Massachusetts Llc Operating Agreement With State

Description

How to fill out Massachusetts Llc Operating Agreement With State?

What is the most dependable service to obtain the Massachusetts LLC Operating Agreement with the state and other current versions of legal documents? US Legal Forms is the answer!

It's the most comprehensive collection of legal forms for any purpose. Each template is meticulously drafted and verified to ensure compliance with federal and local regulations. They are organized by field and state of use, making it simple to locate the one you require.

US Legal Forms is an excellent solution for anyone who needs to navigate legal documentation. Premium users can benefit even more as they can complete and approve previously saved documents electronically at any time using the integrated PDF editing tool. Try it out today!

- Experienced users of the platform just need to Log In to the system, confirm if their subscription is active, and click the Download button next to the Massachusetts LLC Operating Agreement with the state to acquire it.

- Once saved, the template will be accessible for further use within the My documents section of your profile.

- If you don't yet have an account with our library, here are the steps you should follow to create one.

- Form compliance verification. Before obtaining any template, ensure it meets your usage criteria and adheres to your state or county's regulations. Review the form description and utilize the Preview if available.

Form popularity

FAQ

Instructions for Filing Massachusetts Certificate of Organization by MailName of your LLC.Street Address.General Character of your Business.Dissolution.Name and Street Address of Resident Agent (aka Registered Agent)Name and Address of Managers (if your LLC is Manager-Managed)More items...?

