Massachusetts Certificate Of Organization With Multiple Owners

Description

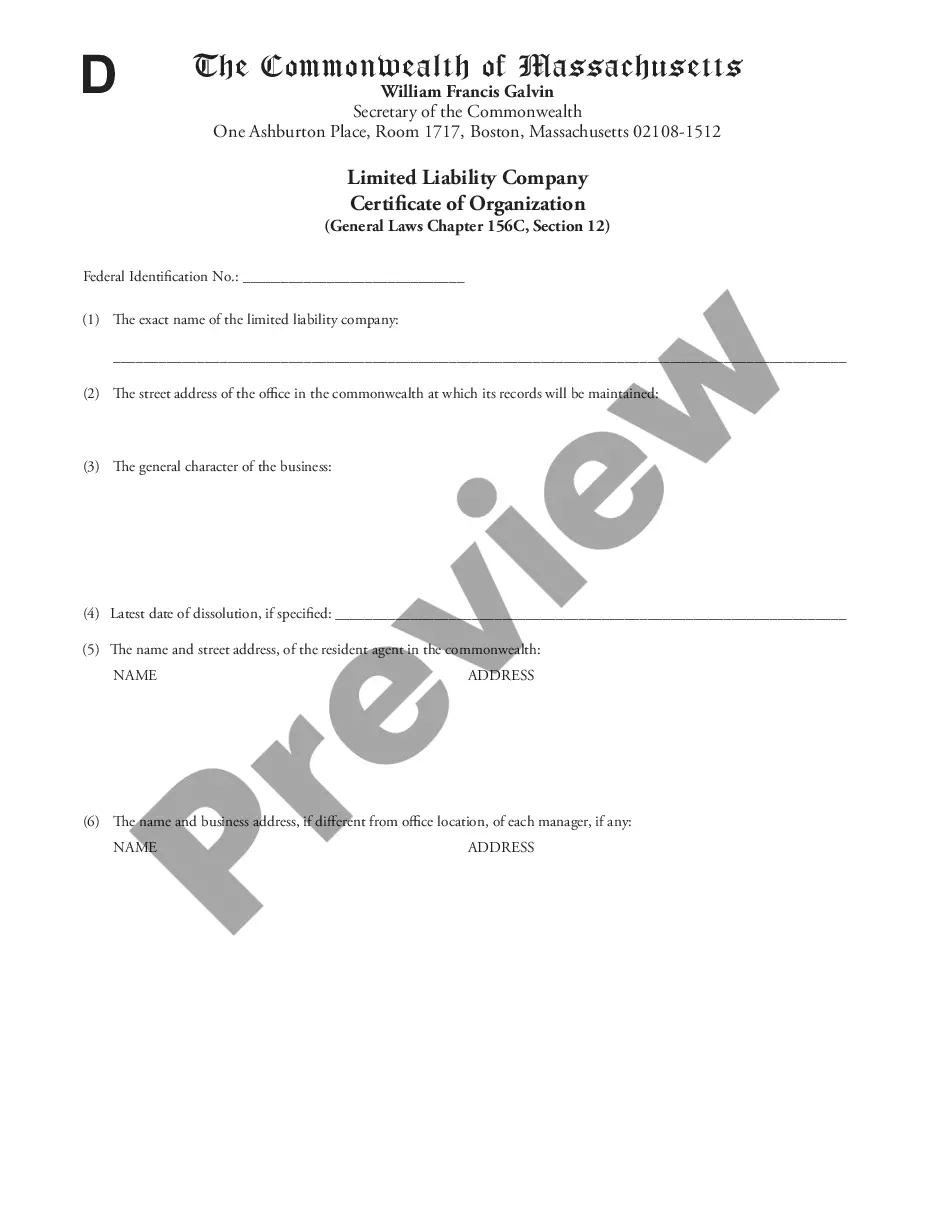

How to fill out Massachusetts Certificate Of Formation For Domestic Limited Liability Company LLC?

Finding a go-to place to take the most recent and appropriate legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal files calls for accuracy and attention to detail, which is the reason it is important to take samples of Massachusetts Certificate Of Organization With Multiple Owners only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and check all the details concerning the document’s use and relevance for the circumstances and in your state or region.

Consider the listed steps to complete your Massachusetts Certificate Of Organization With Multiple Owners:

- Make use of the library navigation or search field to locate your sample.

- Open the form’s description to check if it fits the requirements of your state and county.

- Open the form preview, if available, to make sure the form is the one you are looking for.

- Return to the search and locate the correct document if the Massachusetts Certificate Of Organization With Multiple Owners does not fit your requirements.

