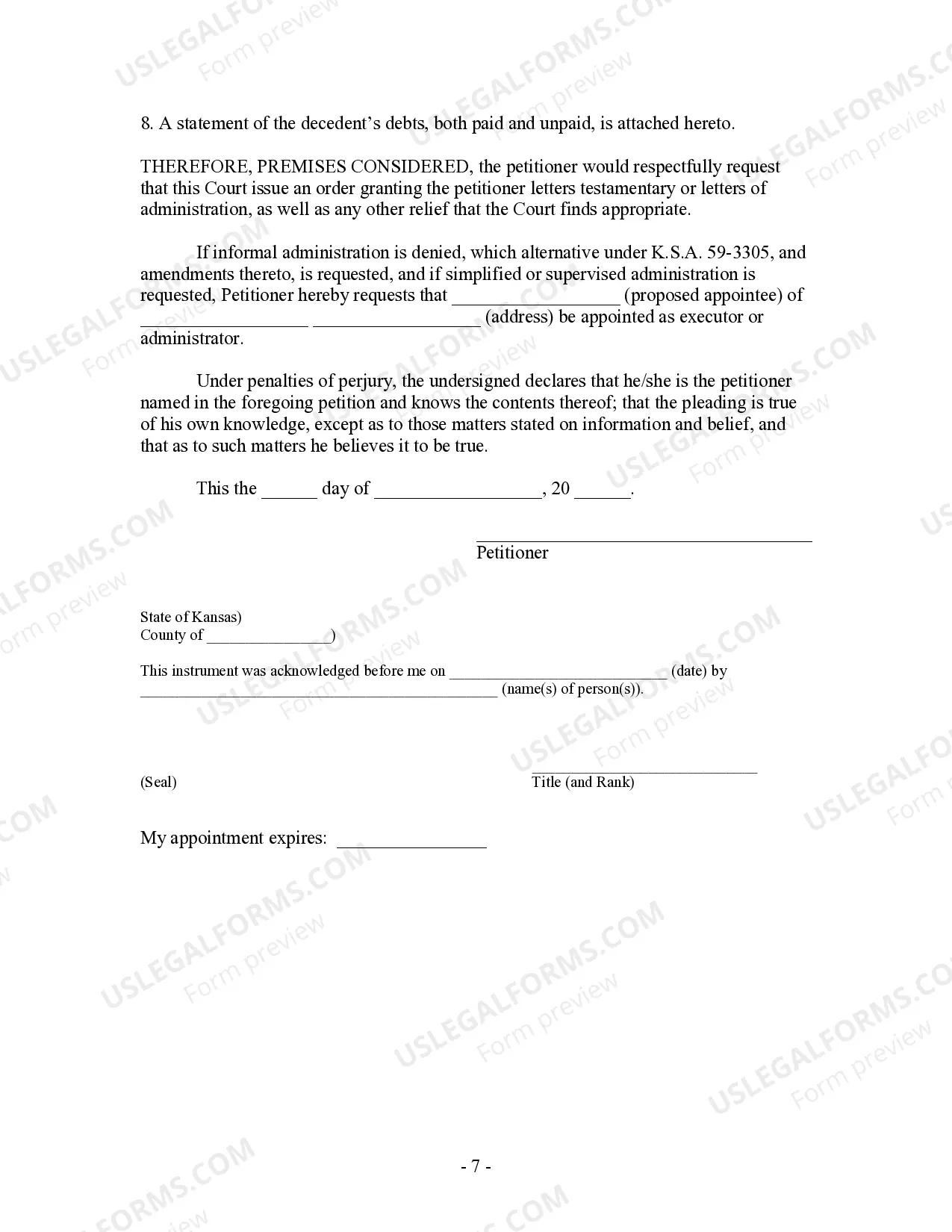

Kansas Simplified Estates Act Form

Description

How to fill out Kansas Simplified Estates Act Form?

Bureaucracy demands exactness and precision.

