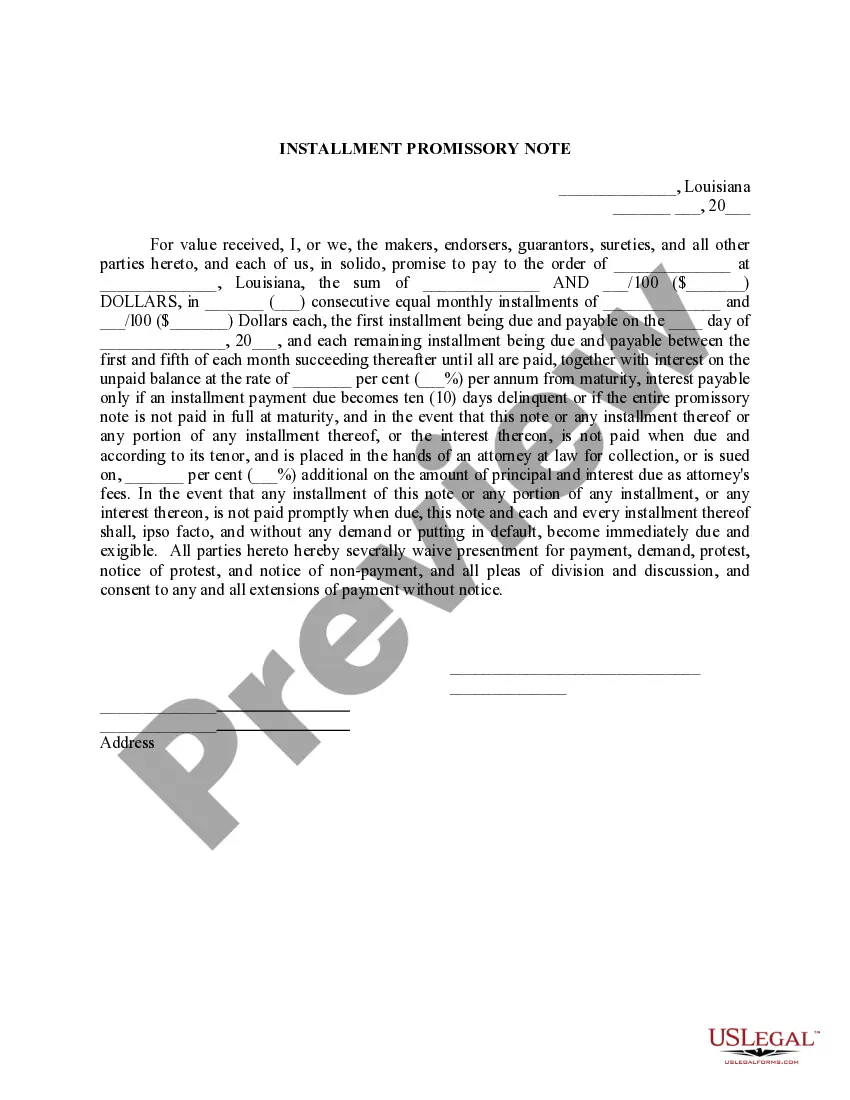

Installment Promissory Note For Purchase Of Vehicle

Description

How to fill out Louisiana Installment Promissory Note With Interest Accruing?

Whether you handle documents frequently or need to submit a legal report occasionally, it is crucial to have a reliable source of information where all the samples are applicable and current.

One important step when using an Installment Promissory Note For Purchase Of Vehicle is to ensure that you have the latest version, as it determines if it can be submitted.

If you want to streamline your search for the most recent document samples, look for them on US Legal Forms.

