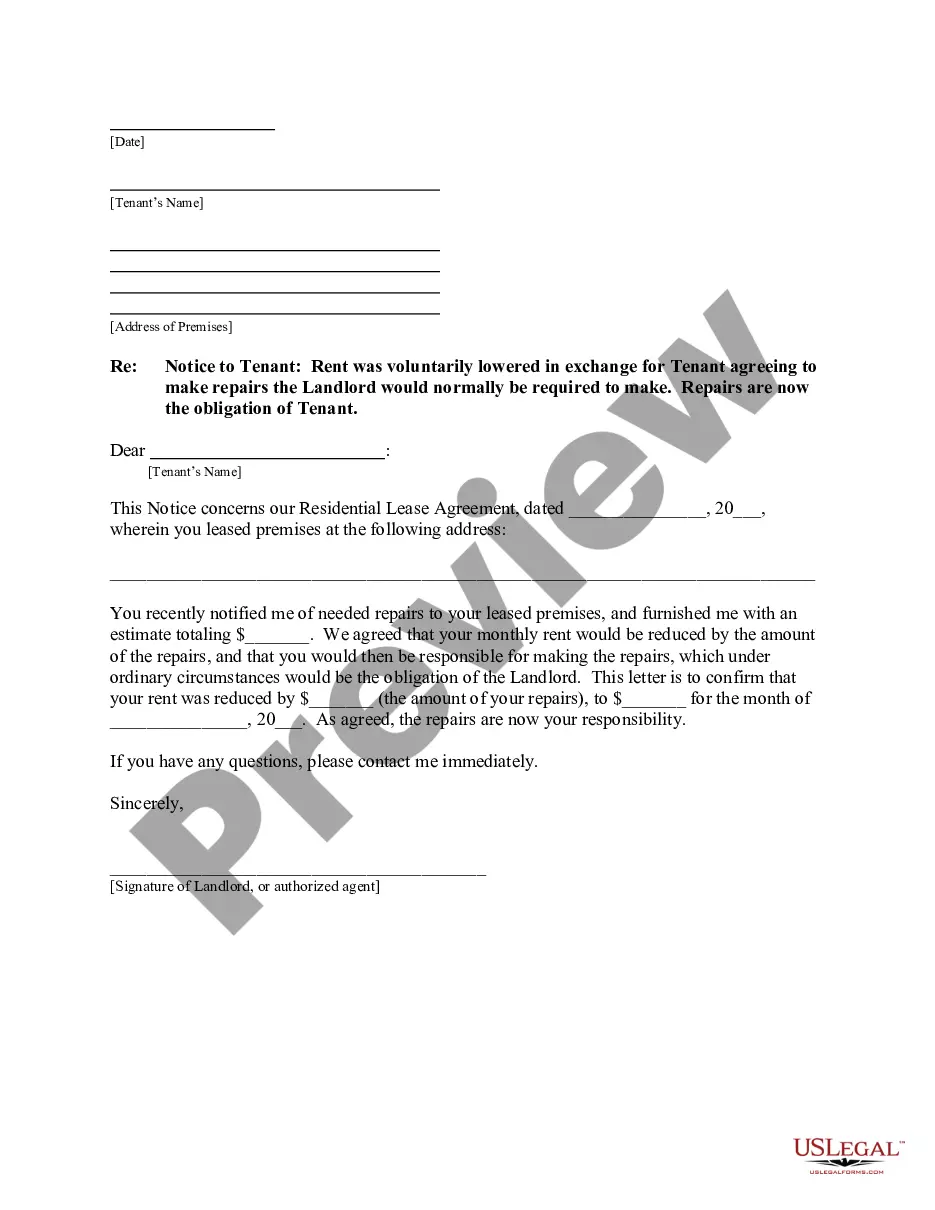

This is a sample letter from the Landlord to the Tenant. This letter is used as a Notice to the Tenant that the rent was voluntarily lowered in exchange for the Tenant making needed repairs to the premises.

Tenant Voluntarily Withholding Tax

Description

Form popularity

FAQ

For extra withholding, input an amount based on what you anticipate owing in taxes. Think about your income sources and any deductions you qualify for, as these affect your total tax obligation. It's helpful to adjust your withholding periodically to adapt to changes in your financial situation. Platforms like uslegalforms offer resources to guide you on tenant voluntarily withholding tax and help streamline your filing process.

To determine how much additional tax to withhold, calculate your expected income and any potential deductions. You should also consider your current tax rate and any credits you might be eligible for. Using online calculators can provide insights into the ideal withholding amount. Assessing these factors helps you manage tenant voluntarily withholding tax effectively.

Putting 0 for additional withholding indicates that you do not want to withhold any extra taxes from your payments. However, consider your overall financial situation and whether you may owe taxes later. Making this decision requires understanding your income level and expenses throughout the year. Consulting with a tax expert can clarify your needs for tenant voluntarily withholding tax.

Yes, you can file a W-4V online depending on the platform you choose to use. Many online tax services allow you to complete and submit the form digitally. Using a reliable platform makes it easy to manage your tenant voluntarily withholding tax obligations efficiently. Make sure to review your entries for accuracy before submission.

To submit withholding to the IRS, you will need to fill out the relevant forms, like the W-4V for voluntary withholding. Ensure you provide accurate information to prevent any issues. After completing the form, follow the instructions on where to send it or how to file it online through the IRS website. Keeping good records can help manage tenant voluntarily withholding tax.

When considering additional withholdings, think about your financial situation and goals. You may want to claim more if you expect to owe taxes at the end of the year. Understanding your income and any deductions you may qualify for helps you make an informed decision. It's wise to consult with a tax professional for personalized advice related to tenant voluntarily withholding tax.

For additional withholding, consider your overall tax situation, including deductions, credits, and income levels. It's essential to calculate if you need to reduce your withholding or make further adjustments, particularly if you are a tenant voluntarily withholding tax. Consulting with a tax professional or using resources from platforms like uslegalforms can provide valuable insights.

Voluntary withholding tax allows individuals, like tenants, to have extra amounts deducted from their payments. This option lets you manage your tax responsibilities more effectively and avoid surprises during tax season. Understanding this concept is vital, especially for tenants voluntarily withholding tax to ensure compliance with federal requirements.

Yes, you can fill out an AW 4V form online through various platforms that offer tax solutions, including uslegalforms. This feature simplifies the process, allowing you to complete the form from the comfort of your home. Using an online service can also help you accurately manage your tenant voluntarily withholding tax obligations.