Articles Of Incorporation Louisiana Withholding

Description

Form popularity

FAQ

Yes, Louisiana is a mandatory withholding state, meaning employers must withhold state income tax from employee wages. This requirement ensures proper tax revenue collection for the state. Consequently, understanding your obligations helps you navigate Articles of Incorporation Louisiana withholding, ensuring compliance and smooth business operations.

To obtain a Louisiana state withholding number, you can register online through the Louisiana Department of Revenue's website. The registration process is straightforward and typically requires basic information about your business. Securing your withholding number is vital for maintaining compliance with Articles of Incorporation Louisiana withholding provisions.

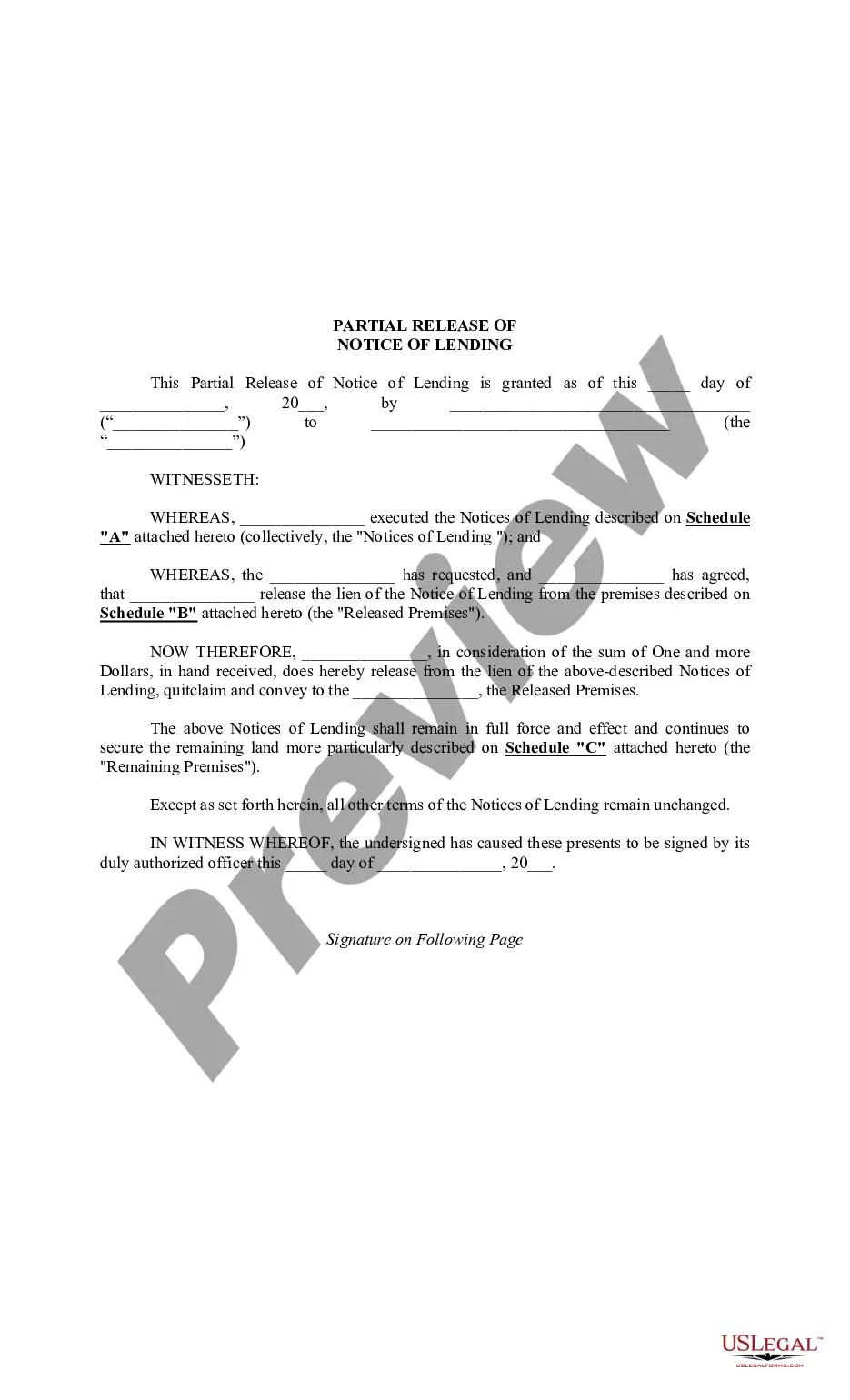

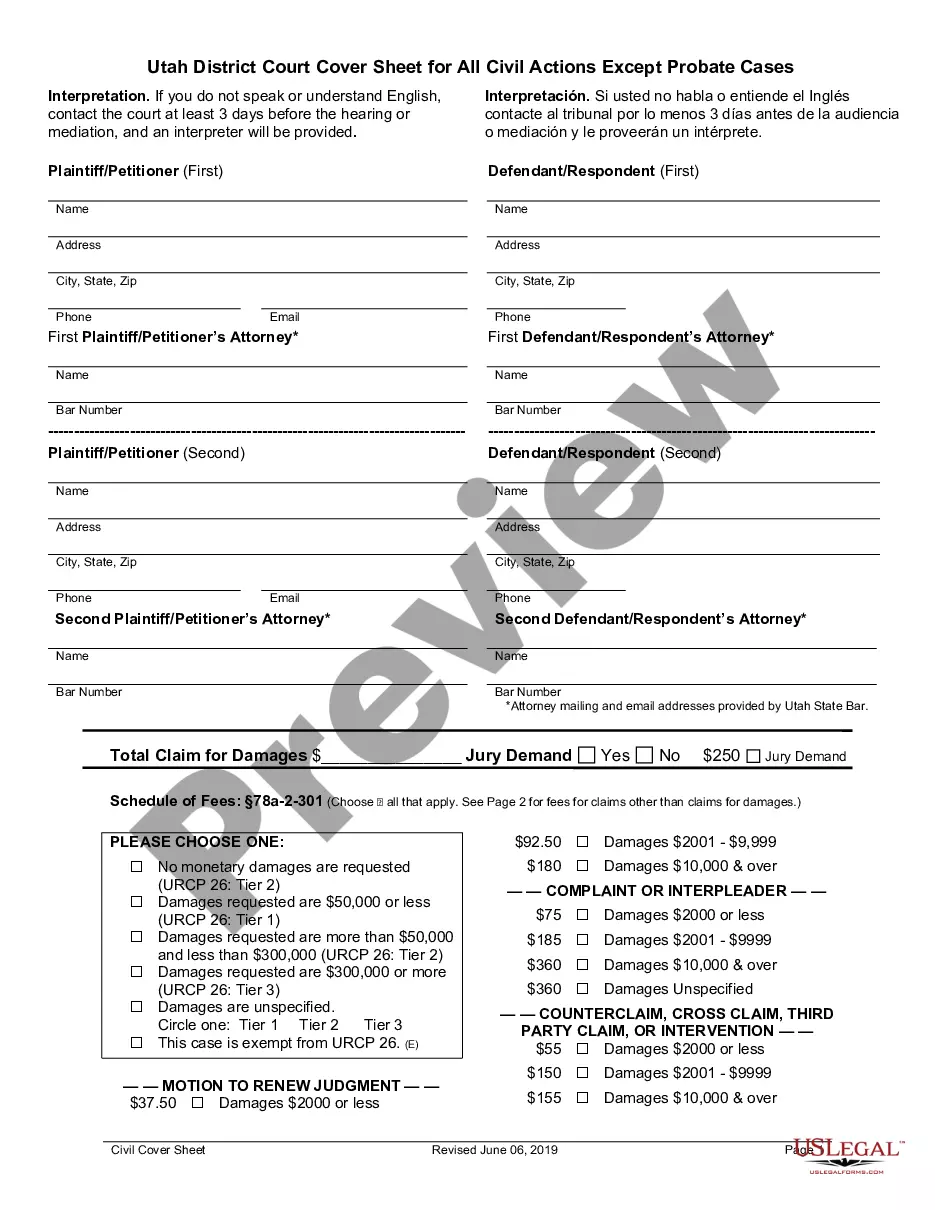

To complete Articles of Incorporation in Louisiana, you must provide essential information about your business, including its name, address, and purpose. After preparing the necessary documents, file them with the Louisiana Secretary of State, along with the required fees. Utilizing resources from platforms like USLegalForms can simplify this process, ensuring you meet all Articles of Incorporation Louisiana withholding requirements.

In Louisiana, the amount of tax withheld from a paycheck usually depends on the employee's income level and personal exemptions. Generally, employers are required to withhold a specific percentage based on state tax brackets. Keeping track of these figures is essential for accurate withholding, especially due to implications on the Articles of Incorporation Louisiana withholding requirements.

The state withholding tax rate in Louisiana is progressive, ranging from 2% to 6% based on your taxable income. Understanding this range is crucial for employees and employers to calculate appropriate withholding amounts. Knowledge of Louisiana's withholding tax rates ensures you remain compliant while completing the Articles of Incorporation Louisiana withholding process smoothly.

