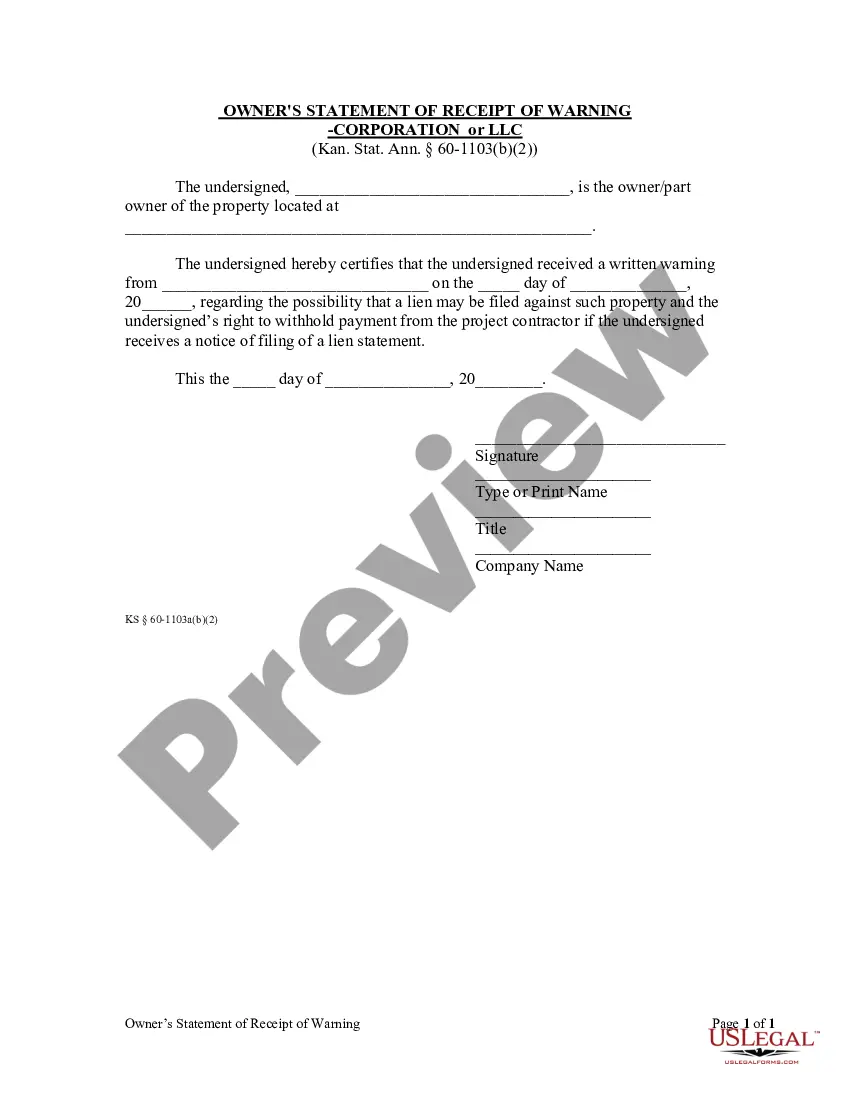

Owner Receipt With Credit Card

Description

How to fill out Owner Receipt With Credit Card?

How to obtain professional legal documents that adhere to your state's regulations and prepare the Owner Receipt With Credit Card without consulting a lawyer.

Many online services provide templates for various legal situations and formalities. However, it might take some time to ascertain which available samples meet both usability and legal requirements for you.

US Legal Forms is a trustworthy platform that assists you in locating formal documents created in accordance with the most recent state law updates and helps you save expenses on legal aid.

If you do not yet have an account with US Legal Forms, follow the guide below: Look through the webpage you’ve opened and verify if the form meets your requirements. To do this, utilize the form description and preview options if accessible. Search for another sample in the header by providing your state if needed. Click the Buy Now button upon finding the suitable document. Choose the most appropriate pricing plan, then Log In or register for an account. Decide on the payment method (by credit card or via PayPal). Select the file format for your Owner Receipt With Credit Card and click Download. The obtained templates are yours to keep: you can return to them anytime in the My documents tab of your profile. Join our library and create legal documents on your own like a seasoned legal expert!

- US Legal Forms is not just an ordinary online catalog.

- It's a repository of over 85k verified templates for a wide range of business and personal scenarios.

- All documents are categorized by area and state to facilitate a faster and more convenient search process.

- Furthermore, it integrates with powerful tools for PDF editing and electronic signatures, enabling users with a Premium subscription to efficiently finalize their paperwork online.

- It requires minimal time and effort to acquire the necessary documents.

- If you already possess an account, Log In and confirm that your subscription is active.

- Download the Owner Receipt With Credit Card using the corresponding button next to the file name.

Form popularity

FAQ

Filling out an official receipt calls for attention to detail. You should record the transaction date, amount, payer's name, and specifics of the goods or services. If it's an owner receipt with credit card, highlight this payment method to ensure compliance and proper record-keeping.

To fill out a payment receipt, you should include essential details like the date, the payer's information, and the amount received. If applicable, note the payment method used, such as an owner receipt with credit card for clarity. This information makes it easy for both parties to track payments.

Typically, credit card receipts include the cardholder's name, making it easier to identify the purchaser. This feature is important for maintaining accurate records, especially with an owner receipt with credit card. Always ensure the information is correct for future reference.

When filling out a credit card receipt, start by entering the date and transaction number. Record the total amount and categorize the items purchased. It’s essential to note that this is an owner receipt with credit card, making it a formal acknowledgment of the payment method used.

Writing proof of payment involves stating the details of the transaction, such as the date, the amount, and the method of payment. For an owner receipt with credit card, include the card type and the last four digits of the card number. This documentation serves as confirmation that the transaction took place.

When disposing of credit card statements, it is best to shred them rather than just throwing them away. Each statement contains sensitive data, just like an owner receipt with credit card. Secure disposal practices will help you manage your information and reduce the risk of fraud.

To dispose of credit card receipts, consider using a shredder to ensure your personal information does not fall into the wrong hands. Since an owner receipt with credit card contains financial details, prioritizing secure disposal is crucial. Simply discarding them without protection may lead to identity theft.

You can dispose of merchant receipts by shredding them to safeguard your personal information. An owner receipt with credit card can include sensitive data, so it is wise to keep your information secure. After confirming the details, simply place them in a shredder or a secure disposal bin.

It is generally safe to throw away credit card receipts after you have verified your transactions. However, keep in mind that an owner receipt with credit card can contain personal information. For this reason, you should take precautions like shredding them before disposal to protect your identity.

Generally, a receipt does not contain sensitive credit card information like your full card number or security code. However, it may display the last four digits of your card, which can be associated with your account. Keeping a secure owner receipt with credit card information can help protect your financial data.