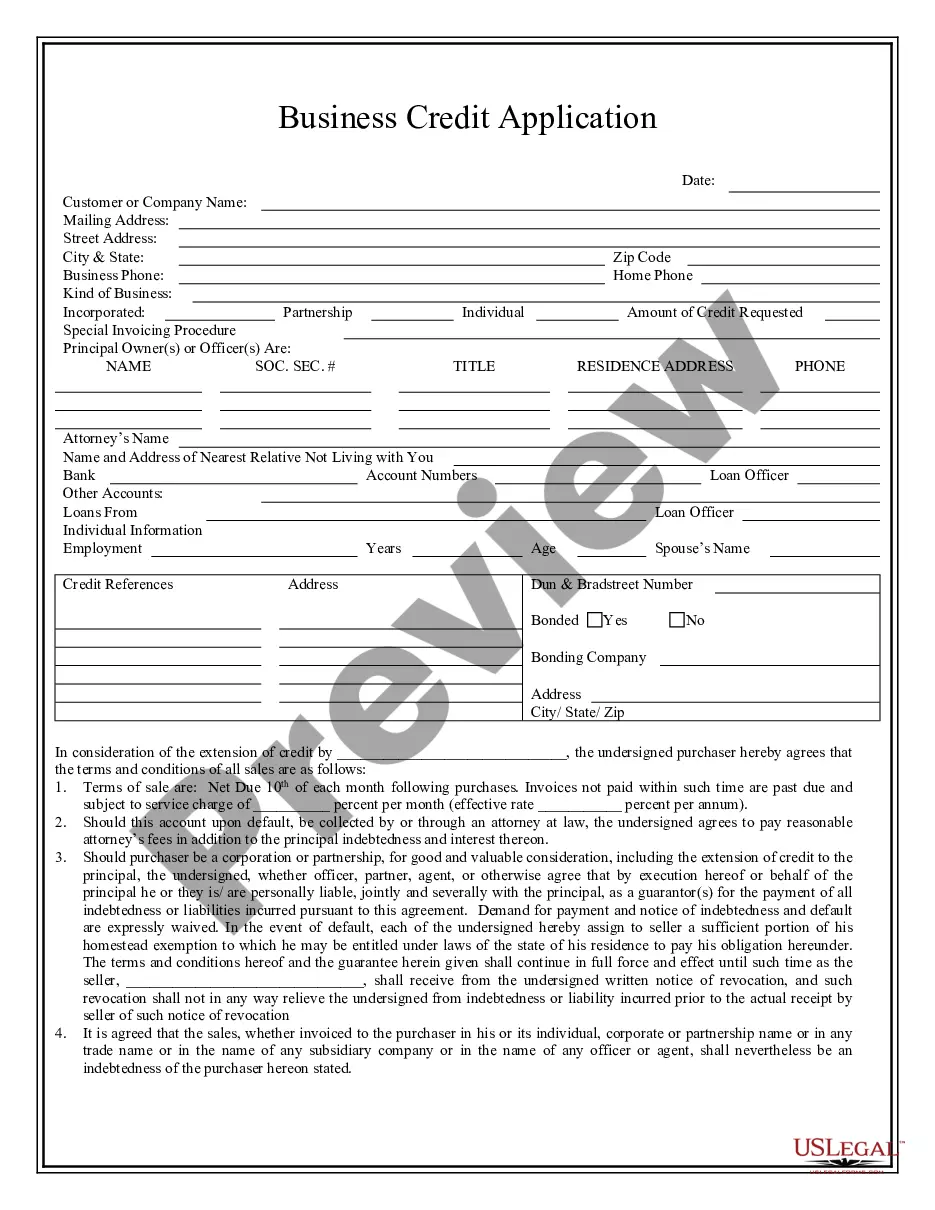

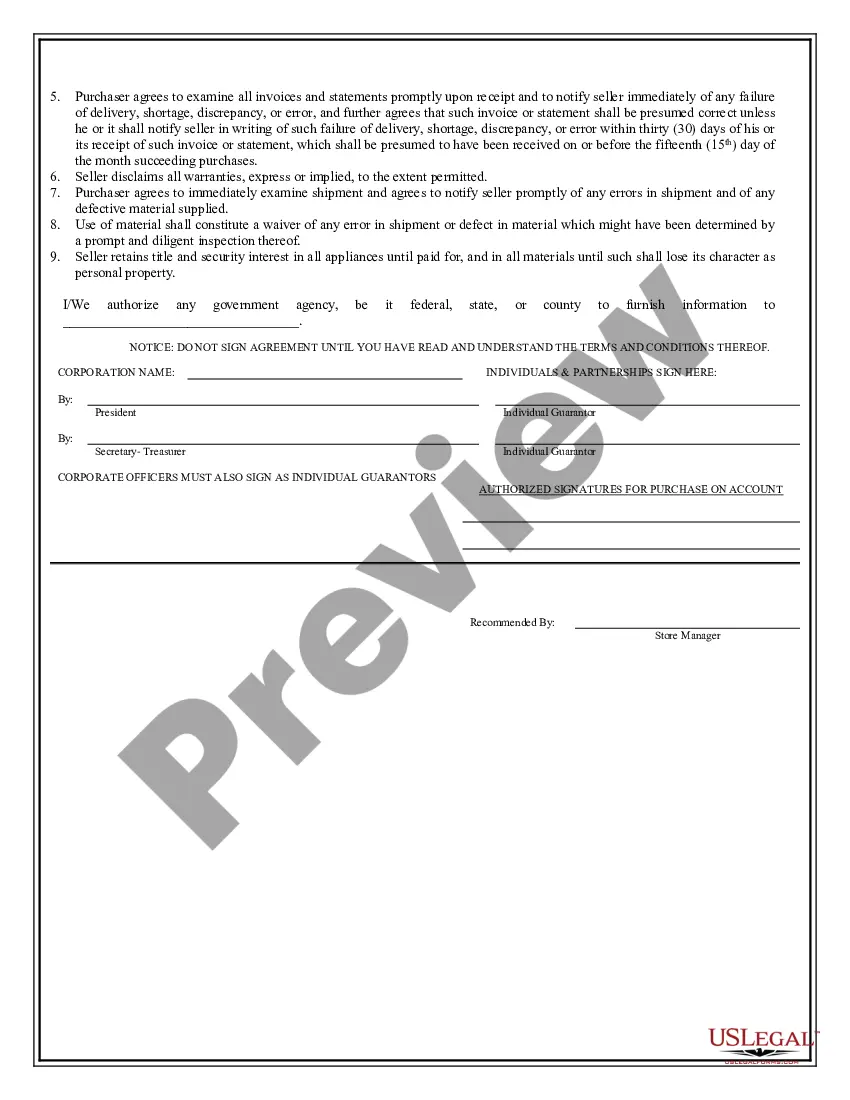

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Business Credit Applications With Salesforce

Description

How to fill out Business Credit Applications With Salesforce?

When you need to finalize Business Credit Applications With Salesforce that adheres to your local state's laws and regulations, there can be various choices to select from.

There's no need to scrutinize every document to ensure it meets all the legal requirements if you are a US Legal Forms subscriber.

It is a reliable resource that can assist you in obtaining a reusable and current template on any subject.

Using the Preview mode and review the form description if available.

- US Legal Forms is the largest online repository with a compilation of over 85k ready-to-use documents for business and individual legal matters.

- All templates are verified to comply with each state's laws.

- Therefore, when obtaining Business Credit Applications With Salesforce from our site, you can be confident that you have a valid and up-to-date document.

- Acquiring the necessary example from our platform is very straightforward.

- If you already possess an account, simply Log In/">Log In to the system, verify that your subscription is still active, and save the chosen file.

- In the future, you can access the My documents tab in your profile and retrieve the Business Credit Applications With Salesforce at any time.

- If it's your first experience with our website, please follow the steps below.

- Navigate through the suggested page and verify it for compliance with your requirements.

Form popularity

FAQ

A credit application is a standardized form that a customer or borrower uses to request credit. The form contains requests for such information as: The amount of credit requested. The identification of the applicant. The financial status of the applicant.

Long credit approval processes can slow the sales cycle and open the door for your competitors. D&B Credit Check for Salesforce enables field sales to quickly and easily submit a credit request directly from Salesforce into D&B Finance Analytics.

Experian's Salesforce integration is designed to help you clean existing contact records and capture accurate contact data from future customers. The solution helps you verify data like mailing addresses, email addresses, and phone numbers.

A business credit application form is used by businesses to request funding or lines of credit with a bank through the business's website.

The business credit application is your opportunity to prove that your business is an appropriate credit risk.