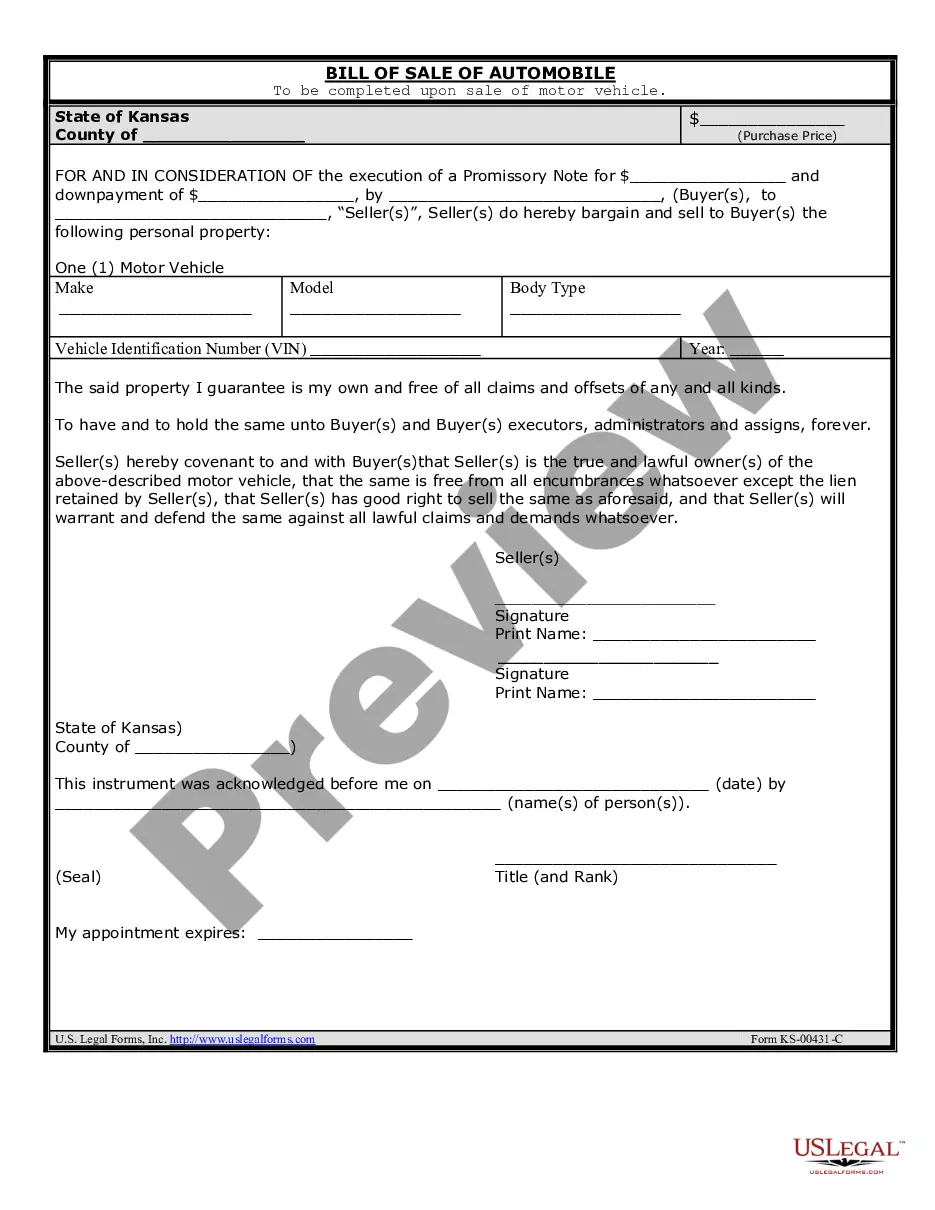

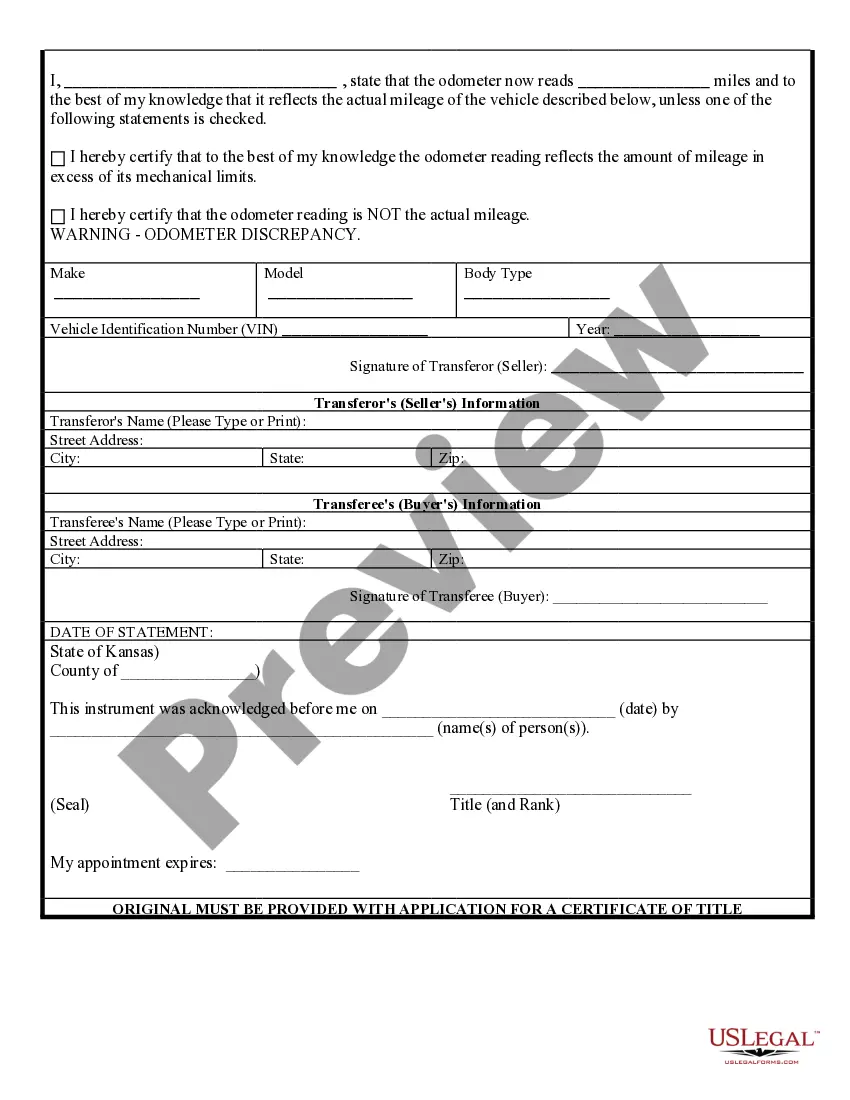

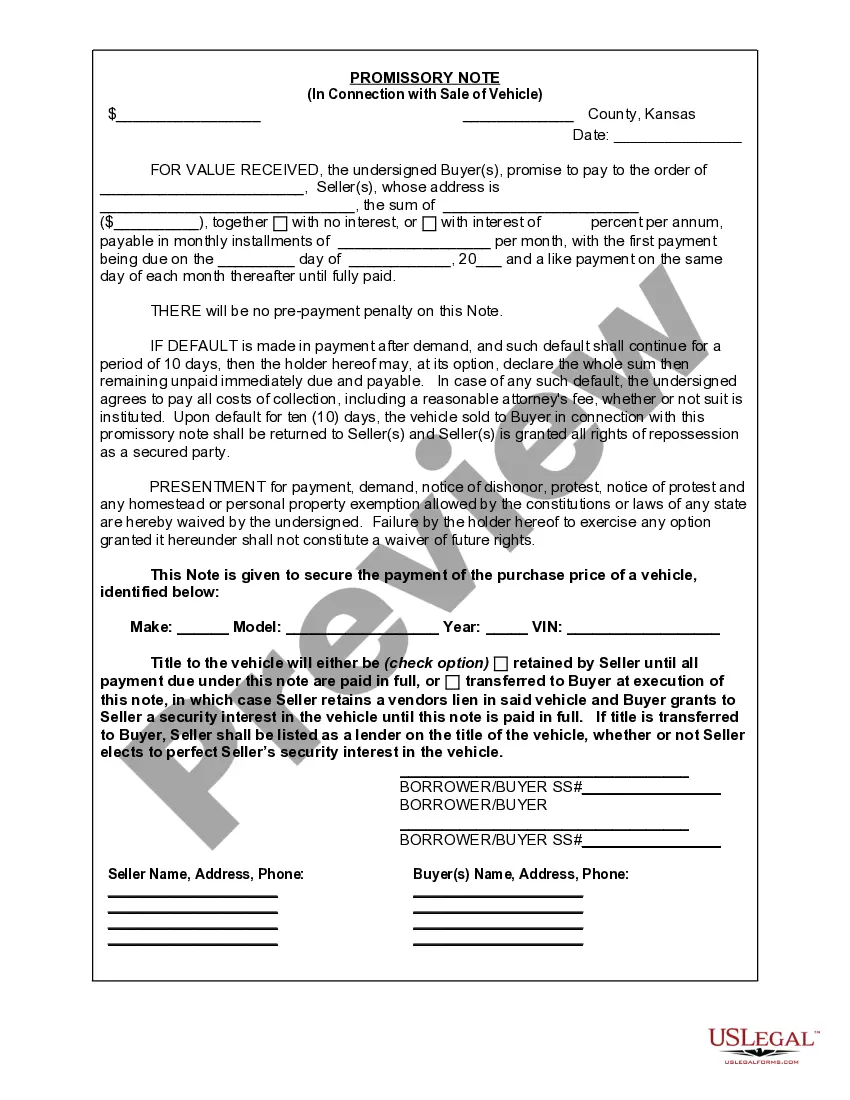

Kansas Auto Bill Of Sale With Lien Holder

Description

How to fill out Kansas Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

Bureaucracy requires precision and exactness.

If you do not manage the completion of documents like the Kansas Auto Bill Of Sale With Lien Holder regularly, it can result in some misunderstandings.

Choosing the correct sample from the outset will ensure that your document submission proceeds smoothly and avoid any complications of resending a file or repeating the entire process from the beginning.

Finding the appropriate and current samples for your documentation is a matter of a few minutes with an account at US Legal Forms. Sidestep the bureaucratic frustrations and simplify your form handling.

- Find the template utilizing the search feature.

