Estate Planning For Parents

Description

Form popularity

FAQ

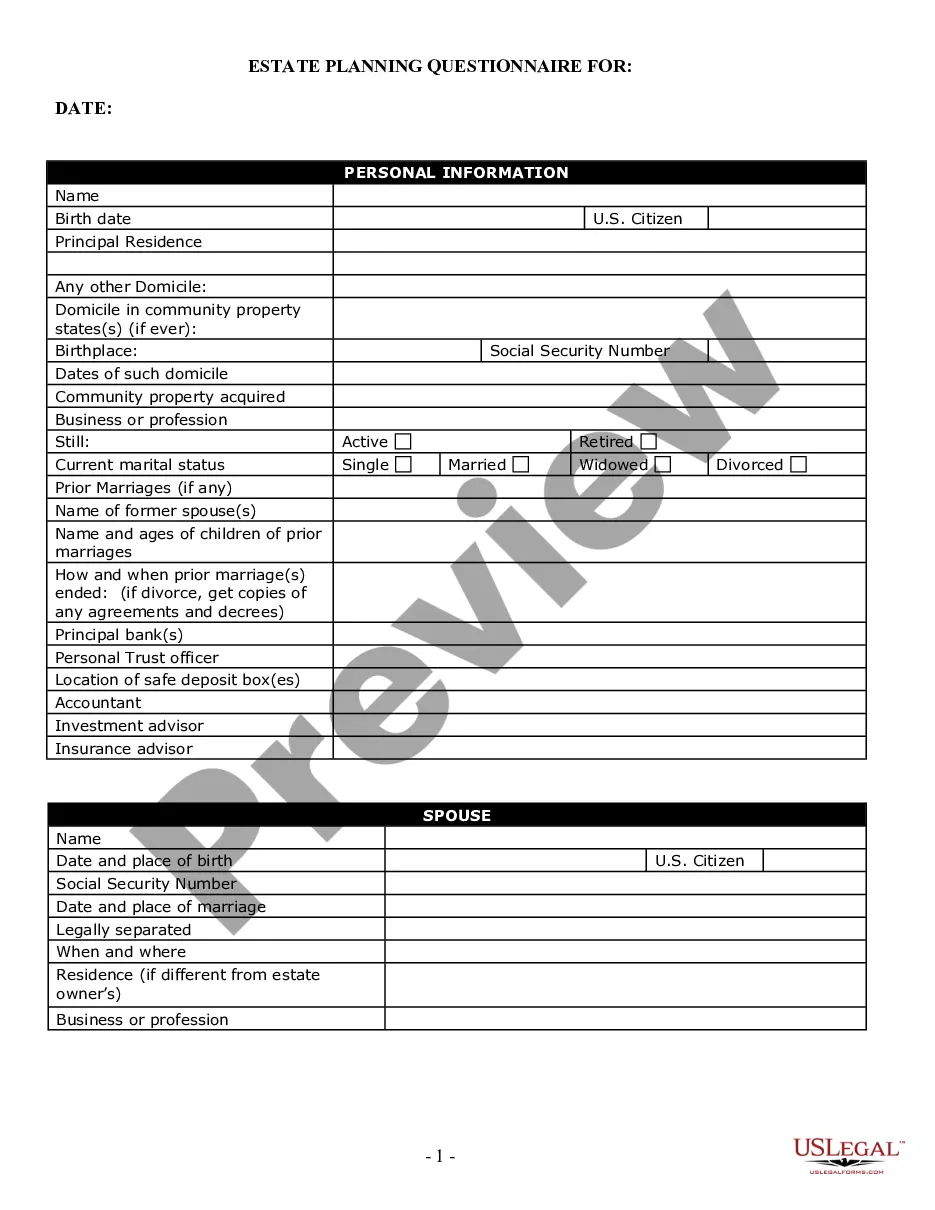

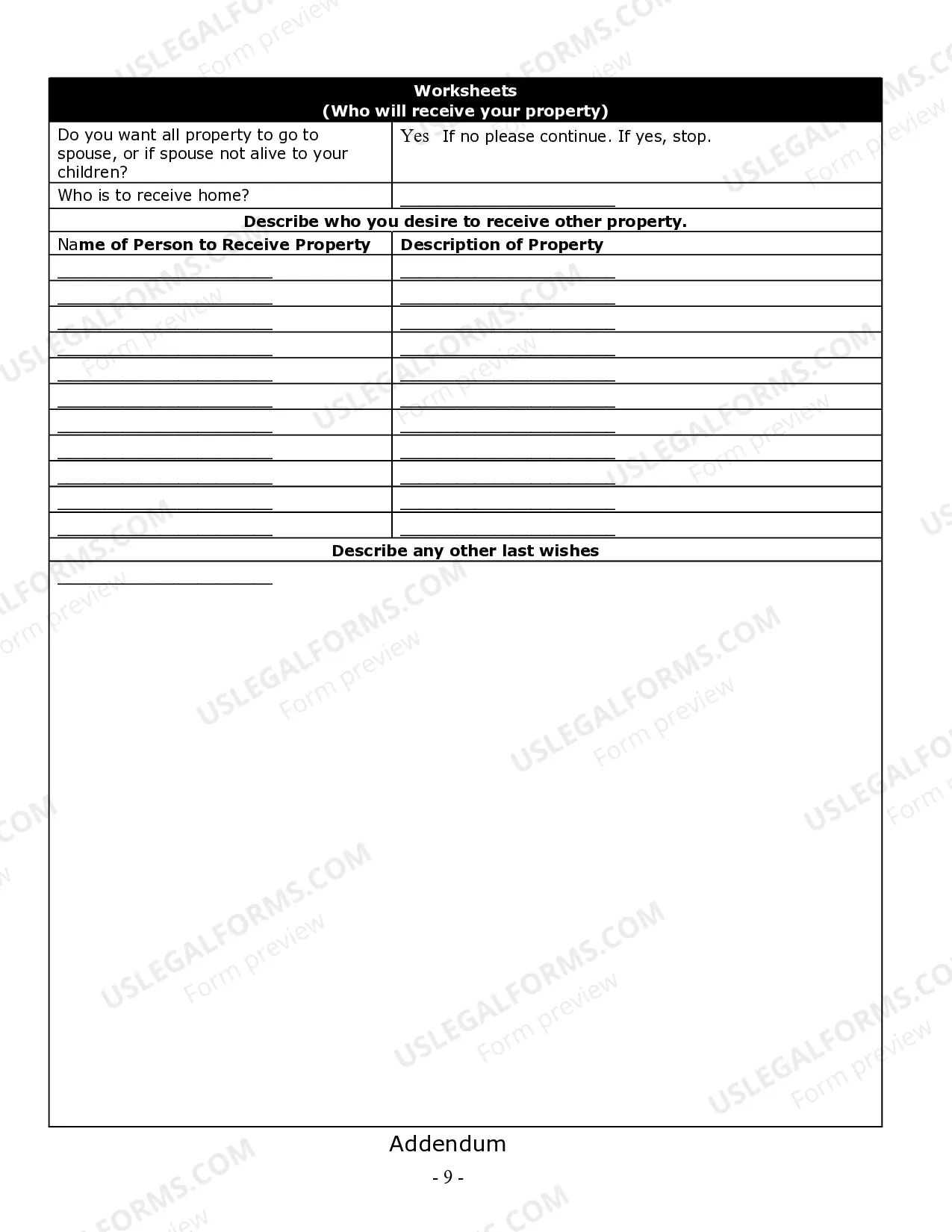

Two key documents commonly used in estate planning for parents are the will and the power of attorney. A will outlines how your assets should be distributed after your passing, while a power of attorney designates someone to make decisions on your behalf if you become unable to do so. These documents play a vital role in protecting your family's interests and ensuring your wishes are honored. Utilizing resources from US Legal Forms can assist you in creating these essential documents effectively.

