Letter Nsf Check With Bank Statement

Description statement enclosed letter

How to fill out Letter Nsf Check With Bank Statement?

Individuals frequently link legal documents with something intricate that only an expert can manage.

In some respect, it is accurate, as formulating the Letter Nsf Check With Bank Statement requires considerable knowledge of subject matter requirements, including state and local statutes.

Nonetheless, with US Legal Forms, everything has become simpler: ready-to-use legal templates for any personal and business situation tailored to state laws are consolidated in a single online repository and are now accessible to everyone.

All templates in our repository are reusable: once obtained, they remain stored in your profile. You can access them whenever needed via the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and purpose, so locating the Letter Nsf Check With Bank Statement or any other specific template only takes a few minutes.

- Previously registered members with a valid subscription must Log In to their account and click Download to obtain the form.

- Individuals new to the platform will first need to create an account and subscribe before they can store any files.

- Here is the step-by-step guide on how to acquire the Letter Nsf Check With Bank Statement.

- Review the page content thoroughly to ensure it fulfills your requirements.

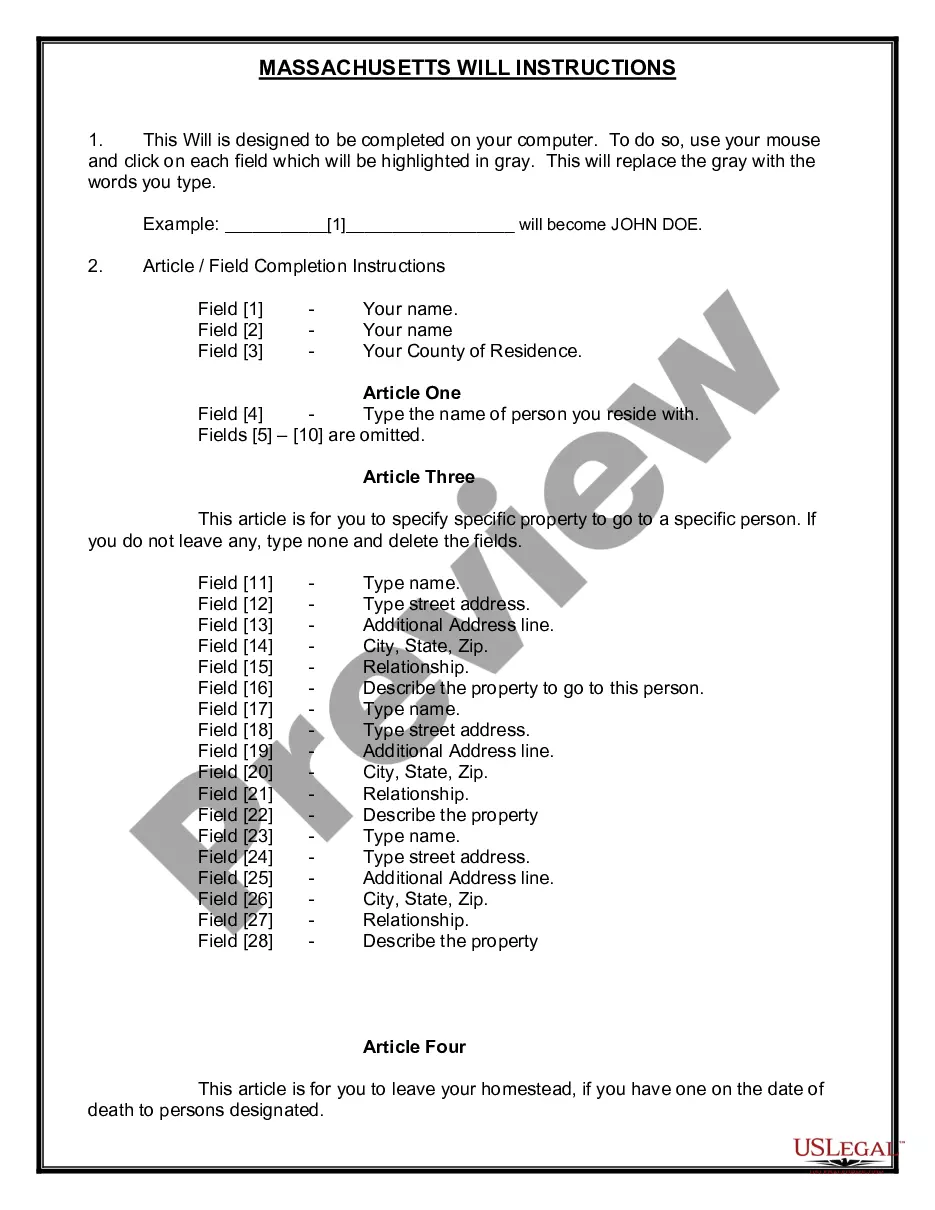

- Read the form description or view it through the Preview option.

- Look for another template via the Search bar above if the previous one does not meet your expectations.

- Click Buy Now once you locate the correct Letter Nsf Check With Bank Statement.

- Select a pricing plan that fits your needs and financial situation.

- Create an account or Log In to continue to the payment page.

- Complete your subscription payment via PayPal or with your credit card.

- Choose the format for your file and click Download.

- Print your document or upload it to an online editor for faster completion.

request letter to get bank statement Form popularity

FAQ

Dear Name of Bounced-Check Writer: I am writing to inform you that check #Check Number dated Date on Bounced Check, in the amount of $Amount of Bounced Check made payable to Your Name/Payee's Name has been returned to me due to insufficient funds, a closed account, etc..

How do I record an NSF check returned on a payment made and applied to a customer invoice in accounts receivable?Click the "+" icon and choose Journal Entry.Enter the date the check bounced.In the Account column, select Accounts Receivable.Under Debit, enter the amount of the bounced check.More items...?

A common choice for the invoice number is to use the original invoice with NSF. For example ff the check was originally applied to invoice #1234, make this invoice #1234NSF.

Non-sufficient funds is the term used when the holder of a checking account is overdrawn meaning there is not enough money in the account to pay the check written against it. The bank returns the bounced check to the accountholder and charges a returned-check charge, or a non-sufficient funds (NSF) fee.

NSF fees are charged by banks and credit unions when a check or other payment transaction is returned unpaid because you don't have sufficient funds to cover pending transactions.