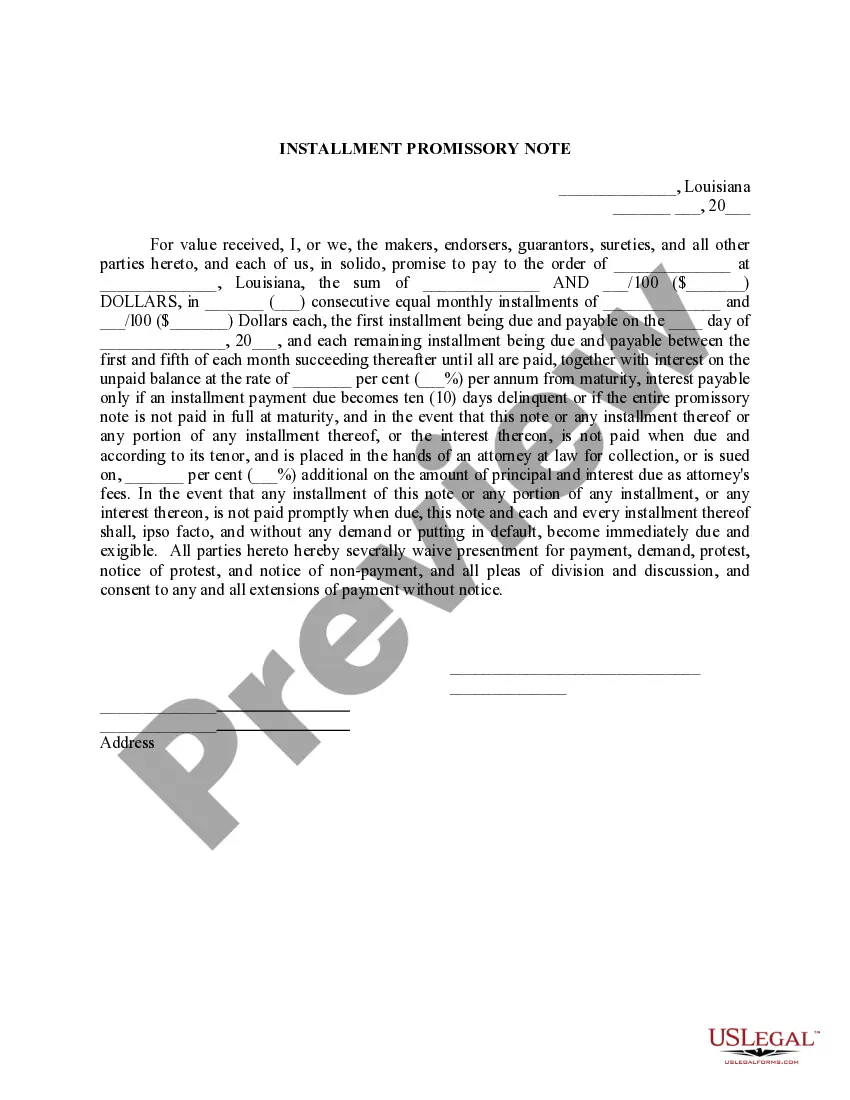

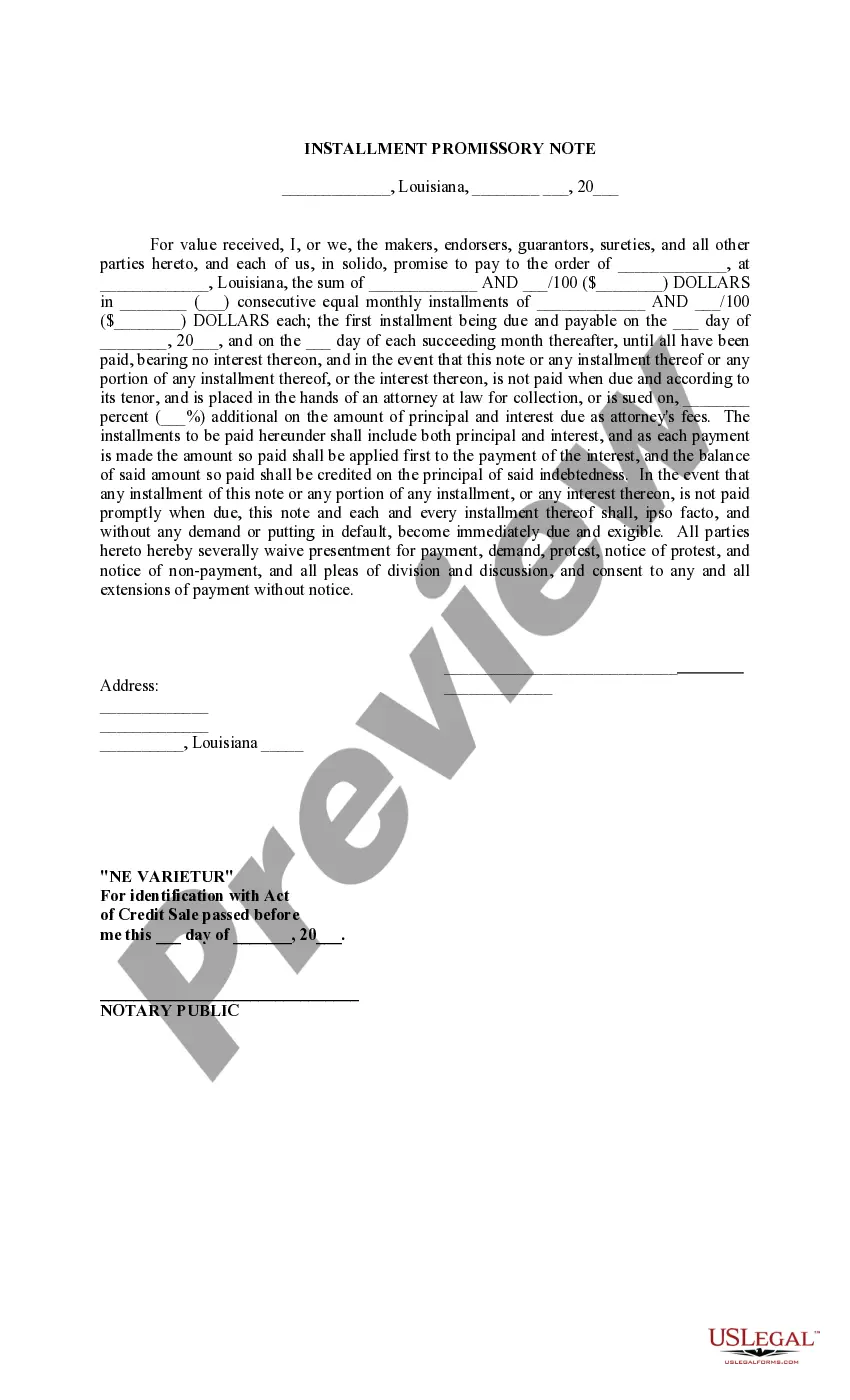

Installment Promissory Note Form

Description

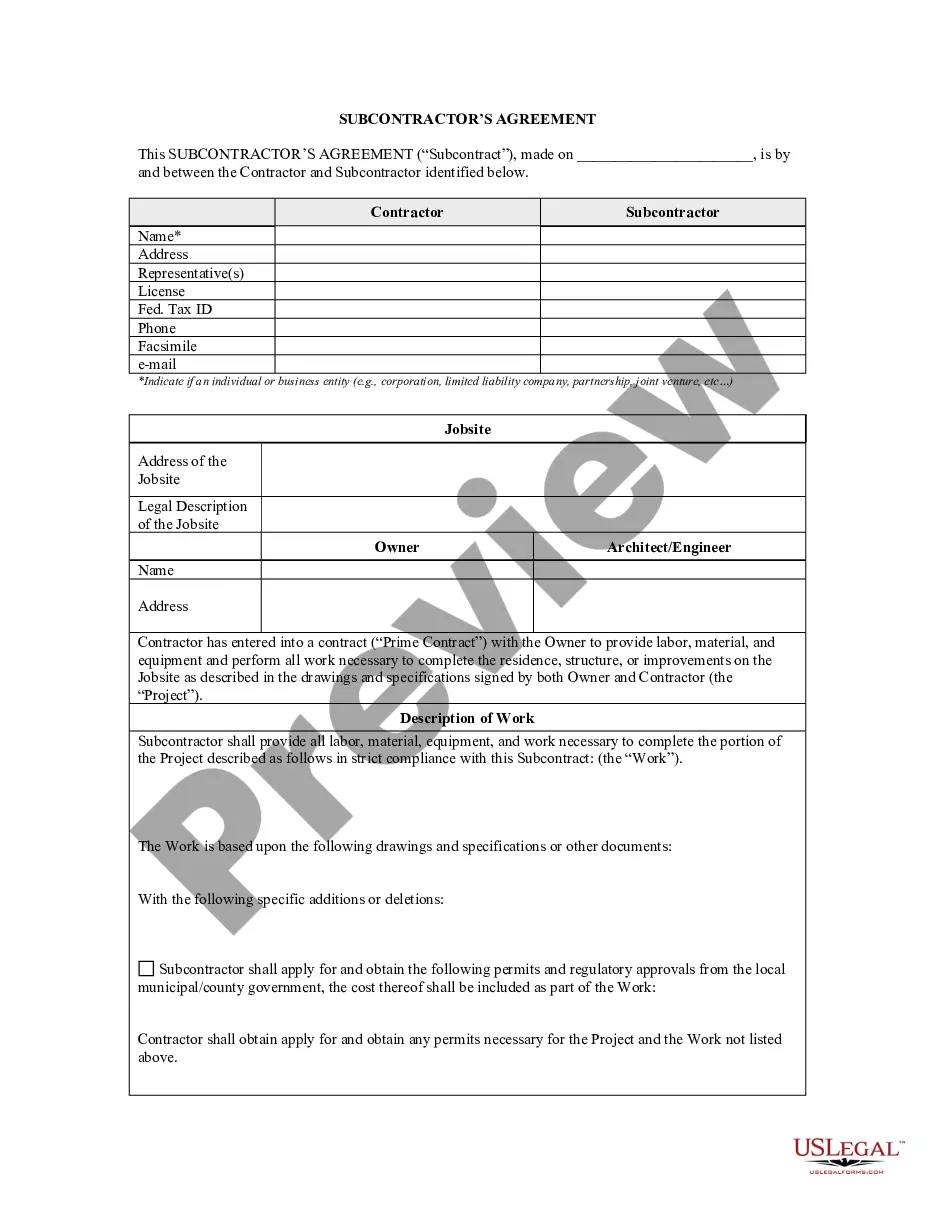

How to fill out Louisiana Installment Promissory Note With Interest Accruing?

Individuals typically link legal documents with complexity that only an expert can handle.

In some respects, this is accurate, as formulating an Installment Promissory Note necessitates significant knowledge in relevant areas, including state and county laws.

Nonetheless, with US Legal Forms, the process has become simpler: a collection of ready-made legal templates for various life and business scenarios, tailored to state regulations, is now consolidated in one online collection and accessible to all.

All templates in our collection are reusable: upon purchase, they remain stored in your account. You can access them anytime necessary via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- Scrutinize the page details carefully to ensure it meets your requirements.

- Examine the form description or confirm via the Preview feature.

- Utilize the Search field at the top to find another example if the initial one does not meet your needs.

- Click Buy Now when you discover the appropriate Installment Promissory Note Form.

- Select the pricing plan that suits your preferences and financial capacity.

- Create an account or sign in to move to the payment section.

- Complete your subscription payment using PayPal or with a credit card.

- Choose the desired format for your document and click Download.

Form popularity

FAQ

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

A Promissory Note with Installment Payments is a lending contract that sets terms for a loan to be repaid in installments. This Promissory Note specifies that the loan will be paid back with consistent, equal, payments. Whether you're the lender or the borrower, you know exactly what each payment will be.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

How to sign a loan agreement onlineLoad the loan agreement template.Fill in the lender and borrower information.Specify the loan amount and the date of the loan.Specify the loan delivery method.Fill in the details of the loan repayment schedule and regular payment options.More items...