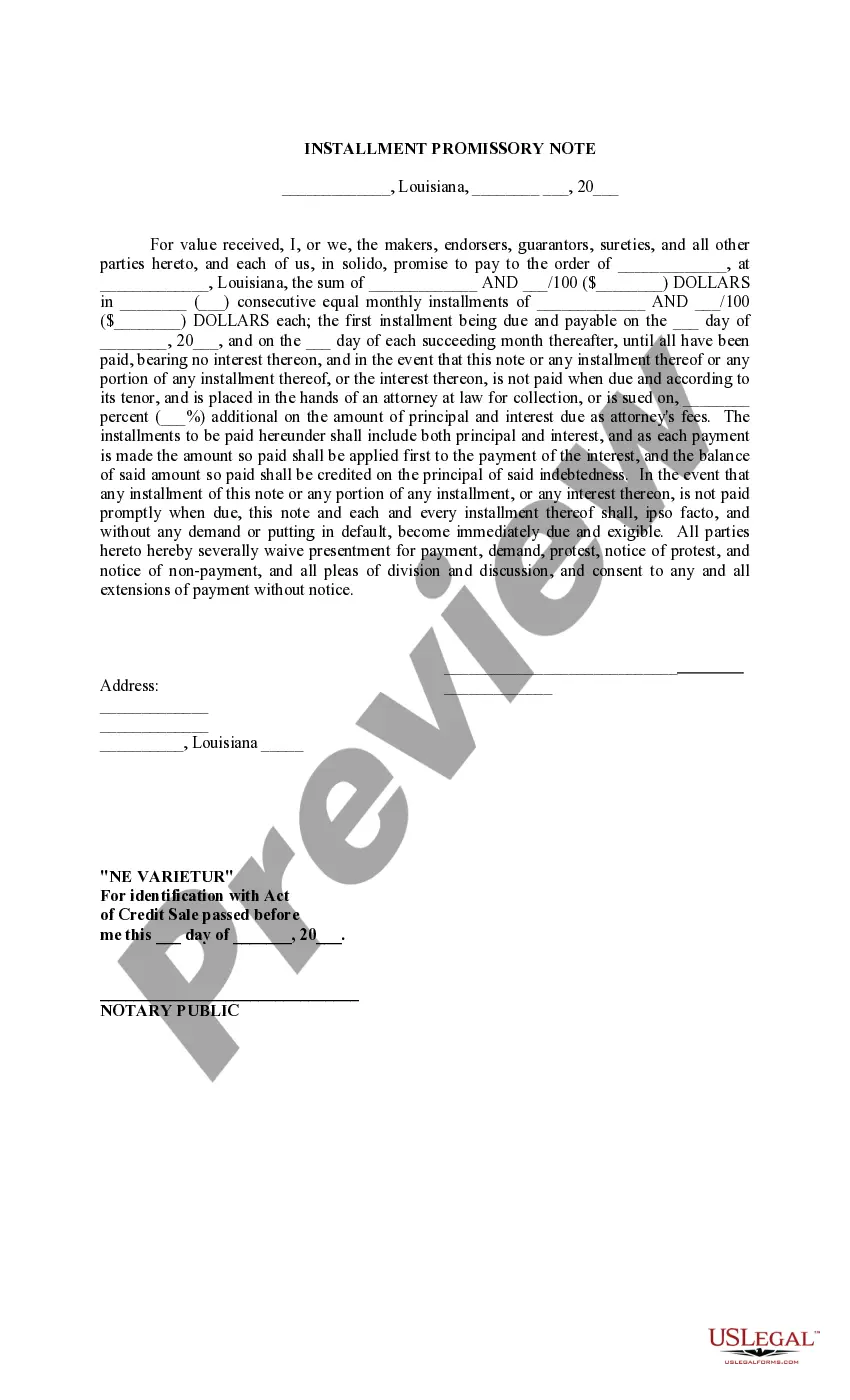

To obtain a form without an account, follow these steps: Use the search bar to locate the desired form. Review the Installment Promissory Note For Purchase Of Vehicle preview and description to ensure it is the exact one you seek. After confirming the form, simply click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Enter your credit card information or PayPal account details to finalize the purchase. Select the file format for download and confirm it. Forget about the confusion associated with legal documents. All your templates will be organized and authenticated with a US Legal Forms account.

- US Legal Forms is a collection of legal documents that includes nearly any form sample you might need.

- Search for the templates you need, evaluate their applicability right away, and learn more about their usage.

- With US Legal Forms, you gain access to over 85,000 form templates across various disciplines.

- Locate the Installment Promissory Note For Purchase Of Vehicle samples in just a few clicks and save them at any time in your account.

- A US Legal Forms account allows you to access all the samples you need with ease and minimal fuss.

