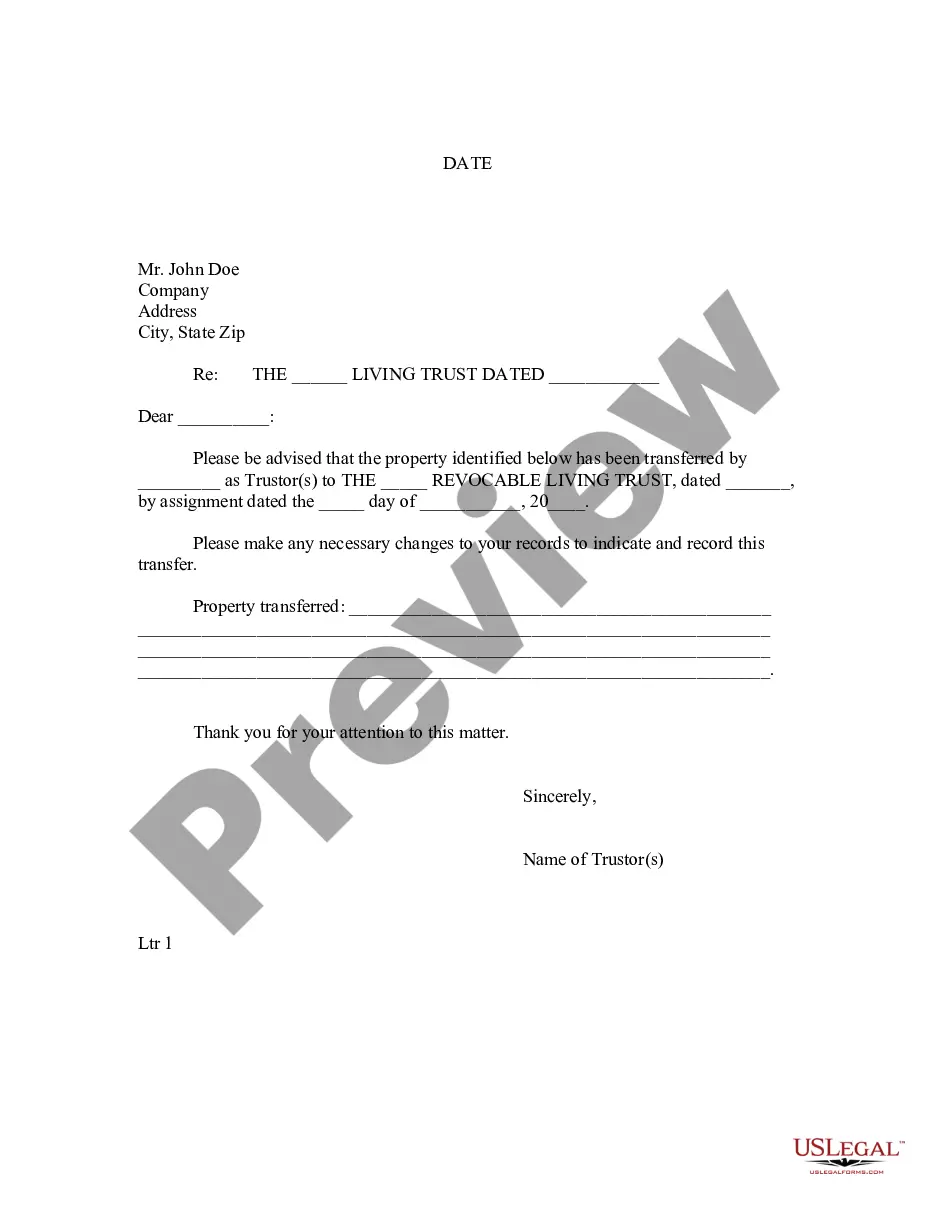

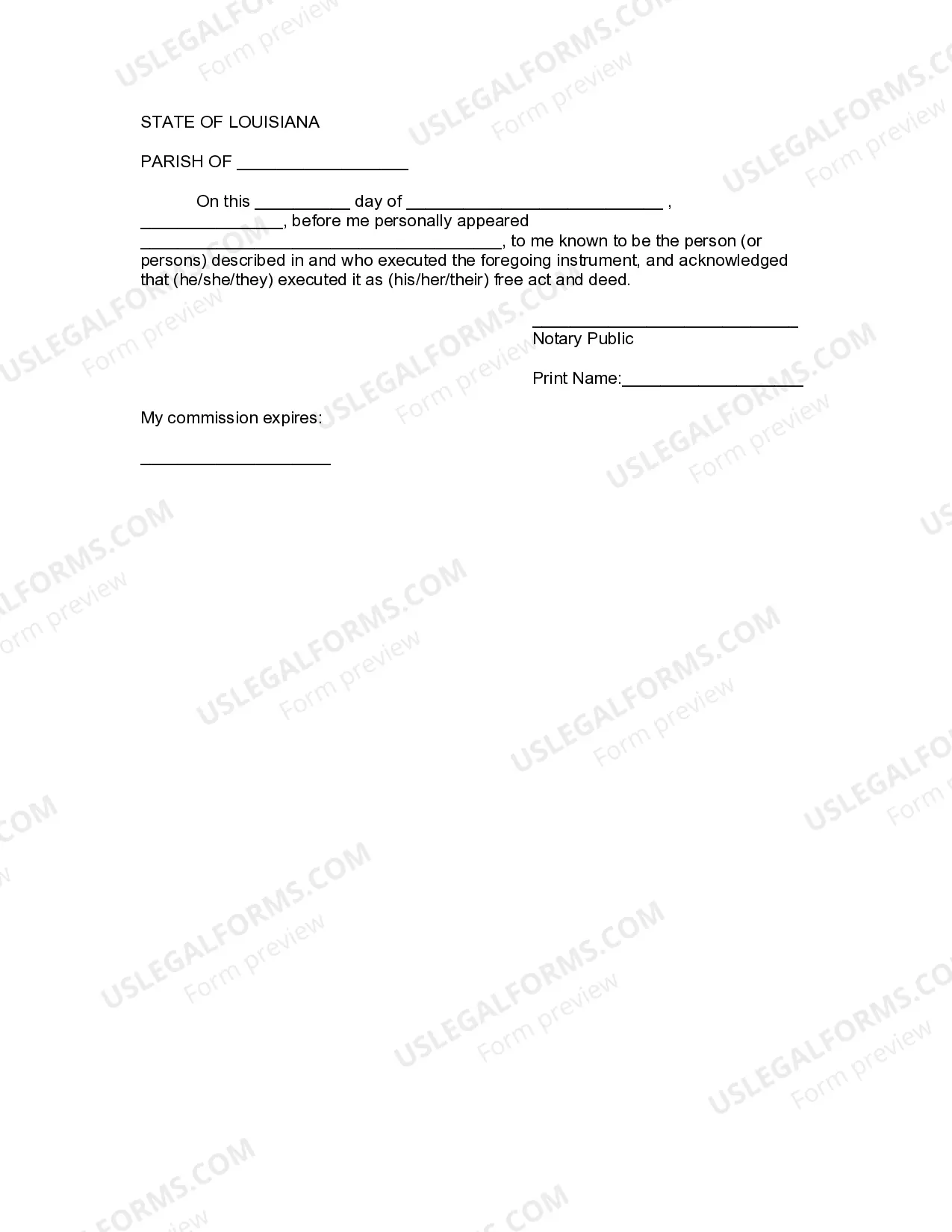

A Letter of Guarantee for Title Template is a document that serves as proof or assurance of the ownership rights of a property or asset. This letter is typically issued by a financial institution or a third-party entity to guarantee that there are no undisclosed claims or liens on the property's title or ownership. It provides confidence to the recipient, usually the buyer or lender, that they will have a clear and marketable title upon completion of a transaction. The content of a Letter of Guarantee for Title Template may include the following key components: 1. Heading: The letter should begin with a clear and concise title, such as "Letter of Guarantee for Title Template." 2. Date: The date of issuance of the letter should be mentioned. 3. Recipient Information: Include the name, address, and contact details of the recipient or the party who will be relying on this letter. 4. Property Description: Provide a detailed description of the property involved, including the address, legal description, and any other relevant identifying information. 5. Guarantor Information: State the name, address, and contact details of the guarantor, which is usually a financial institution or a third-party entity providing the guarantee. 6. Guarantee Statement: Clearly state that the guarantor guarantees the title of the property without any undisclosed claims or liens, and that they will take responsibility for any future claims or issues that may arise. 7. Duration of Guarantee: Specify the duration for which the guarantee will remain valid. This can be until the completion of a specific transaction or for a certain period. 8. Notarization: If required, include a section for notarization of the letter, ensuring its legality and validity. Different types of Letter of Guarantee for Title Templates may include: 1. Commercial Real Estate Title Guarantee: This type of letter is specifically designed for commercial real estate transactions, providing assurance of a clear and marketable title. 