If you do not handle completing documents like the Kansas Simplified Estates Act Form on a daily basis, it can result in some misunderstandings.

Choosing the correct example from the outset will guarantee that your document submission proceeds seamlessly and avoid any hassles of re-sending a file or starting the entire process anew.

If you are not a registered user, locating the necessary example will involve a few extra steps: Locate the template using the search bar. Ensure the Kansas Simplified Estates Act Form you have found is suitable for your state or area. Examine the preview or go through the description that includes the details on how to use the template. If the result meets your expectations, click the Buy Now button. Select the correct option from the available subscription plans. Log In/">Log In to your account or create a new one. Finalize the purchase using a credit card or PayPal account. Download the form in your preferred file format. Finding the right and updated samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic uncertainties and simplify your paperwork tasks.

- Acquire the accurate example for your documentation from US Legal Forms.

- US Legal Forms is the largest online repository of forms, housing over 85 thousand examples across various domains.

- You can obtain the latest and most relevant version of the Kansas Simplified Estates Act Form by simply searching for it on the platform.

- Find, save, and download templates within your account or refer to the description to confirm you have the appropriate one available.

- Having an account at US Legal Forms makes it simple to obtain, keep in one place, and browse the templates you've saved for quick access.

- When on the website, click the Log In/">Log In button to authenticate.

- Next, navigate to the My documents page, where your document history is maintained.

- Review the details of the forms and download those you require at any time.

Form popularity

FAQ

In Kansas, the minimum estate value for probate largely depends on specific laws that govern property and assets. Generally, if an estate's total value falls below a certain threshold, it may not require probate. However, understanding the details surrounding the Kansas simplified estates act form can clarify what counts towards this value. For comprehensive support and accurate forms, USLegalForms can be an excellent resource to navigate these requirements.

Filling out an estate document, such as the Kansas simplified estates act form, requires clear and accurate information. Start by gathering necessary details about the estate, including assets and beneficiaries. Then, follow the instructions provided with the form carefully to ensure you include all required information. If you have questions during the process, consider using platforms like USLegalForms for helpful resources and guidance.

