassignment of Title Section (Form 37763): This form is used by licensed dealerships when transferring the ownership of a vehicle. It includes an odometer disclosure statement section where the dealer records the mileage and signs as the seller. The buyer's information is also included, and the form must be notarized. It is vital for buyers and sellers to understand the importance of providing accurate odometer information and completing the Indiana odometer statement with a notary signature. Any attempt to falsify or tamper with this statement can result in legal consequences, as odometer fraud is considered a serious offense. Overall, the Indiana odometer statement with notary signature serves as a crucial document to protect both buyers and sellers and ensure transparency in vehicle transactions.