Massachusetts Covid Mortgage Forbearance

State:

Massachusetts

Control #:

MA-ED1014

Format:

Word;

Rich Text

Instant download

Description Release Mortgagors Form

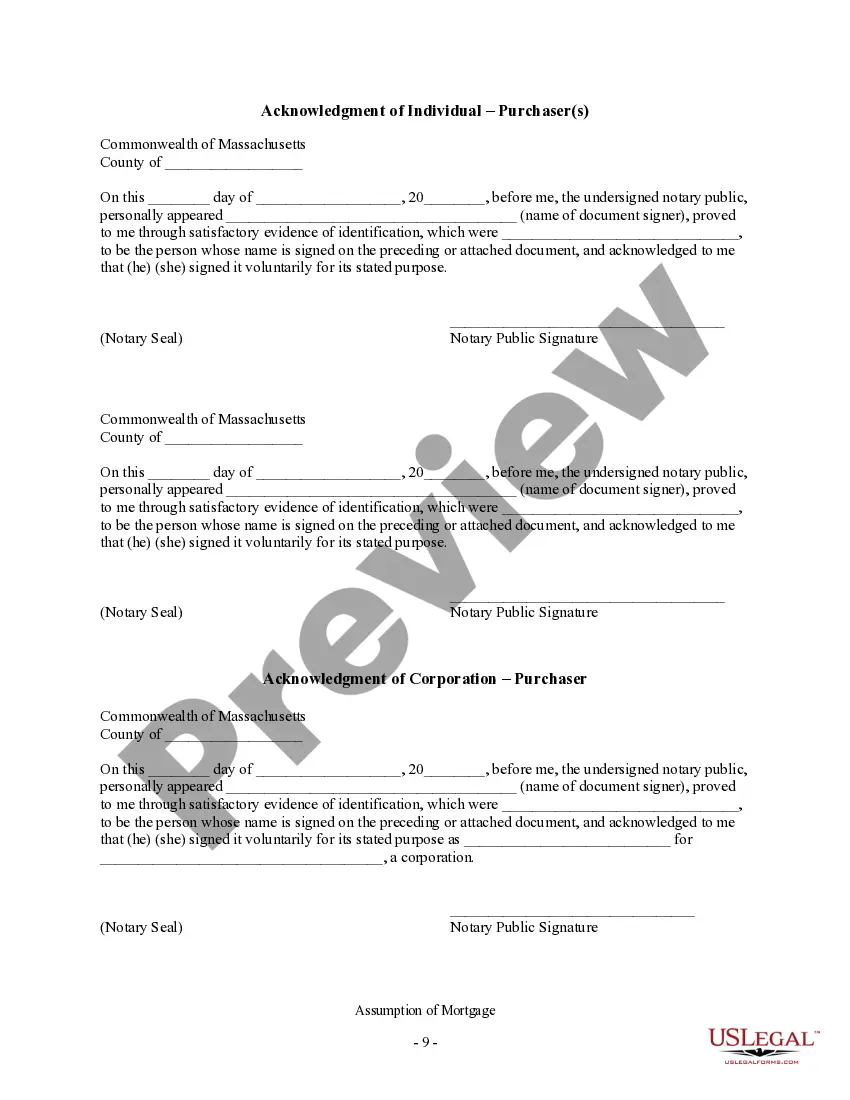

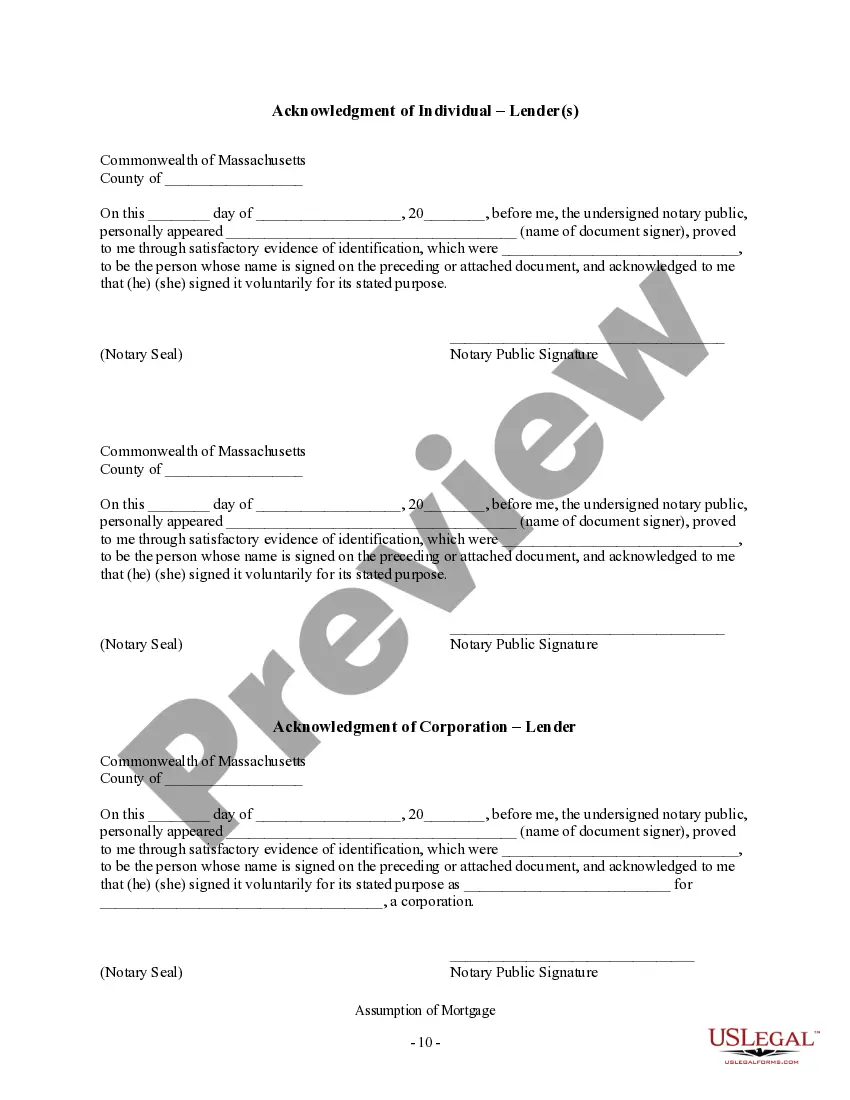

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Free preview Mortgage Release Mortgagors