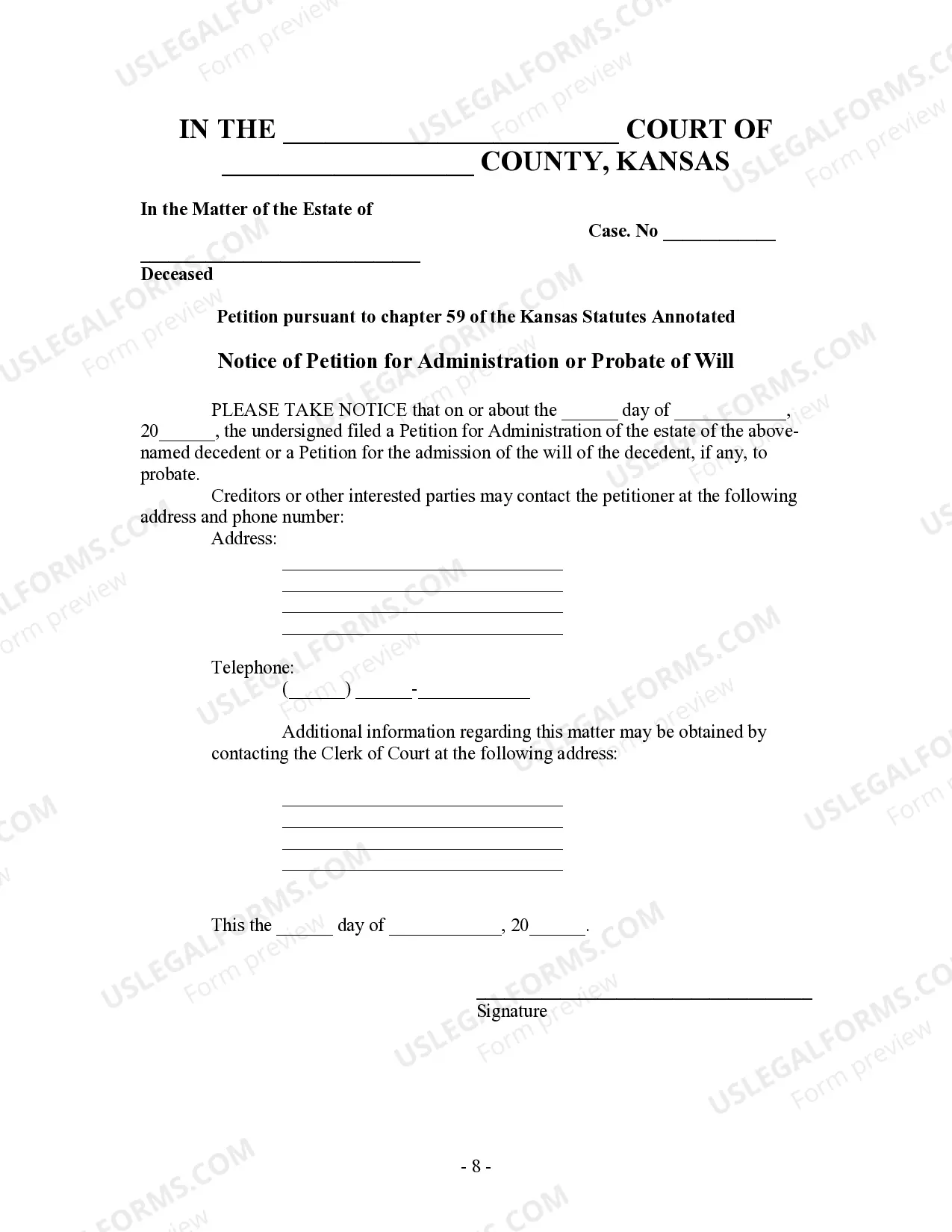

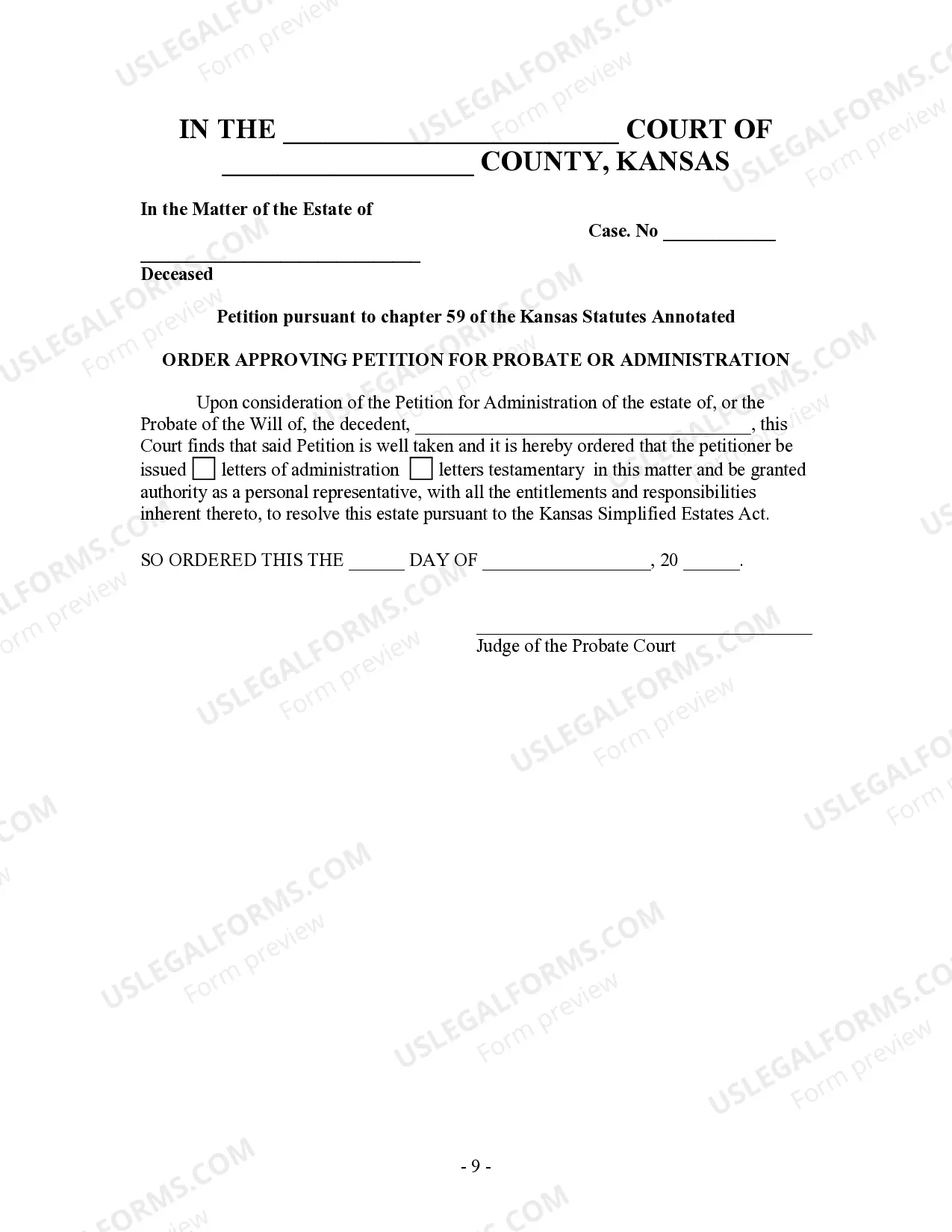

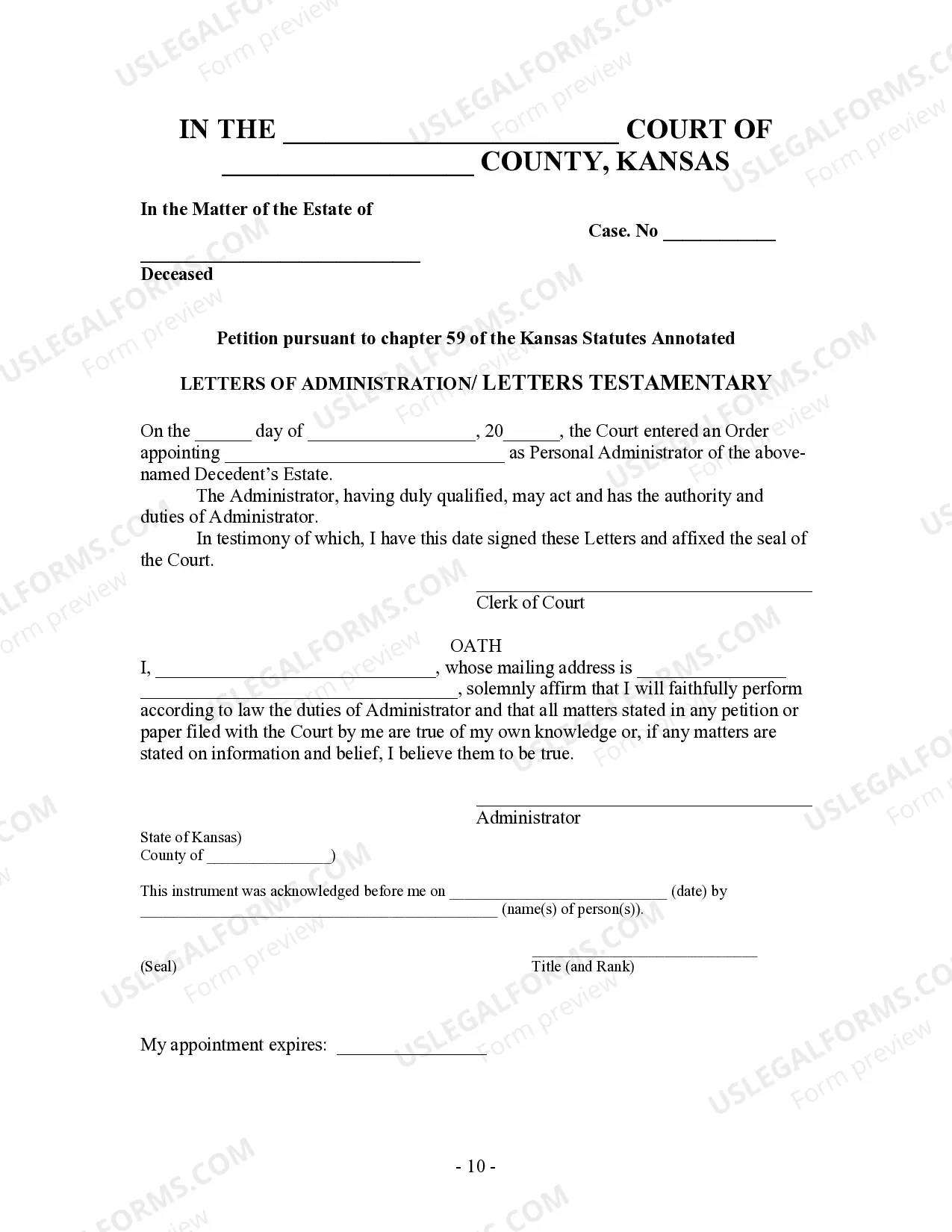

The Kansas Simplified Estates Act provides a streamlined process for settling smaller estates without formal probate. This act allows eligible estates to be administered more quickly and with fewer legal requirements. To take advantage of this, you will need to complete the Kansas simplified estates act form, which simplifies documentation and expedites the process. This can be a great solution for families looking to manage estates efficiently during challenging times.

To file for executor of an estate in Kansas, you must first file the will with the probate court in the county where the deceased lived. After this, you’ll need to complete the necessary paperwork, which may include the Kansas Simplified Estates Act form if the estate qualifies. Throughout this process, being organized and thorough will help you ensure compliance with legal requirements. It's advisable to seek guidance if you encounter any complexities.

