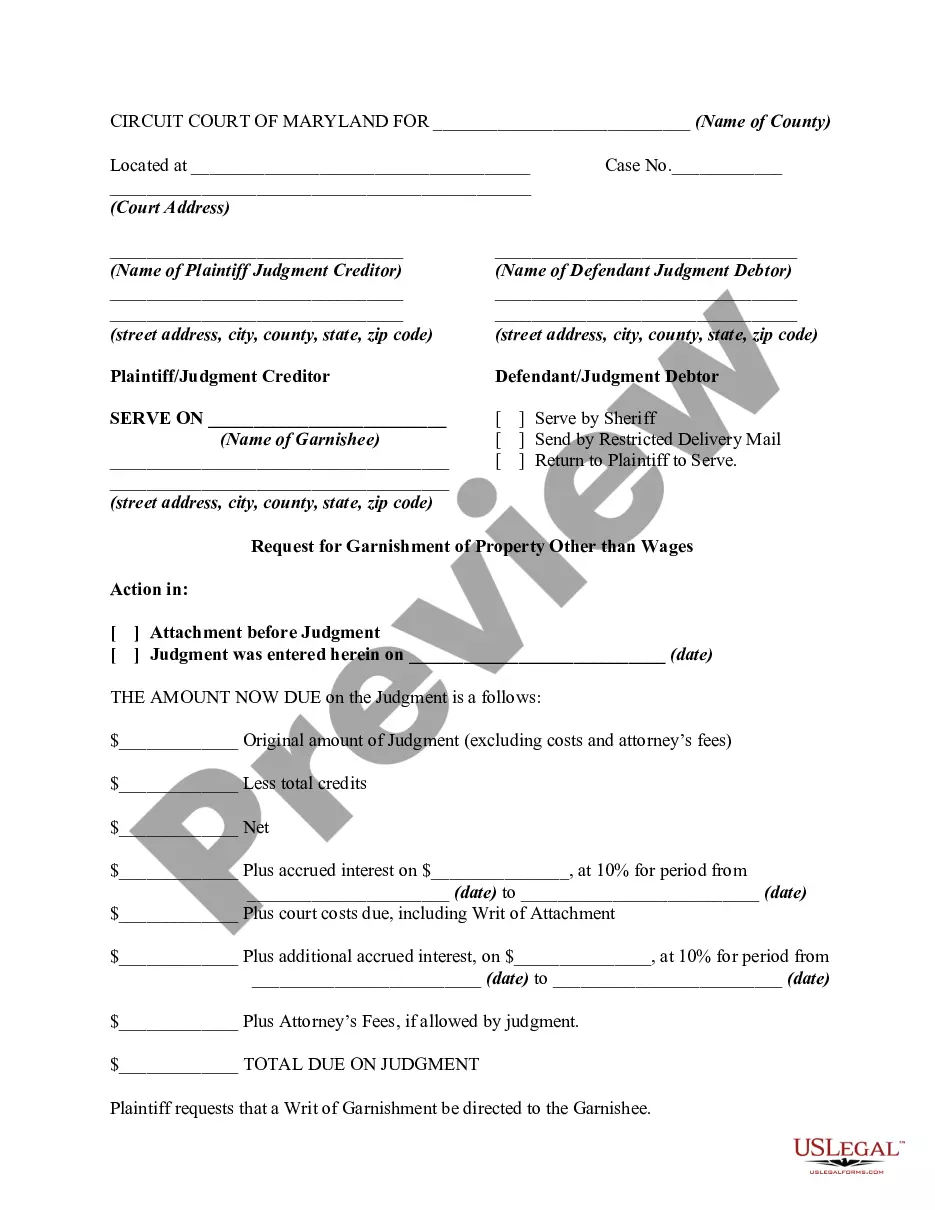

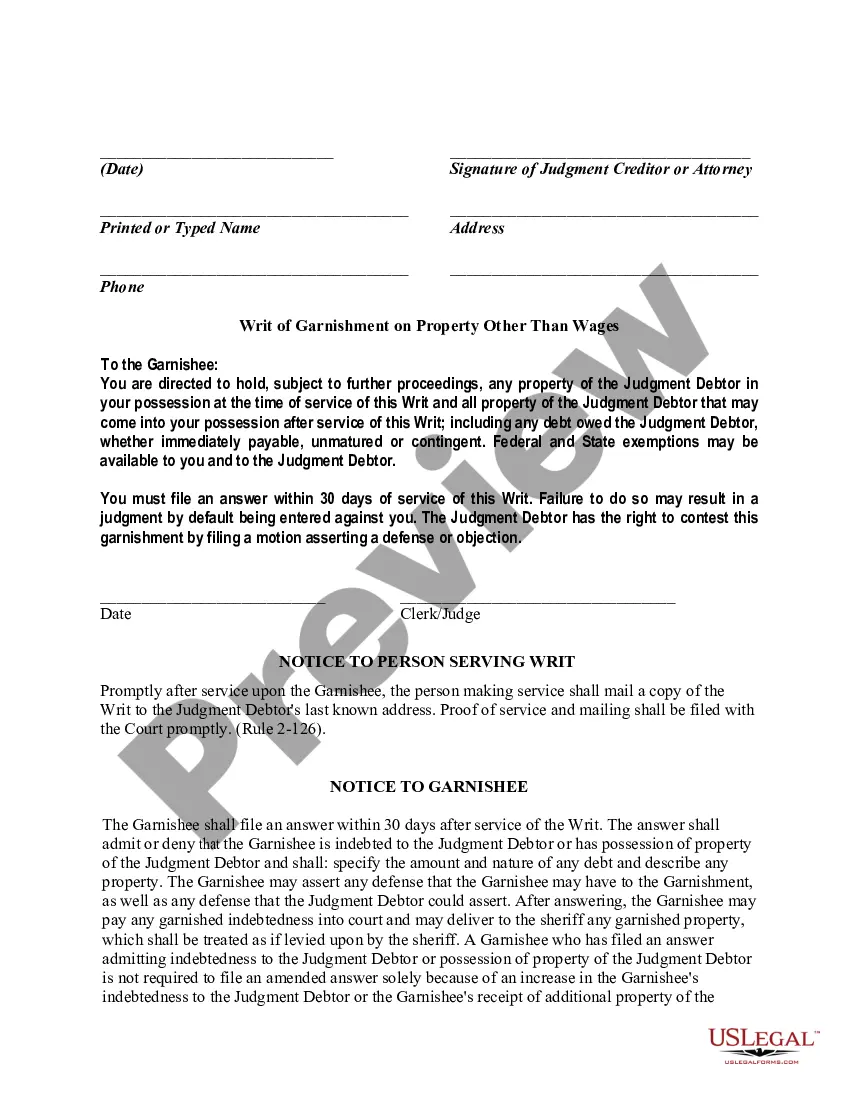

The judgment creditor may obtain issuance of a writ of garnishment by filing in the same action in which the judgment was entered a request that contains (1) the caption of the action, (2) the amount owed under the judgment, (3) the name and last known address of each judgment debtor with respect to whom a writ is requested, and (4) the name and address of the garnishee. Upon the filing of the request, the clerk shall issue a writ of garnishment directed to the garnishee.

Maryland Wage Garnishment Exemption Form

Description

How to fill out Maryland Wage Garnishment Exemption Form?

There's no longer a necessity to waste time searching for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in one location and enhanced their accessibility.

Our website provides over 85,000 templates for any business and personal legal matters compiled by state and usage area. All forms are correctly drafted and verified for legitimacy, so you can have confidence in acquiring a valid Maryland Wage Garnishment Exemption Form.

Select the most suitable pricing plan and either register for an account or Log In. Process your payment with a credit card or through PayPal to continue. Choose the file format for your Maryland Wage Garnishment Exemption Form and download it onto your device. Print out your form to fill it in by hand or upload the template if you prefer to complete it in an online editor. Creating official documents under federal and state laws and regulations is quick and simple with our library. Experience US Legal Forms now to maintain your documentation in order!

- If you are accustomed to our platform and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also access all obtained documents at any time by navigating to the My documents tab in your profile.

- If you are unfamiliar with our platform, the procedure will entail a few additional steps to finish.

- Here's how new users can locate the Maryland Wage Garnishment Exemption Form in our library.

