Promissory Note Template Louisiana With Balloon Payment

Description note protest pay

How to fill out Notice Note Pay?

When you have to finalize a Promissory Note Template Louisiana With Balloon Payment in alignment with your local state's statutes, there may be several alternatives available.

There's no need to scrutinize every document to ensure it satisfies all the legal requirements if you hold a subscription to US Legal Forms.

It is a reliable service that can assist you in acquiring a reusable and current template on any subject.

Utilize the Preview mode and examine the form description if accessible.

- US Legal Forms is the largest online repository with a collection of over 85,000 ready-to-use documents for both business and personal legal matters.

- All templates are verified to comply with each state's regulations.

- Consequently, when you download the Promissory Note Template Louisiana With Balloon Payment from our platform, you can be confident that you possess a valid and current document.

- Obtaining the necessary sample from our platform is quite simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can navigate to the My documents section in your profile and access the Promissory Note Template Louisiana With Balloon Payment at any time.

- If it's your first time using our website, please adhere to the following instructions.

- Review the recommended page and verify it aligns with your criteria.

louisiana promissory note Form popularity

louisiana template with Other Form Names

louisiana promissory with FAQ

A balloon loan is a type of loan that does not fully amortize over its term. Since it is not fully amortized, a balloon payment is required at the end of the term to repay the remaining principal balance of the loan.

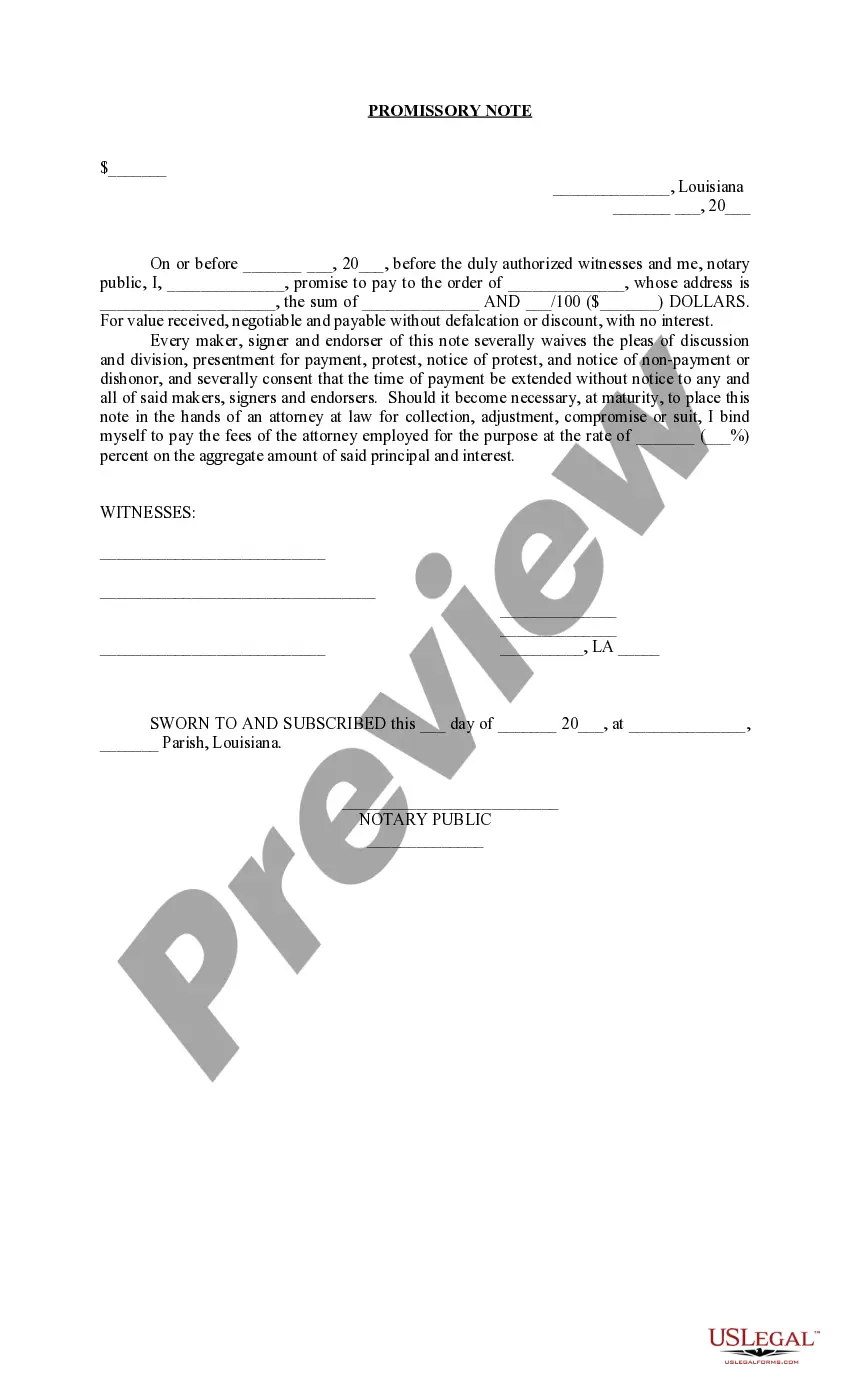

A Promissory Note with Balloon Payments is a loan contract that enables a lender set loan terms with one or more larger payments at the end. This lending document helps you to clarify the terms of a loan, define the payment schedule, and provide an amortization table, if the loan includes interest.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

There is no legal requirement for a promissory note to be notarized in Louisiana. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.