Louisiana Foreign Llc Withdrawal

Instant download

Description How To Register An Llc In Louisiana

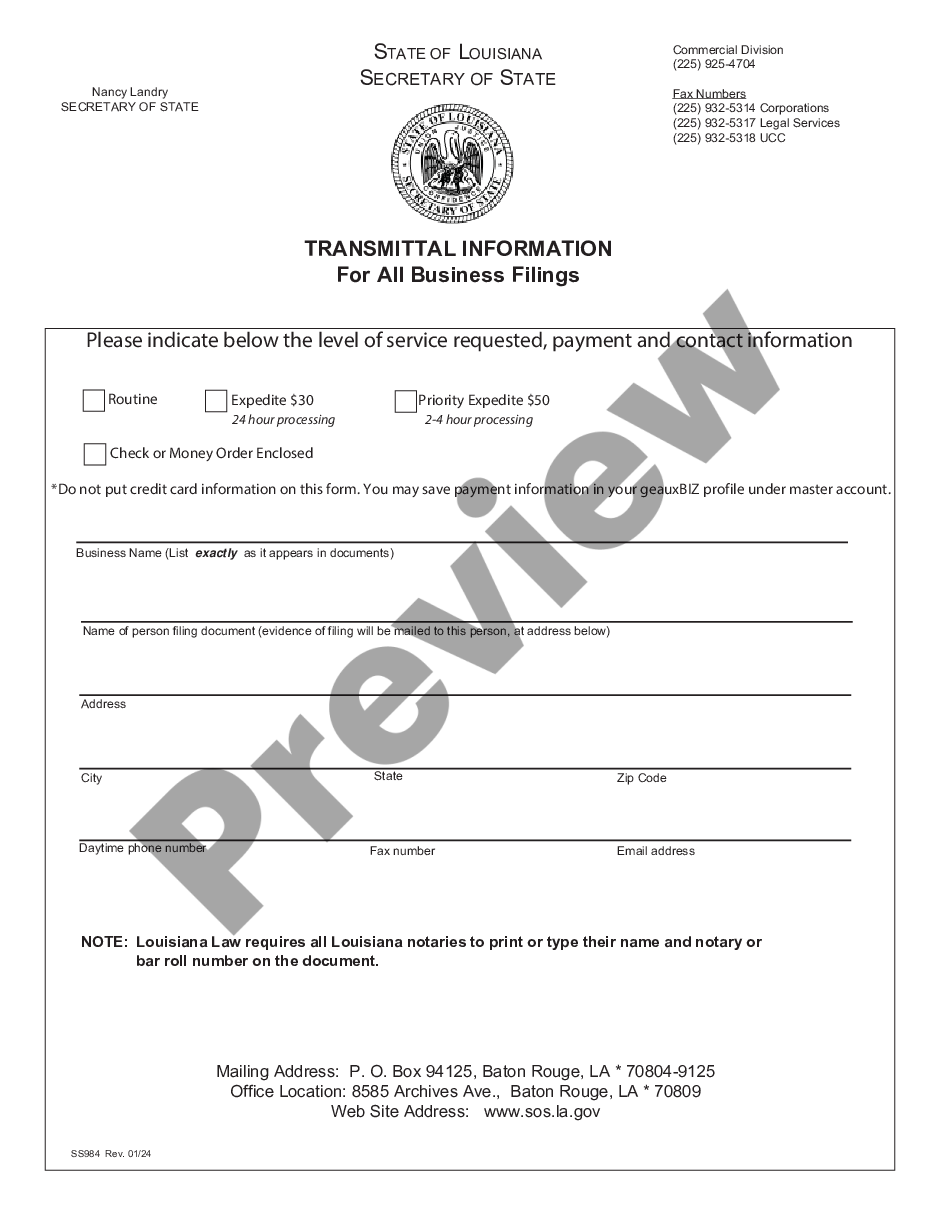

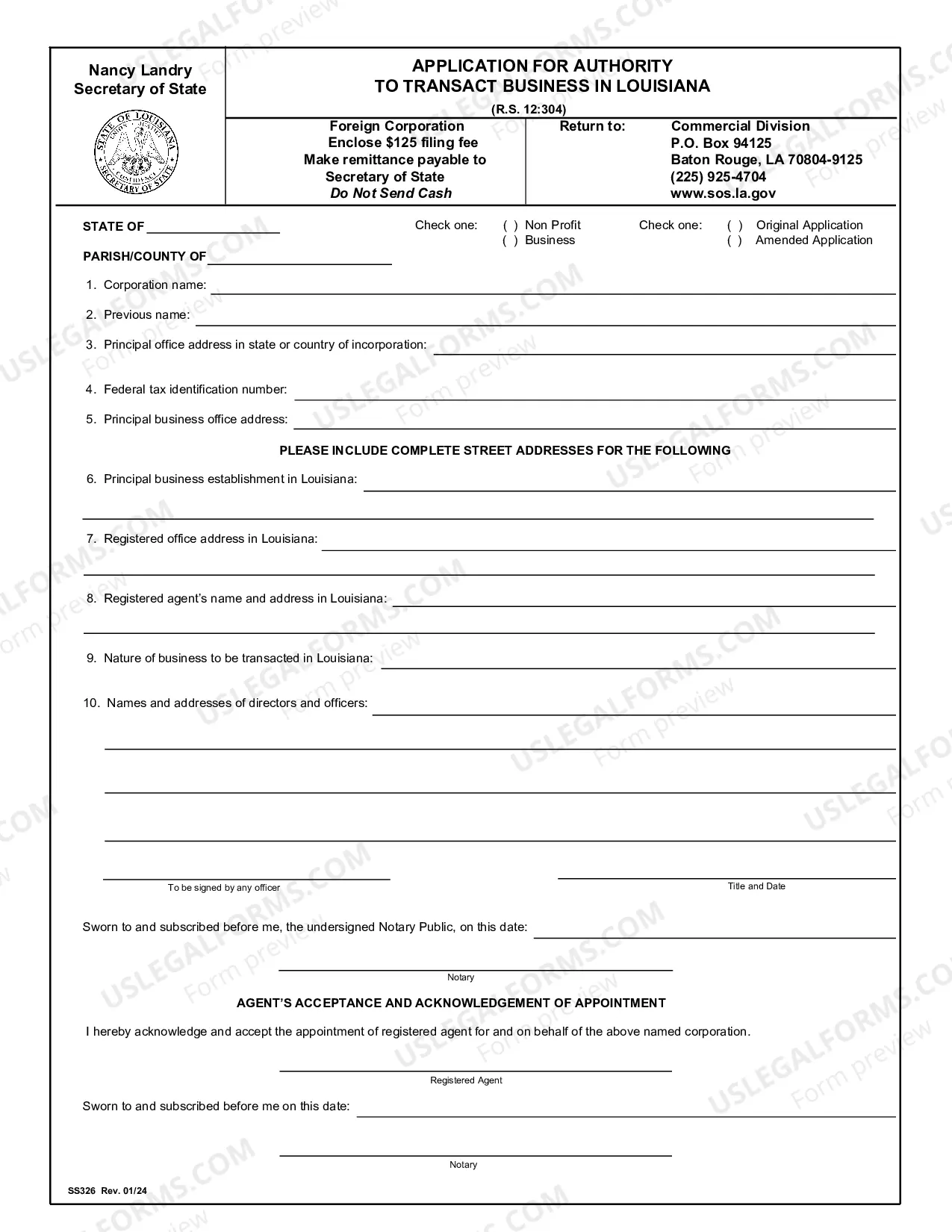

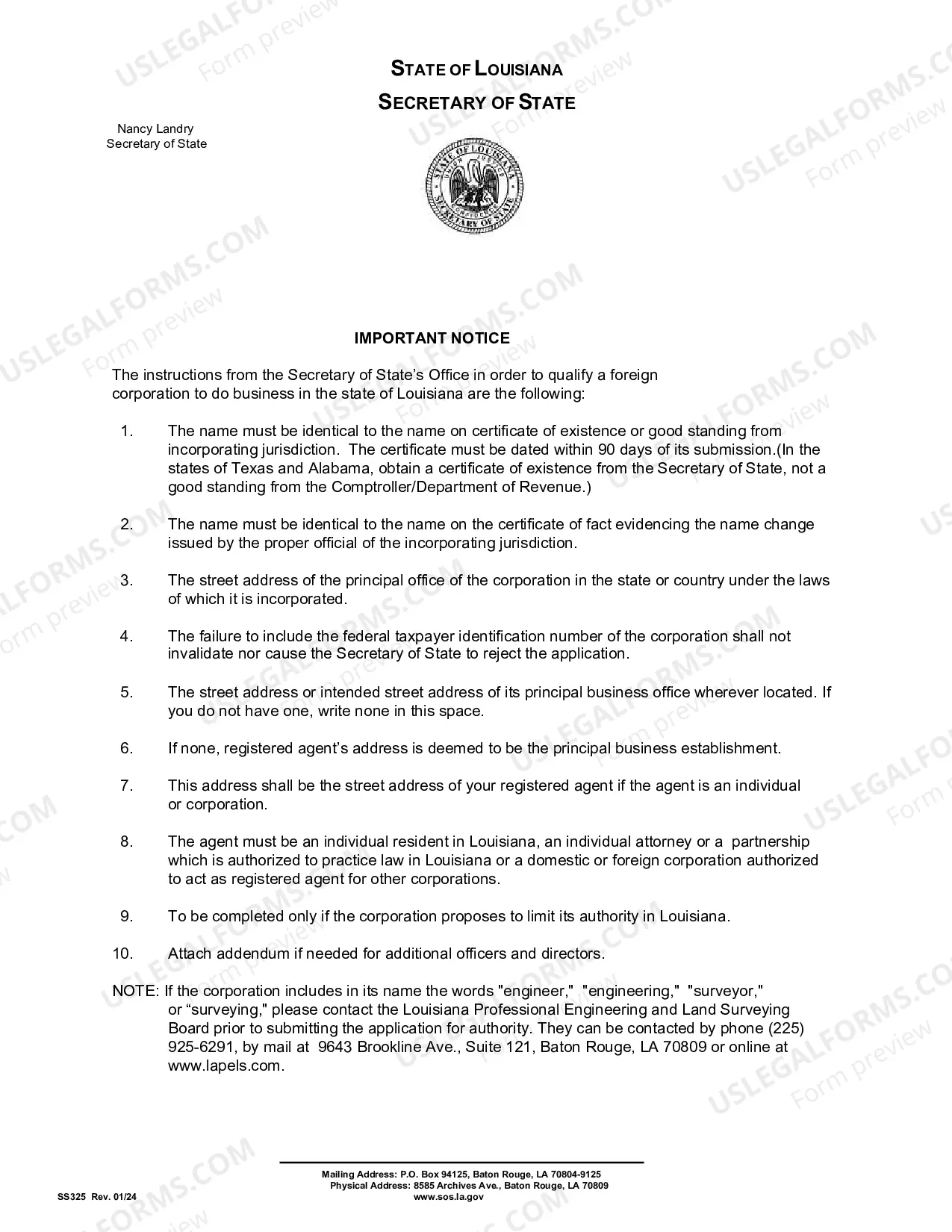

