Inventory Probate Form With Will

Description

Form popularity

FAQ

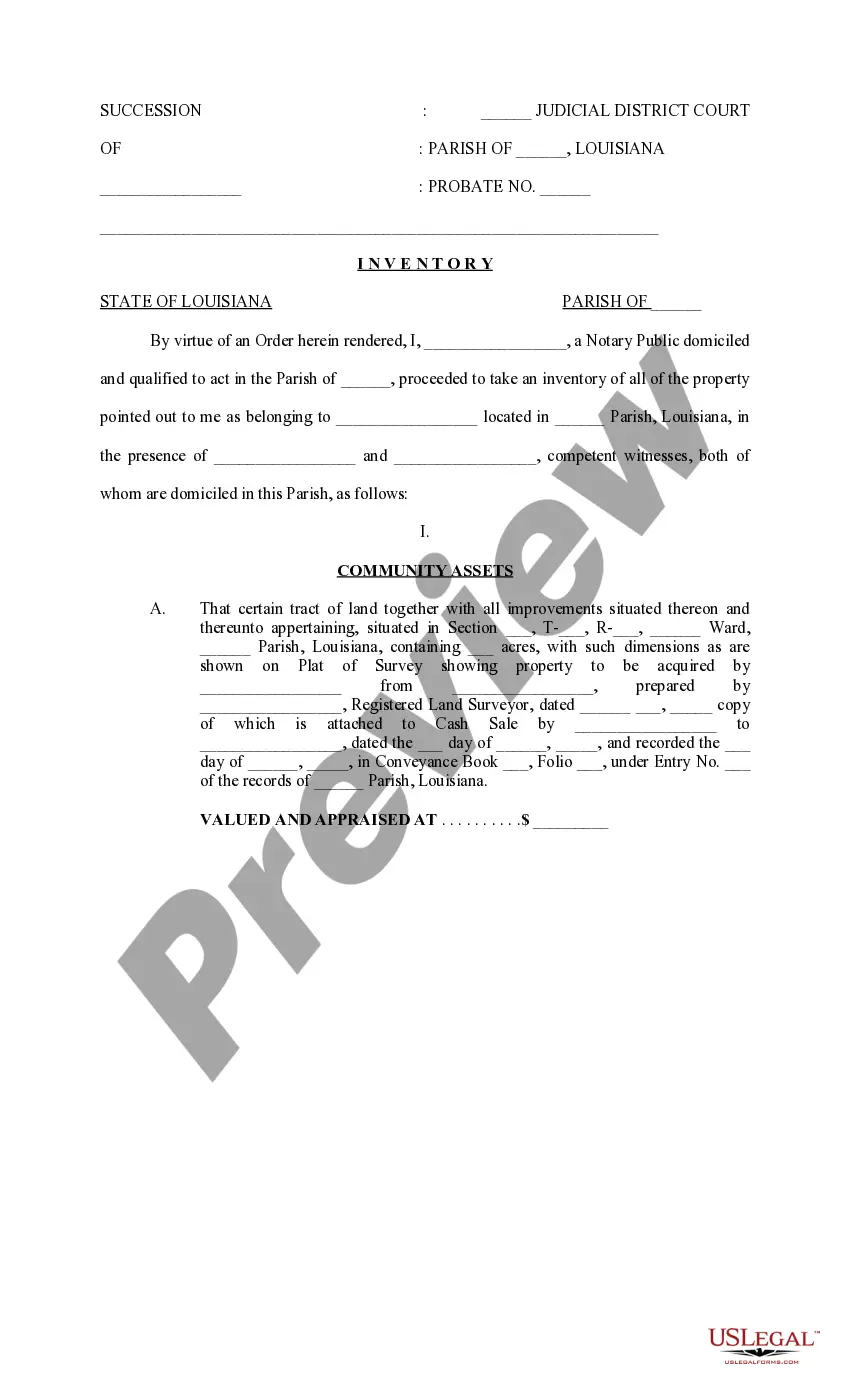

Making an inventory list involves several straightforward steps. Start by collecting a detailed list of items, noting each item's description and estimated value. It’s important to categorize items for clarity, such as dividing possessions into sections like furniture, electronics, and financial assets. Utilizing an inventory probate form with will simplifies this process, providing a structured template to ensure nothing is overlooked.

To create an inventory list for an estate, begin by gathering all assets that the deceased owned. Include real estate, bank accounts, investments, personal belongings, and any other valuables. Next, assign a value to each item, which may require appraisals for high-value assets. Utilizing an inventory probate form with will will help organize this information systematically and ensure compliance with legal requirements.

Items included in inventory can range from real estate properties and bank accounts to personal items like jewelry and collectibles. Additionally, any business interests or investments should also be part of the inventory. Using an inventory probate form with will helps you list all pertinent items systematically, ensuring a thorough understanding of the estate's value and content.

An inventory count typically includes all tangible and intangible assets owned by the decedent. This may encompass real estate, personal belongings, financial accounts, and vehicles. When preparing this count, it’s important to use an inventory probate form with will to capture every detail accurately, aiding in the efficient settlement of the estate.

A property inventory is a detailed list of all assets owned by an individual or estate. This document plays a crucial role during the probate process, especially when a will is present. By utilizing an inventory probate form with will, you can ensure that all assets are properly accounted for, simplifying the distribution process among beneficiaries.

An inventory provides a complete list of assets belonging to a deceased person, while accounting involves detailing how these assets are managed and allocated throughout the probate process. The inventory probate form with will helps create this essential asset listing, serving as a basis for the subsequent accounting. Understanding this difference is crucial for both executors and beneficiaries to ensure that all assets are appropriately managed and distributed.

The inventory of assets showcases everything the deceased owned, which becomes critical during the probate process. This includes both tangible and intangible assets, such as property, vehicles, stocks, and business interests. Completing the inventory probate form with will is necessary to represent these assets faithfully. This documentation is vital for settling debts and distributing the remaining estate to beneficiaries.

The inventory property consists of all the assets owned by the deceased at the time of death. This includes real estate, personal belongings, bank accounts, and investments. When filling out the inventory probate form with will, it's essential to list every item accurately to ensure a smooth probate process. An exhaustive inventory provides clarity for beneficiaries and helps the court understand the estate's value.

To create an inventory list for probate, start by gathering all financial documents and records of assets owned by the deceased. Identify and evaluate each item carefully, noting its value. It is beneficial to use the inventory probate form with will to ensure that all information is accurately captured and organized. This form can guide you through the process step-by-step.

The inventory should list all significant assets owned by the deceased. This includes real estate, bank accounts, retirement accounts, vehicles, collectibles, and any heirlooms. Listing all assets ensures that the estate is fairly and accurately divided among beneficiaries. Using the inventory probate form with will can simplify compiling this comprehensive list.