Maryland Boat Bill Of Sale With Down Payment

Description

How to fill out Maryland Bill Of Sale For WaterCraft Or Boat?

Bureaucracy requires exactness and correctness.

If you do not deal with completing paperwork like the Maryland Boat Bill Of Sale With Down Payment regularly, it may lead to some misunderstanding.

Selecting the appropriate template from the beginning will guarantee that your document submission proceeds smoothly and avoids any hassles of resending a file or starting the same task from scratch.

If you are not a subscribed user, finding the needed template will require a few additional steps.

- You can always find the suitable template for your documentation in US Legal Forms.

- US Legal Forms is the biggest online forms repository that provides over 85 thousand templates for various fields.

- You can retrieve the latest and most relevant version of the Maryland Boat Bill Of Sale With Down Payment by simply searching for it on the platform.

- Find, store, and save templates in your profile or consult the description to ensure you have the correct one available.

- With an account at US Legal Forms, it is simple to obtain, keep in one location, and navigate through the templates you save for quick access.

- When on the website, click the Log In button to sign in.

- Afterward, go to the My documents page, where your document history is kept.

- Examine the description of the forms and save the ones you need whenever you want.

Form popularity

FAQ

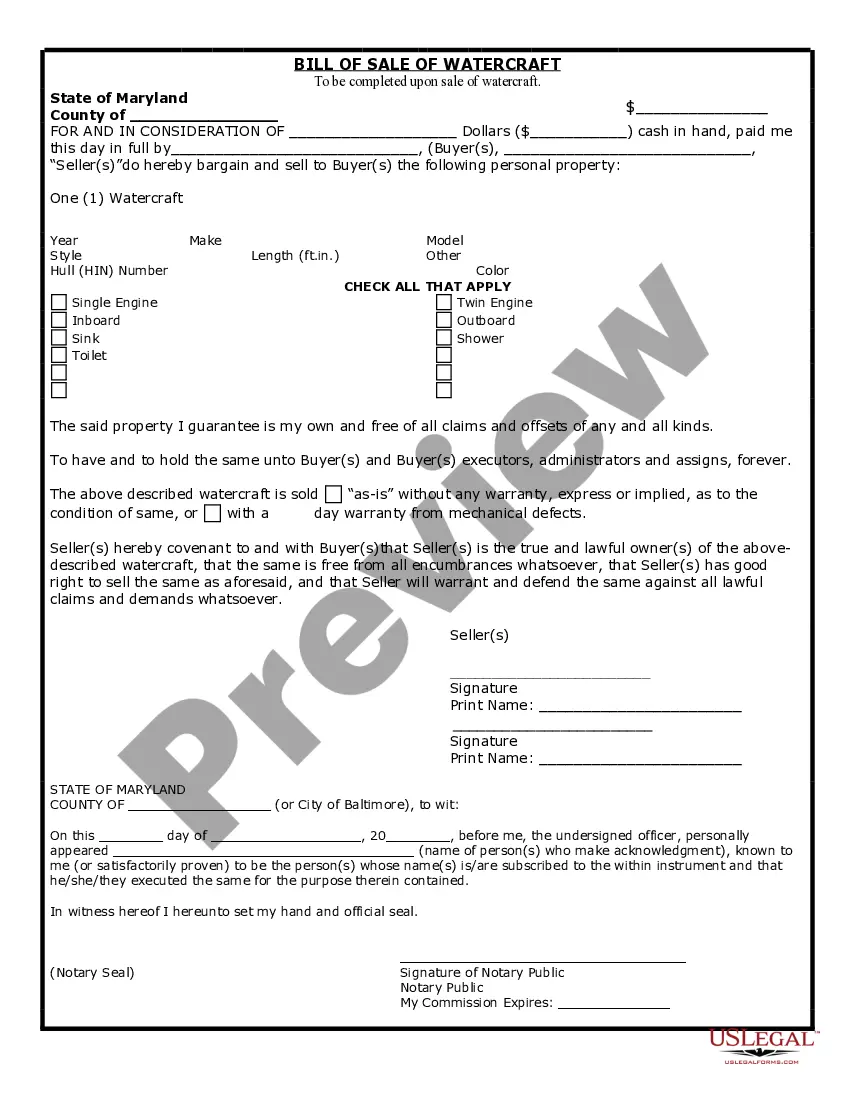

Does a Boat Bill of Sale Have to Be Notarized in Maryland? Yes, a Boat Bill of Sale needs to be notarized in order for the sale to be considered valid.

Maryland law requires all owners of vessels used principally in Maryland to pay an excise tax of 5% of its purchase price or fair market value. This tax must be paid within 30 days of purchase or entry into the state or penalties or interest may be assessed.

Bill Of Sale or Receipt for funds paid The bill of sale or receipt must include a description and hull identification number, purchase date, price, and the name and signature of the seller.

What Should Be Included on a Boat Purchase Agreement?The name, address and contact information for the buyer;The name, address and contact information for the seller;A description of the boatbrand, model, year of manufacture, length, Hull Identification Number (HIN);State registration number.

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?