Louisiana Life Estate With Mortgage

Description

Form popularity

FAQ

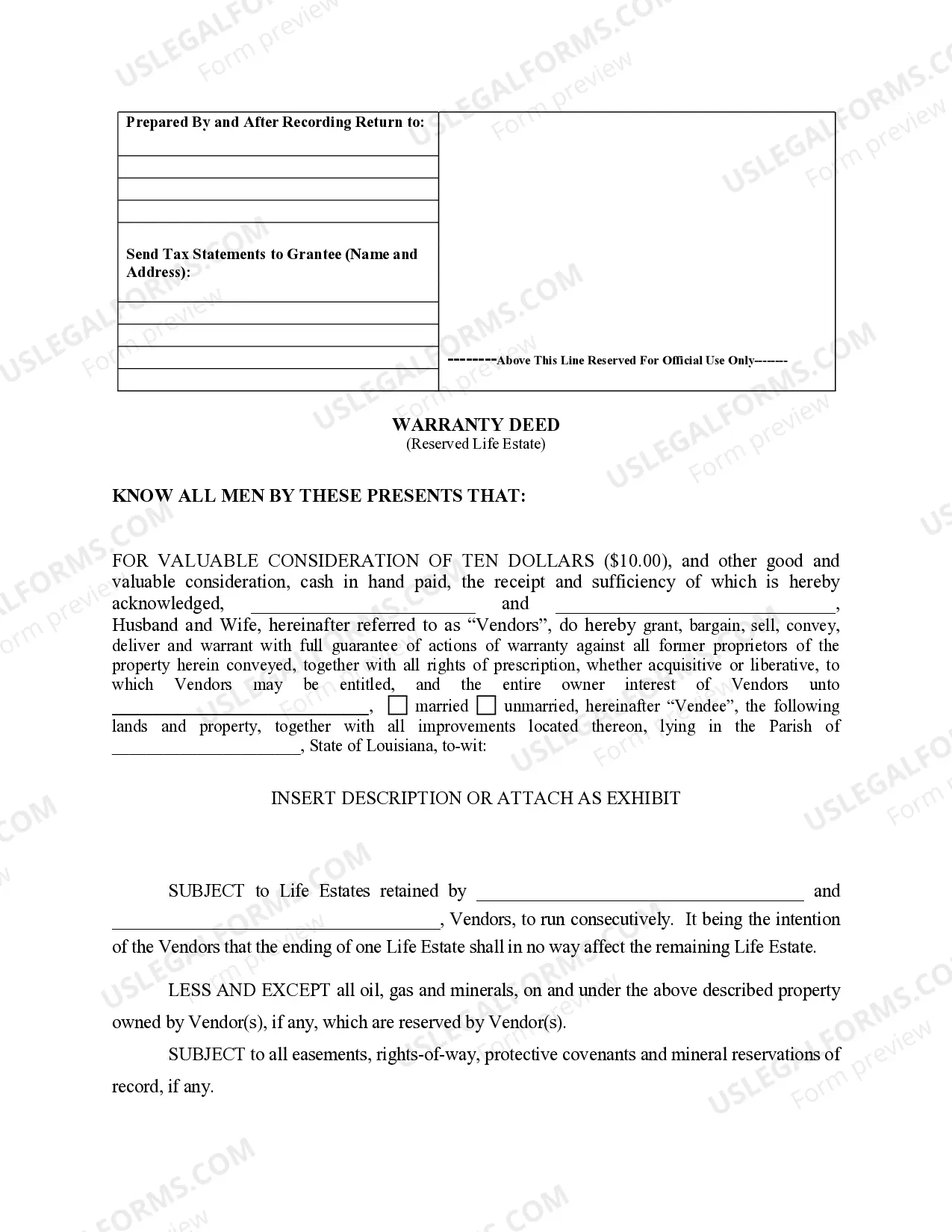

In a life estate, the property ownership is divided between the life tenant and the remainderman. The life tenant has the right to use the property during their lifetime, but they cannot sell or transfer it without the remainderman's consent. This arrangement is similar to a Louisiana life estate with mortgage, where the life tenant may also have mortgage responsibilities. If you are considering a life estate, consulting with a legal professional can help clarify ownership and responsibilities.

In Louisiana, a life estate is a property ownership structure that allows one person to live in and control the property during their lifetime. This arrangement typically includes provisions for transferring the property to designated heirs upon death, maintaining a clear succession plan. When discussing a Louisiana life estate with mortgage, it's important to consider how the mortgage obligations affect both the life tenant and the remainderman's rights. Understanding these implications can lead to better financial and estate planning.

To navigate around a life estate, one option is to explore the possibility of creating a legal agreement that terminates the life estate. Alternatively, you can consider transferring ownership through a joint tenancy or wider estate planning strategies. In the case of a Louisiana life estate with mortgage, it's crucial to consult with legal professionals to ensure that your actions align with local laws and do not adversely affect your financial interests.

A life estate is often referred to as a 'life interest.' This legal arrangement allows individuals to hold property for their lifetime while defining how the property transfers after their death. If you consider a Louisiana life estate with mortgage, it becomes essential to understand how these interests interact with property financing and inheritance. Understanding these terms can help avoid potential complications down the line.

One drawback of a life estate is that the life tenant cannot sell or modify the property without the remainderman's consent. Additionally, life estates can complicate estate planning and may lead to tax implications. Understanding the specifics of a Louisiana life estate with mortgage is essential to avoid pitfalls and ensure that your estate is handled as desired. US Legal Forms offers resources that can guide you through these complexities.

Yes, you can create a life estate even if a mortgage exists on the property. However, the mortgage lender's participation may vary, as they often have specific requirements. Consultation about a Louisiana life estate with mortgage before making arrangements can help ensure compliance with lender expectations and safeguard your ownership rights.

A bank generally cannot foreclose on a life estate without considering the original mortgage terms. The life tenant retains rights to the property, but if they default on a mortgage, the bank may take action. In a Louisiana life estate with mortgage, it is crucial to understand how foreclosure processes work to protect your investment and rights.

Yes, you can sell a house that is in a life estate, but the process has specific implications. The life tenant can sell their interest in the property, but this does not affect the remainderman's rights. In Louisiana, understanding how a life estate with mortgage impacts transactions can ensure that all parties are clear about their rights during the sale process.

In a life estate arrangement, the property is owned by the life tenant for the duration of their life. Upon the death of the life tenant, ownership typically transfers to a remainderman, who holds the right to the property thereafter. It's important to note that this arrangement operates similarly in other states, including Louisiana. Understanding the concept of a Louisiana life estate with mortgage can clarify your rights and responsibilities.