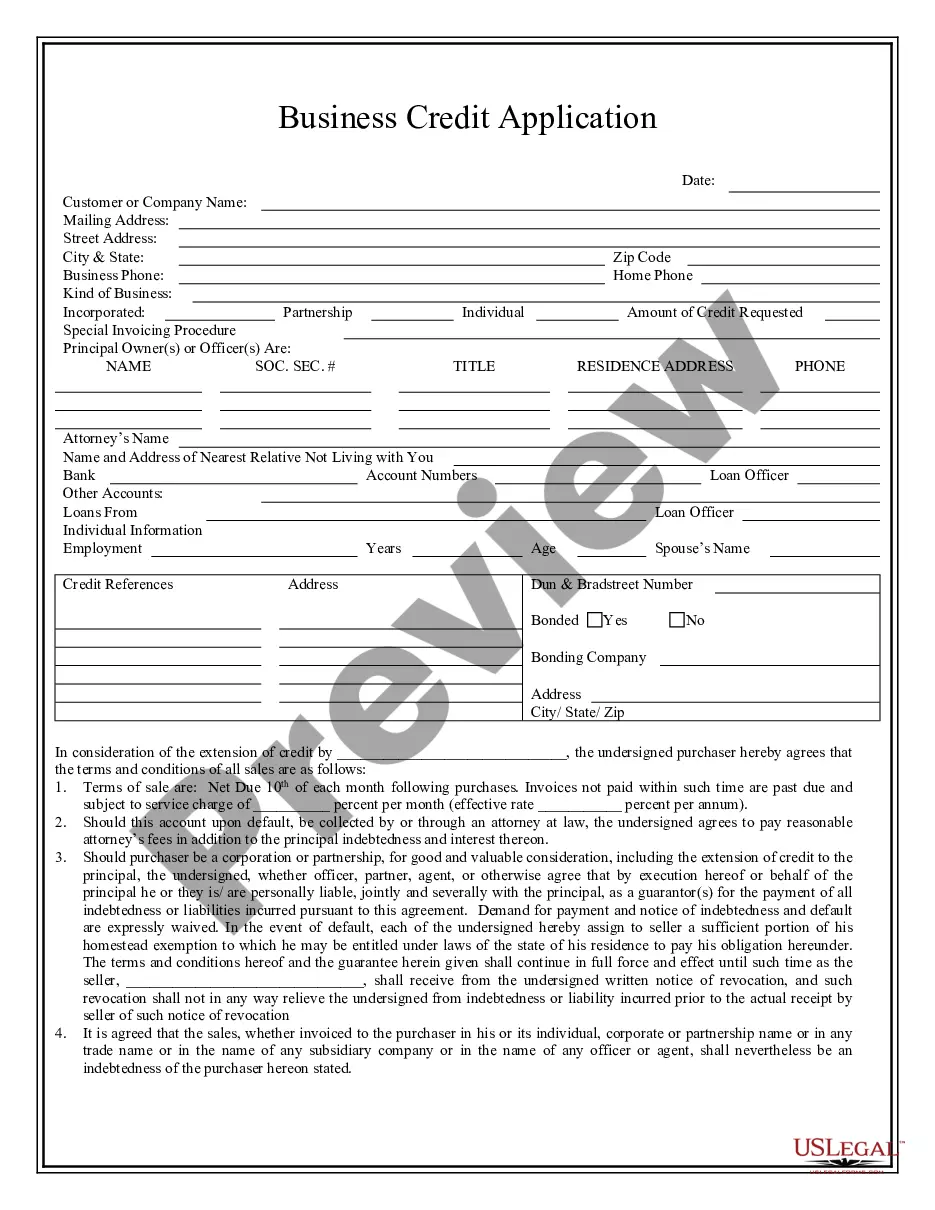

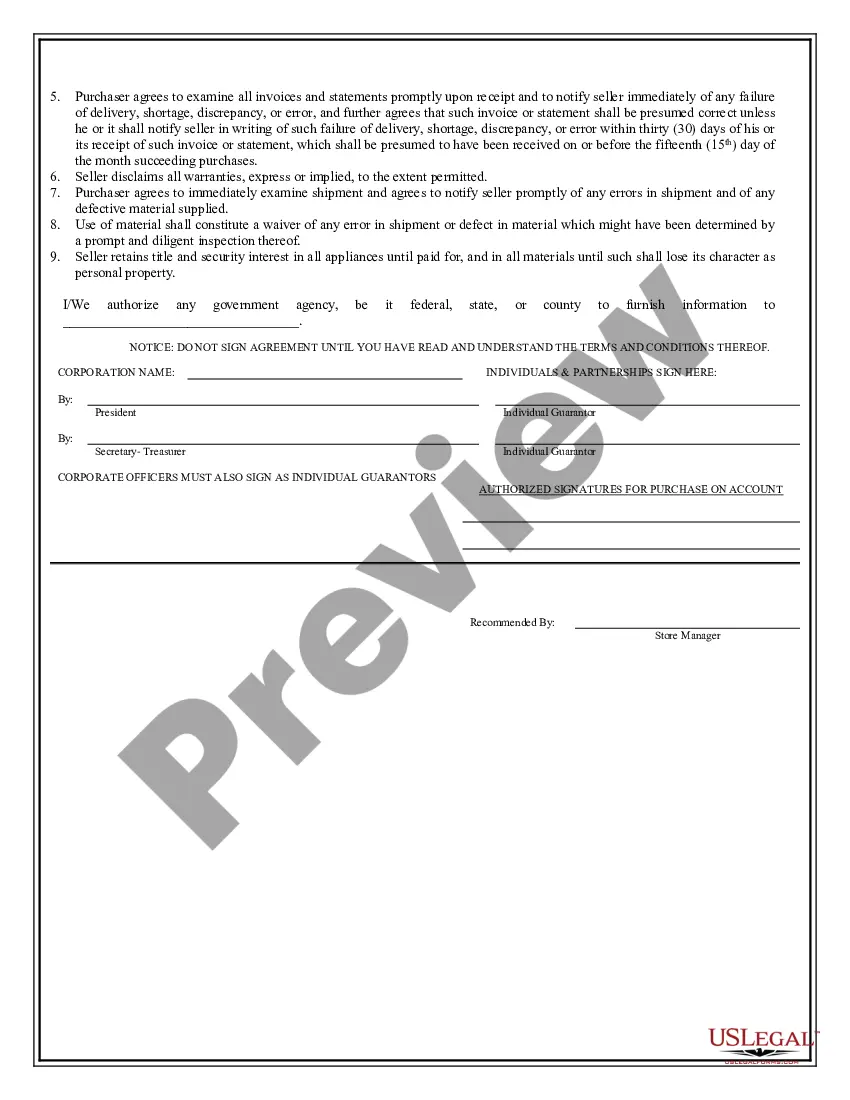

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Business Credit Applications With Office 365

Description

How to fill out Business Credit Applications With Office 365?

