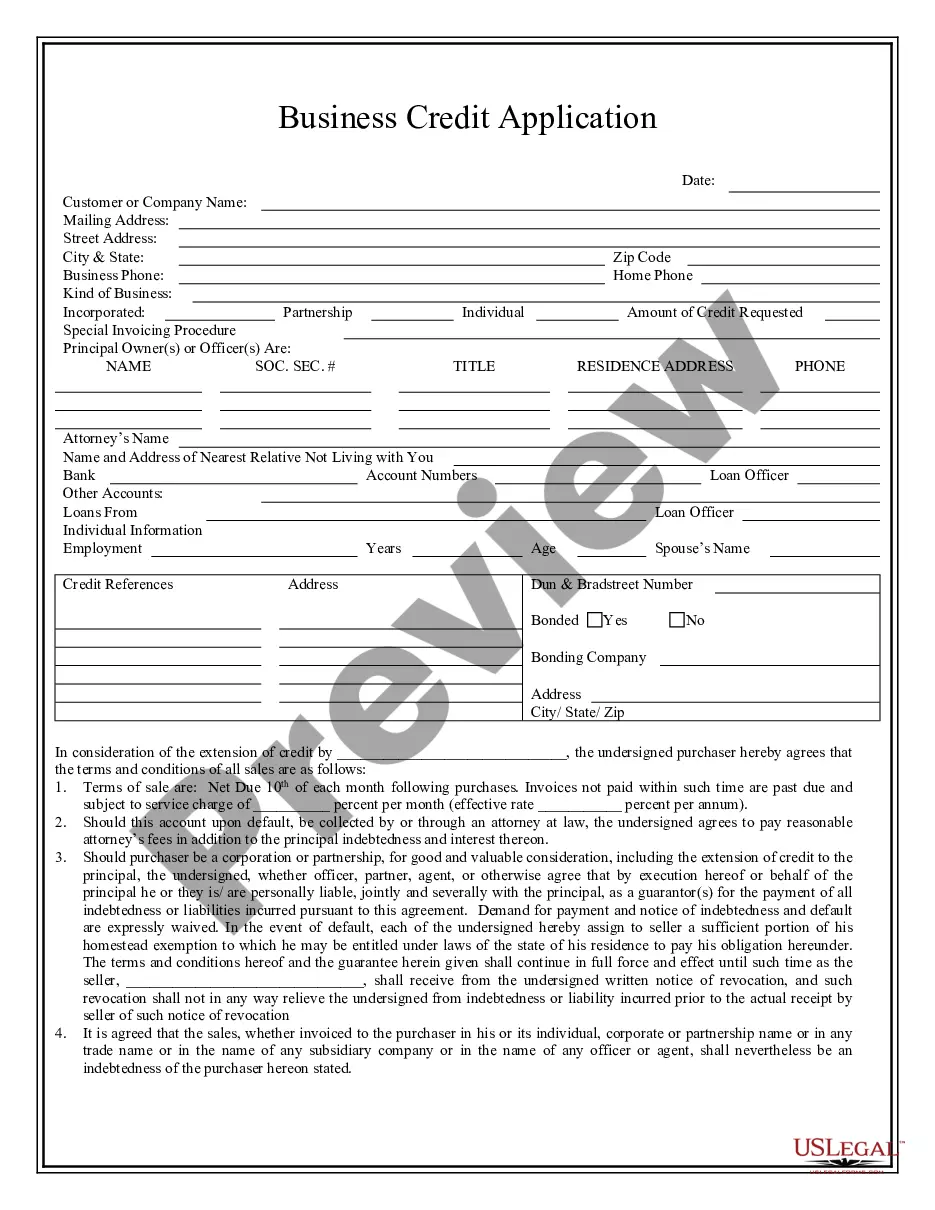

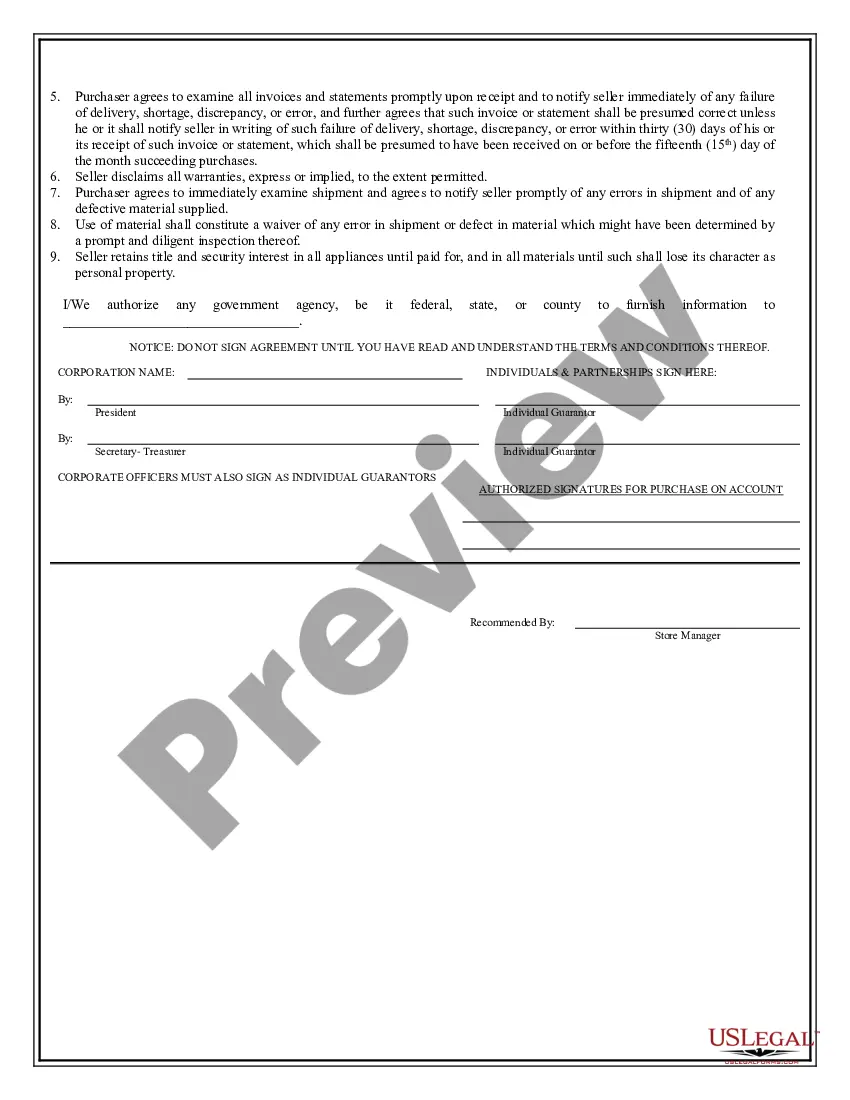

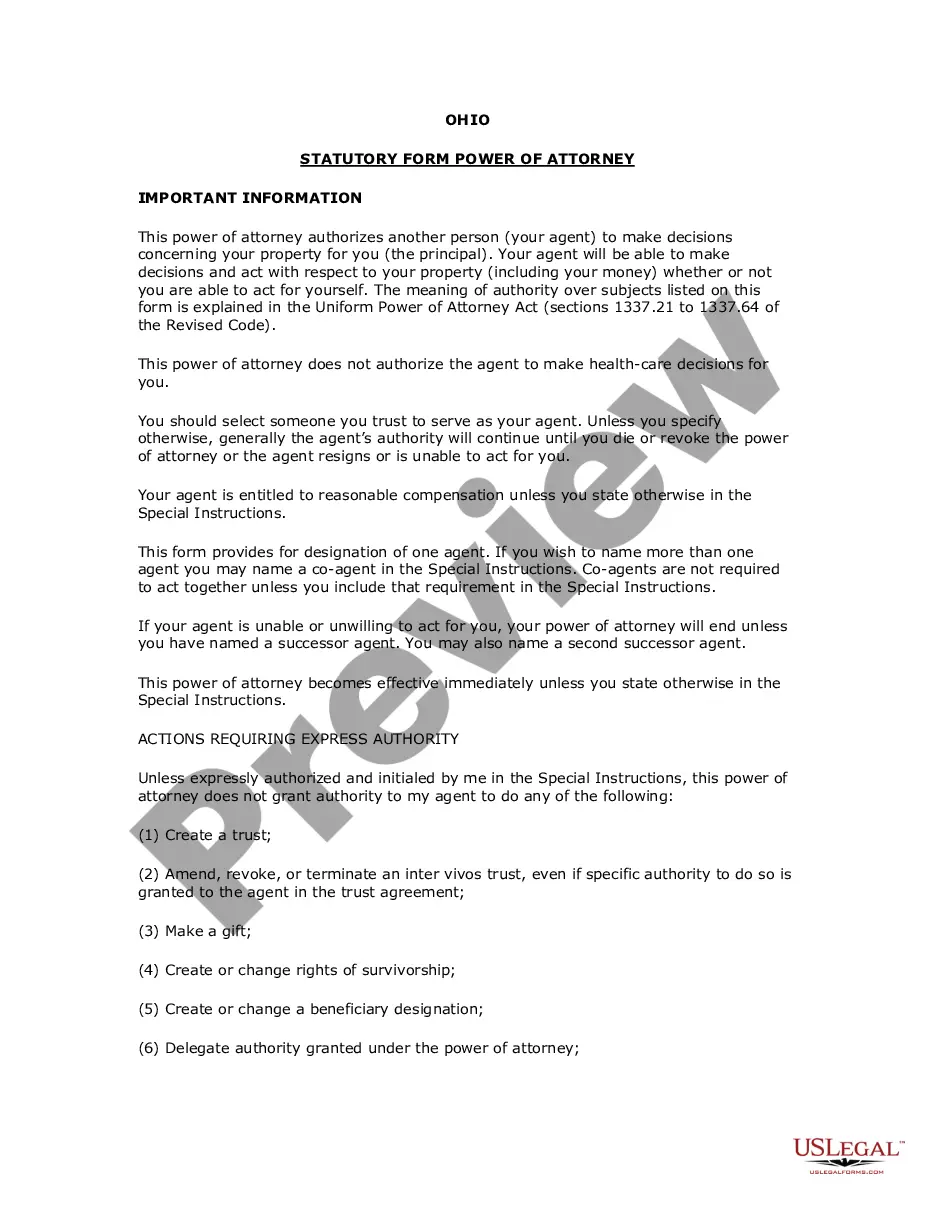

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Business Credit Applications With Planned Wages

Description

How to fill out Business Credit Applications With Planned Wages?

Individuals frequently link legal documentation with something complex that only an expert can handle.

In some respect, this is accurate, as composing Business Credit Applications With Planned Wages necessitates significant knowledge of subject criteria, encompassing state and local laws.

Nevertheless, with US Legal Forms, matters have become more straightforward: readily available legal templates for any life and business event pertinent to state regulations are compiled in a single online repository and are now accessible to all.

Choose the format for your template and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once acquired, they remain stored in your profile. You can access them whenever necessary through the My documents section. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current documents organized by state and usage, allowing exploration for Business Credit Applications With Planned Wages or any other specific template to take only minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to acquire the form.