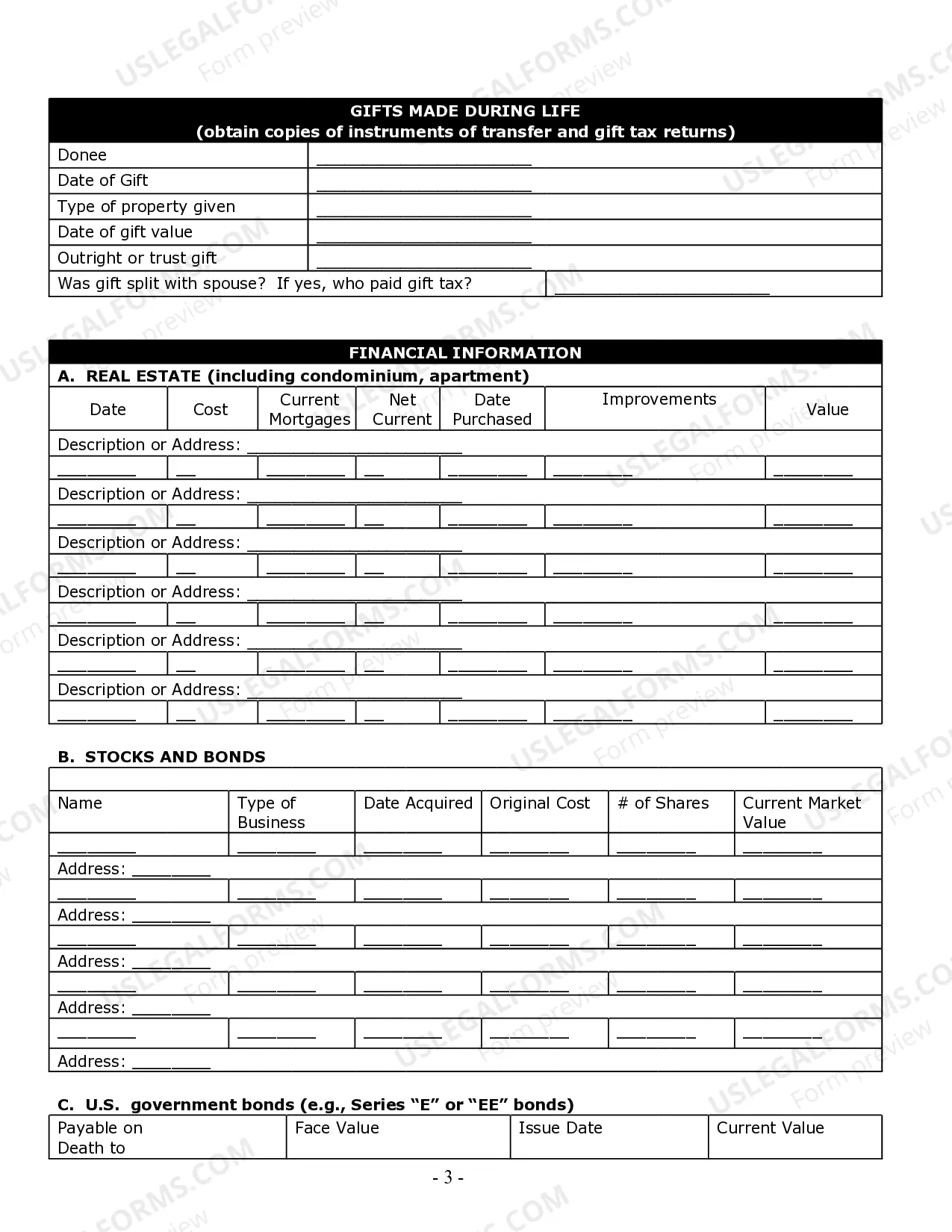

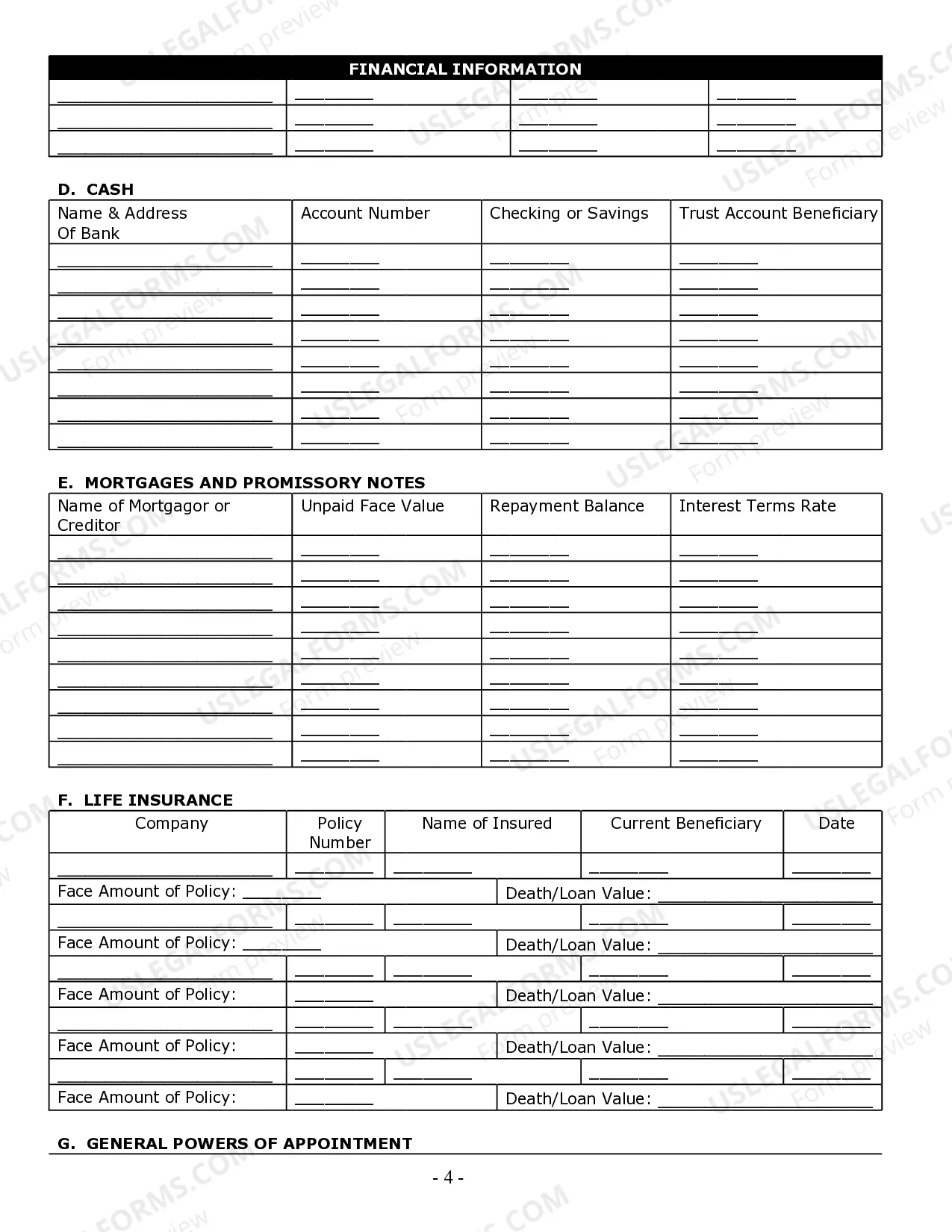

The 3 year rule in estate planning refers to the timeframe regarding gifts and asset transfers made before death. Specifically, if a person gifts an asset without retaining control over it within three years of passing, that asset is typically not counted for estate taxes. This rule can significantly impact your estate planning for parents, influencing how you transfer wealth to your children or other beneficiaries. Understanding these nuances can be critical, and platforms like US Legal Forms can provide resources to clarify these rules.

Many parents hesitate to engage in estate planning due to misconceptions about complexity or a belief that it's unnecessary. Some may find it uncomfortable to think about death or assume they do not have sufficient assets to merit planning. However, estate planning for parents is essential, regardless of wealth, as it ensures a secure future for your children. By addressing these concerns head-on and utilizing tools like US Legal Forms, you can make estate planning straightforward and accessible.

