Kansas Probate Testate Beneficiary Notices Without Consent

Description

Form popularity

FAQ

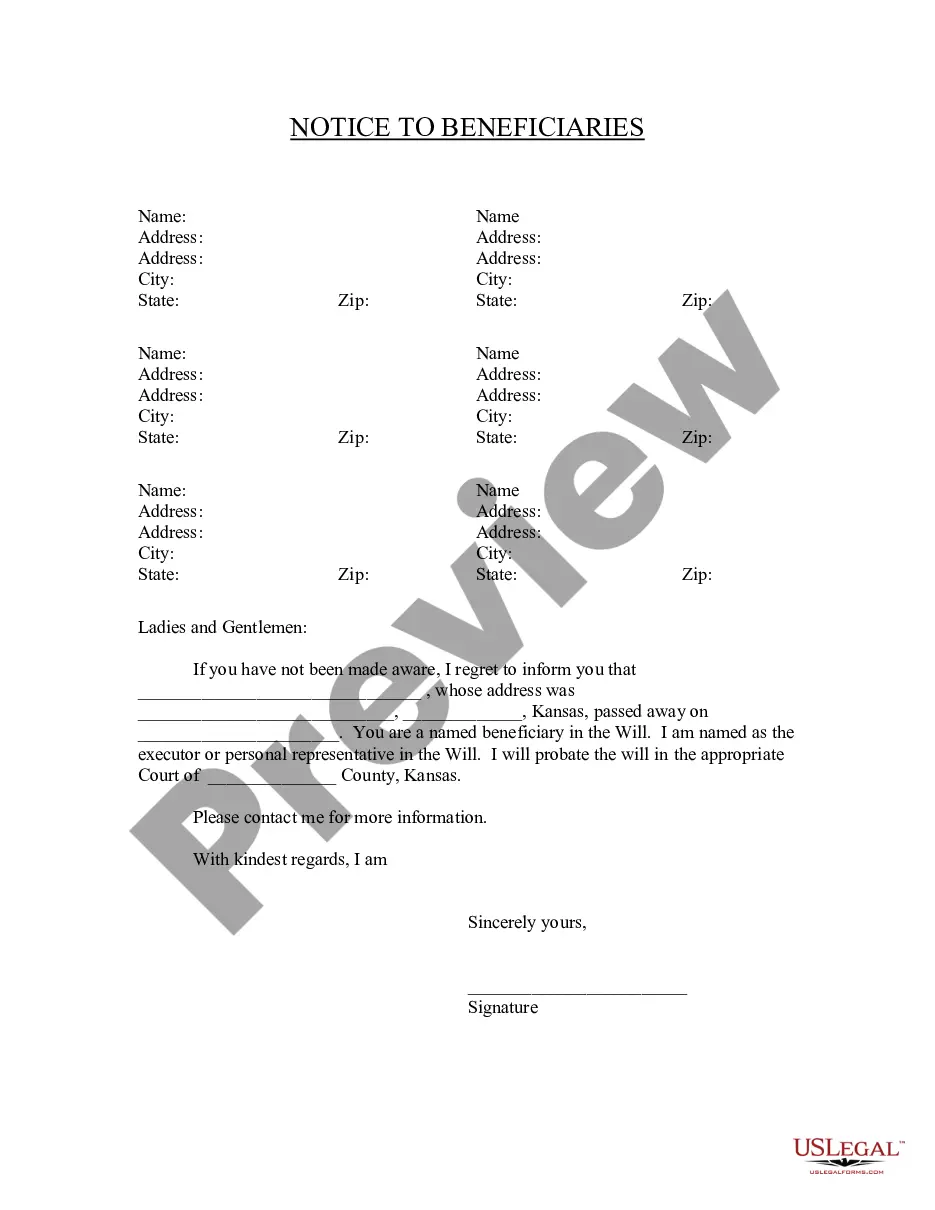

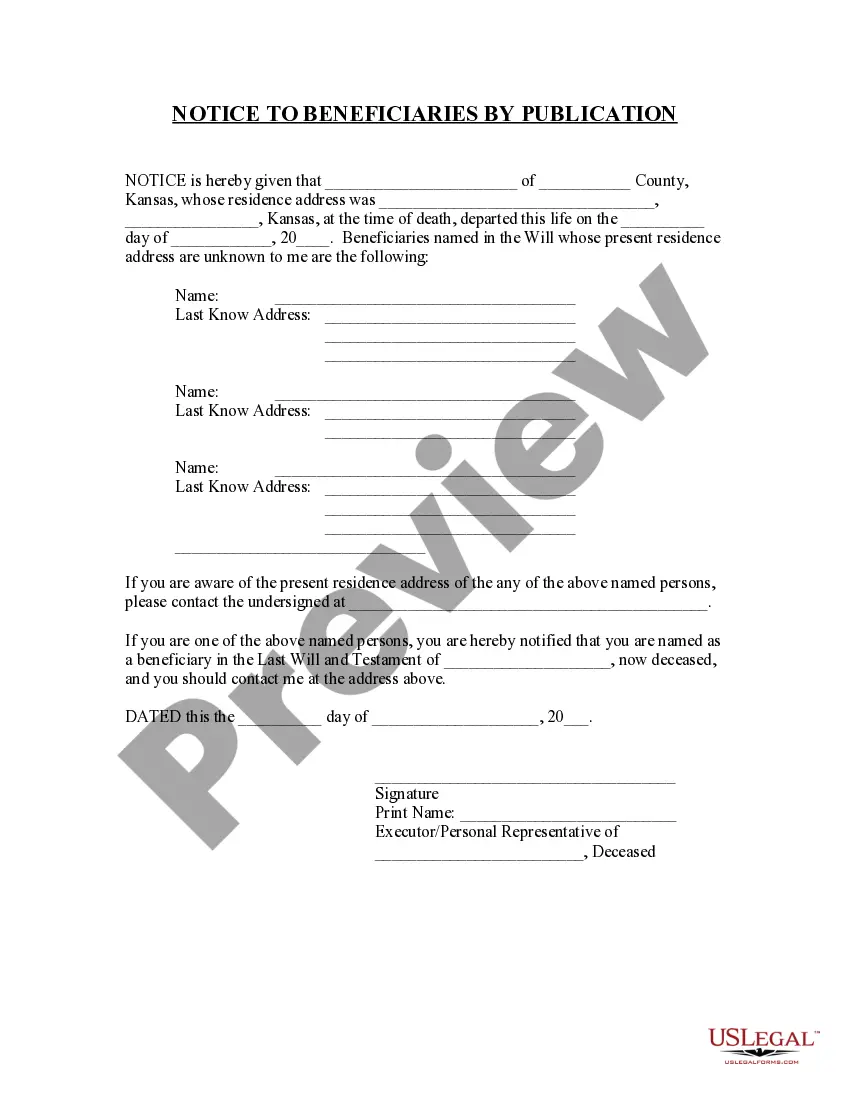

Yes, beneficiaries need to be informed about the estate proceedings, as it is a fundamental aspect of the probate process. Under Kansas law, providing beneficiaries with updates promotes transparency and allows them to understand their rights and interests. Especially concerning Kansas probate testate beneficiary notices without consent, keeping beneficiaries in the loop reduces misunderstandings and potential disputes. Utilizing tools like USLegalForms can help ensure that you meet communication requirements effectively.

Yes, you can write your own will and have it notarized in Kansas, provided you meet the state's legal requirements. While a self-written will can be valid, it is essential to ensure it adheres to the necessary formalities, including signatures and witnesses. However, it's worth noting that Kansas probate testate beneficiary notices without consent can complicate the estate process. Using resources from USLegalForms can help you draft a compliant will and understanding the implications for beneficiaries.

If the executor fails to communicate with the beneficiaries, it can lead to frustration and confusion. Beneficiaries have the right to seek information regarding the estate, especially under Kansas probate testate beneficiary notices without consent. If necessary, they may consider legal action to compel the executor to fulfill their duties or even request the appointment of a new executor. Engaging with platforms like USLegalForms can provide valuable resources and guidance in such situations.

The duty to keep beneficiaries informed is an essential responsibility of the executor in a Kansas probate estate. Executors must provide timely updates about the estate's progress, including financial matters and any actions taken. When dealing with Kansas probate testate beneficiary notices without consent, transparency fosters trust and helps prevent conflicts among beneficiaries. Clear communication ensures everyone understands their rights and the estate's management.

