Llc Operating Agreement Maryland With S Corp Election

Description

How to fill out Llc Operating Agreement Maryland With S Corp Election?

When you are required to present Llc Operating Agreement Maryland With S Corp Election in accordance with your local state's laws, there may be various alternatives to choose from.

There's no necessity to examine each form to confirm it fulfills all the legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any subject.

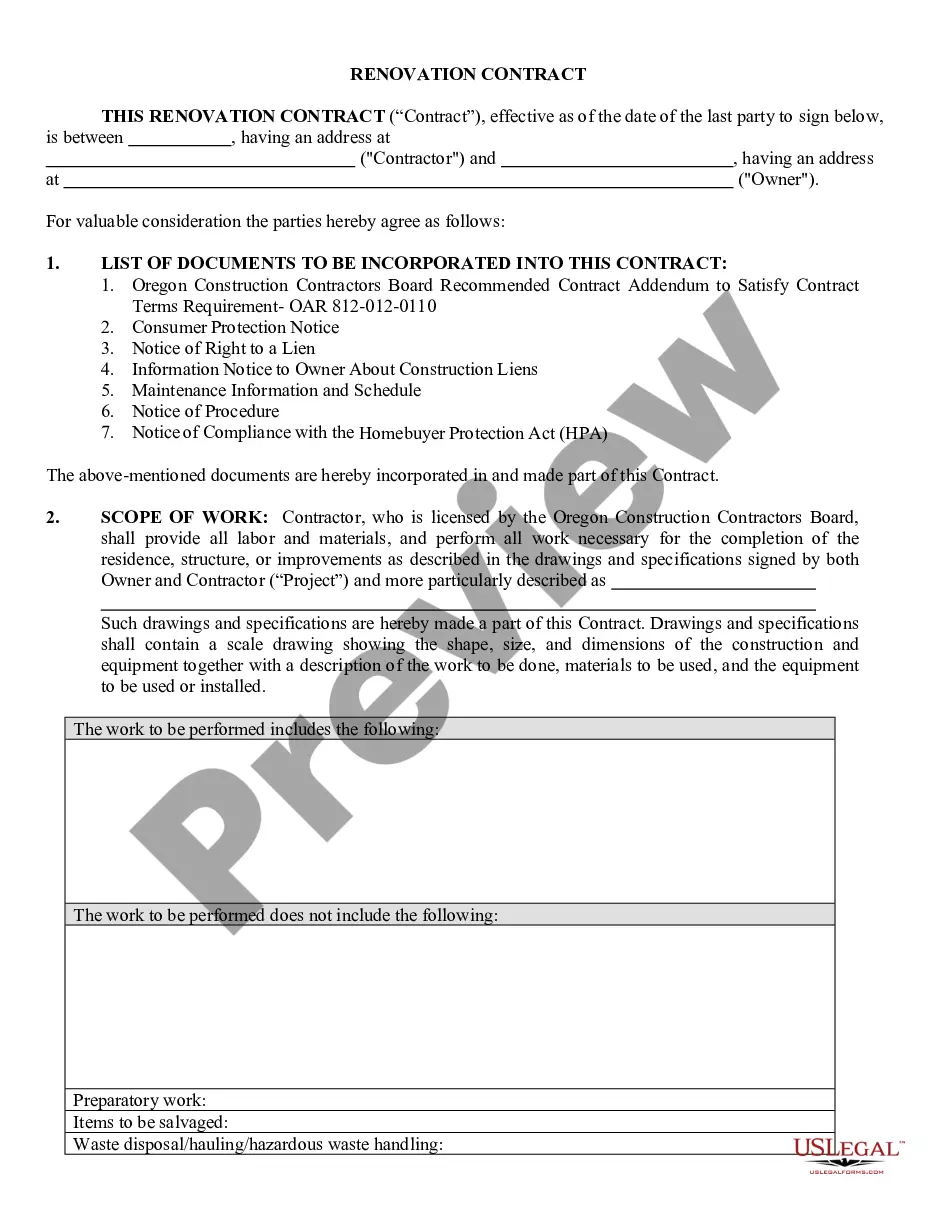

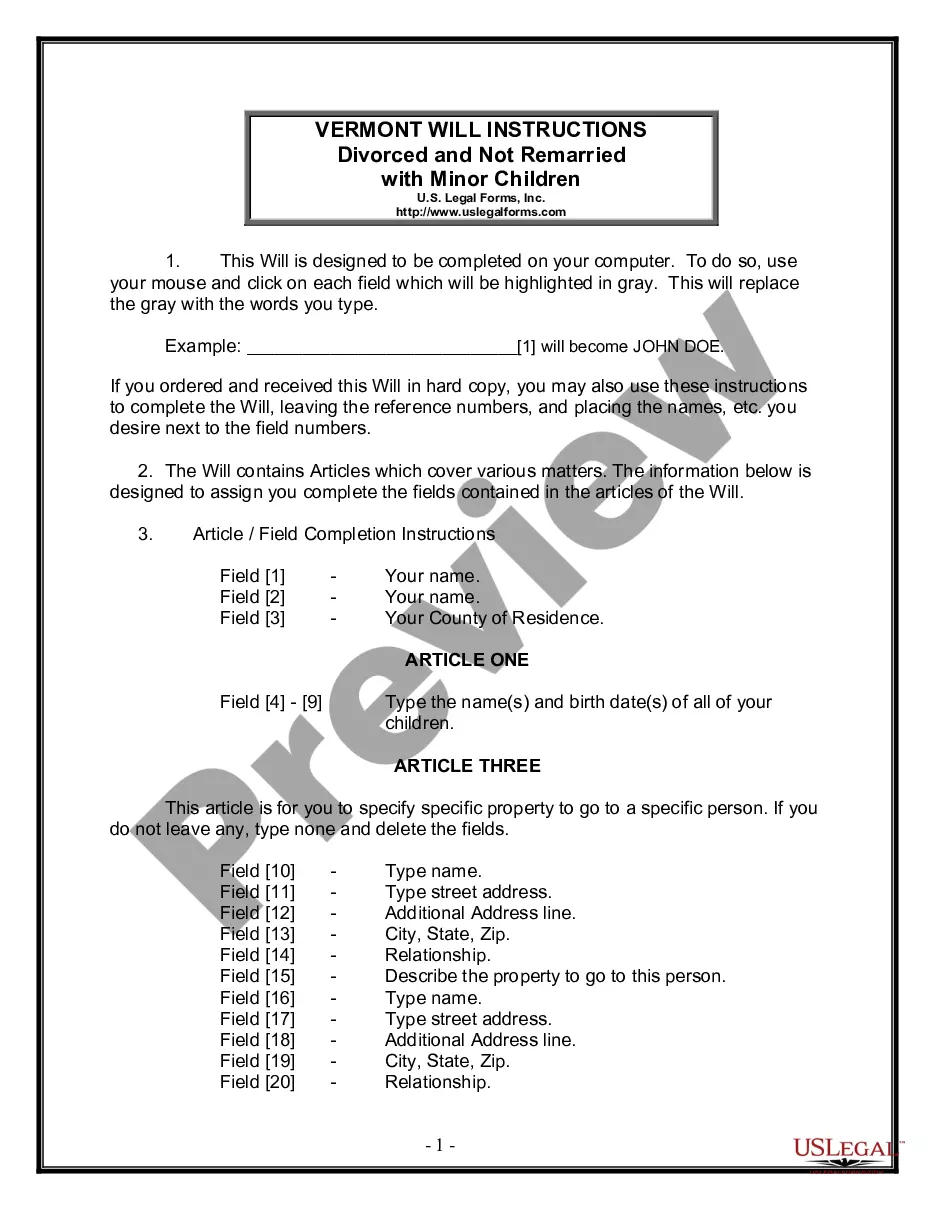

Employ the Preview mode and review the form description if available. Find another example via the Search field in the header if needed. Hit Buy Now once you identify the correct Llc Operating Agreement Maryland With S Corp Election. Select the most appropriate subscription plan, Log Into your account, or create a new one. Make payment for a subscription (PayPal and credit card options are provided). Download the template in your preferred file format (PDF or DOCX). Print the document or complete it electronically in an online editor. Obtaining professionally crafted formal documents becomes simple with US Legal Forms. Additionally, Premium users can also benefit from the powerful integrated solutions for online document editing and signing. Try it out today!

- US Legal Forms is the most extensive online directory featuring a collection of over 85k ready-to-use documents for business and personal legal matters.

