Louisiana Revocable Living Trust Form

Description

Form popularity

FAQ

Yes, a tax return must be filed for an irrevocable trust if it generates income. This is important for tax reporting purposes, and the Louisiana revocable living trust form can serve as a helpful guide in tracking financial activities. Ensure compliance with tax laws by consulting a professional who can help navigate the specifics of irrevocable trust requirements.

To file a return for a trust, you will typically need TurboTax Premier or a higher version that accommodates more complex tax situations. With the Louisiana revocable living trust form, you can effectively track income and expenses, making TurboTax an easy choice for completing your trusts' tax obligations. Choosing the right software ensures a smoother filing process.

A K1 for a trust is usually prepared by the trustee or the individual responsible for managing the trust's financial affairs. If you are using a Louisiana revocable living trust form, this document helps ensure that each beneficiary receives the correct tax information. It is crucial that this is prepared accurately to facilitate tax reporting for beneficiaries.

In Louisiana, a revocable trust typically does not need to be recorded. However, if the trust holds certain assets, it is beneficial to document its existence for clarity and legal recognition. Utilizing the Louisiana revocable living trust form can help provide clear terms and conditions, which may assist in any potential disputes.

To file a revocable trust tax return, you will need to collect all the necessary financial documents relating to your trust. You can use the Louisiana revocable living trust form to streamline the process of reporting income and expenses. It is advisable to consult a tax professional familiar with trust taxation to ensure compliance with IRS regulations and proper filing.

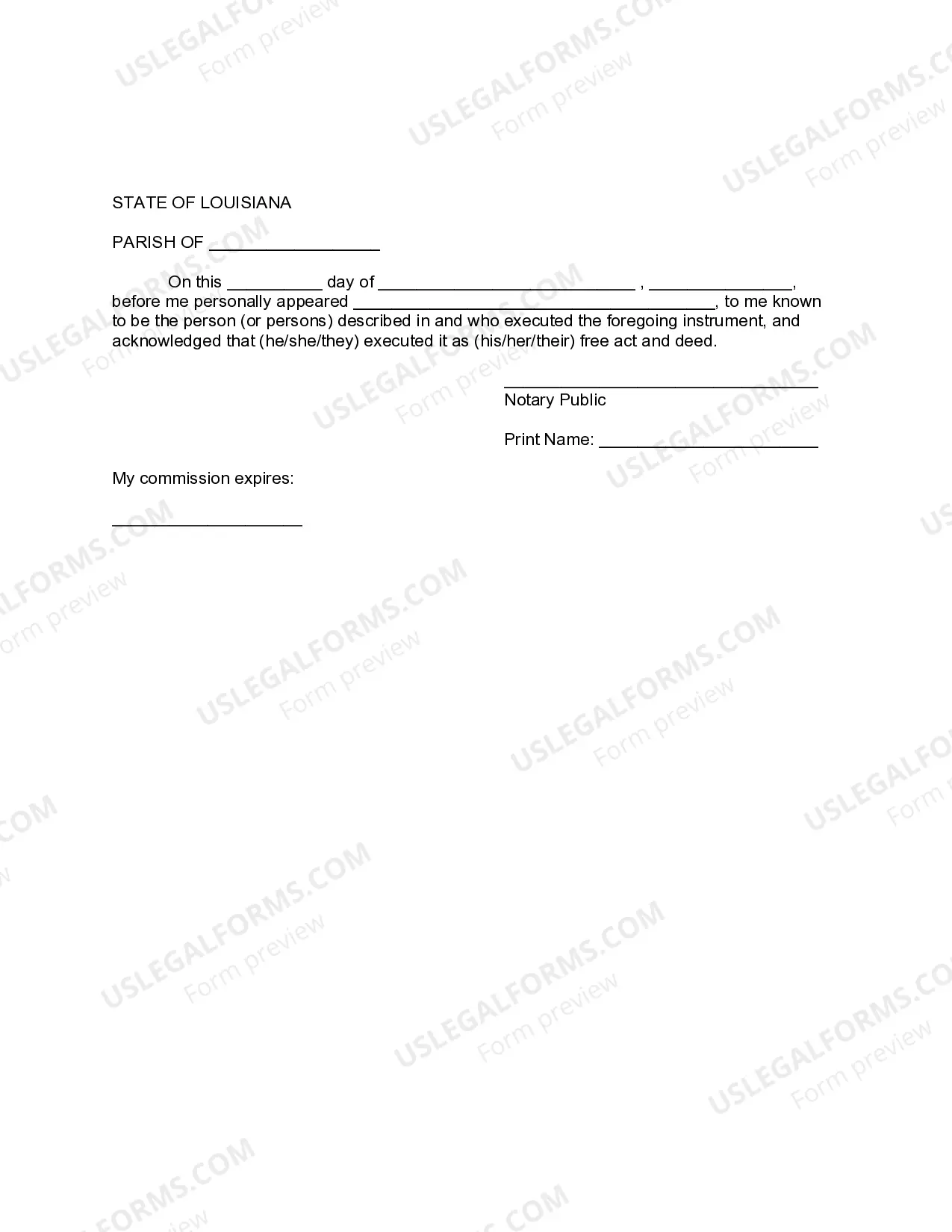

In Louisiana, a revocable living trust does not need to be notarized, but it is highly recommended. While the Louisiana revocable living trust form can be created without a notary, having it notarized enhances the document's credibility and may help during property transfers. Notarization ensures that the signatures are verified, adding a layer of protection against potential disputes. For your convenience, you can easily find a Louisiana revocable living trust form on the US Legal Forms platform, which provides straightforward access to essential legal documents.

