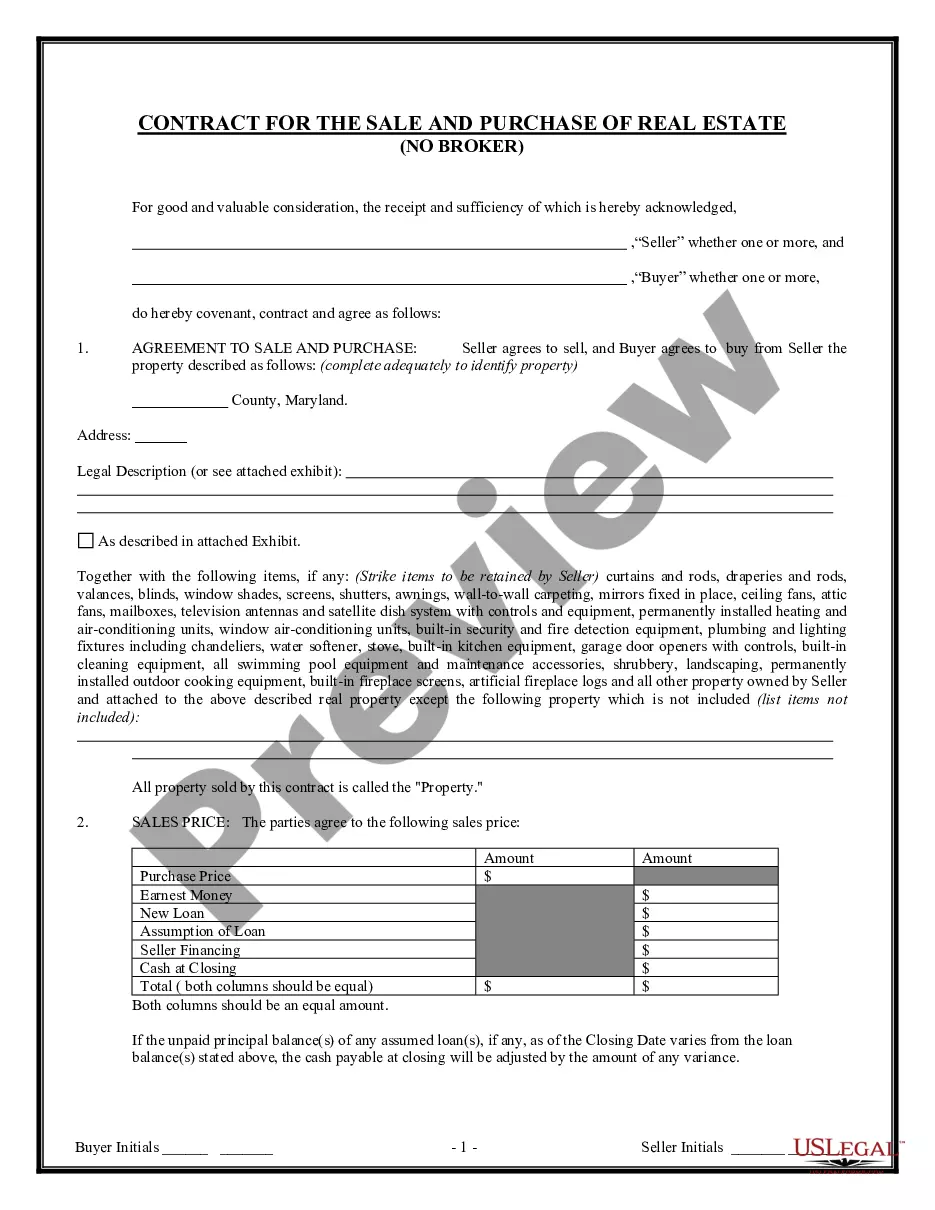

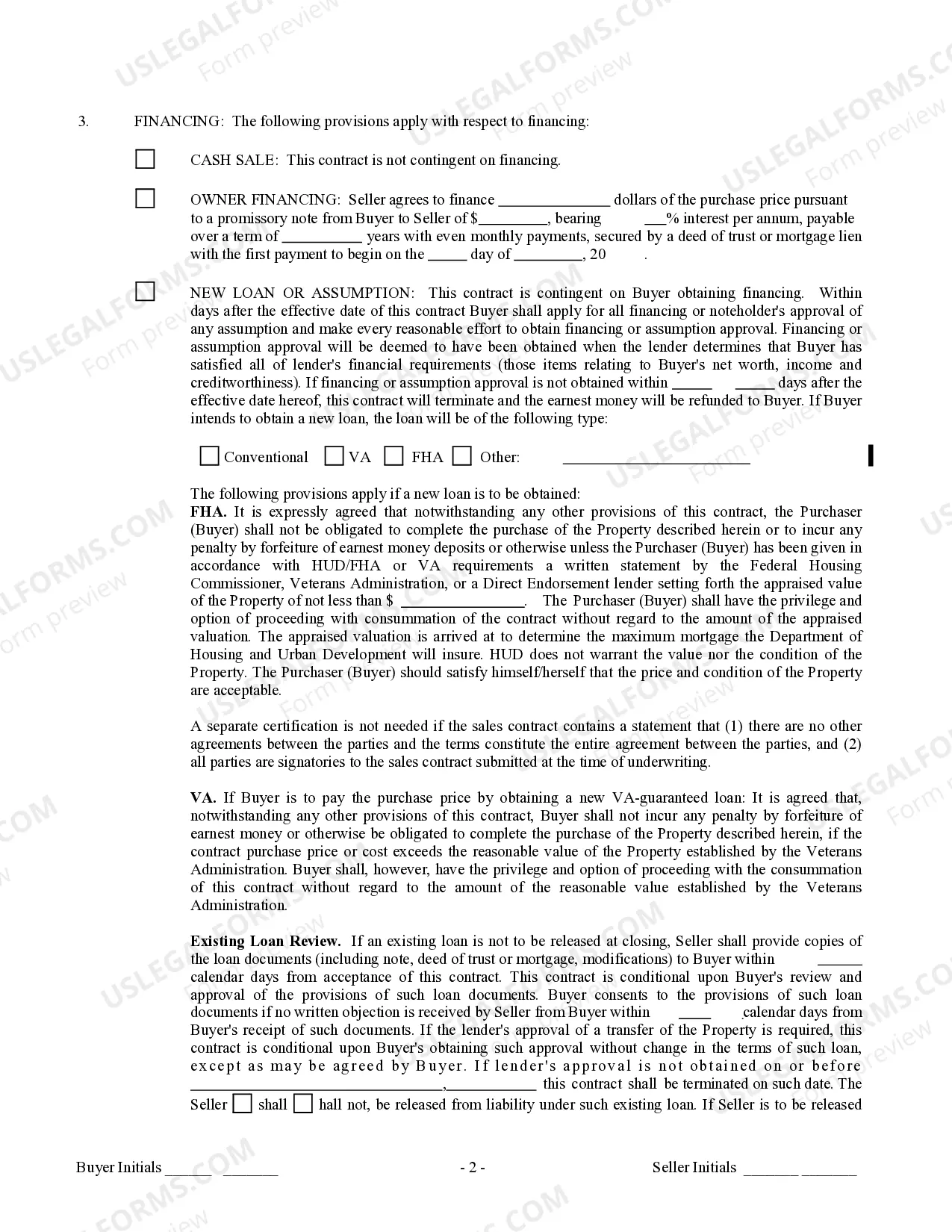

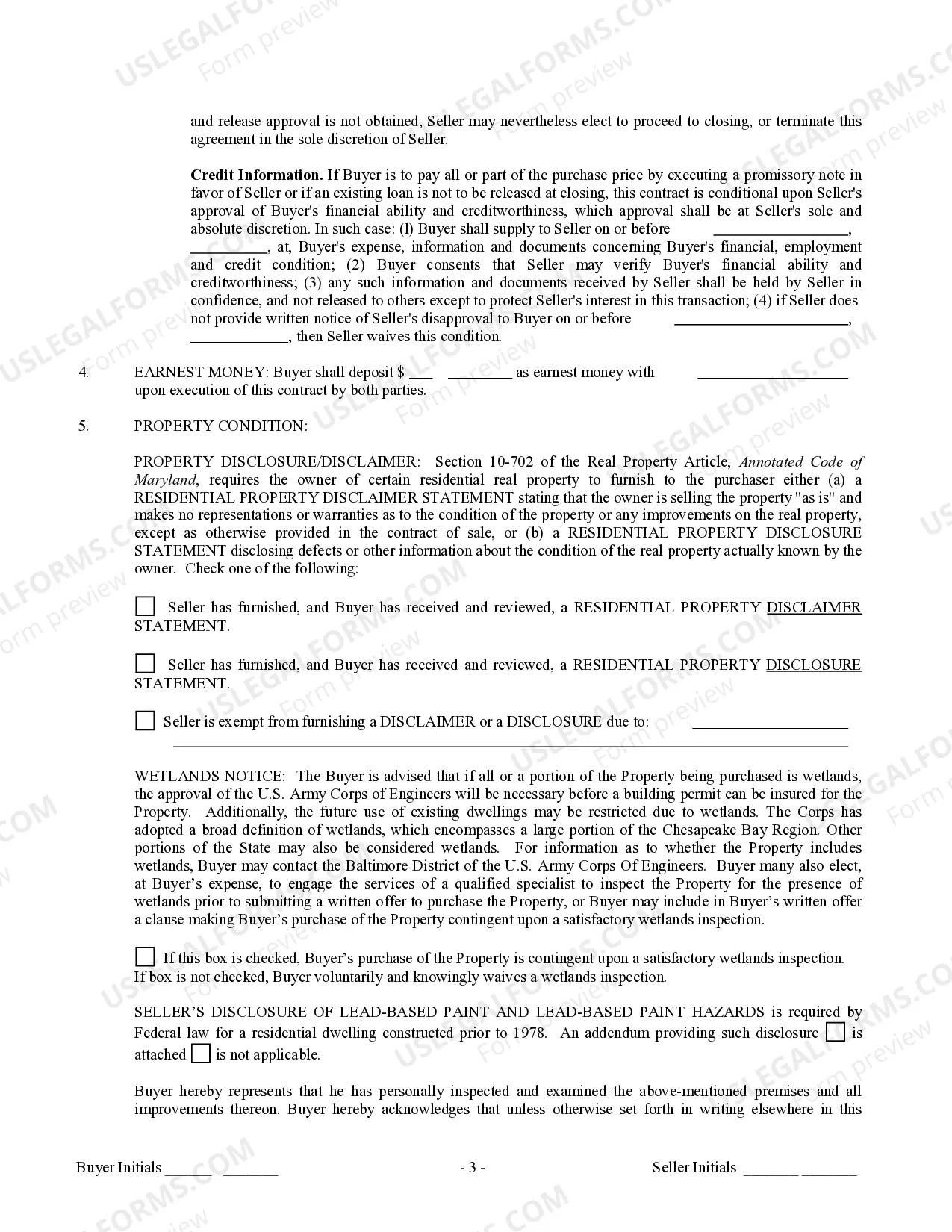

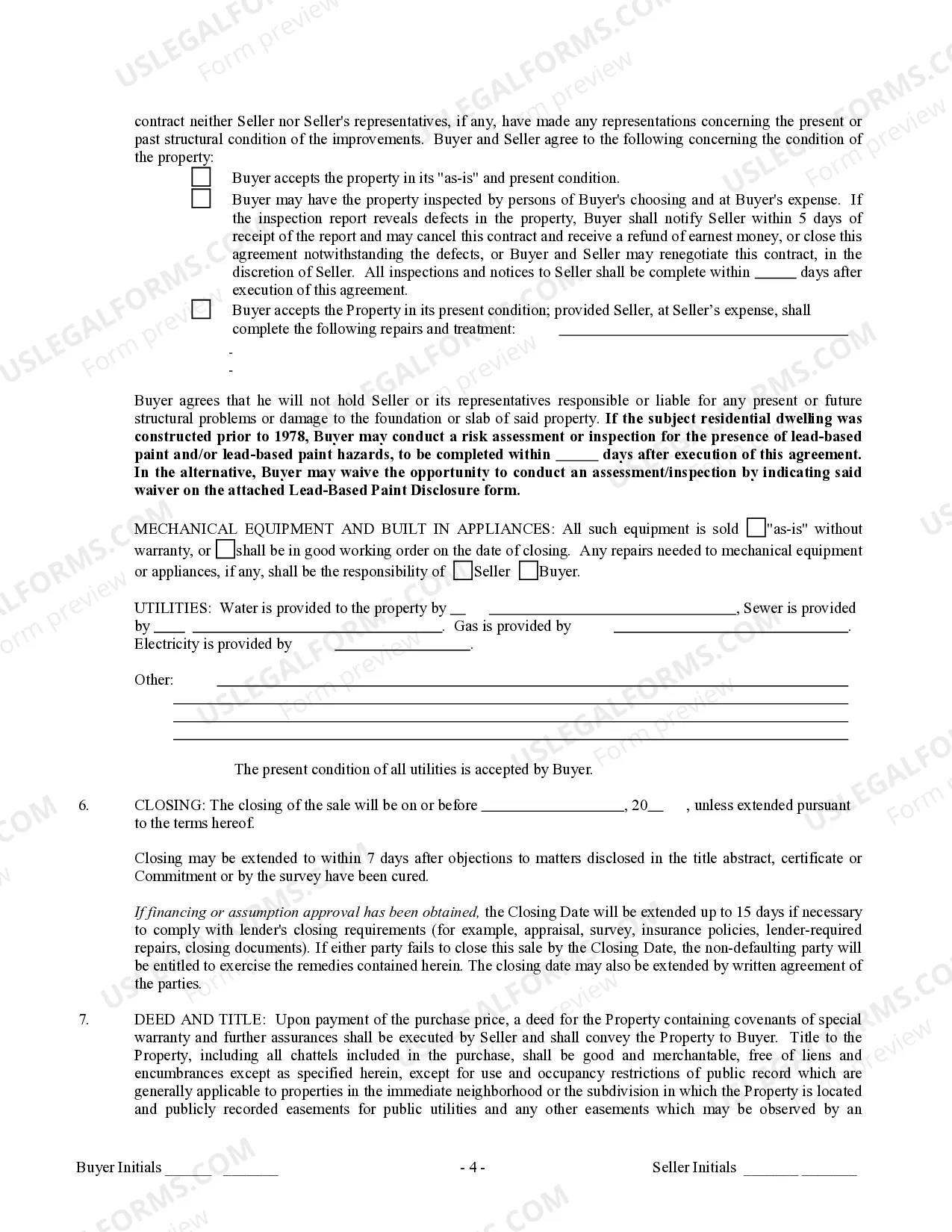

Maryland For Sale By Owner Contract with Owner Financing: A Comprehensive Guide If you are considering purchasing a property in Maryland through a for-sale-by-owner (FBO) transaction and looking for a financing option that cuts out traditional lenders, a Maryland for sale by owner contract with owner financing might be the perfect solution for you. This arrangement allows potential buyers to secure a mortgage directly from the property owner, eliminating the need for a bank or lending institution. In a Maryland for sale by owner contract with owner financing, the seller acts as the lender, providing financial assistance to the buyer in the form of a loan. The contract outlines the terms and conditions of the financing agreement, including interest rates, duration, payment schedule, and any additional provisions specific to the transaction. There are several types of Maryland for sale by owner contracts with owner financing, each offering unique benefits and features tailored to meet the needs of both buyers and sellers: 1. Installment Agreement: In this type of contract, the buyer agrees to make regular payments, including principal and interest, over a specified period of time until the loan is fully repaid. The seller retains the property's legal title until the buyer completes all payments, serving as a form of security for the seller's investment. 