Letter Of Guarantee From Employer

Category:

State:

Louisiana

Control #:

LA-E0178H

Format:

Word;

Rich Text

Instant download

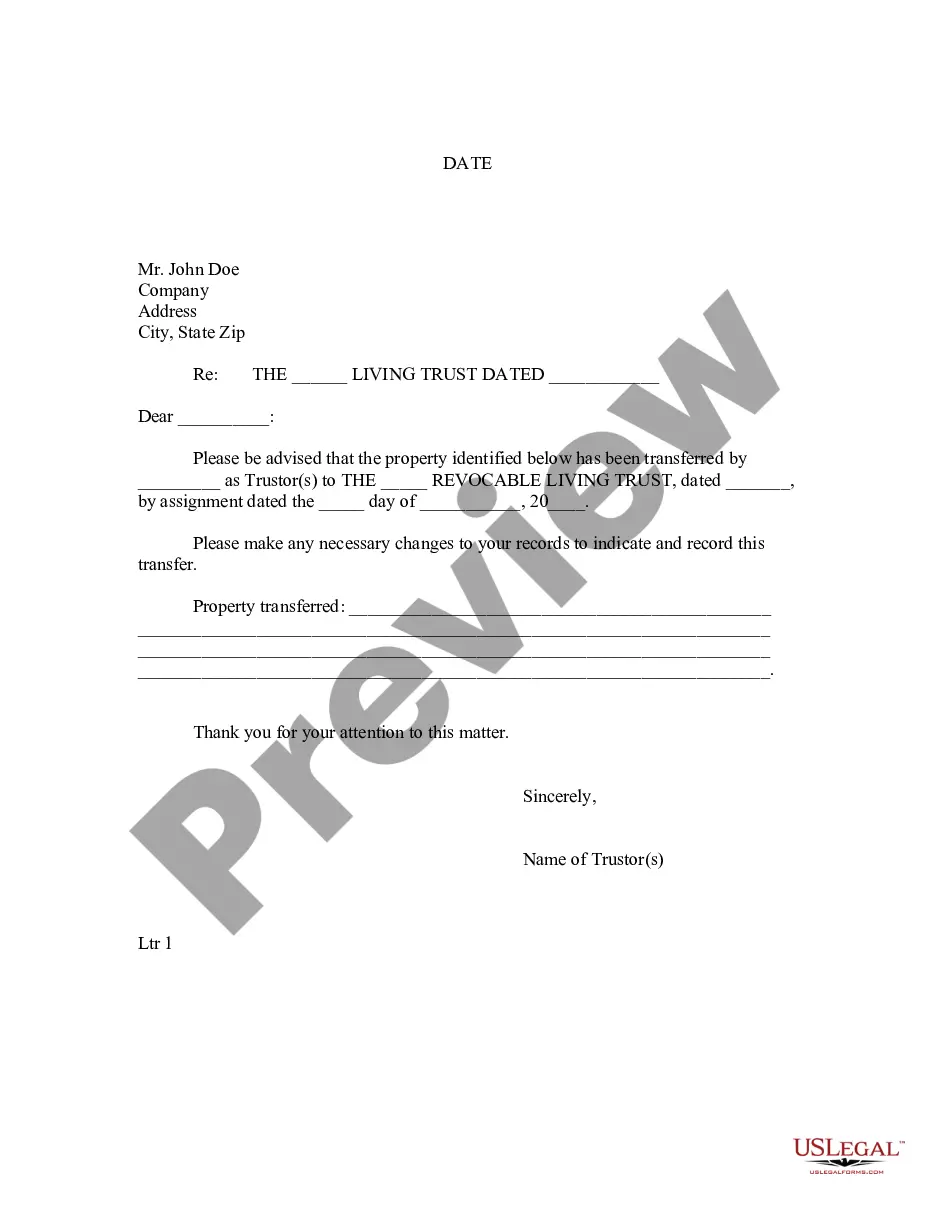

