Kansas A Corporation Form For State Withholding

Description

How to fill out Kansas A Corporation Form For State Withholding?

When you are required to submit Kansas A Corporation Form For State Withholding in alignment with the laws and regulations of your local state, there may be numerous options available. If you are a subscriber of US Legal Forms, there is no need to scrutinize every form to ensure it satisfies all legal requirements. This is a trustworthy service that can assist you in obtaining a reusable and up-to-date template on any subject.

US Legal Forms is the largest online catalog featuring a collection of over 85,000 ready-to-use documents for both business and personal legal matters. All templates are verified to meet the laws of each state. Consequently, when downloading the Kansas A Corporation Form For State Withholding from our platform, you can be assured that you are maintaining a valid and current document.

Obtaining the necessary sample from our platform is incredibly simple. If you already possess an account, just Log In/">Log In to the system, verify that your subscription is active, and save the selected file. In the future, you can access the My documents section in your profile and retrieve the Kansas A Corporation Form For State Withholding anytime. If this is your first encounter with our website, please adhere to the following guide.

Acquiring professionally created formal documentation becomes effortless with US Legal Forms. Additionally, Premium users can take advantage of comprehensive integrated solutions for online PDF editing and signing. Give it a try today!

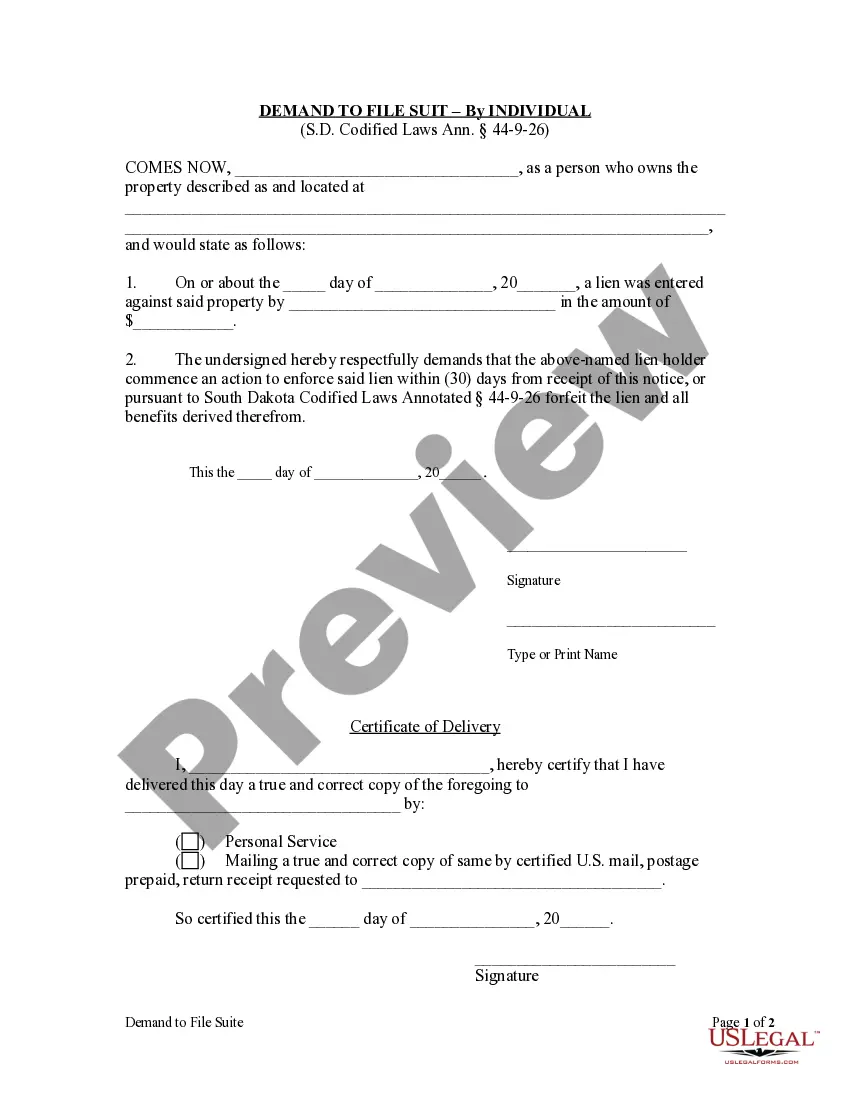

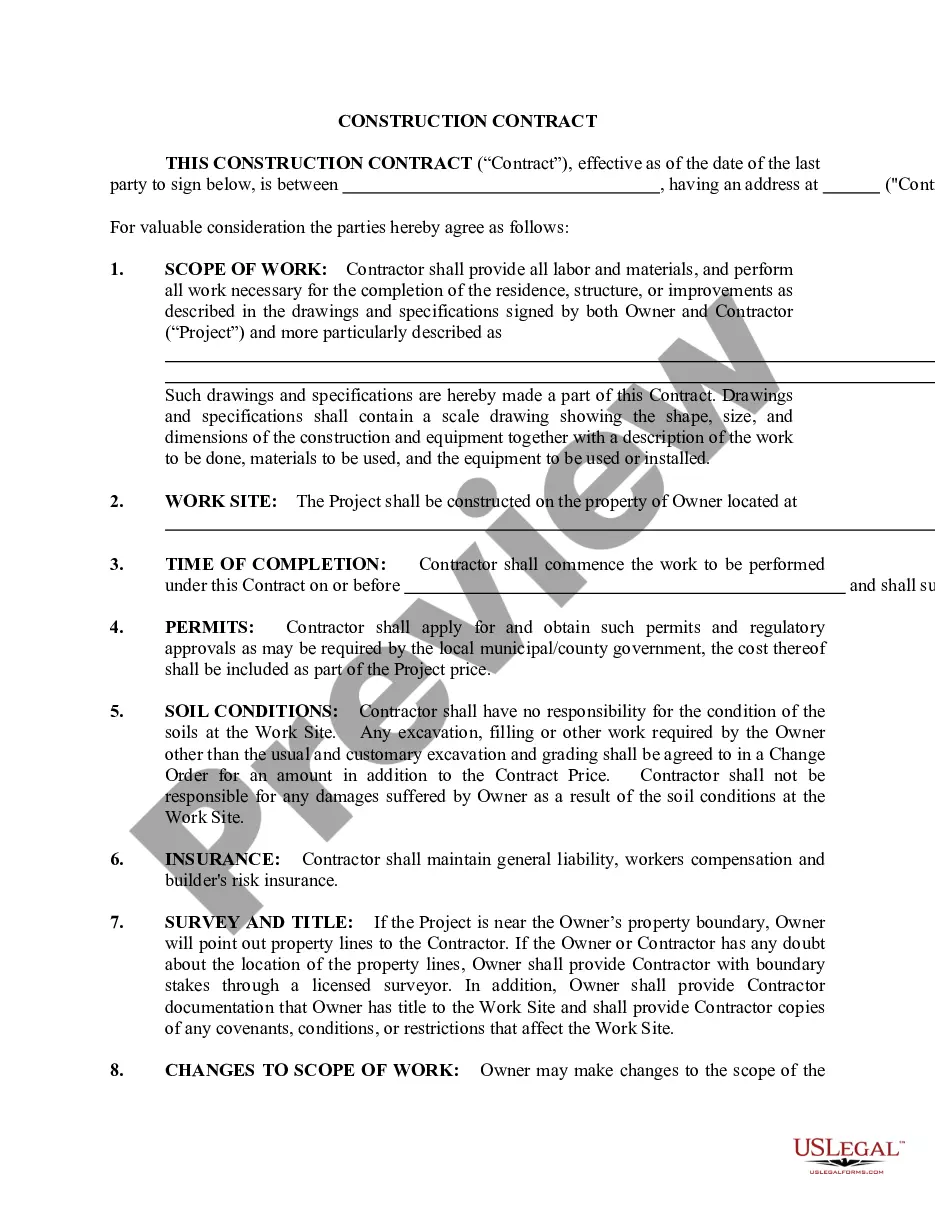

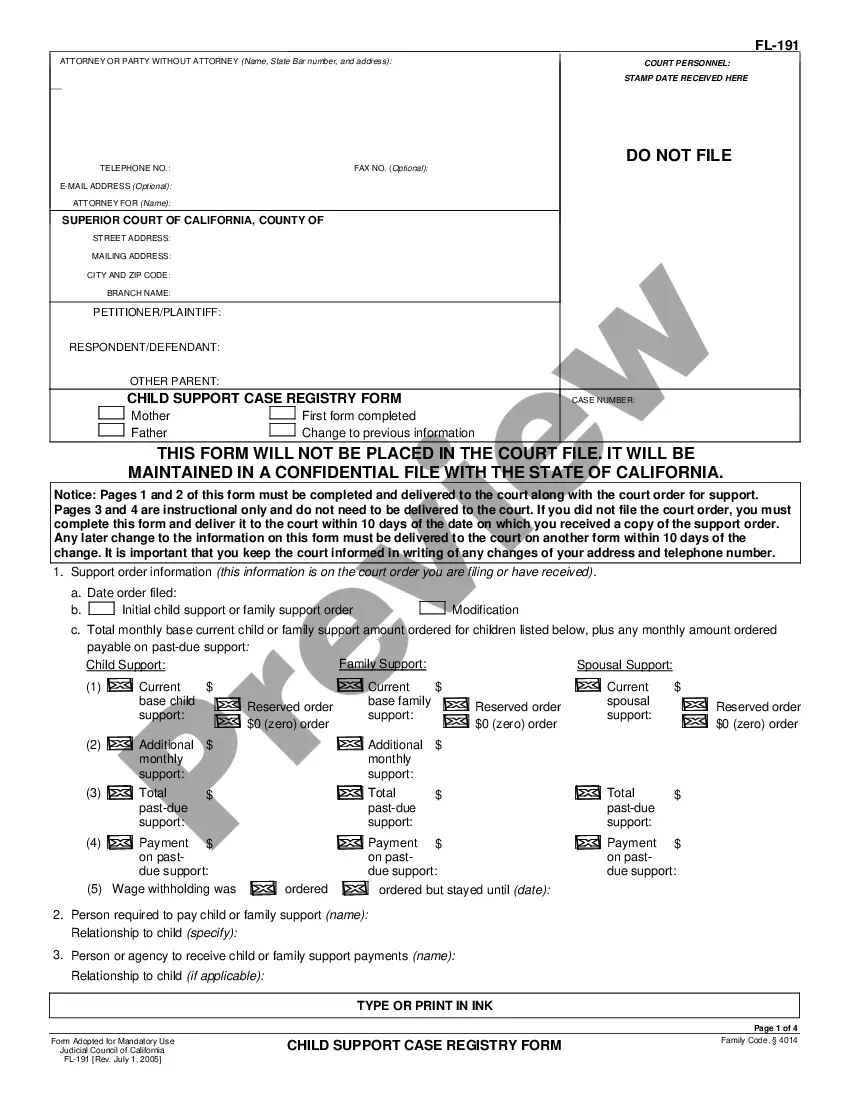

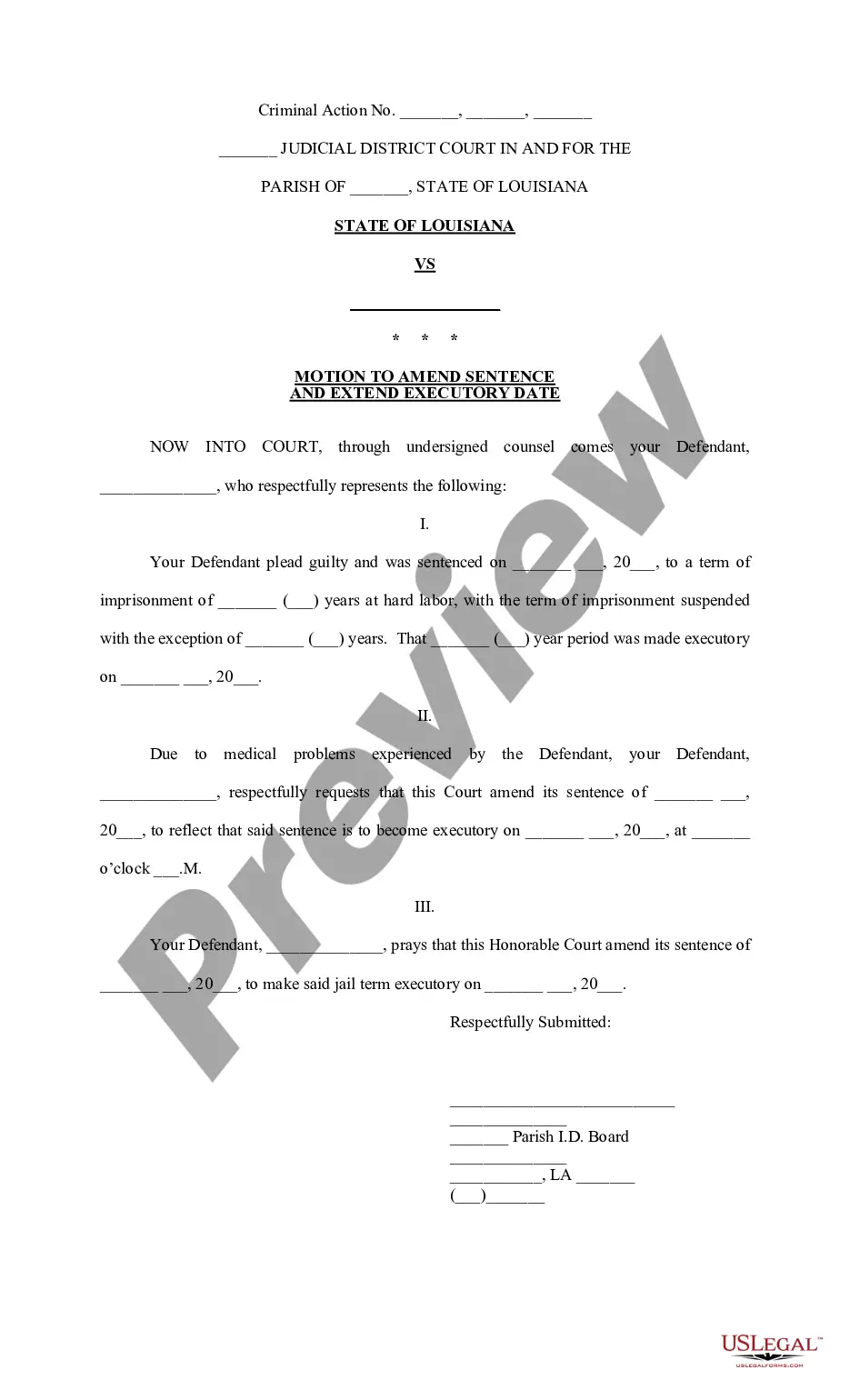

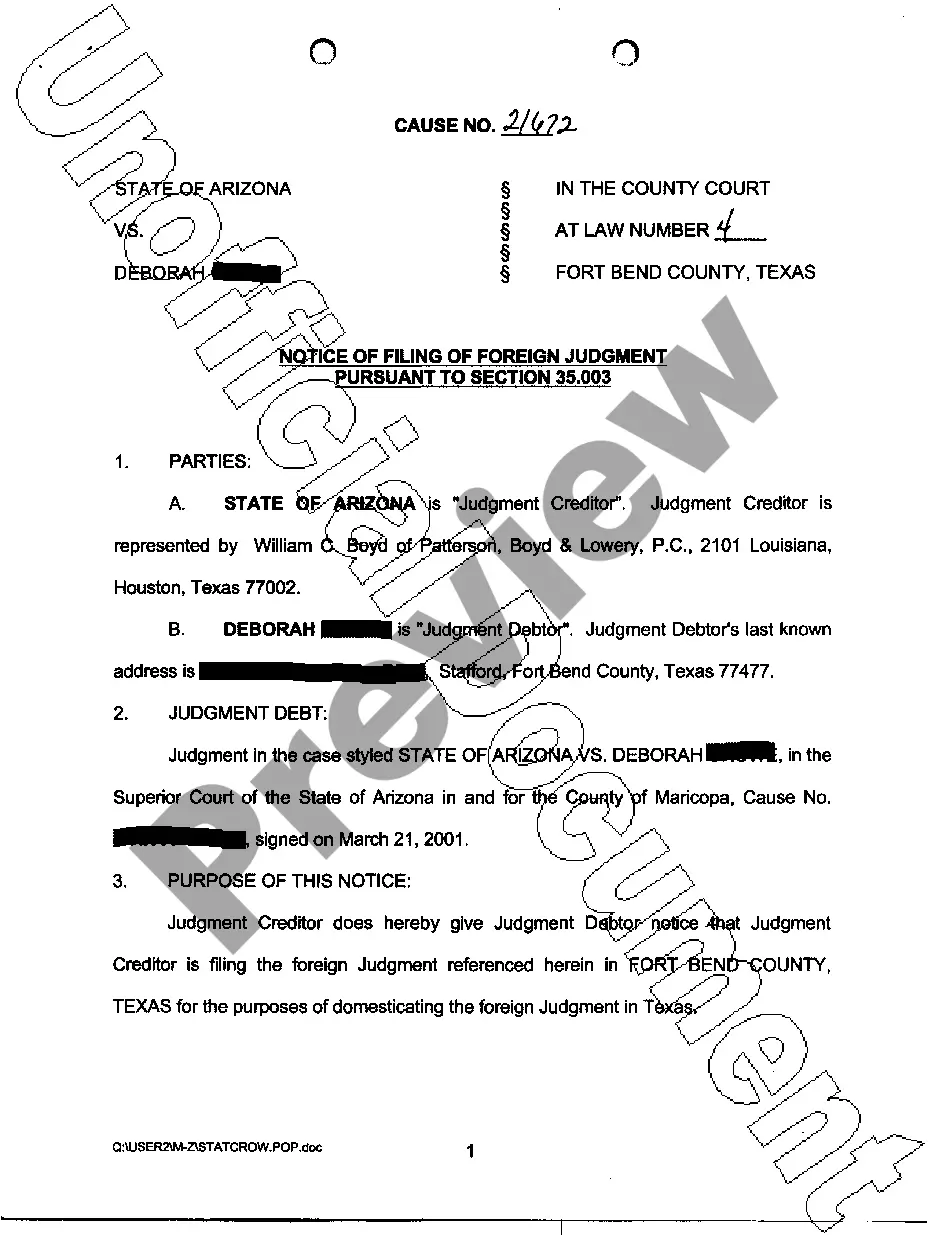

- Browse the suggested page and verify it for alignment with your needs.

- Utilize the Preview mode and review the form description if available.

- Search for another template using the Search field in the header if needed.

- Click Buy Now after locating the appropriate Kansas A Corporation Form For State Withholding.

- Choose the most suitable pricing plan, sign in to your account, or create a new one.

- Make a payment for the subscription (options for PayPal and credit card are available).

- Download the template in your preferred file format (PDF or DOCX).