Kansas probate laws govern the process of administering an estate after someone passes away. In general, the process requires filing a will with the court, notifying beneficiaries, and possibly conducting a hearing if there are disputes. Important to note, Kansas probate testate beneficiary notices without consent ensure interested parties are informed throughout the process. Familiarizing yourself with these laws can help reduce complications for your heirs.

To avoid probate in Kansas, consider establishing a living trust, which allows you to transfer assets outside of probate. Additionally, you can use joint ownership for property or designate beneficiaries on accounts and policies. By doing this, your heirs may not need to receive Kansas probate testate beneficiary notices without consent, simplifying the process. Consulting with an attorney can further streamline your estate planning efforts.

When someone dies without a will in Kansas, the state's intestacy laws govern the distribution of assets. The court appoints an administrator to oversee the probate process, ensuring heirs receive their rightful shares. Additionally, Kansas probate testate beneficiary notices without consent may still need to be issued, depending on the case. To navigate this complex situation, using US Legal Forms can offer valuable support.

To start probate in Kansas, begin by gathering necessary documents, including the death certificate and any existing will. You need to file a petition with the appropriate probate court and inform interested parties. If you face challenges dealing with Kansas probate testate beneficiary notices without consent, consider seeking help from US Legal Forms to guide you through the process.

Yes, it is possible to avoid probate in Kansas through various methods. Options include establishing a living trust, utilizing joint ownership, or designating beneficiaries on accounts. These strategies can be beneficial, as they help circumvent Kansas probate testate beneficiary notices without consent, thus simplifying asset transfer. To learn more about these options, consult a knowledgeable legal resource such as US Legal Forms.

In Kansas, you generally have six months from the date of death to file probate. However, it’s wise to act promptly to ensure all assets are properly administered. Delays can complicate matters, especially regarding Kansas probate testate beneficiary notices without consent. To streamline your filing, you may consider using a reliable platform like US Legal Forms.