Promissory Note Template Louisiana With Amortization Schedule

Description promissory note with amortization schedule

How to fill out Promissory Note Template Louisiana With Amortization Schedule?

Navigating through the red tape of traditional documents and templates can be difficult, particularly when one is not doing it professionally.

Finding the suitable template for a Promissory Note Template Louisiana With Amortization Schedule can be arduous, as it must be valid and precise to the very last digit.

However, you will significantly reduce the time spent searching for an appropriate template if it originates from a source you can rely on.

Obtain the appropriate form in a few simple steps: Enter the document title in the search box, find the relevant Promissory Note Template Louisiana With Amortization Schedule in the results, review the sample description or view its preview. If the template fits your needs, click Buy Now. Then, select your subscription plan, use your email to create a secure password to register with US Legal Forms, choose a credit card or PayPal payment option, and save the template document on your device in your preferred format. US Legal Forms can save you considerable time investigating whether the form you found online is suitable for your needs. Create an account and gain unlimited access to all necessary templates.

- US Legal Forms is a platform that streamlines the process of searching for the correct forms online.

- US Legal Forms serves as a centralized place where you can find the latest document samples, understand their usage, and download these templates for completion.

- This is a repository containing over 85K forms applicable in various fields.

- When searching for a Promissory Note Template Louisiana With Amortization Schedule, you will not have to question its validity as all forms are vetted.

- Having an account at US Legal Forms ensures you have all the necessary samples at your disposal.

- You can store them in your history or add them to your My documents catalog.

- Access your saved forms from any device by logging in on the library website.

- If you don't have an account yet, you can always search for the template you require.

Form popularity

FAQ

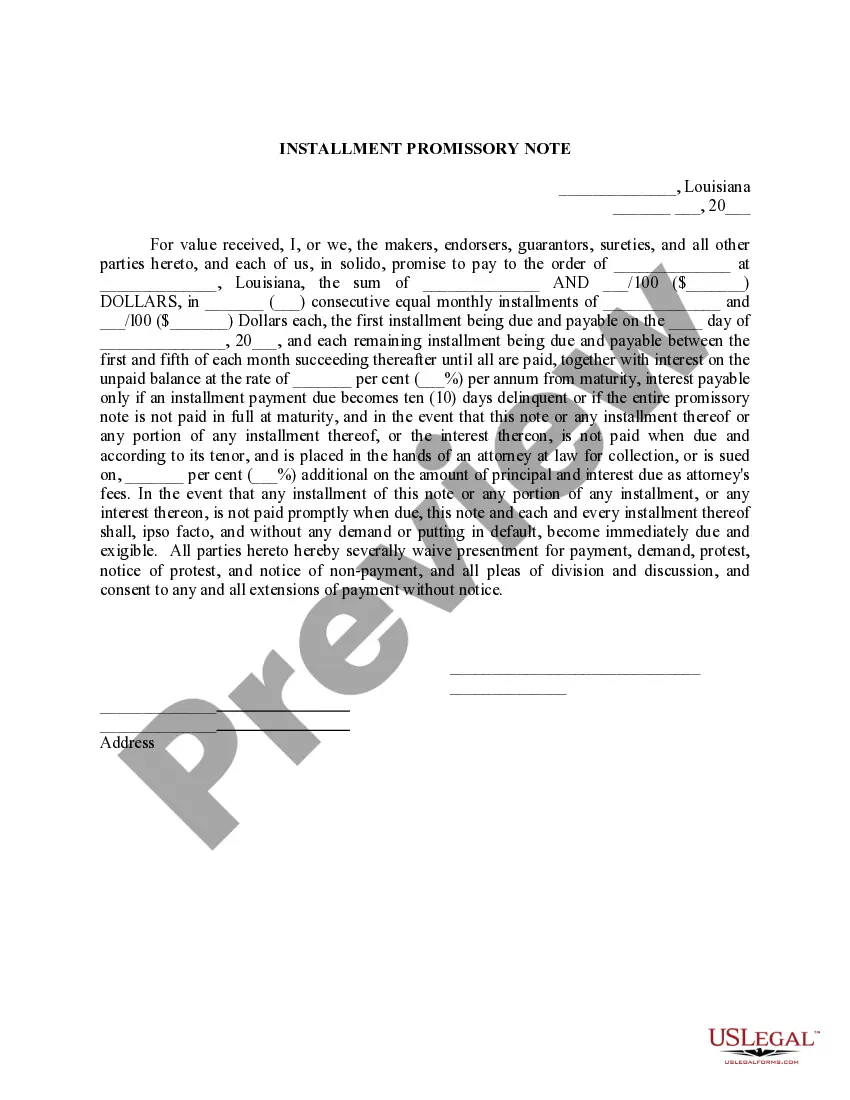

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Signatures. Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

There is no legal requirement for a promissory note to be notarized in Louisiana. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.