- Print the document or complete it electronically in an online editor.

Form popularity

FAQ

Yes, Kansas does have nonresident withholding requirements. When a corporation operates in Kansas, it must ensure compliance with the state's withholding laws, particularly when working with nonresident employees or contractors. The correct Kansas a corporation form for state withholding helps streamline this process, ensuring that all necessary taxes are withheld properly. Using platforms like uslegalforms can assist you in completing the required documentation efficiently.

The corporate state tax rate in Kansas is currently set at 4%. This rate applies to corporate income earned within the state, making it essential for businesses to understand and comply with these tax obligations. For proper filing, businesses should consider the Kansas a corporation form for state withholding to ensure all requirements are met.

In Kansas, the primary form for state tax withholding is the K-4 form. This form is essential for both employers and employees to accurately report and manage state taxes. Exploring the Kansas a corporation form for state withholding will provide you with detailed instructions and help you file correctly.

Yes, Kansas is a mandatory withholding state. Employers are required to withhold state income tax from employee wages, ensuring compliance with state regulations. Utilizing the Kansas a corporation form for state withholding helps businesses meet their tax obligations efficiently.

Yes, Kansas utilizes the federal W-4 form, which employees complete to determine their withholding allowances. It's important to submit an accurate W-4, as it impacts how much tax is deducted from your paycheck. Utilize resources on the Kansas a corporation form for state withholding for guidance on managing your state tax responsibilities.

Kansas state withholding tax varies based on the employee's income level and filing status. Generally, these rates range from 3.10% to 5.70%. Understanding your obligation is crucial for compliance, especially when looking at the Kansas a corporation form for state withholding, as this impacts your payroll process.

The Kansas K-9 form is used to update withholding allowances when an employee experiences a change in situation. This could include adjustments in marital status, dependents, or job changes. It's important to submit this form promptly to ensure accurate withholding. For corporations, utilizing the Kansas a corporation form for state withholding can enhance the tracking and management of such updates.

Yes, Kansas requires state withholding from employees' wages. Employers must withhold a certain percentage of income for state taxes, which play a crucial role in funding local services. For businesses, understanding these withholding obligations is vital. Utilizing the Kansas a corporation form for state withholding can streamline this requirement.

Yes, Kansas has made recent changes to its state withholding guidelines. These adjustments affect both individuals and corporations operating in the state. It is essential to stay informed about these modifications to ensure compliance and to properly manage your withheld amounts. Using the Kansas a corporation form for state withholding can help simplify this process.

Yes, Kansas allows electronic filing (efile) for various tax forms, including those related to corporate income tax and withholding. E-filing streamlines the submission process and helps ensure accuracy. For corporations, utilizing the efile option can make managing Kansas a corporation form for state withholding much simpler and more efficient.