2. Lease Purchase Agreement: This contract combines a lease agreement with an option to purchase the property at a predetermined price and date. A portion of the rental payments is credited toward the down payment or purchase price, allowing the buyer to secure the property gradually while building equity. 3. Land Contract: Also known as a contract for deed or agreement for deed, this type of contract allows the buyer to occupy the property while making regular payments to the seller. The seller retains legal ownership until the buyer pays off the contract, at which point the property title transfers to the buyer. 4. Wraparound Mortgage: This agreement involves the buyer assuming the seller's existing mortgage while executing a second mortgage to cover the remaining purchase price. The buyer combines the two mortgages into one payment to the seller, who then distributes the appropriate sums to the existing lender. Regardless of the specific type of Maryland for sale by owner contract with owner financing, it is crucial for both parties to consult legal professionals to ensure that the contract aligns with state regulations and protects their rights and interests. When engaging in a Maryland for sale by owner contract with owner financing, be mindful of relevant keywords for easier searchability and discoverability. Some essential keywords to include in the content are: Maryland for sale by owner contract, owner financing in Maryland, FBO contract with owner financing, types of owner financing in Maryland, Maryland owner financing agreements, seller-financed homes in Maryland, and advantages of owner financing in Maryland. In conclusion, a Maryland for sale by owner contract with owner financing offers an alternative approach to property acquisition, providing flexibility and opportunities for buyers and sellers alike. By understanding the different types of contracts available and integrating relevant keywords into your search, you can navigate the Maryland real estate market with confidence and efficiency.

Maryland For Sale By Owner Contract With Owner Financing

Description owner financing contract

How to fill out Maryland For Sale By Owner Contract With Owner Financing?

The Maryland For Sale By Owner Contract With Owner Financing you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and regional regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, easiest and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Maryland For Sale By Owner Contract With Owner Financing will take you just a few simple steps:

- Look for the document you need and check it. Look through the file you searched and preview it or review the form description to confirm it suits your requirements. If it does not, utilize the search bar to get the appropriate one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Select the format you want for your Maryland For Sale By Owner Contract With Owner Financing (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your papers one more time. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

owner finance agreement template Form popularity

contract for buying a house from owner Other Form Names

FAQ

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

What is Seller Financing? Seller Financing is a real estate agreement in which the seller handles the mortgage process instead of a financial institution. Instead of applying for a conventional bank mortgage, the buyer signs a mortgage with the seller. 1. Owner financing is another name for seller financing.

Owner financing?also known as seller financing?lets buyers pay for a new home without relying on a traditional mortgage. Instead, the homeowner (seller) finances the purchase, often at an interest rate higher than current mortgage rates and with a balloon payment due after at least five years.

A Home of Choice contingency allows you to sell your home to a buyer with the option to back out of the agreement and stay in your home if you're unable to find a new home within your Home of Choice contingency period.

Home of Choice Contingency: This is a contingency in the contract that allows the seller to be in a ratified contract with a buyer, but allows the seller an agreed upon amount of time to find a new home.