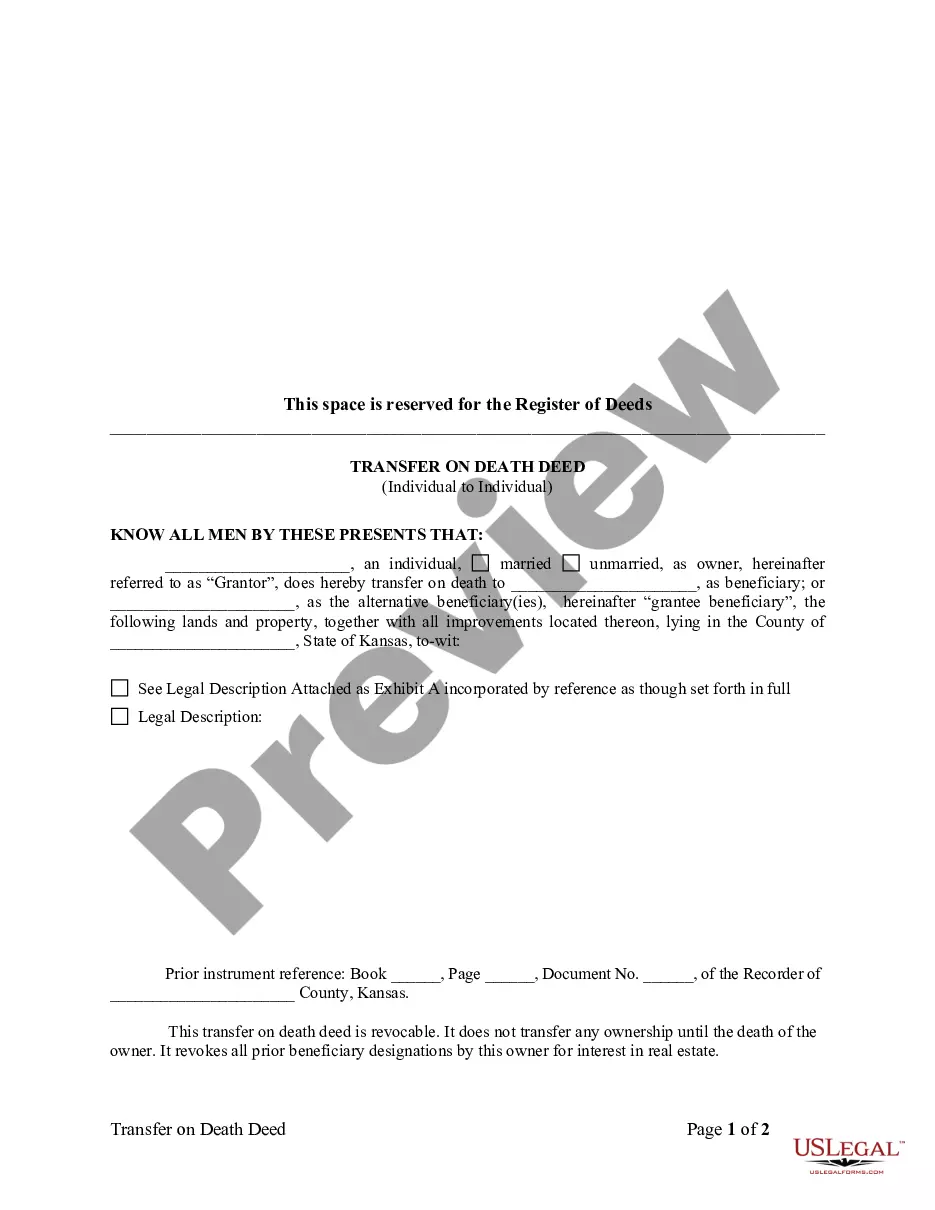

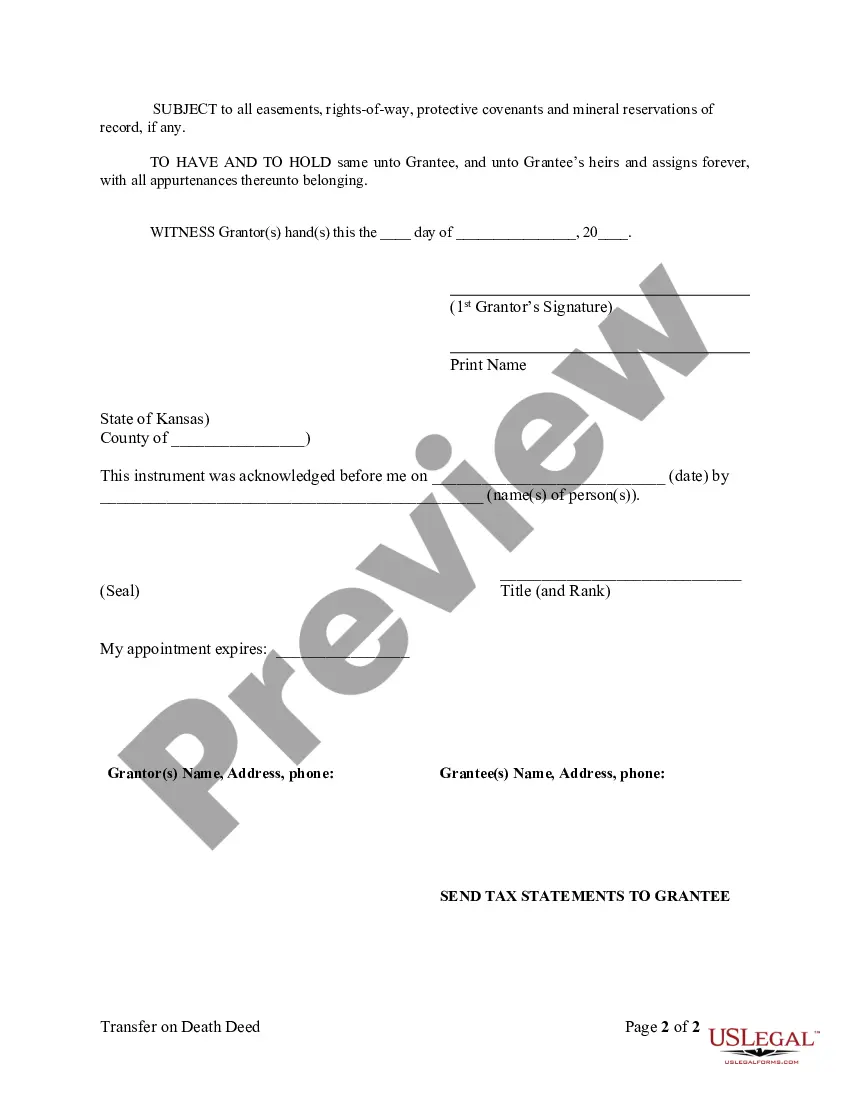

The Kansas Transfer on Death Deed (TODD) is a legal document that allows real estate owners in Kansas to designate a beneficiary who will inherit their property upon their death, without the need for probate. Here is a detailed description of the Kansas Transfer on Death Deed form and instructions, along with different types: 1. Kansas Transfer on Death Deed Form: The Kansas TODD form, also known as the Kansas Beneficiary Deed, is a specially designed form available for property owners in Kansas to transfer their real estate upon their death. This form must meet the specific requirements established by the Kansas Statutes Annotated (K.S.A.) to be legally valid. 2. Instructions for Kansas Transfer on Death Deed Form: To properly complete the Kansas TODD form, property owners must follow these instructions: a. Identify the Granter: Begin by clearly identifying yourself (the granter) by providing your full legal name, address, and other required details. b. Describe the Property: Accurately describe the property being transferred, including its full address, legal description, and county where it is located. c. Designate the Beneficiary: Specify the full legal name, address, and relationship of the beneficiary who will inherit the property upon your death. d. Contingent Beneficiary: Optionally, you may include a contingent beneficiary who will inherit the property only if the primary beneficiary predeceases you or is unable or unwilling to accept the transfer. e. Notarization: The Kansas TODD form requires notarization. Ensure that all parties involved (granter, witnesses, and notary) sign the form in the presence of a notary public. f. Recording: After completing the form, file it with the county recorder's office where the property is located. Pay the necessary recording fees to formalize the transfer on death deed. 3. Types of Kansas Transfer on Death Deed Forms: While there is generally only one Kansas TODD form, variations may exist depending on the specific requirements or preferences of the property owner. It is advisable to consult an attorney or use an online legal service to ensure compliance with all legal standards when preparing the form. a. Individual Transfer