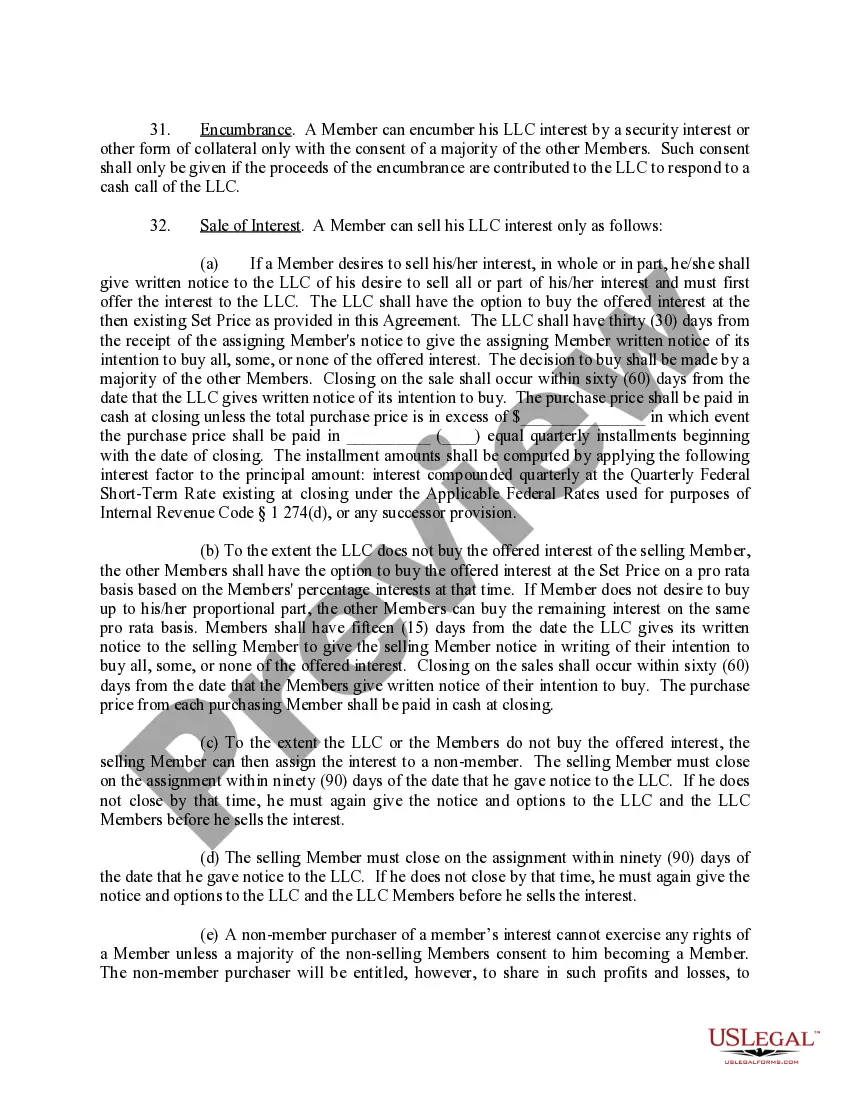

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

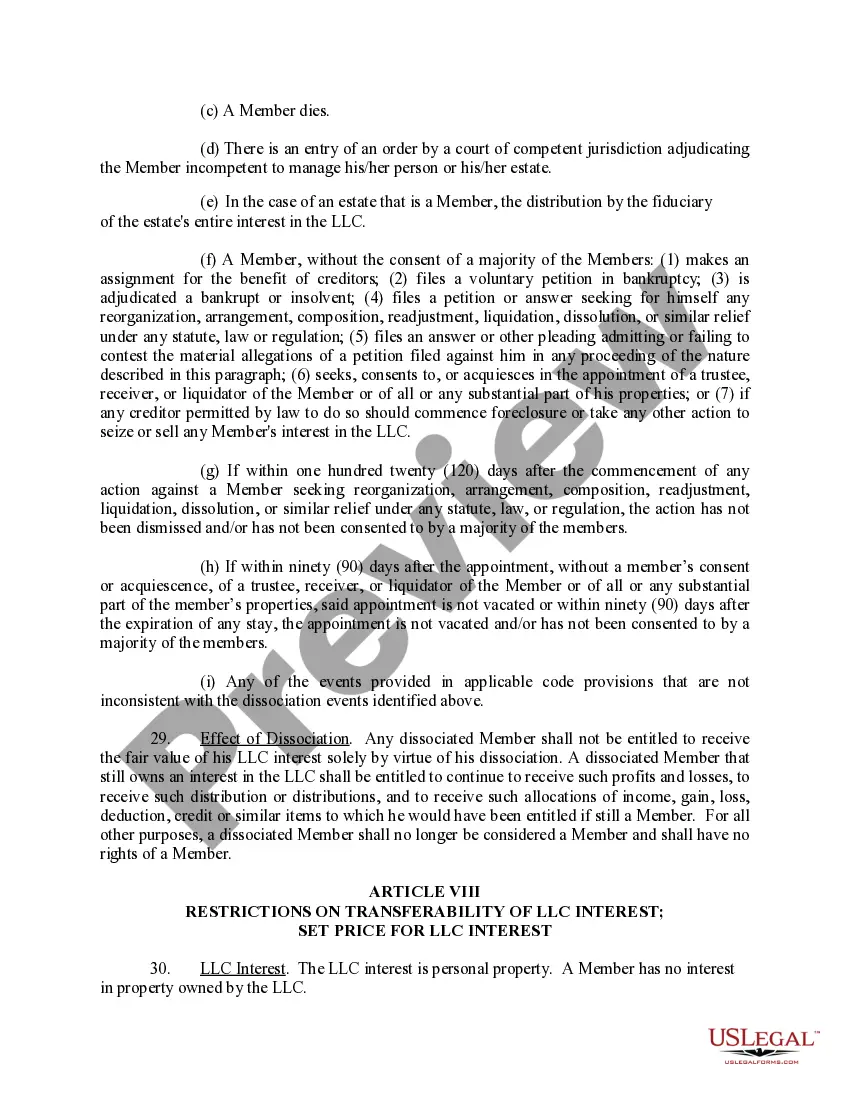

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.

Massachusetts does not require an operating agreement in order to form an LLC, but executing one is highly advisable. . . An operating agreement is the basic written agreement between the members (i.e., owners) of the LLC, or between the members and the managers of the company, if there are managers.

GENERAL. Massachusetts has approved single member LLCs to organize under state law. In the past, an LLC had to have two members. By allowing single member LLCs, a sole proprietorship can now convert to a single member LLC and get liability protection from creditors.