- First-time users of the platform will need to establish an account and subscribe prior to being able to save any files.

- Here is the step-by-step guide on how to acquire the Business Credit Applications With Planned Wages.

- Review the page content thoroughly to ensure it meets your requirements.

- Examine the form description or view it through the Preview option.

- If the prior sample does not fit, locate another by using the Search bar at the top.

- When you identify the suitable Business Credit Applications With Planned Wages, click Buy Now.

- Select the pricing plan that aligns with your needs and budget.

- Sign up for an account or Log In to move on to the payment page.

- Complete the subscription payment via PayPal or with your credit card.

Form popularity

FAQ

Your business plan is the foundation of your business. It defines your vision and mission, and serves as a road map as you move forward. It's one of the most important documents you'll ever create. It's also an invaluable tool when it comes time to apply for a business loan.

Lenders look to a loan proposal as evidence that your business has strong management, experience, and a thorough understanding of the marketplace. They will also look for relevant financial information that demonstrates your ability to repay the loan.

Best Practices for Giving Your Customers CreditDo check references.Do use a credit application.Do get a credit report.Do establish a credit policy.Don't extend too much credit.Don't extend credit informally.Do consider the company type.More articles from AllBusiness.com:

In the credit application, you should request:bank details including account name, BSB and bank location;accountant's details;permission to do credit checks; and.trade references from at least three other suppliers, including full business name, ABN, mobile number and email address.17 Sept 2019

Below are few things to consider when it comes to determining customer credit terms:How long has this customer been a customer?What is their payment history?What are your competitors and peers doing?Do you have cash flow issues?Consider discounts for on-time or early payment?Have you tried more creative terms?More items...