2. Residential Property Title Guarantee: Similar to the commercial version, this template focuses on residential properties to assure the buyer or lender of a clear and marketable title. 3. Financial Institution Guarantee: This type of letter is issued by a financial institution, such as a bank, to assure the recipient of a property's clear and marketable title when used as collateral for a loan or mortgage. 4. Third-Party Title Guarantee: In some cases, a third-party entity or title insurance company may issue the letter of guarantee to ensure the title's clarity and marketability. It's worth noting that the content and format of the Letter of Guarantee for Title Template may vary depending on the specific requirements of the parties involved and the jurisdiction in which the transaction takes place.

Letter Of Guarantee For Title Template

Description how to title a letter

How to fill out Letter Of Guarantee For Title Template?

Dealing with legal paperwork and procedures can be a time-consuming addition to your day. Letter Of Guarantee For Title Template and forms like it often require you to look for them and understand the best way to complete them appropriately. Consequently, if you are taking care of economic, legal, or individual matters, using a thorough and hassle-free web library of forms when you need it will help a lot.

US Legal Forms is the best web platform of legal templates, featuring more than 85,000 state-specific forms and numerous resources to assist you to complete your paperwork quickly. Discover the library of appropriate documents accessible to you with just a single click.

US Legal Forms gives you state- and county-specific forms offered by any moment for downloading. Protect your document administration operations with a high quality services that lets you make any form within minutes with no extra or hidden fees. Simply log in to your account, find Letter Of Guarantee For Title Template and acquire it straight away from the My Forms tab. You can also gain access to formerly saved forms.

