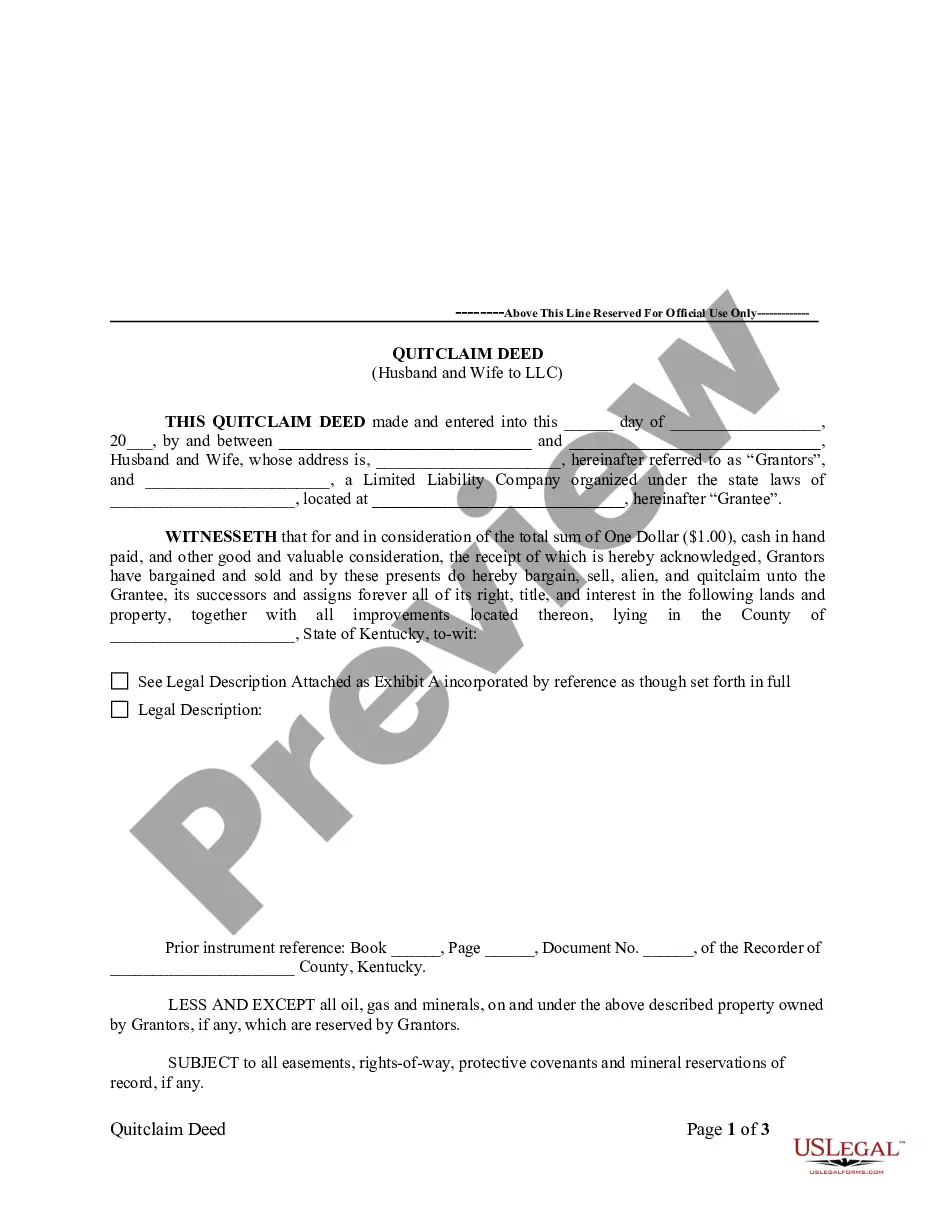

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Husband Wife Llc Agreement With Wife

Description

How to fill out Husband Wife Llc Agreement With Wife?

How to obtain professional legal documents that adhere to your state regulations and create the Husband Wife LLC Agreement With Wife without hiring an attorney? Numerous online services offer templates to address various legal situations and formalities. However, it might require time to ascertain which of the available samples meet both your use case and legal standards.

US Legal Forms is a reliable platform designed to assist you in finding formal documents crafted in accordance with the latest updates in state law, helping you save on legal fees.

Unlike a typical online library, US Legal Forms is a repository of over 85,000 verified templates for various business and personal scenarios. All documents are categorized by area and state, streamlining your search process and minimizing hassle. Additionally, it offers robust tools for PDF editing and electronic signatures, enabling users with a Premium subscription to efficiently complete their paperwork online.

Select the most suitable pricing plan, then Log In or register for an account. Choose the payment method (credit card or PayPal). Select the file format for your Husband Wife LLC Agreement With Wife and click Download. The downloaded documents remain yours: you can always revisit them in the My documents section of your profile. Join our library and create legal documents independently like a seasoned legal expert!

- It requires minimal time and effort to obtain the needed documentation.

- If you already possess an account, Log In and verify that your subscription is active.

- Download the Husband Wife LLC Agreement With Wife using the appropriate button next to the file name.

- If you do not have an account with US Legal Forms, follow the instructions below.

- Examine the webpage you have opened and verify if the form suits your requirements.

- Utilize the form description and preview options if they are available.

- Search for another template in the header specifying your state if needed.

- Click the Buy Now button when you identify the correct document.

Form popularity

FAQ

The straightforward answer is no: You are not required to name your spouse anywhere in the LLC documents, especially if they aren't directly involved in the business. However, there are some occasions where it may be helpful or necessary to include your spouse.

Note: If an LLC is owned by husband and wife in a non-community property state, the LLC should file as a partnership. LLCs owned by a husband and wife are not eligible to be "qualified joint ventures" (which can elect not be treated as partnerships) because they are state law entities.

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC.

To make the election, income, deductions, asset gain, or loss must be divided between each spouse based on the percentage of their ownership in the LLC. Then each spouse must file a separate Schedule C or C-EZ and will also file a Schedule SE to pay any self-employment tax.

The LLC is wholly owned by the husband and wife as community property under state law. no one else would be considered an owner for federal tax purposes, and. the business is not otherwise treated as a corporation under federal law.