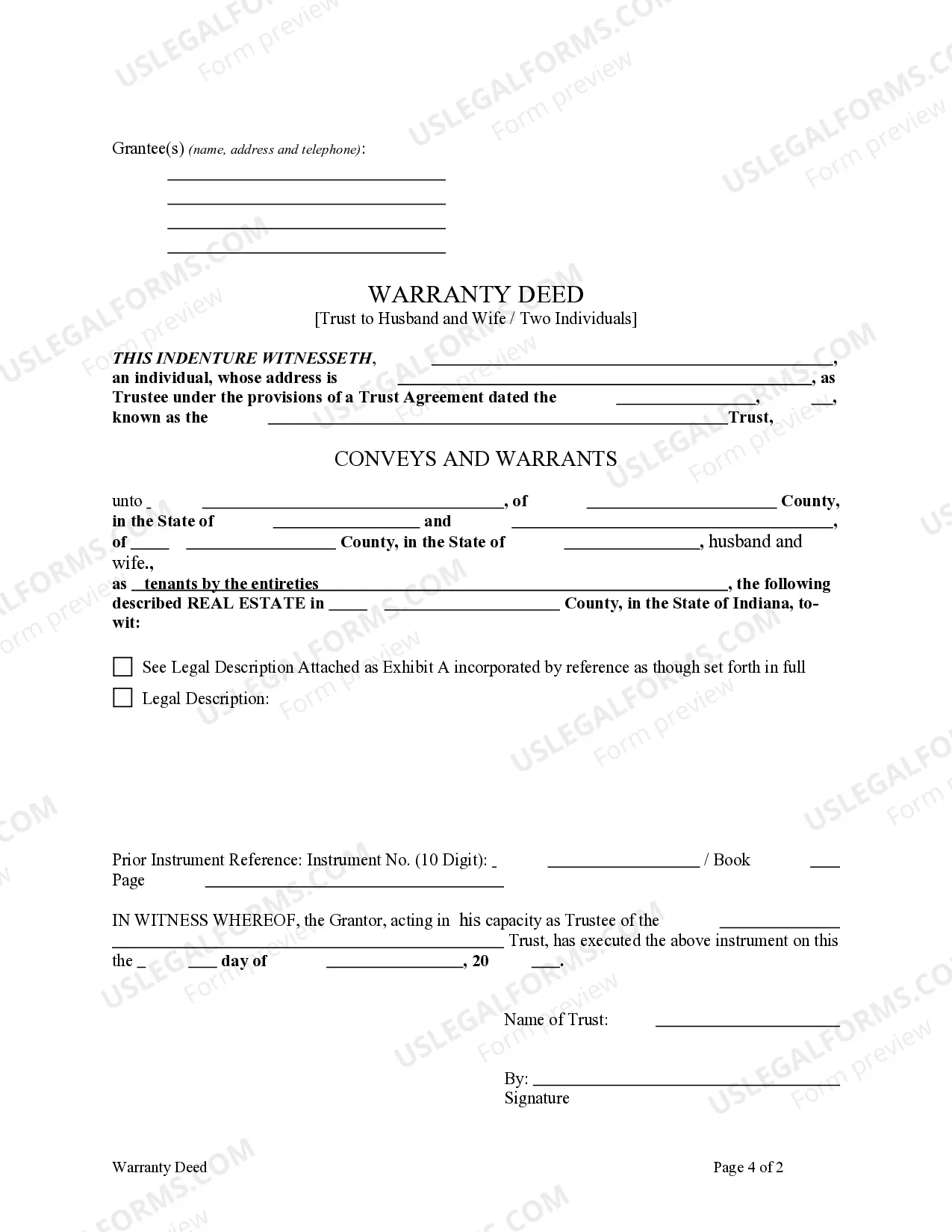

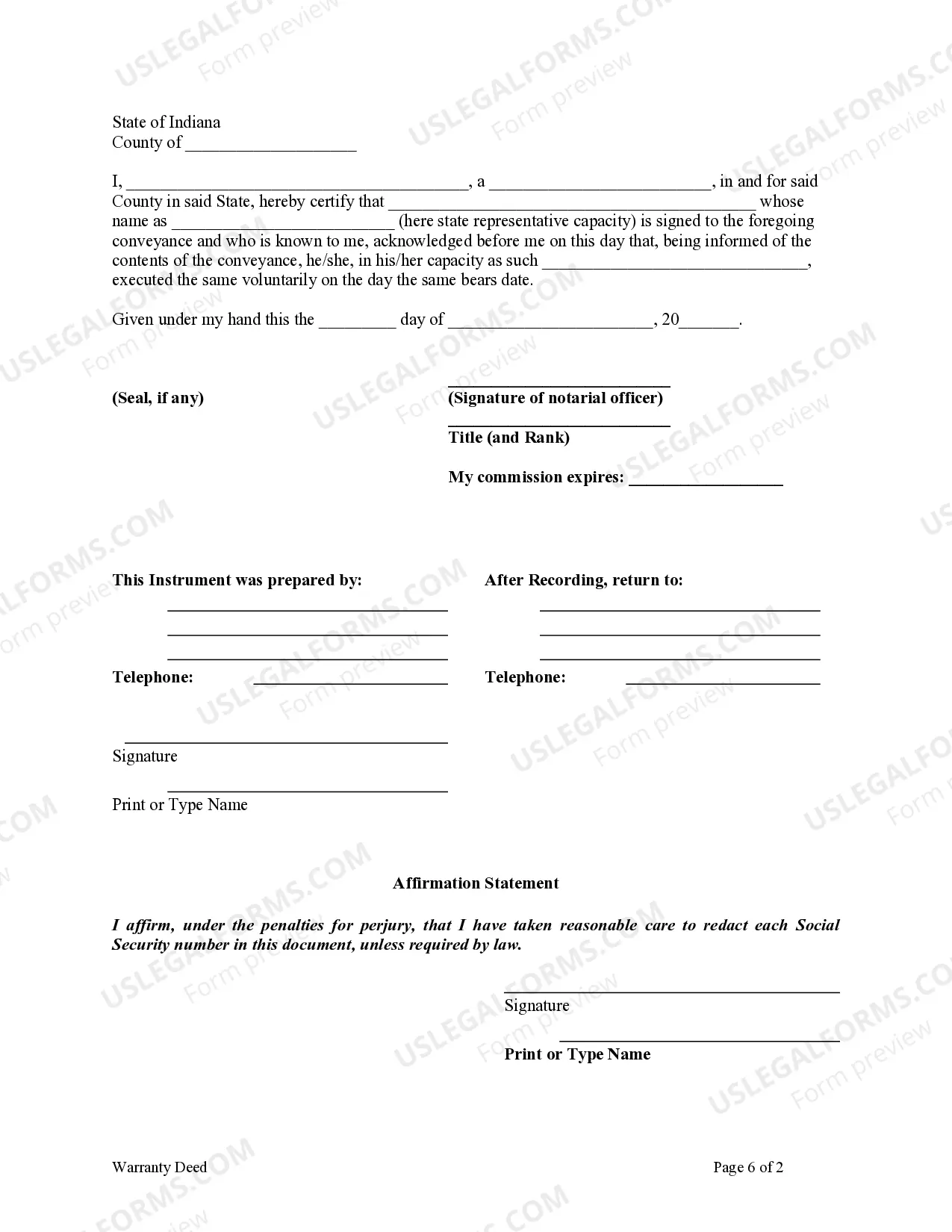

This form is a Warranty Deed where the Grantor is a Trust and the Grantees are husband and wife / two individuals. Upon ordering, you may download the form in Word or Rich Text formats.

Deed Of Trust And Mortgage

Description

How to fill out Indiana Warranty Deed From A Trust To Husband And Wife?

Maneuvering through the red tape of traditional forms and templates can be challenging, particularly if one is not engaged in that field professionally.

Even locating the appropriate template to acquire a Deed Of Trust And Mortgage will take time, as it needs to be valid and precise to the last detail.

However, you will need to invest significantly less time selecting a suitable template from a source you can rely on.