- Scrutinize the page content carefully to confirm it contains the sample you require.

- To achieve this, utilize the form description and preview options if available.

- Employ the Search bar above to find another sample if the current one does not suit your needs.

- Click Buy Now next to the template name once you identify the appropriate one.

Form popularity

FAQ

Filling out a challenge to garnishment form requires careful attention to detail. Begin by providing your personal information and the case number associated with the garnishment. Clearly outline the reasons for your challenge, which may include referencing the Maryland wage garnishment exemption form to explain any exemptions. Submit the completed form according to court guidelines to ensure your challenge is considered.

To write an objection letter regarding wage garnishment, begin by detailing your personal and account information, along with a reference to the garnishment order. Clearly state your objections and include any supporting documentation, like the Maryland wage garnishment exemption form, to bolster your stance. Address the letter to the appropriate court or creditor and ensure you keep a copy for your records.

The best way to stop a garnishment is to proactively address the underlying debt through negotiation or by demonstrating that the garnishment is in violation of your rights. Consider completing the Maryland wage garnishment exemption form if applicable, which may provide you with legal protections. Engaging a legal professional can also significantly enhance your options for stopping garnishment effectively.

Writing a letter to stop wage garnishment should include your personal details, case number, and a clear request for cessation. State the reasons for your request, such as using the Maryland wage garnishment exemption form to assert your claims. Ensure that the letter conveys your situation clearly, and send it to both the creditor and the court. Keeping a copy for your records is essential.