One notable disadvantage of a revocable living trust is that it does not provide asset protection from creditors. Since you retain control over the trust, creditors may still reach your assets in some situations. Additionally, while establishing a Louisiana revocable living trust form can streamline estate management, it may incur upfront costs in creation and ongoing maintenance. Understanding these factors ensures you make informed decisions regarding your estate planning.

Certain assets should typically be excluded from a revocable living trust. For instance, retirement accounts, such as 401(k)s and IRAs, generally should not be placed in the trust due to tax implications. Additionally, you may want to keep life insurance policies and certain personal items separate, as they can complicate your trust management. Ensuring you understand these exclusions helps you effectively use the Louisiana revocable living trust form.

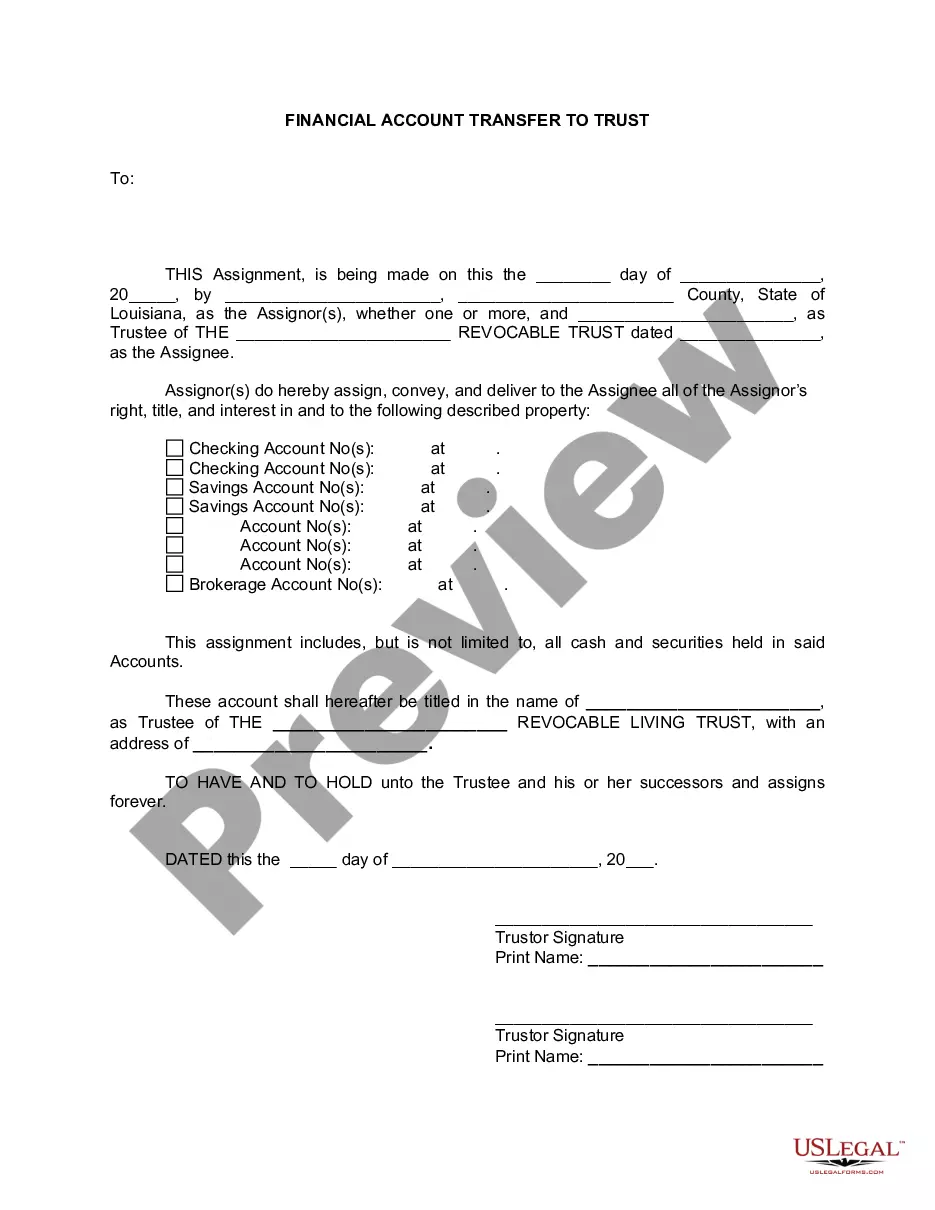

To set up a Louisiana revocable living trust form, start by choosing a reliable trustee, which can be yourself. Next, you need to draft the trust document outlining the details of the trust, including beneficiaries and specific assets. You can use uslegalforms to find the appropriate templates and guidelines to simplify this process. Finally, transfer your chosen assets into the trust to ensure they are protected and managed according to your wishes.

To fill out a Louisiana revocable living trust form, you need to clearly state your intentions regarding your assets. Include your name as the grantor and your chosen trustee's name. Carefully outline how you want your assets to be distributed after your death. Utilizing resources like USLegalForms can ensure you fill it out correctly and comprehensively.