Living Trust Louisiana With No Assets

Category:

State:

Louisiana

Control #:

LA-E0178G

Format:

Word;

Rich Text

Instant download

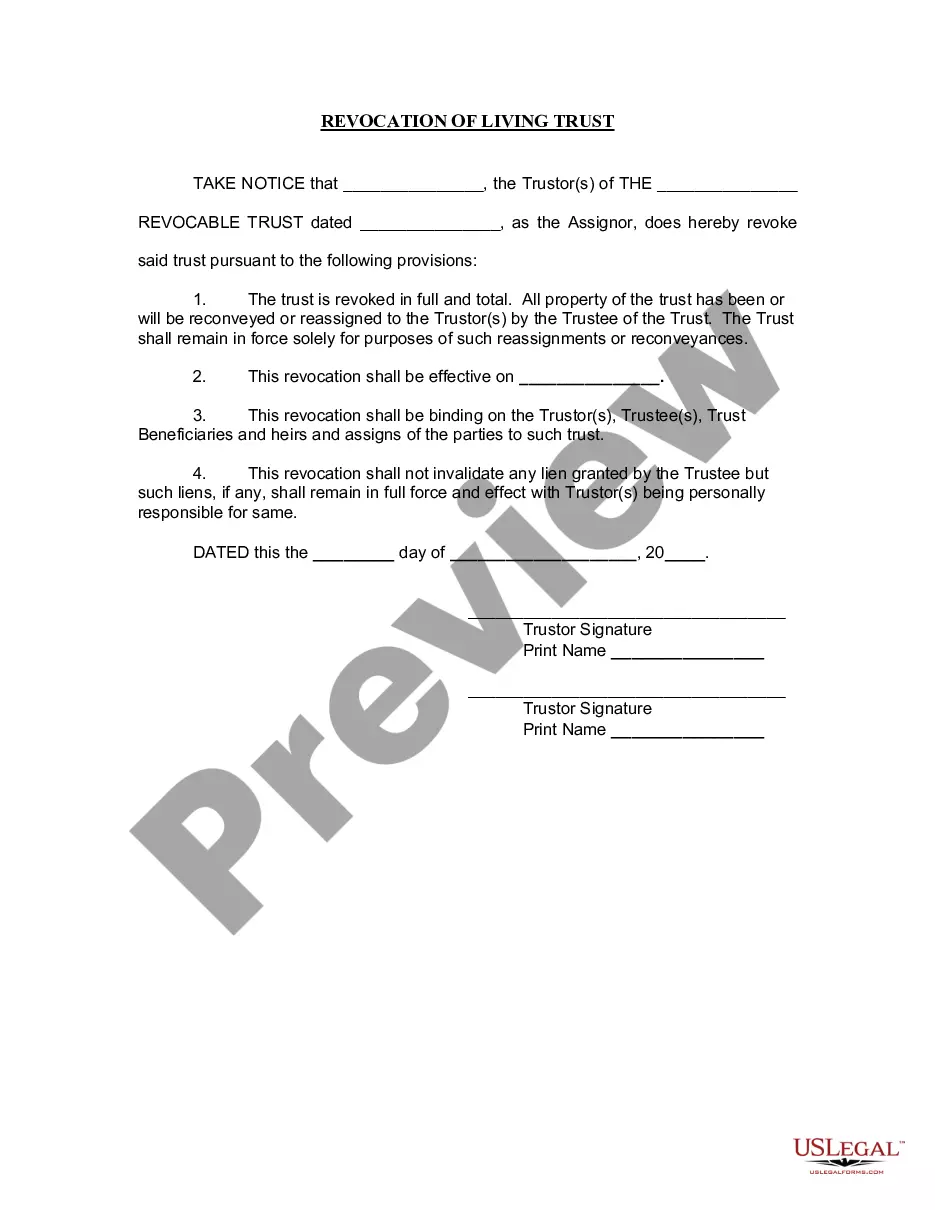

Description

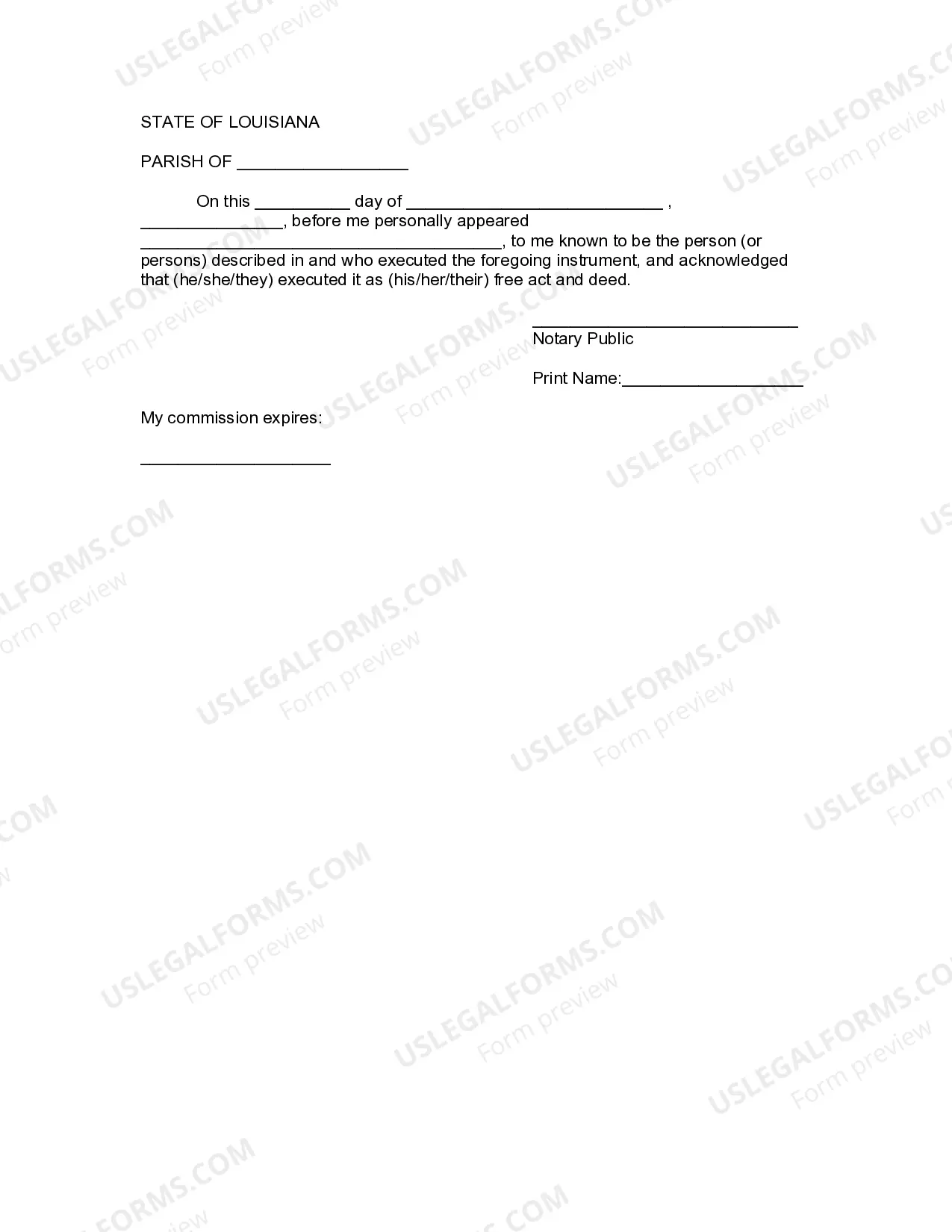

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Free preview