To stop a writ of garnishment in Maryland, you must file a motion with the court that issued the writ. Include necessary documentation to support your claim, such as the Maryland wage garnishment exemption form if applicable. Depending on the circumstances, a hearing may be scheduled, allowing you to present your case. Engaging a legal expert can further assist in navigating this process.

Negotiating a garnishment settlement involves discussing terms with your creditor to reduce the amount owed. Start by reviewing your financial situation and determining what you can realistically afford. Present this information to the creditor, along with any relevant details from the Maryland wage garnishment exemption form that support your case. A successful negotiation could result in a more manageable payment plan.

To answer a writ of garnishment, you need to prepare a response that addresses the claims made in the writ. Include information about any exemptions, such as those highlighted in the Maryland wage garnishment exemption form. Submit your answer to the court and serve a copy to the creditor’s attorney. Timeliness is crucial, so ensure you respond by the court's deadline.

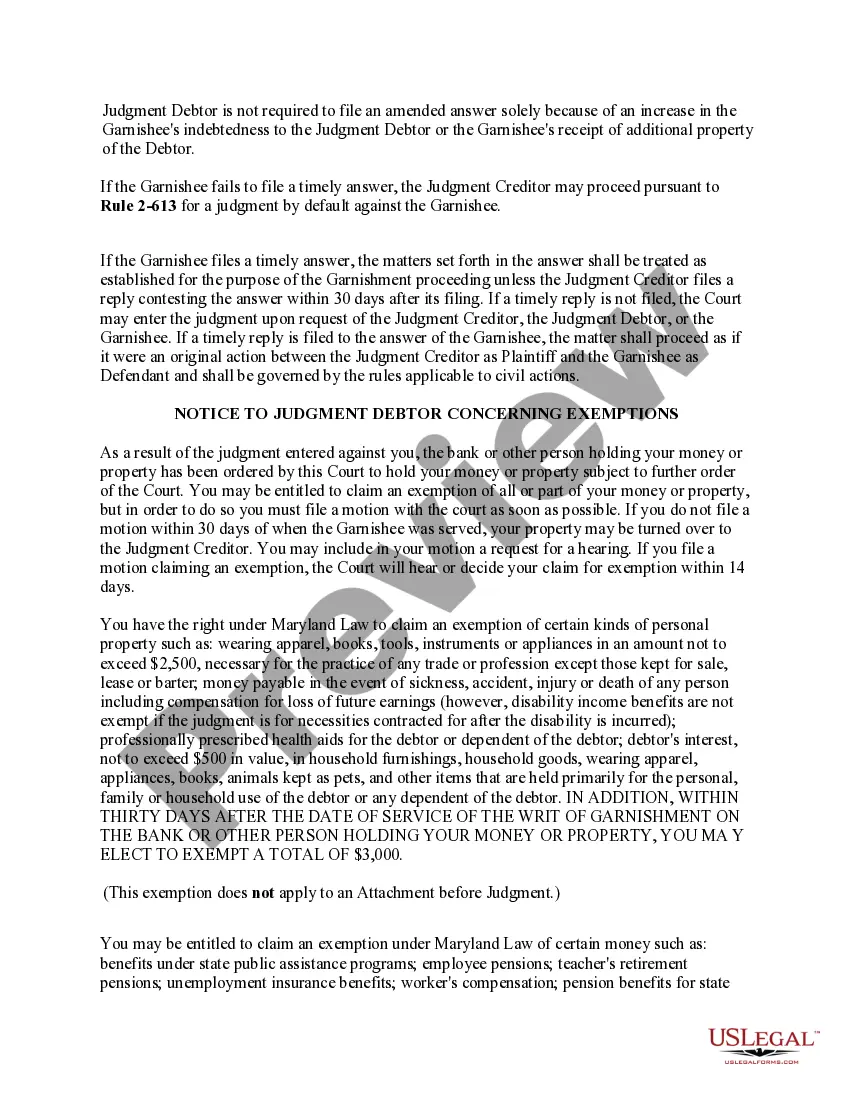

To claim an exemption from wage garnishment in Maryland, complete the Maryland wage garnishment exemption form. This form allows you to assert your rights regarding certain funds that cannot be garnished. You should submit the form to the court that issued the garnishment order, as well as to your employer. Consulting with a legal professional may enhance your understanding of what qualifies for exemption.

When you receive a wage garnishment letter, respond promptly to avoid further complications. Begin by reviewing the garnishment details and gathering necessary documents. You can reference the Maryland wage garnishment exemption form if you believe you qualify for an exemption. Craft a clear and concise response stating your position and any actions you plan to take.

To write a letter to stop a garnishment, start by clearly stating your intention to halt the garnishment process. Include your personal information, details about the garnishment, and a request for reconsideration. You may want to mention the Maryland wage garnishment exemption form to support your case. Make sure to send the letter via certified mail for documentation purposes.