Title: Understanding Donation of Property to a Family Member Without Paying Taxes Introduction: Donation of property to a family member without incurring tax implications can be a beneficial estate planning strategy. This detailed description aims to provide a comprehensive understanding of this process, its advantages, and any potential variations or limitations. Keep reading to learn about the different types of property donation to family members without tax obligations and the relevant keywords associated with this topic. Key Topics: 1. Gift Tax Exemption: Explaining the legal provisions ensuring tax-free property transfers among family members, particularly the annual exclusion and lifetime exemption amounts. 2. Eligible Donors and Done BS: Clarifying who can donate property to a family member without incurring taxable consequences, including spouses, parents, children, and other close relatives. 3. Types of Property: Discussing various assets that can be donated without triggering a gift tax, such as real estate, cash, securities, personal belongings, and more. 4. Strategies to Minimize Tax Liability: Highlighting effective techniques for donating property while minimizing or eliminating potential tax burdens, including joint ownership, life estates, and utilizing trusts. 5. Donations for Specific Purposes: Exploring circumstances where property donations are tax-free due to their purpose, such as educational or medical expenses, charitable donations, or financial assistance. 6. Requirements and Limitations: Addressing specific criteria and conditions to be met for a successful tax-free property donation, including gift documentation, appraisals, and adherence to IRS guidelines. 7. Special Considerations: Providing insights into potential exceptions, restrictions, or variations when donating certain types of property, like artwork, business assets, or inherited assets. 8. Estate Planning Benefits: Highlighting how the donation of property to family members offers advantages beyond tax considerations, including wealth preservation, asset protection, and avoiding probate. 9. Consulting Professionals: Underlining the importance of seeking advice from tax attorneys, financial advisors, or estate planning experts to ensure compliance with tax laws and maximize benefits. 10. Recent Legal Updates: Discussing any recent legislative changes or updates relevant to tax-free property donations, including any proposed reforms that may impact this process. Keywords: — Donatiopropertyrt— - Tax-free property transfer — Family member— - Gift tax exemption - Annual exclusion — Lifetimexemptionio— - Donor - Donee - Real estate donation — Casgiftingin— - Securities transfer - Personal belongings — Joinownershiphi— - Life estate - Trusts — Educational expense— - Medical expenses — Charitable donation— - Financial assistance — IRS guideline— - Gift documentation - Appraisals — Artwork donation— - Business assets - Inherited assets — Estatplanningin— - Wealth preservation - Asset protection Probateat— - Tax attorneys - Financial advisors — Legislative change— - Legal updates - Proposed reforms.