Yes, Louisiana requires businesses to file Articles of Organization to legally establish a Limited Liability Company (LLC). This process is essential for compliance with state laws, and it provides credibility for your business. Moreover, when you file Articles of Organization, you lay the foundation for addressing Louisiana withholding requirements properly.

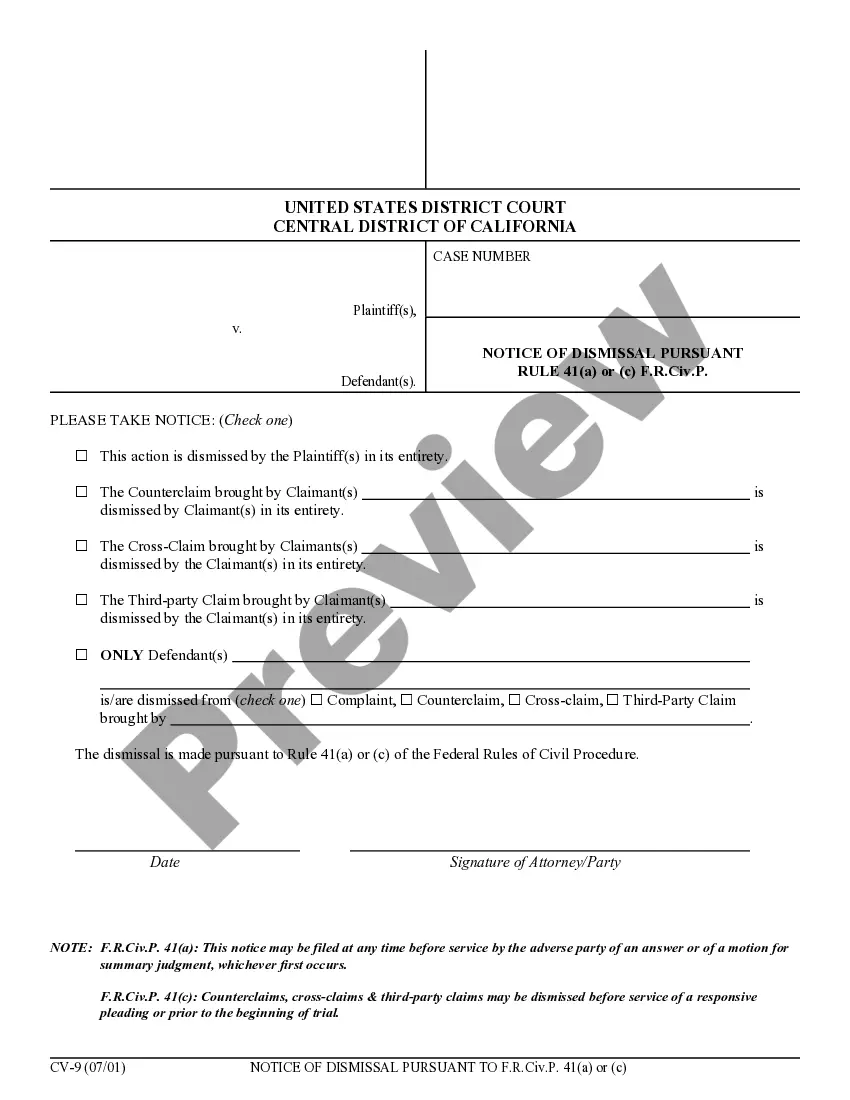

The L3 form is a Louisiana employer's quarterly report used to report wages and withholding of state income tax. This form helps employers comply with their tax obligations and maintain accurate records. Proper filing of the L3 contributes to understanding Articles of incorporation Louisiana withholding requirements, ensuring no issues arise.

To file an L3 form in Louisiana, visit the Department of Revenue's website to download the form. After completing it, submit it via mail or electronically as specified. Filing the L3 correctly is vital, as it relates directly to Articles of incorporation Louisiana withholding and overall tax compliance.

Yes, Louisiana requires employers to withhold state income tax from employee wages. This mandatory withholding ensures that individuals meet their state tax obligations. Understanding your responsibilities related to Articles of incorporation Louisiana withholding can help you manage your company’s finances effectively.

Yes, if you are forming a Limited Liability Company (LLC) in Louisiana, you need to file Articles of Organization. This document officially creates your LLC and outlines its structure. By filing these articles, you also enter the realm of Articles of incorporation Louisiana withholding, which includes tax obligations.