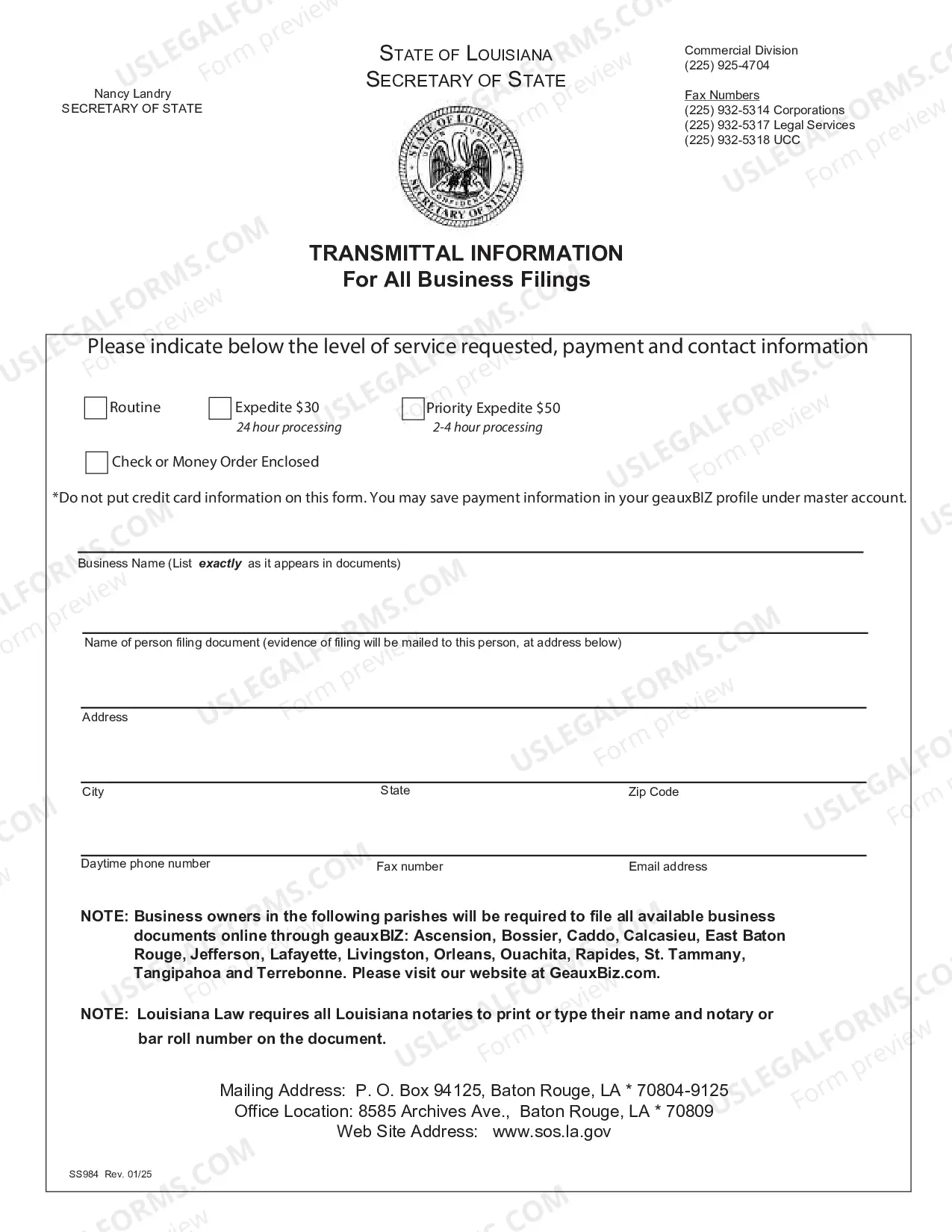

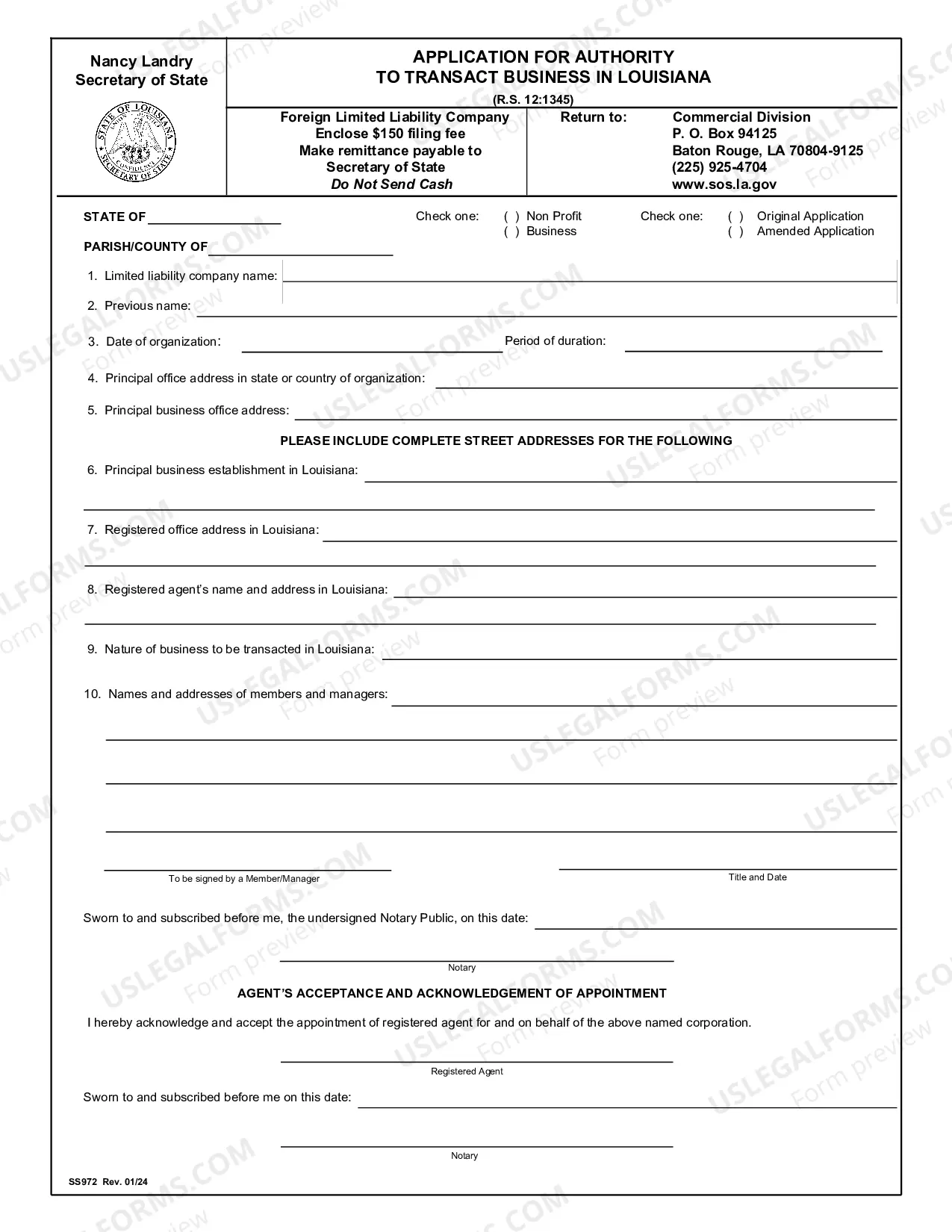

Includes instructions and form to register a foreign corporation or LLC in Louisiana.

Free preview Geauxbiz Com