Kansas Landlord Notice For Lien Form

State:

Kansas

Control #:

KS-1007LT

Format:

Word;

Rich Text

Instant download

Description

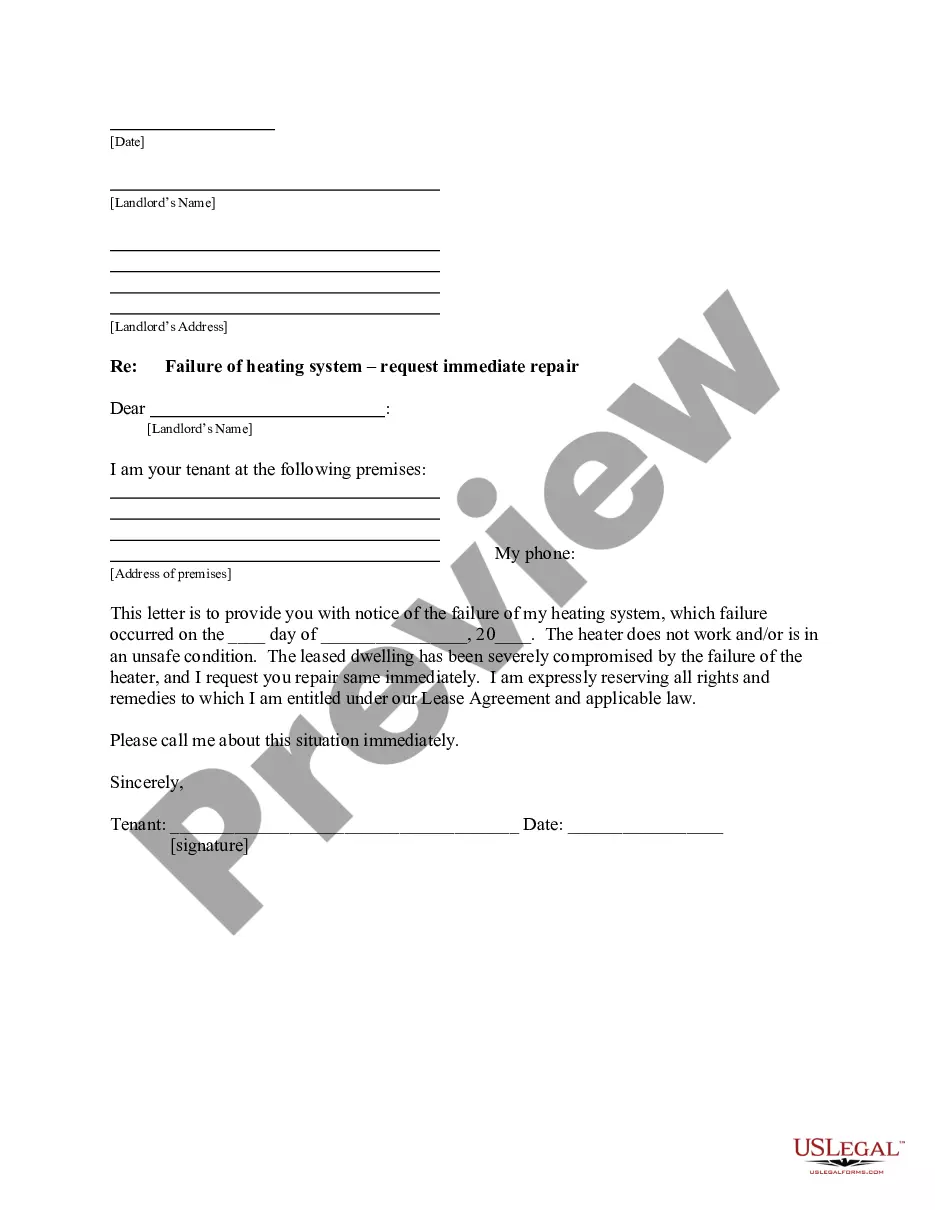

This form is used by a tenant to inform the landlord of a problem with the lease premises, specifically failure of the heating system. With this form, the tenant notifies the landlord that he/she/it has breached the statutory duty to maintain the property in tenantable condition and demands that immediate repairs be made.

Free preview