on Death Deed: This is the most common Kansas TODD form, enabling an individual property owner to designate a specific beneficiary. b. Joint Tenancy with Right of Survivorship Transfer on Death Deed: This type of TODD is used when two or more co-owners want to transfer their interests in a property upon their deaths, specifying the surviving co-owner(s) as the primary beneficiary(IES). c. Tenancy in Common Transfer on Death Deed: If property owners want to transfer their individual undivided interests in a property upon their deaths, this type of Kansas TODD can be used. In conclusion, the Kansas Transfer on Death Deed form provides a convenient and efficient way for real estate owners in Kansas to pass down their properties to designated beneficiaries without the need for probate. It's essential to follow the specific instructions and utilize the correct form type to ensure a legally valid transfer. Seeking legal guidance is recommended for a smooth and error-free process.

Kansas Transfer On Death Deed Form With Instructions

Description

How to fill out Kansas Transfer On Death Deed Form With Instructions?

Drafting legal documents from scratch can often be daunting. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re looking for a a simpler and more affordable way of preparing Kansas Transfer On Death Deed Form With Instructions or any other documents without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online library of more than 85,000 up-to-date legal documents covers almost every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-compliant forms diligently prepared for you by our legal professionals.

Use our platform whenever you need a trusted and reliable services through which you can quickly find and download the Kansas Transfer On Death Deed Form With Instructions. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No problem. It takes little to no time to set it up and explore the library. But before jumping straight to downloading Kansas Transfer On Death Deed Form With Instructions, follow these tips:

- Review the form preview and descriptions to make sure you are on the the form you are searching for.

- Make sure the template you choose complies with the requirements of your state and county.

