Credit Shelter Trust Massachusetts For Single Person

Description

Form popularity

FAQ

While credit shelter trusts offer many benefits, they also have potential disadvantages, such as complexity and costs associated with setting them up. Additionally, if the trust is not structured correctly, you may not fully benefit from estate tax exemptions. It’s important to weigh these factors carefully with a knowledgeable professional to ensure the credit shelter trust Massachusetts for single person aligns with your financial objectives.

Credit shelter trusts remain relevant, especially for individuals looking to maximize their estate's tax efficiency. They provide significant benefits by allowing individuals to protect assets while potentially minimizing estate taxes owed upon death. Evaluating your specific financial situation with an expert can help determine if establishing a credit shelter trust Massachusetts for single person is the right decision for your estate plan.

The trust itself may generate income, and generally, the income taxes associated with that income will be the responsibility of the beneficiaries. However, the specifics can vary based on how the trust is structured. It’s crucial to understand how a credit shelter trust Massachusetts for single person interacts with tax obligations, and seeking expert advice can provide clarity on who is responsible for the tax liabilities.

The maximum amount for a credit shelter trust is typically aligned with the federal estate tax exemption limits, which changes periodically. Currently, this threshold can be significant, and a properly funded credit shelter trust Massachusetts for single person can help maximize tax benefits. It is essential to stay updated with current laws and work with a professional to ensure compliance and efficiency.

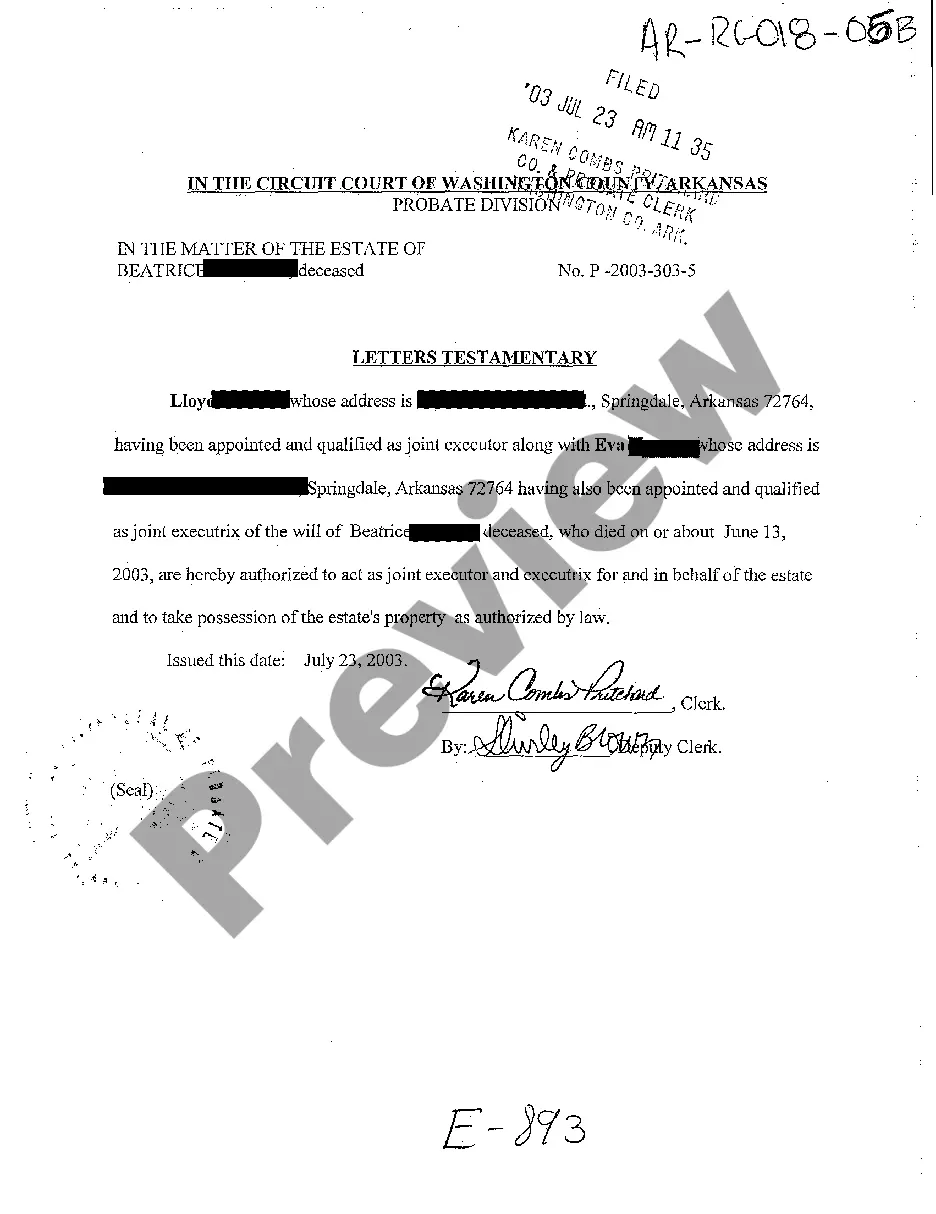

To set up a credit shelter trust, begin by consulting with a qualified estate planning attorney who comprehends Massachusetts laws. They will help you draft the necessary legal documents and determine which assets to place into the trust. After that, you will fund the trust with your chosen assets to activate its protective features. Following these steps will ensure your credit shelter trust Massachusetts for single person meets your intentions.

Creating a credit shelter trust involves several key steps and requires careful planning. You need to draft a trust document that outlines the terms, appoint a trustee, and decide which assets to transfer into the trust. By engaging with a professional experienced in estate planning, you can effectively establish a credit shelter trust Massachusetts for single person that meets your financial goals and needs.

A trust can help in reducing estate taxes in Massachusetts, but it does not completely eliminate them. By utilizing a properly established credit shelter trust Massachusetts for single person, individuals can protect assets from being counted in their taxable estate, thus lowering potential estate tax. It’s crucial to consult with a legal expert to ensure the trust is set up correctly to optimize tax benefits.

When a bypass trust is not funded, it essentially becomes ineffective in achieving its intended purpose. Without assets, the trust cannot provide the tax benefits or protections for the beneficiaries. As a result, the possibility of avoiding estate taxes in Massachusetts diminishes greatly. Therefore, it is essential to ensure that a credit shelter trust Massachusetts for single person is properly funded to maximize its advantages.

A simple trust is defined as one that must distribute all its income to beneficiaries annually and does not provide for any charitable deductions. In contrast to more complex trusts, such as credit shelter trusts, simple trusts focus solely on income distribution. For single individuals in Massachusetts looking to create an estate plan, recognizing this distinction can help in selecting the most suitable trust. You may consider using resources like US Legal Forms for guidance on setting up the ideal trust for your situation.

No, a credit shelter trust is not typically classified as a simple trust. Unlike simple trusts that must distribute all income earned during the year, credit shelter trusts retain income and can reinvest it. This feature allows more flexibility and tax advantages, especially for single persons establishing a credit shelter trust Massachusetts. Understanding the distinction is crucial for effective estate planning.