Could it be your first time making use of US Legal Forms? Sign up and set up your account in a few minutes and you’ll gain access to the form library and Letter Of Guarantee For Title Template. Then, stick to the steps below to complete your form:

- Ensure you have the right form by using the Review option and looking at the form information.

- Pick Buy Now as soon as all set, and select the subscription plan that fits your needs.

- Press Download then complete, sign, and print the form.

US Legal Forms has 25 years of experience helping users deal with their legal paperwork. Get the form you need right now and improve any operation without breaking a sweat.

title guarantee letter Form popularity

guarantee of title letter Other Form Names

FAQ

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

The release assignment must be recorded at the local land office in order to be valid. It contains a legal description of the property, the borrower's name, the title company's contact info and the date the release takes effect. A copy of the release is sent to the borrower and should be kept for future reference.

Key takeaways. A transfer of mortgage is the reassignment of an existing mortgage, usually on a home, from the current holder to another person or entity. Not all mortgages can be transferred; if they are, the lender has the right to approve the person assuming the loan.

(3) No greater interest than eight percent per annum shall be charged on life insurance policy loans unless otherwise provided by law.

Before a bank can institute a foreclosure proceeding, the bank must record the assignment of the note. The bank must also be in actual possession of the note. If the bank fails to ?produce the note,? that is, cannot demonstrate that the note was assigned to it, the bank cannot demonstrate it owns the note.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.

Suppose a mortgage lender fails to record a Satisfaction of Mortgage document within 60 days from the final payment date. In that case, you can file a lawsuit against the mortgagee. Contact a local law firm to speak with an intake specialist about your legal options.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.