- Choose the right subscription option to purchase the Kansas Transfer On Death Deed Form With Instructions.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us today and transform form execution into something easy and streamlined!

Form popularity

FAQ

To succeed with a motion for modification of child support: The proposed modified amount must be consistent with Utah state guidelines. The current order?including the Decree of Divorce, Decree of Paternity, and Decree of Child Support and Parent Time?must not have already been modified within the past three years.

Monthly child support payments are calculated by using a formula established by the Utah State Legislature. Things that are considered in determining the amount of child support payments include: each parent's income, the child's needs, the number of children needing support and other factors.

However, in most cases, if you haven't paid your child support payments, you'll be held in contempt of court and penalties will be added to what you owe. The judge might even impose jail time until the payments are made.

What Does Child Support Cover? In Utah, the child support is used to cater for the living expenses of the child. Some of the basic items covered by in the child support cover include necessities such as food, shelter, medical expenses, health insurance, and clothing.

Sometimes we ask the courts to help collect past-due support. If your case meets certain legal conditions, we may start civil contempt proceedings. If the court does hold you in contempt, you can face a variety of sanctions, including community service or even short-term incarceration.

Under federal and state laws in Utah, when the child is born to unmarried parents, the mother will gain the natural or primary right to custody.

In Utah, both parents must be financially responsible for their children. The amount they pay in joint custody child support depends on the custody arrangement, their income, and the number of children they are raising. Joint custody may reduce child support, but it isn't always the case.

There are two ways to ask the court to change child support ? a Motion to Adjust and a Petition to Modify. A motion is simpler and usually faster, but can only be used in limited circumstances. Usually, you must file a petition.