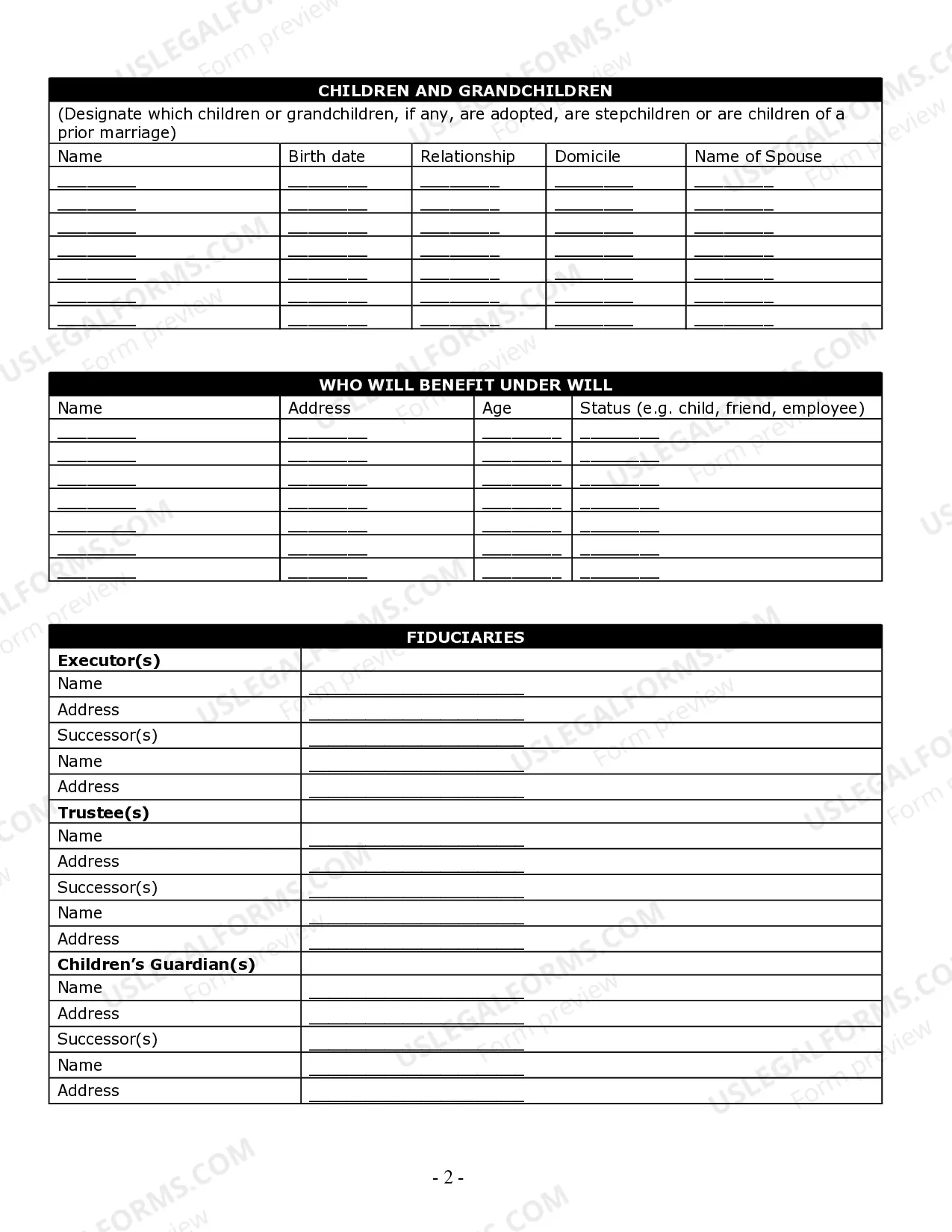

Estate planning for parents is vital because it provides clarity and security for your family. Parents benefit significantly as they can outline guardianship for their children, manage assets, and reduce potential disputes among heirs. This proactive approach ensures that your wishes are respected and your family is taken care of in difficult times. Furthermore, utilizing a platform like US Legal Forms can simplify the process and help create a comprehensive estate plan.

To leave your estate to your children effectively, focus on tailored estate planning for parents. Clearly articulating your intentions in a will is essential, but also consider utilizing trusts or beneficiary designations to simplify the process. By planning ahead, you ensure a smoother transition and minimize potential tax burdens for your heirs. USLegalForms offers templates and guidance to help you create a comprehensive estate plan.