- All templates are authenticated to adhere to each state's regulations.

- Thus, when downloading Llc Operating Agreement Maryland With S Corp Election from our platform, you can rest assured that you have a legitimate and current document.

- Obtaining the required sample from our site is exceptionally straightforward.

- If you already possess an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- In the future, you can access the My documents section in your profile and maintain access to the Llc Operating Agreement Maryland With S Corp Election at any time.

- If this is your first time using our website, please follow the instructions below.

- Browse the suggested page and verify it for alignment with your requirements.

Form popularity

FAQ

A Maryland LLC operating agreement is a document that is designed to guide member-managed entities or sole proprietors through the process of establishing the various procedures and policies according to the type of business.

To elect Corporation status, the LLC must file IRS Form 8832 - Entity Classification Election. To elect S Corporation status, the LLC must file IRS Form 2553 - Election by a Small Business Corporation.

Every Maryland LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

You can start an S corporation (S corp) in Maryland by forming a limited liability company (LLC) or a corporation, and then electing S corp status from the IRS when you apply for your EIN. An S corp is an IRS tax classification, not a business structure. The S corp status is used to reduce a business's tax burden.

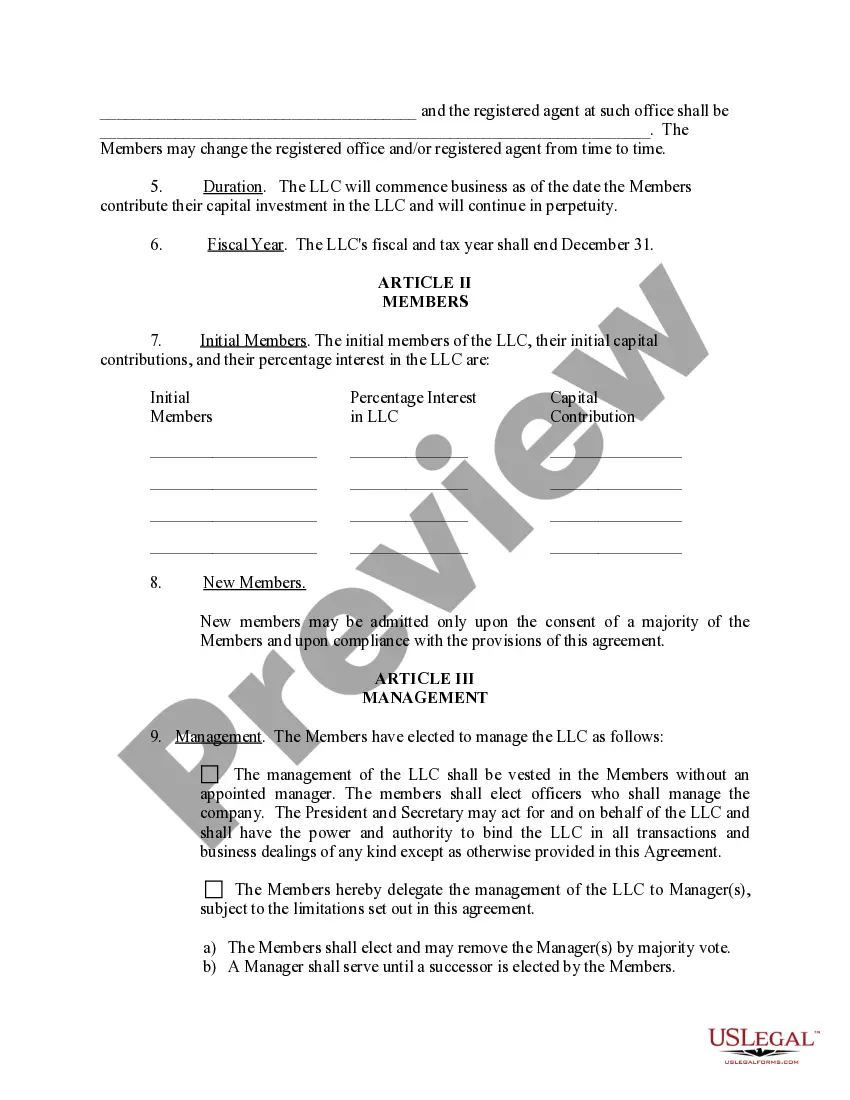

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.