- If you are positive regarding the form’s relevance, download it.

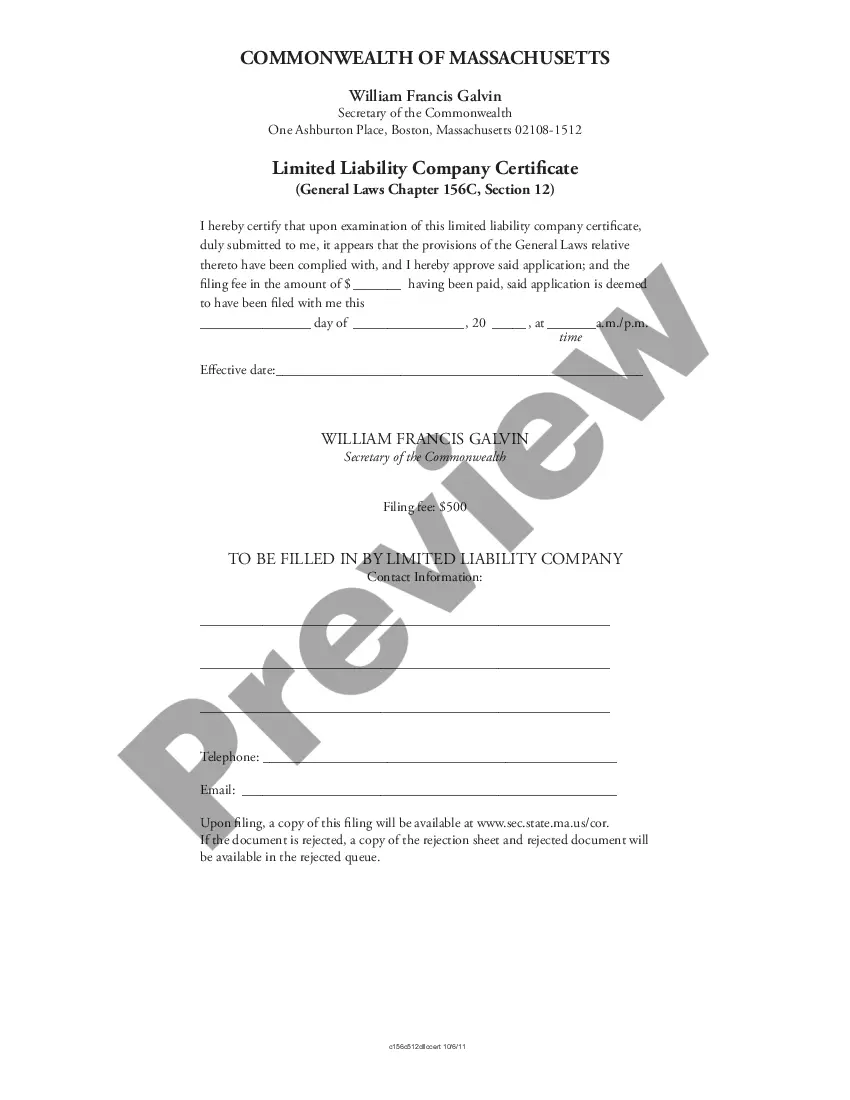

- When you are a registered user, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Select the pricing plan that fits your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by picking a transaction method (credit card or PayPal).

- Select the file format for downloading Massachusetts Certificate Of Organization With Multiple Owners.

- When you have the form on your gadget, you can alter it with the editor or print it and finish it manually.

Eliminate the inconvenience that comes with your legal paperwork. Explore the extensive US Legal Forms library to find legal templates, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

The process of adding a member to a Massachusetts LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

In Massachusetts, for tax purposes, LLCs are treated the same at the state level as they're treated at the federal level. So, if your LLC is taxed as a partnership (the default classification for multi-member LLCs) at the federal level, your LLC will be taxed as a partnership in Massachusetts. No franchise tax.

Most states require an LLC designation be included in the name of a company that's registered as an LLC. The designations vary from state to state, but generally include phrases or abbreviations such as "Limited Liability Company," "Limited Liability Co." "LLC," and "Limited."

Each year, all Massachusetts corporations, LLCs, nonprofits, LPs, and LLPs must file an annual report with the Secretary of the Commonwealth, Corporations Division. Here we provide a helpful guide to assist you in filing your Massachusetts Annual Report yourself.

Names must comply with Massachusetts naming requirements. The following are the most important requirements to keep in mind: Your business name must include the words limited liability commpany, LLC, or L.L.C.