- Simply click Log In in the site header and navigate to the My documents section with all the forms you need readily available, eliminating the need to spend time searching for the appropriate template or verifying its validity.

Form popularity

FAQ

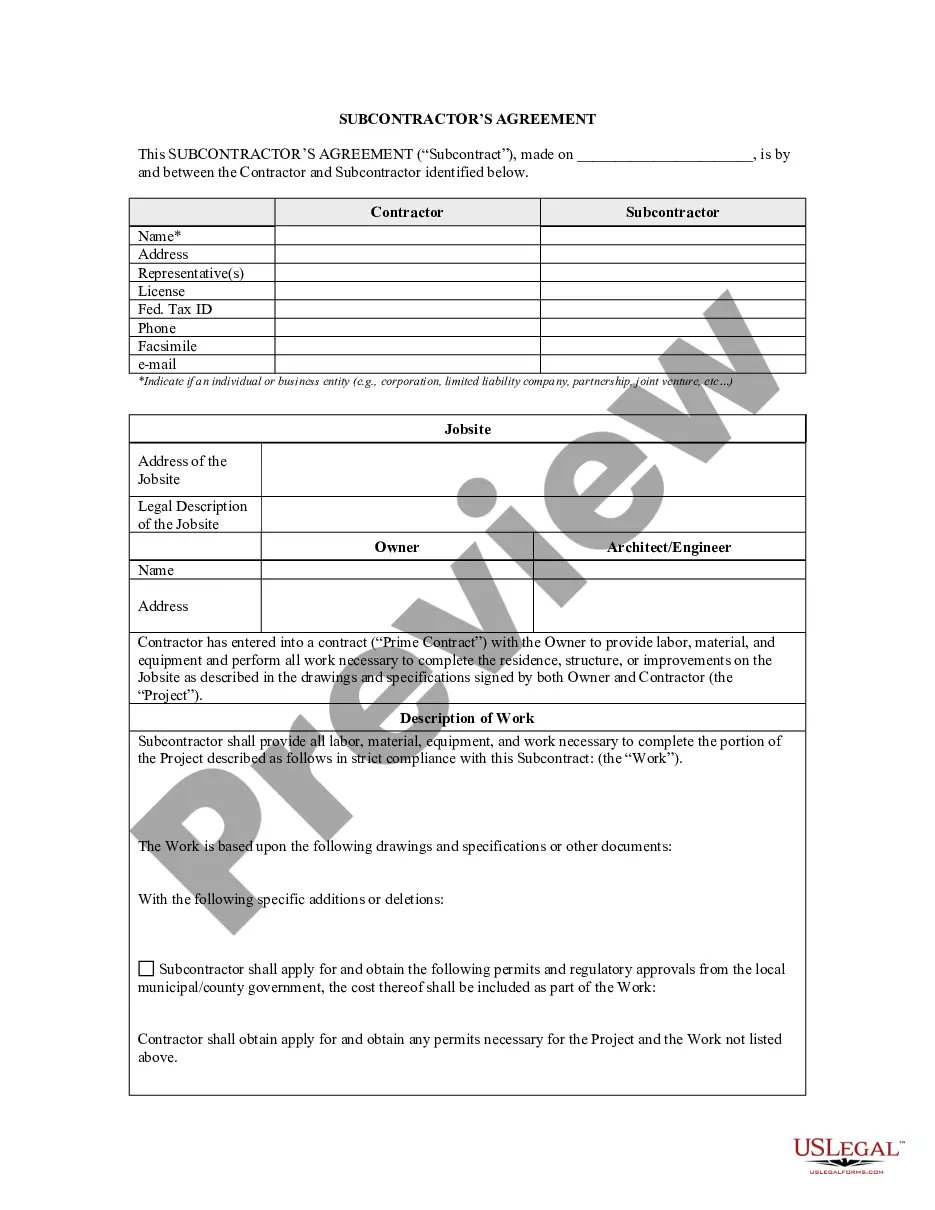

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

How to Write a Promise to Pay Letter?State the sum that is owed. This should be stated without adding on any interest fees or charges.Total sum.Correct date.Identifying the individual in debt.Identifying the creditor party.Payment dates.Sign and date.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.