The Kansas inheritance tax applies to the value of the estate transferred to beneficiaries. This tax varies based on the relationship between the deceased and the heir, with closer relatives typically facing a lower tax rate. Understanding the implications of the Kansas inheritance tax is important for effective estate planning. Utilizing resources like the Kansas Simplified Estates Act form can facilitate this process and help you navigate tax responsibilities.

In Kansas, an executor typically has up to nine months to settle an estate, although this period can be extended under certain circumstances. Executors are responsible for managing the estate, paying debts, and distributing assets to beneficiaries. If you are managing an estate that qualifies, consider using the Kansas Simplified Estates Act form to expedite the process. This can help you meet your obligations without unnecessary delays.

Yes, in Kansas, wills must be filed with the court after the individual passes away. It is important to submit these documents promptly to initiate the probate process, especially if the estate exceeds the established value. Using the Kansas Simplified Estates Act form can streamline this process for eligible estates. This ensures that the decedent's wishes are honored and that the estate is settled correctly.

In Kansas, an estate typically must have a value exceeding $40,000 to require probate. If the estate is below this threshold, the process can be simplified through the Kansas Simplified Estates Act form. By utilizing this form, you can avoid the lengthy probate process and settle the affairs more efficiently. It's essential to determine the estate's value accurately to know which route to take.

To create a small estate affidavit in Kansas, the estate must have a total value of $40,000 or less in personal property and must not involve real estate. The heirs or beneficiaries filing the affidavit must also provide specific information about the deceased's assets. Utilizing the Kansas simplified estates act form can help you fulfill these requirements and ensure a smooth transfer of property.

Not all wills need to be probated in Kansas. If the estate is small, and meets the criteria set by the Kansas simplified estates act form, you might be able to avoid probate entirely. This can save time and expenses while ensuring beneficiaries receive their inheritance promptly.