- Verify the Kansas Auto Bill Of Sale With Lien Holder you’ve discovered is applicable for your state or county.

- Review the preview or browse the outline containing the specific information on the usage of the sample.

- If the result matches your inquiry, click the Buy Now button.

- Select the appropriate option from the available pricing plans.

- Log In to your account or create a new one.

- Complete the transaction using a credit card or PayPal payment option.

- Store the form in your preferred format.

Form popularity

FAQ

In general, Kansas does not require bills of sale, title assignments, and applications to be notarized. However, it has the right to request notarization in unusual circumstances, such as if document information is incomplete or questionable.

How Do I Write a Kansas Bill of Sale?Their names (printed)The date of the bill of sale.Certain information about the item being sold.The amount the item was sold for.The signatures of the involved parties.In some instances, the bill of sale may also need to be notarized.

The lien can be released on the title, a notarized lien release, Form TR-150, or a letter from the lienholder releasing the lien. If the title for the vehicle was issued from another state (not a Kansas title) or the Bill of Sale is from an out of state owner, a vehicle inspection is required.

Is a Bill of Sale Required in Kansas? In most cases, no. You only need a bill of sale in Kansas if the vehicle being registered is an antique at least 35 years old without a title or the title you have doesn't have a figure listed for the sale amount.

Is a Bill of Sale required for selling a car in Kansas? No, a bill of sale is not required. However, it's always a good idea to have a bill of sale signed by the seller and the buyer with a copy for both to transfer ownership and give legal protection to both parties.