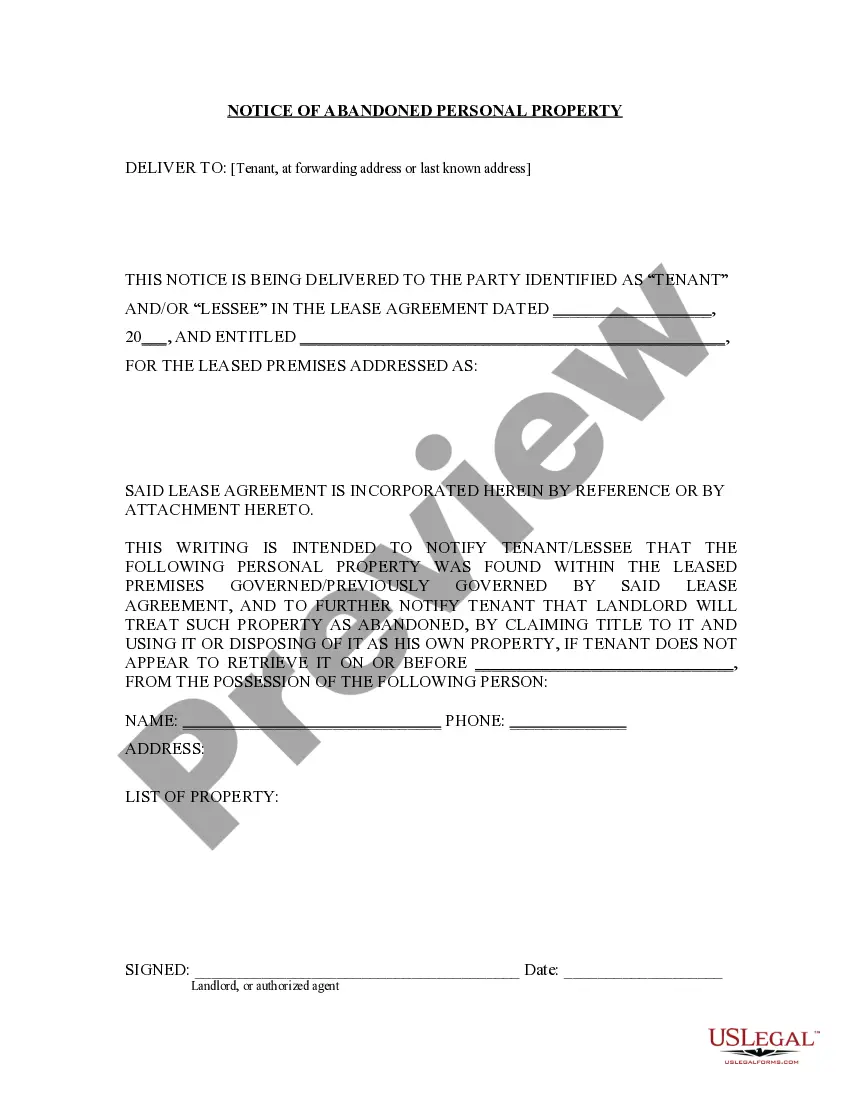

Leaving property to children after death hinges on sound estate planning for parents. A well-drafted will specifies your wishes regarding property distribution and can help avoid family disputes. Additionally, setting up a revocable living trust allows your children to inherit property while potentially avoiding probate. You can utilize resources from USLegalForms to create a clear and effective plan.

Transferring property from parent to child can be effectively managed through estate planning for parents. One common method is a quitclaim deed, which allows you to transfer ownership without the complexities of a full sale. Alternatively, establishing a trust can ensure that property is managed and distributed according to your wishes. USLegalForms provides tools to help you navigate this process smoothly.

The best way to leave an inheritance to your children is through careful estate planning for parents. Establishing a will allows you to clearly outline your wishes and designate assets to your children directly. Additionally, consider exploring trusts, which can provide more control over how and when your children receive their inheritance. At USLegalForms, you can find resources and templates to create an effective estate plan that suits your family's needs.

The best age to start estate planning varies, but as soon as you have dependents or significant assets, it’s wise to begin. Early planning allows parents to make informed decisions about guardianship and financial management for their children. Additionally, using platforms like USLegalForms can simplify the process and provide essential resources to help you get started.

While estate planning is beneficial, some disadvantages include the costs associated with hiring attorneys and the time required to develop a comprehensive plan. Additionally, if not updated regularly, an estate plan can become outdated, failing to reflect your current wishes. Awareness of these aspects is important for effective estate planning for parents.