Estate Planning With Real Estate

Description

Form popularity

FAQ

When someone dies without an estate plan, it is termed as dying 'intestate'. In these cases, state laws determine how assets are distributed, often leading to unforeseen outcomes. This scenario highlights the importance of estate planning with real estate to ensure your wishes are honored. Using UsLegalForms can help you establish a clear estate plan to avoid the complications associated with intestacy.

The best way to leave a house to your child involves drafting a will or setting up a trust. A will specifies your child's inheritance formally, while a trust can offer benefits like asset protection and tax savings. Estate planning with real estate allows you to choose the most beneficial route, ensuring your child's future is secure. Platforms like UsLegalForms provide templates to simplify this process.

Without an estate plan, your assets may be distributed according to state laws, which may not align with your wishes. This often leads to complications, delays, and potential disputes among your heirs. Estate planning with real estate ensures that your property goes to the intended recipients while minimizing legal challenges. By using UsLegalForms, you can create an effective estate plan tailored to your needs.

You can bypass an estate through various methods, such as using joint ownership, creating trusts, or designating beneficiaries for your assets. This approach allows your property to pass directly to your heirs without going through the probate process. Estate planning with real estate can help you structure your assets effectively, ensuring a smoother transition upon your passing. Utilizing platforms like UsLegalForms can provide guidance on these legal tools.