Description Letter Of Guarantee Template

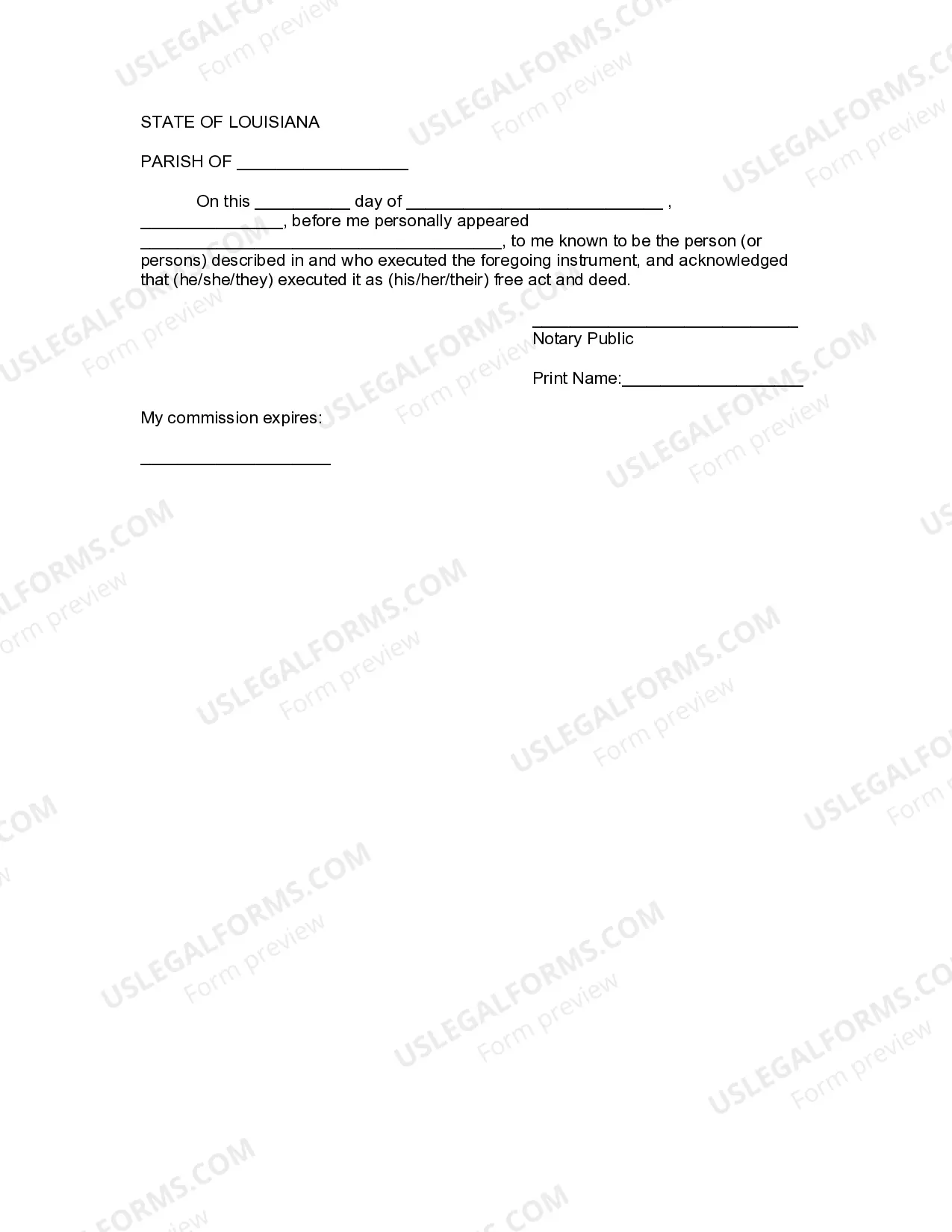

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

Free preview Release Letter From Company