Obtain the correct form in a few simple steps: Enter the title of the document in the search bar, locate the appropriate Deed Of Trust And Mortgage from the list of results, review the description of the sample or view its preview. When the template meets your specifications, click Buy Now. Then, select your subscription plan, use your email to create a secure password to register at US Legal Forms, choose a credit card or PayPal payment method, and save the template document on your device in your preferred format. US Legal Forms can save you significant time in verifying if the form you found online meets your requirements. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a service that streamlines the process of finding the right forms online.

- US Legal Forms is a singular destination where you can obtain the latest samples of forms, seek guidance on their use, and download these samples for completion.

- It is a repository with over 85,000 forms applicable in various domains.

- When searching for a Deed Of Trust And Mortgage, you won’t have to doubt its authenticity, as all forms are verified.

- An account at US Legal Forms guarantees you have all the necessary samples at your fingertips.

- You can store them in your history or add them to the My documents collection.

- Access your saved forms from any device by simply clicking Log In on the library website.

- If you still lack an account, you can continually search for the template you need anew.

Form popularity

FAQ

While a mortgage deed and a deed of trust serve similar purposes, they are not the same. A mortgage deed typically involves just two parties: the borrower and the lender, whereas a deed of trust incorporates a third party, the trustee. This distinction influences how the foreclosure process occurs and the legal rights involved. Knowing these differences can help you make informed decisions about agreements related to a deed of trust and mortgage.

When considering a deed of trust and mortgage, the choice often depends on your specific situation. A deed of trust typically involves three parties: the borrower, the lender, and a neutral trustee, which can simplify the foreclosure process. On the other hand, a mortgage involves two parties and may require more formal judicial proceedings to reclaim property in case of default. Ultimately, both options have their advantages, so evaluating your needs is essential.

In Australia, upon paying off your mortgage, the next step is to obtain a discharge of mortgage from your lender. This document proves that you have fulfilled your mortgage obligations and allows you to apply for your title deed from the land registry. It's essential to follow up with your lender for the discharge documents, as your title will reflect that there is no longer a deed of trust and mortgage on your property. Platforms like uslegalforms can assist you with the paperwork and provide further guidance on securing your title.

Yes, it is possible to be on a mortgage without being on the deed in the UK. This often occurs in situations involving partners or family members where one person is the registered owner of the property, but both share the financial responsibility of the mortgage. However, being on the deed gives you legal ownership, while being on the mortgage merely shows who is liable for the repayments. Be aware that this can complicate your financial and ownership rights regarding the deed of trust and mortgage.

The disadvantages of a deed include less borrower protection during foreclosure, as proceedings can occur swiftly without court oversight. Additionally, you may lose your home quickly if you fall behind on payments. It's vital to consider these potential risks when deciding between a deed of trust and mortgage. Platforms like U.S. Legal Forms can provide helpful resources for making informed choices.

Lenders often prefer a deed of trust because it allows for a faster and more efficient foreclosure process. This type of arrangement reduces the time and costs associated with a default situation, as the trustee can initiate the sale without court involvement. Consequently, understanding the benefits of a deed of trust and mortgage from the lender's perspective can offer valuable insights for borrowers.

One disadvantage of a deed of trust is the potential for a quicker foreclosure process compared to a traditional mortgage. If the borrower defaults, the lender can initiate foreclosure without going through court, which may result in lost equity. It's important to weigh the pros and cons of a deed of trust and mortgage before making a commitment. Educating yourself on these factors can help protect your interests.

A trust deed does not directly impact your bank account, but it may have indirect effects on your financial situation. If you fail to make payments on your deed of trust, it could lead to foreclosure, which may influence your credit score and financial stability. Therefore, it's essential to manage your obligations under a deed of trust and mortgage effectively to protect your finances.

In a deed of trust, the process is typically handled by a trustee, who acts as an intermediary between the borrower and the lender. The trustee manages the property on behalf of the lender in the event of default. This setup contrasts with a traditional mortgage, where the lender has a direct claim against the property. Understanding how a deed of trust and mortgage works can help you make informed decisions.