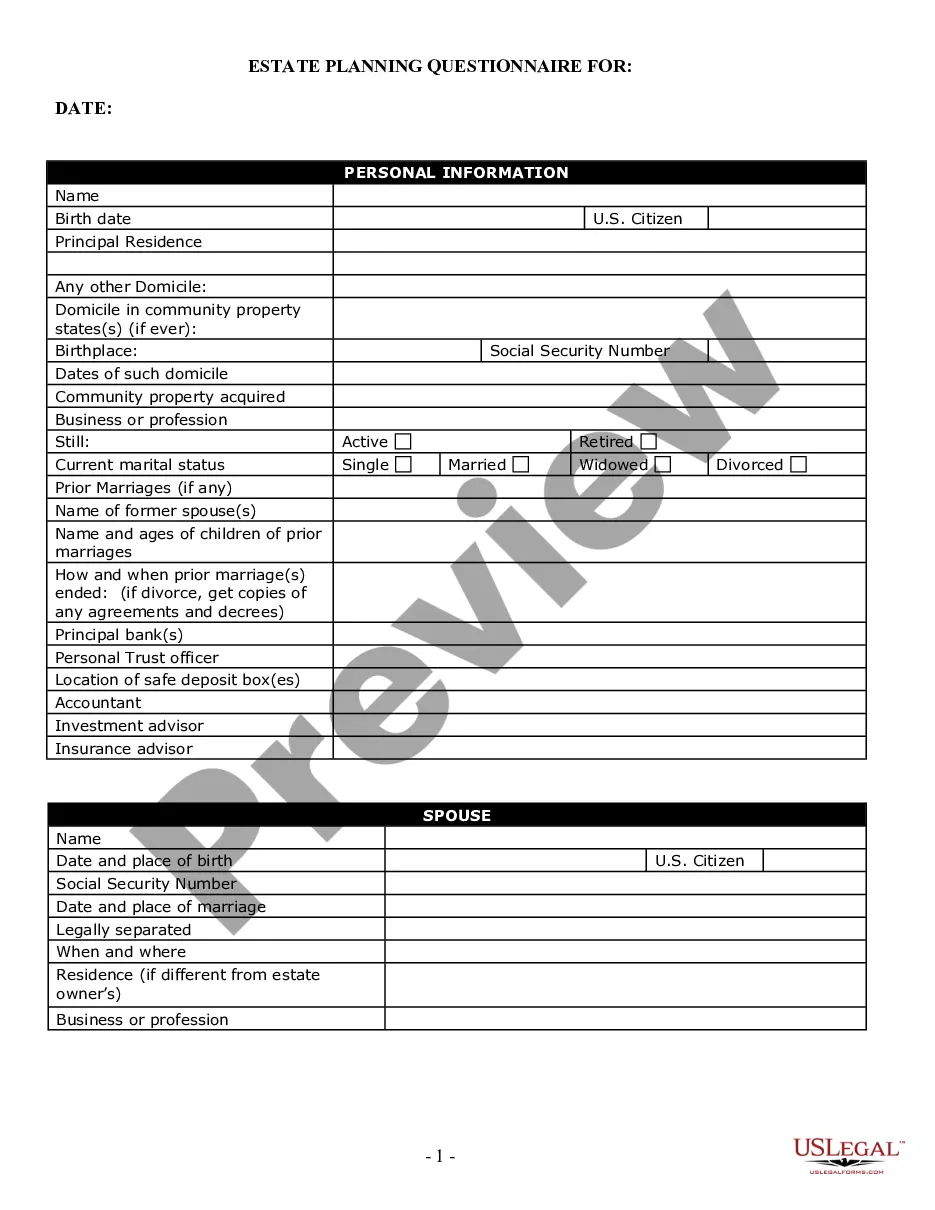

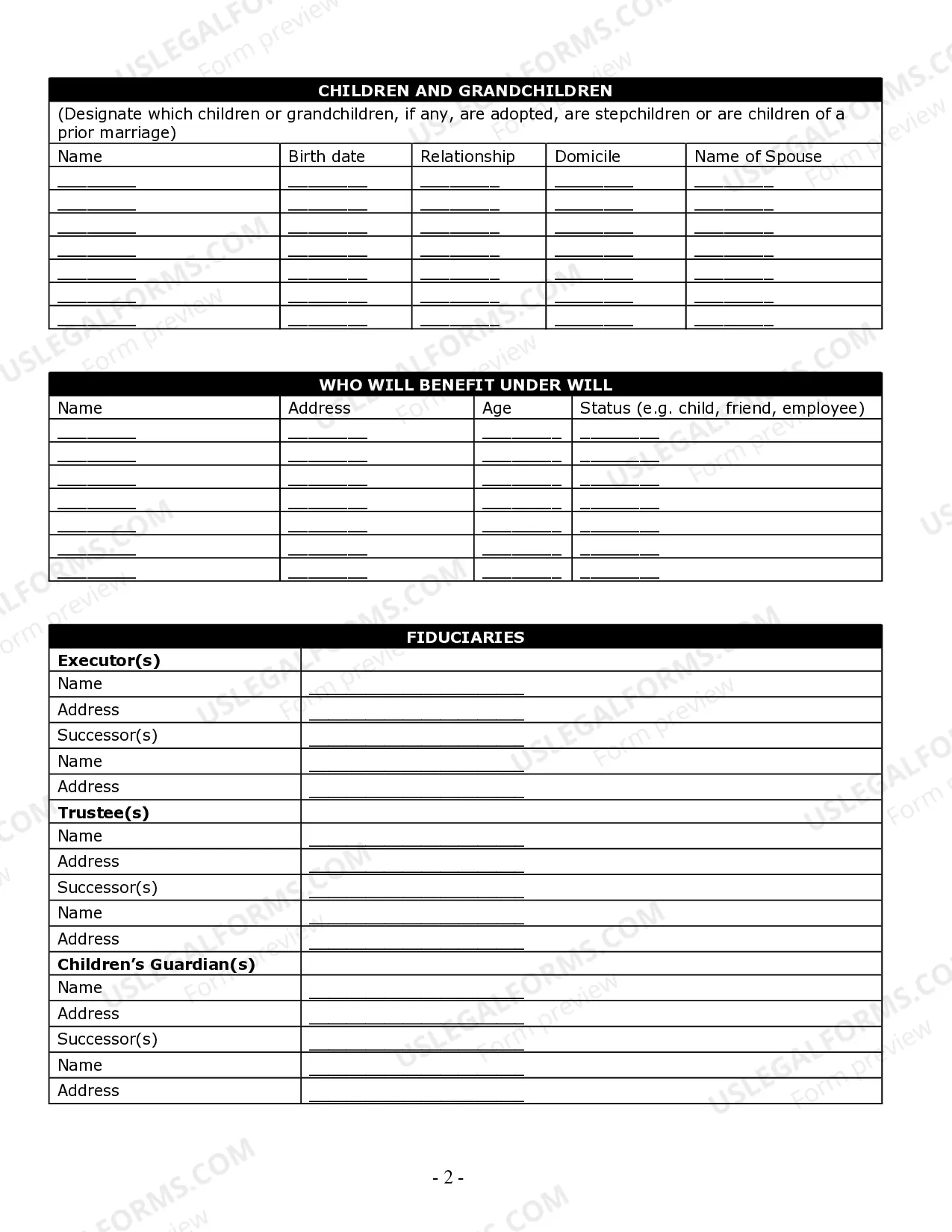

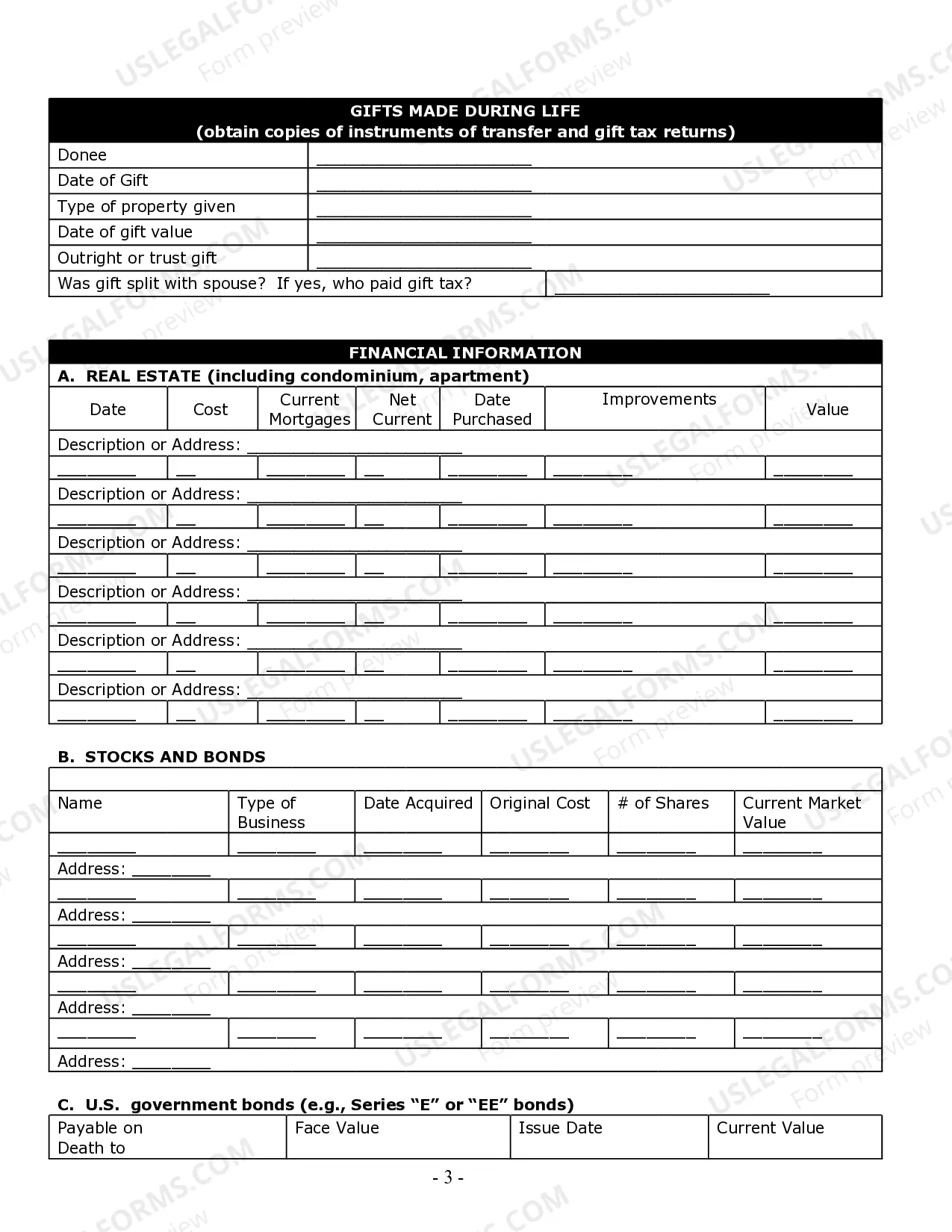

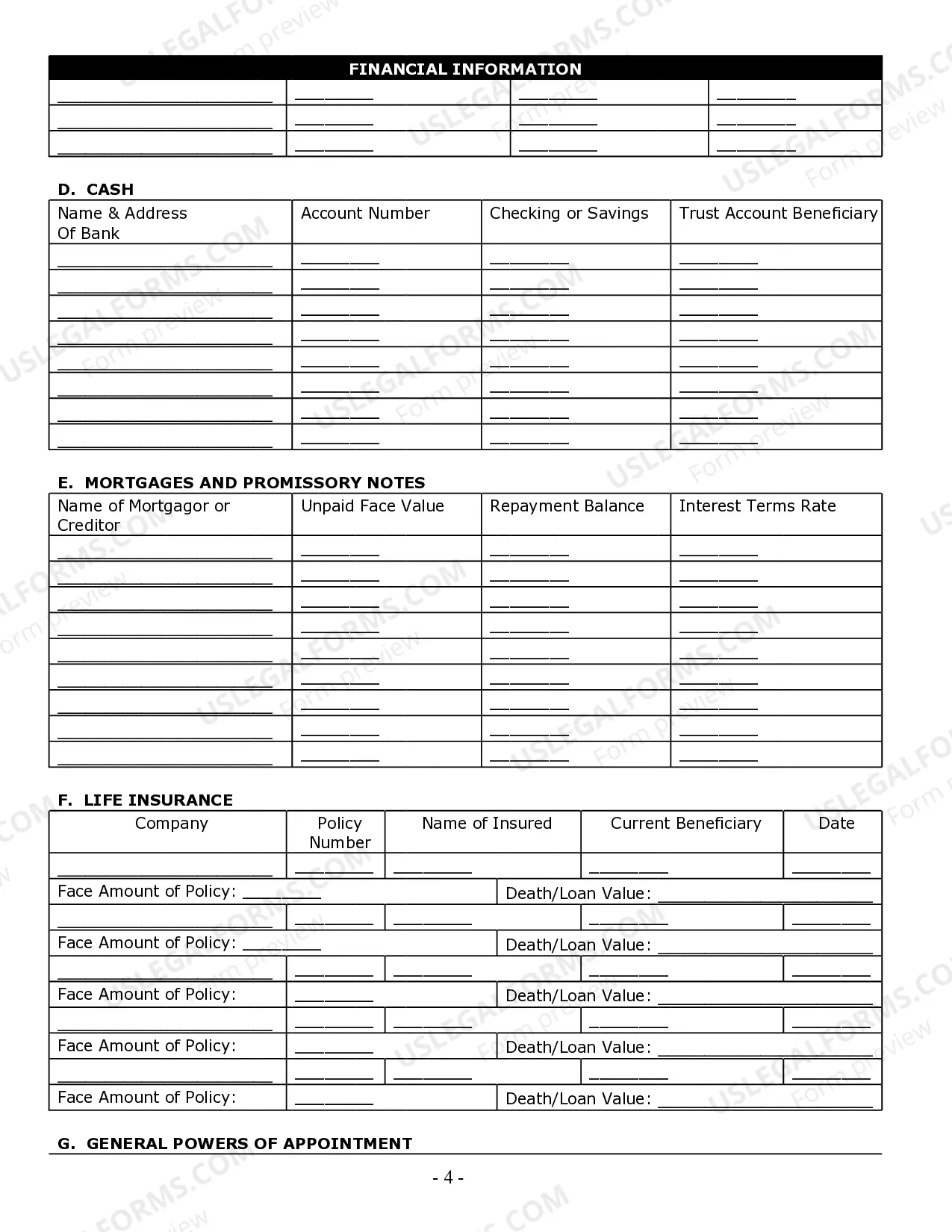

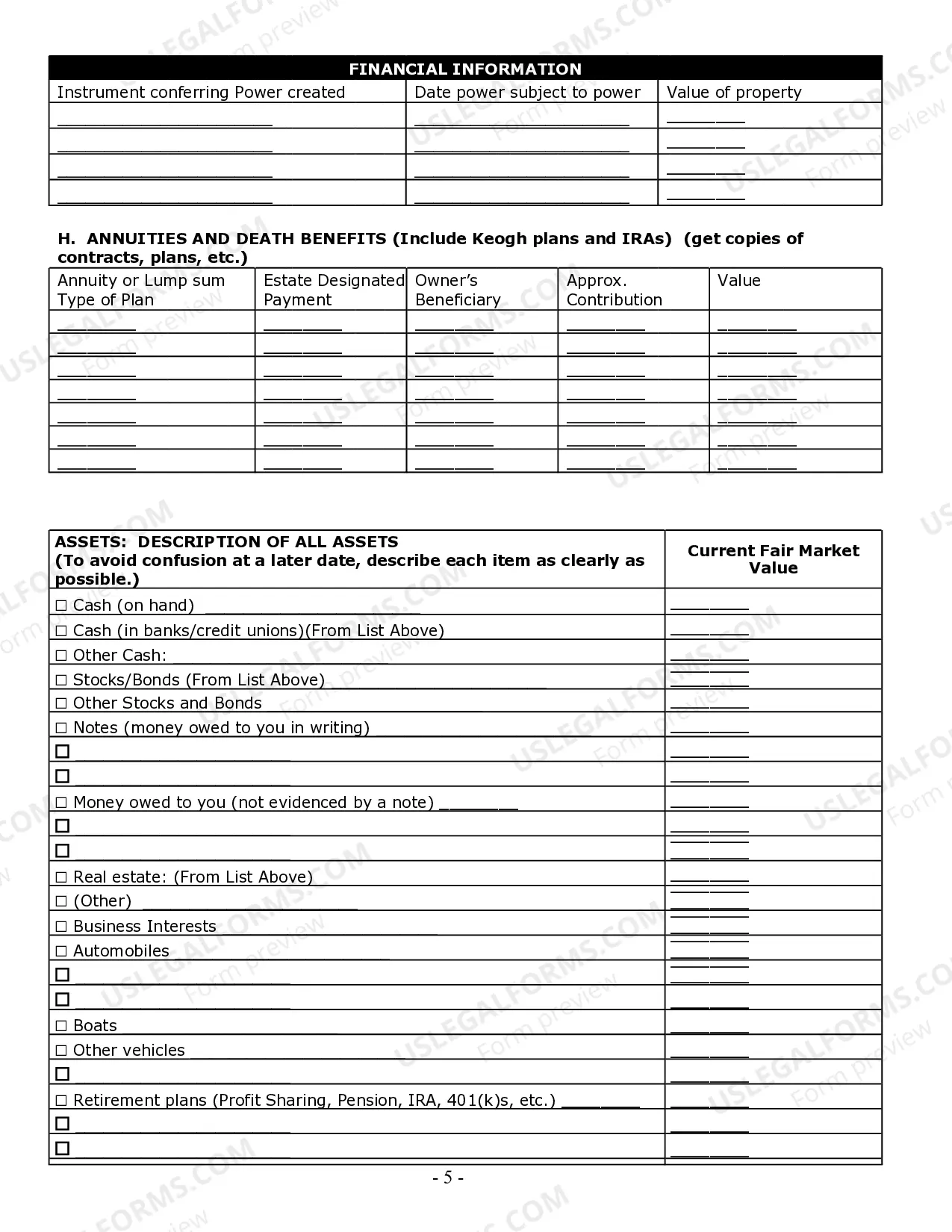

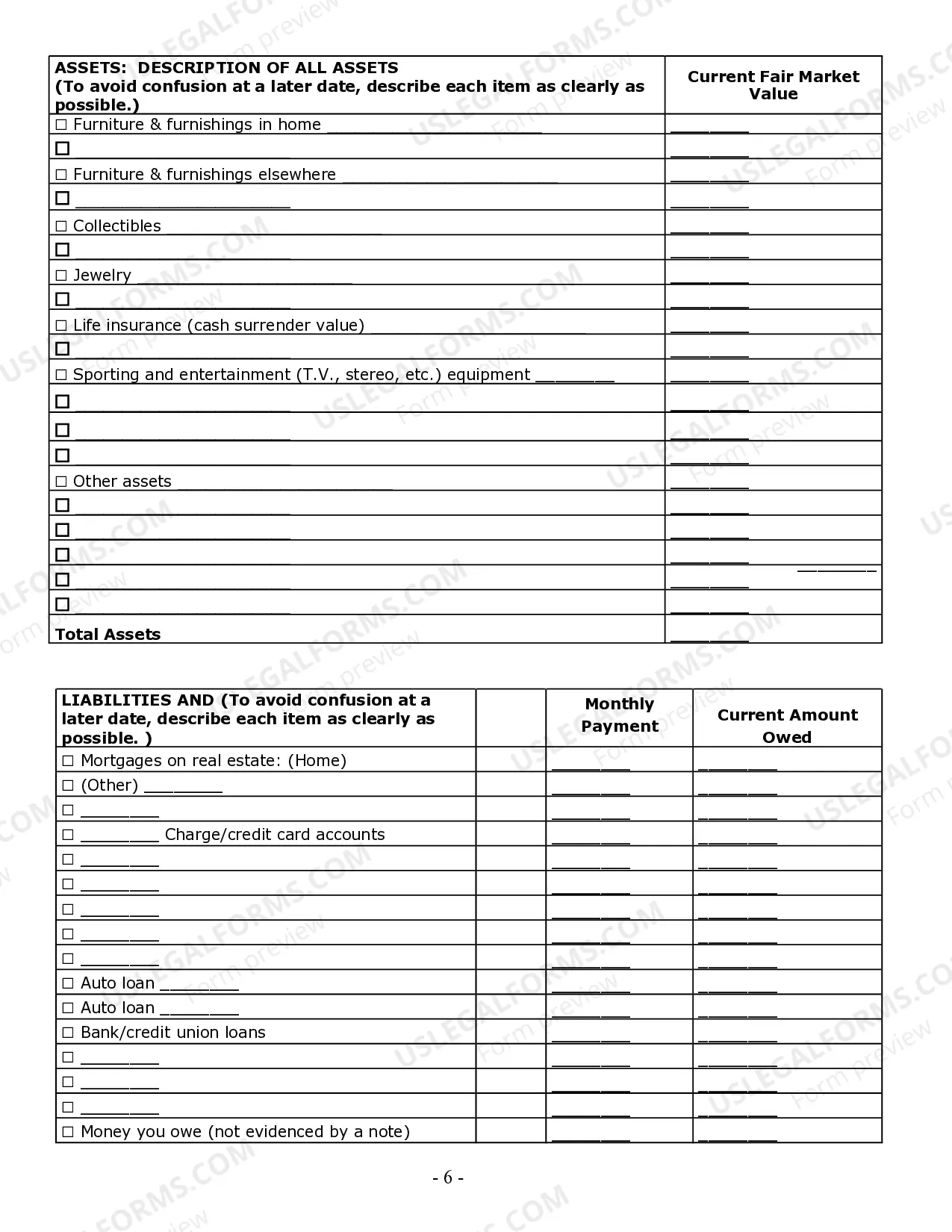

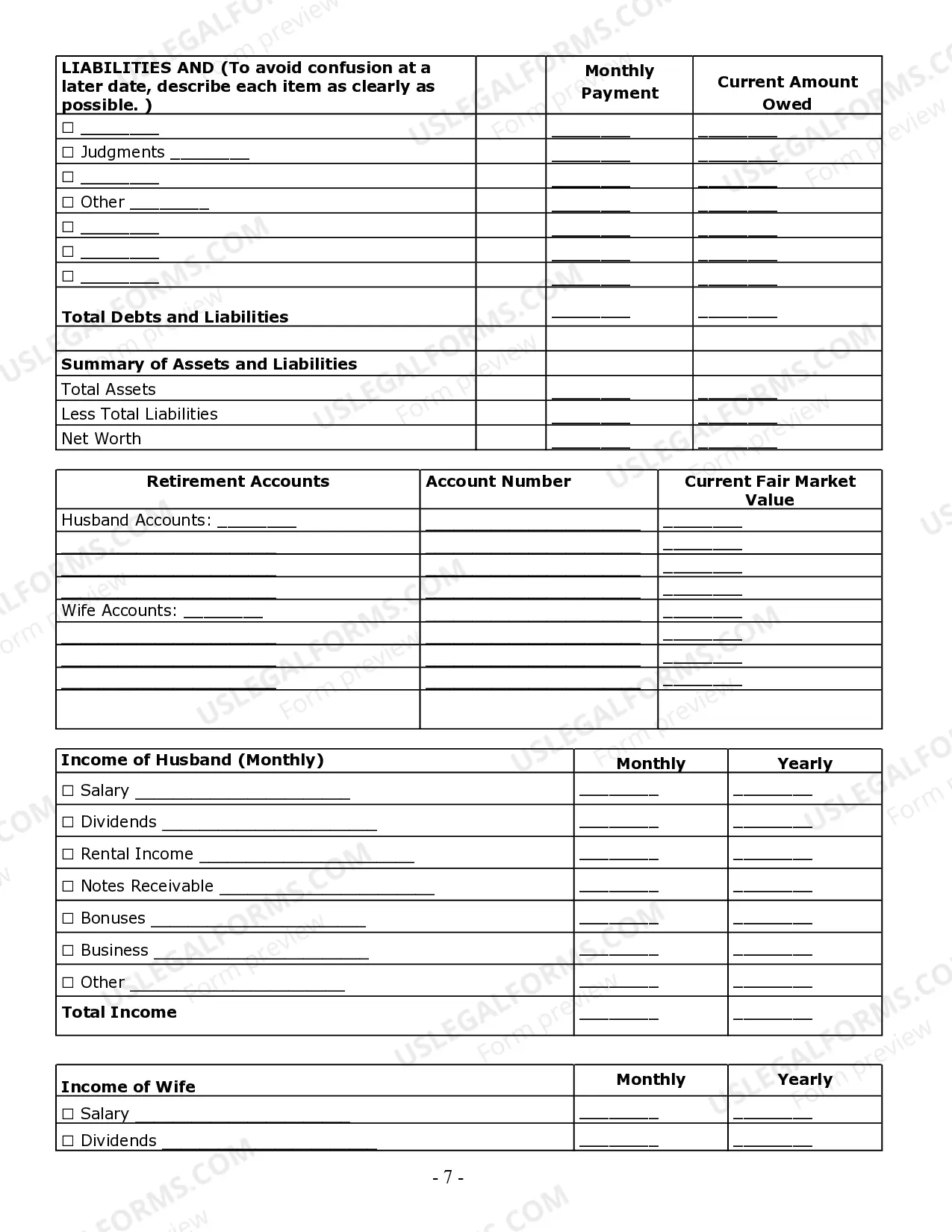

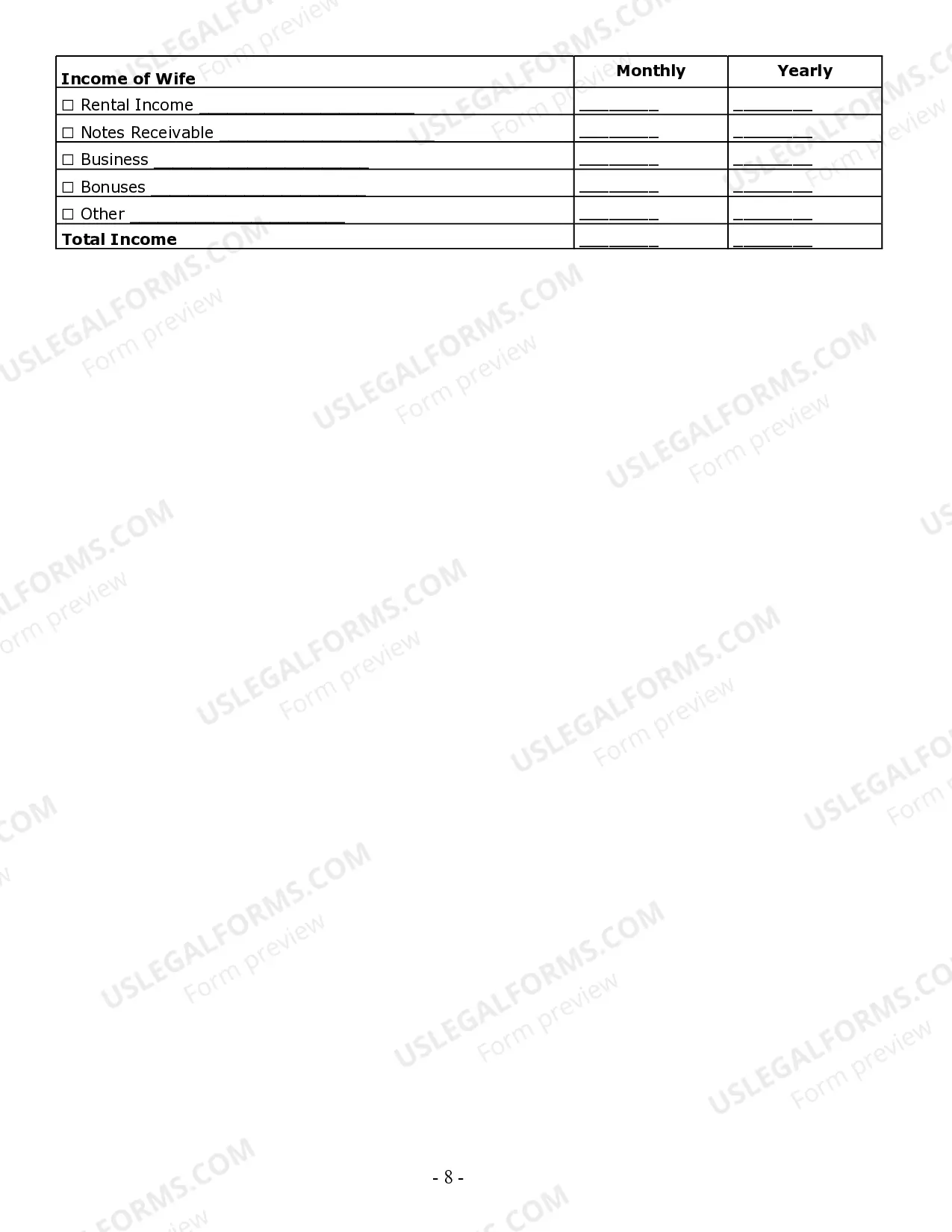

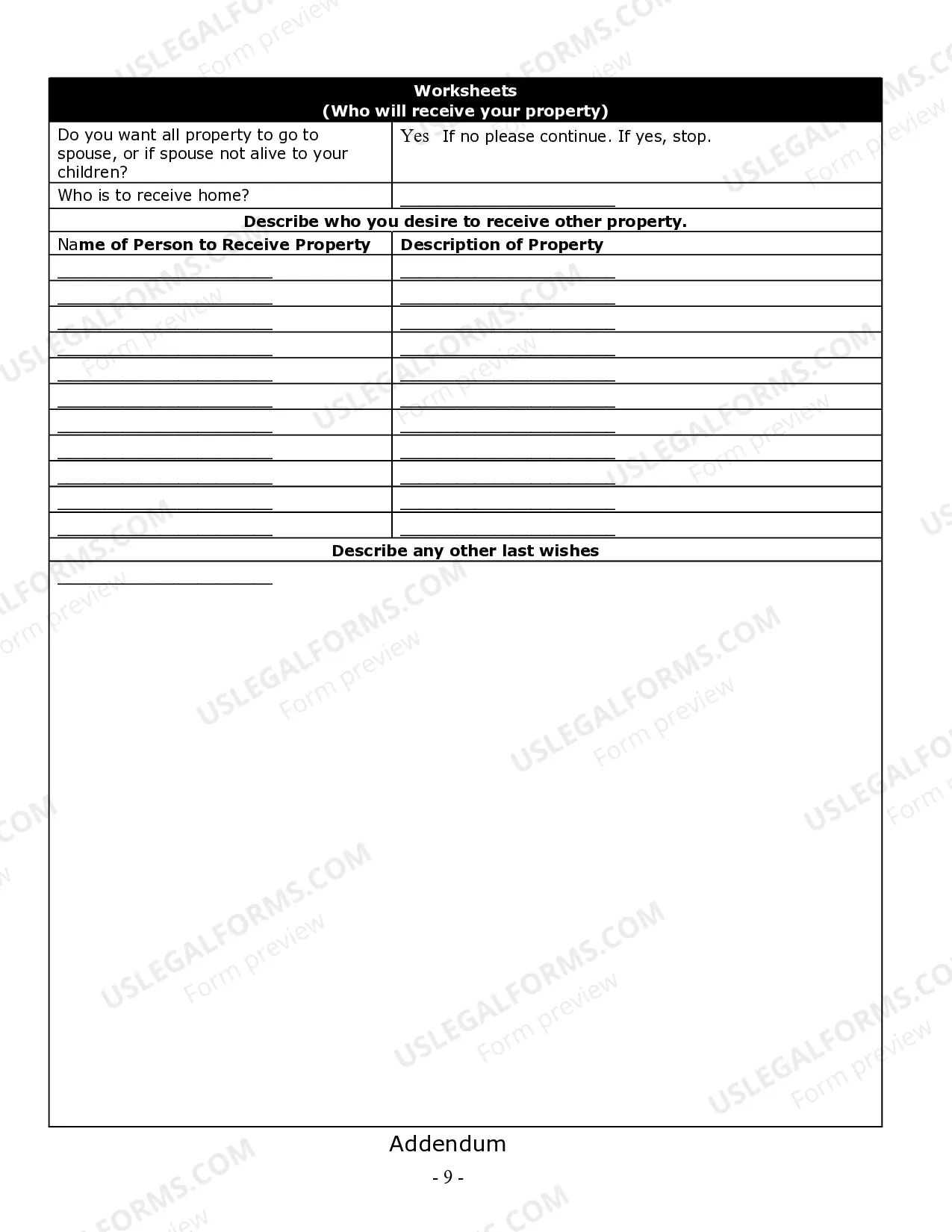