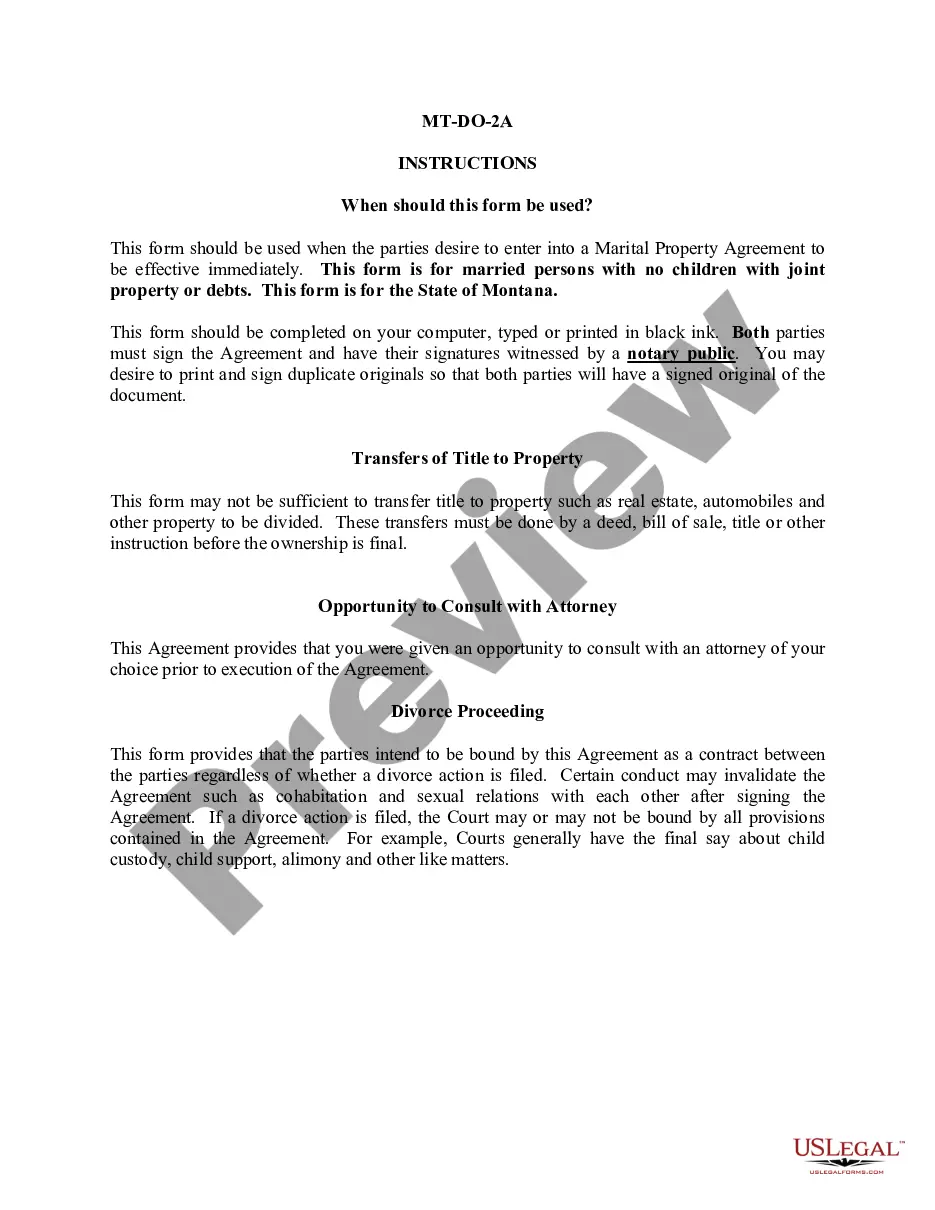

How to locate professional legal documents adhering to your state regulations and create Business Credit Applications using Office 365 without consulting a lawyer.

Numerous online services offer templates to address different legal situations and requirements. However, it might require time to determine which of the accessible samples meet both your usage and legal standards.

US Legal Forms is a reliable service that assists you in locating official documents crafted in compliance with the latest updates in state laws, helping you save on legal fees.

If you do not have an account with US Legal Forms, follow the guide below.

- US Legal Forms is not merely a typical online library.

- It comprises over 85,000 validated templates for a variety of business and personal situations.

- All documents are categorized by field and state to expedite your searching process and enhance convenience.

- Additionally, it offers integration with powerful tools for PDF editing and electronic signing, enabling users with a Premium subscription to efficiently complete their documents online.

- Minimal effort and time are required to obtain the needed paperwork.

- If you already possess an account, Log In to confirm your subscription is active.

- Download the Business Credit Applications using Office 365 with the adjacent button beside the file name.

Form popularity

FAQ

A credit application is a request for an extension of credit. Credit applications can be done either orally or in written form, usually through an electronic system.

A credit application serves two purposes: It is a data gathering tool and it is a contract. As a contract, it specifies the rights and obligations of both the customer and creditor.

A credit application form collects information from your customers to help you to assess their suitability for a credit arrangement.

Once you fill out an application (and turn over your Social Security number), a lender will pull a version of your credit report and/or credit score. They'll use this credit profile and other factors, like your income or debt-to-income ratio, to determine if you meet their underwriting standards.

Here are four things to consider when preparing your application:Credit purpose. When you apply for credit, the financial institution will want to know how you plan to use the money you borrow.Credit history.Company finances.Application and accurate documentation.