Donation Of Property To A Family Member Without Paying Taxes

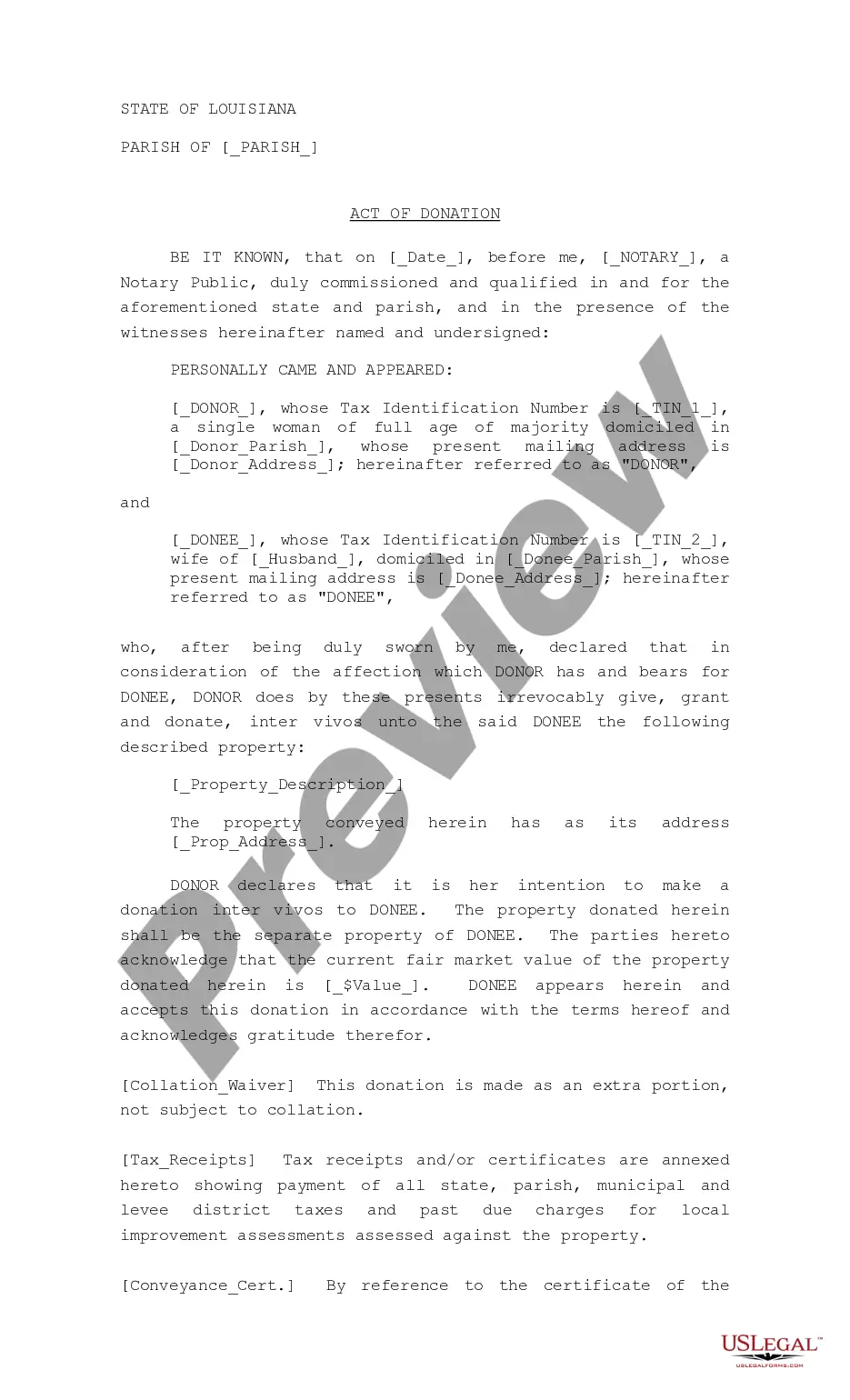

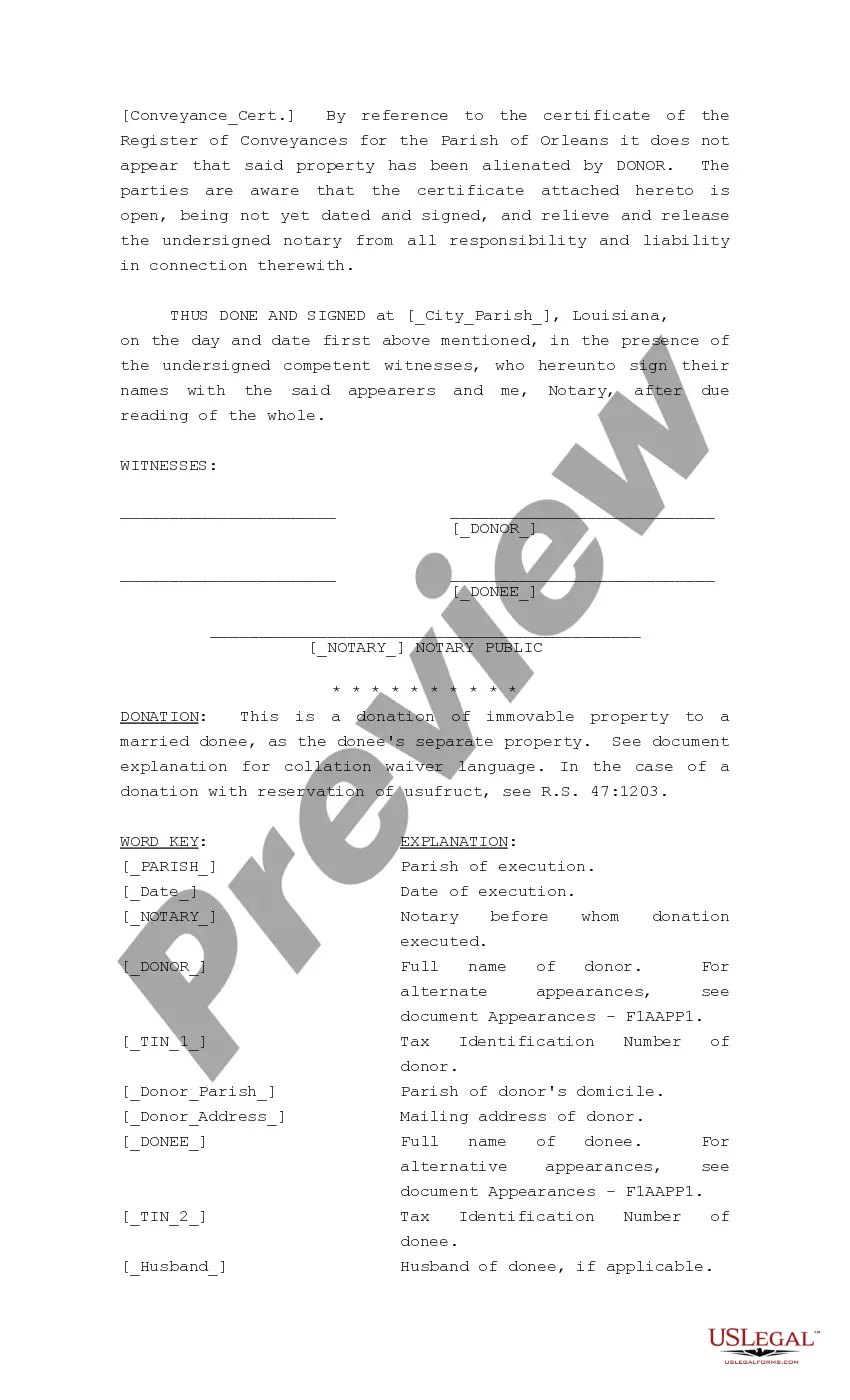

Description Louisiana Act Donation

How to fill out Louisiana Donation?

It’s obvious that you can’t become a law expert overnight, nor can you learn how to quickly draft Donation Of Property To A Family Member Without Paying Taxes without the need of a specialized set of skills. Creating legal documents is a long process requiring a particular education and skills. So why not leave the creation of the Donation Of Property To A Family Member Without Paying Taxes to the professionals?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court documents to templates for in-office communication. We know how crucial compliance and adherence to federal and local laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our platform and obtain the form you need in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether Donation Of Property To A Family Member Without Paying Taxes is what you’re looking for.

- Start your search again if you need a different form.

- Set up a free account and choose a subscription plan to purchase the template.

- Pick Buy now. Once the transaction is through, you can get the Donation Of Property To A Family Member Without Paying Taxes, complete it, print it, and send or send it by post to the necessary people or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your paperwork-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!