Key steps in the estate planning process include gathering all asset information, including real estate, identifying your beneficiaries, and determining your goals for distribution. It is crucial to create the required legal documents, such as wills and trusts, that align with your objectives. Regularly reviewing your plan is equally important, as it accounts for changes in laws, assets, or family dynamics. Utilizing resources like US Legal Forms can streamline this process and improve accuracy.

Structuring an estate involves organizing your assets, particularly real estate, in a way that reflects your wishes. Begin by cataloging all real estate holdings, including any mortgages or liens. Next, consider whether to use a will, trust, or both to structure the distribution of your assets. Consulting with platforms like US Legal Forms can provide you with the necessary templates and guidance to create a well-structured estate plan.

The steps in the estate planning process typically start with evaluating your current assets, including real estate. Next, individuals should determine how they wish to divide these assets among their heirs. Drafting a will or trust is essential, as is reviewing and possibly updating beneficiary designations. Lastly, regularly revisiting and revising your plan ensures it aligns with any changes in your life circumstances or intentions.

The primary objective of estate planning with real estate is to ensure your property is distributed according to your wishes after you pass away. This planning also helps in minimizing taxes and legal fees, making the process easier for your heirs. By addressing potential conflicts and uncertainties, you create a smoother transition for your family. Ultimately, effective estate planning provides peace of mind for you and your loved ones.

The basic steps of estate planning with real estate include assessing your assets, identifying beneficiaries, and creating necessary legal documents. It's important to have a clear inventory of your real estate and other assets. Additionally, consulting with a legal expert can ensure that your plans comply with the law and reflect your intentions. This approach reduces complexity for your loved ones in the future.

Your estate planning team with real estate should typically include an estate planning attorney, a financial advisor, and an accountant. These professionals collaborate to create a comprehensive plan that addresses your unique circumstances. Including experts ensures your estate plan is legally sound and considers all financial implications.