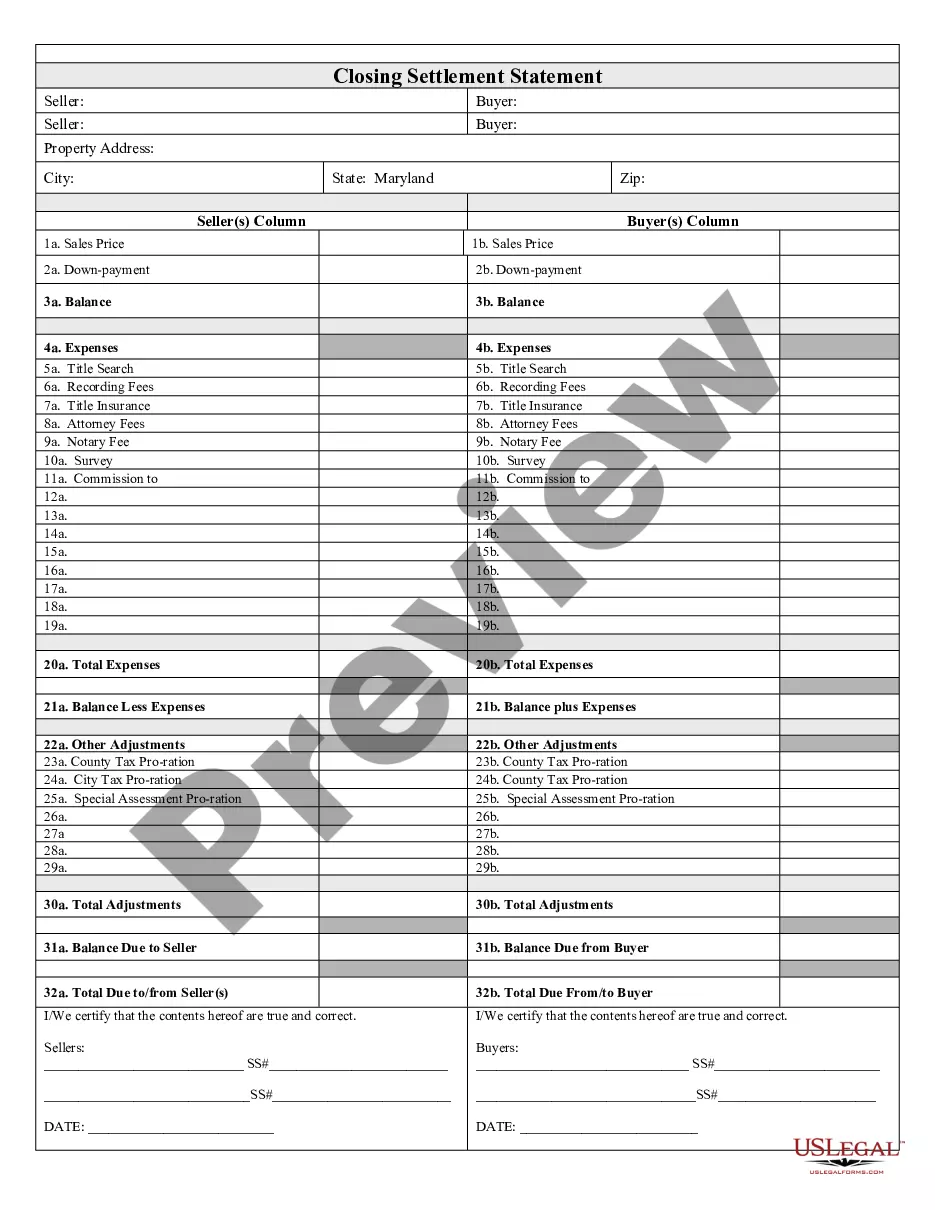

Maryland Closing Costs for Buyers: A Comprehensive Guide When purchasing a home in Maryland, buyers should be prepared to cover various closing costs that are associated with the sale transaction. Closing costs are additional expenses incurred by buyers beyond the property's purchase price and are an integral part of the home buying process. In Maryland, these costs typically fall into several categories. 1. Mortgage-related Costs: The majority of closing costs for buyers in Maryland are usually related to securing a mortgage loan. These costs may include application or loan origination fees, credit report fees, appraisal fees, and mortgage insurance premiums. It is essential for buyers to carefully review the terms and conditions of their specific mortgage agreement to determine which costs are applicable. 2. Title-related Costs: Title-related expenses for buyers in Maryland primarily consist of title insurance premiums. Title insurance protects buyers and lenders against potential ownership disputes, liens, or other defects in the property's title. Additionally, fees might also apply for title searches, surveys, and recording the new deed. 3. Inspection and Appraisal Costs: Home inspections and appraisals are crucial steps in the home buying process. While inspections are not technically closing costs, buyers should still factor in these expenses as part of their overall budget. Inspections can include general home inspections, termite inspections, radon inspections, and more. Similarly, appraisals are often required by lenders to assess the property's value and ensure that it aligns with the loan amount. 4. Attorney and Settlement Costs: In Maryland, it is common for buyers to engage an attorney or a settlement agent to facilitate the closing process. These professionals ensure that all legal aspects of the transaction are handled properly. Buyers should expect to pay attorney or settlement fees which may cover document preparation, contract reviews, and settlement coordination. 5. Recording and Transfer Taxes: Buyers in Maryland are responsible for paying recording and transfer taxes during the closing process. Transfer taxes are calculated based on the property's sale price, and the rates vary by county. Recording fees cover the cost of recording the new deed and other relevant documents with the county's land records office. 6. Prepaid Expenses: Before closing, buyers may need to prepay certain expenses, such as property taxes, homeowner's insurance, and mortgage interest. These prepaid expenses are typically prorated from the closing date until the end of the given period, ensuring that the property is adequately covered and taxes are paid. While this list covers the most common Maryland closing costs for buyers, it is important to note that specific circumstances and loan terms may result in additional fees or variations. Buyers should always consult with their lenders, real estate agents, and attorneys to get a clear understanding of the expected closing costs and budget accordingly. In summary, Maryland closing costs for buyers include mortgage-related expenses, title-related fees, inspection and appraisal costs, attorney and settlement charges, recording and transfer taxes, as well as prepaid expenses. Being aware of these costs and planning ahead will empower buyers to navigate the closing process smoothly and avoid any last-minute surprises.

Maryland Closing Costs For Buyer

Description how much are closing costs in md

How to fill out Maryland Closing Costs For Buyer?

It’s obvious that you can’t become a legal professional immediately, nor can you learn how to quickly prepare Maryland Closing Costs For Buyer without the need of a specialized set of skills. Putting together legal forms is a time-consuming process requiring a certain training and skills. So why not leave the preparation of the Maryland Closing Costs For Buyer to the professionals?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court paperwork to templates for internal corporate communication. We know how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our website and obtain the form you require in mere minutes:

- Discover the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Maryland Closing Costs For Buyer is what you’re searching for.

- Begin your search again if you need any other template.

- Set up a free account and choose a subscription plan to purchase the form.

- Pick Buy now. Once the payment is complete, you can get the Maryland Closing Costs For Buyer, complete it, print it, and send or send it by post to the designated individuals or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

A student shall be eligible for varsity competition in grades 9, 10, 11 and 12 until his/her 19th birthday. A student who attains the age of 19 on or after July 1 may continue to participate during that school year in all varsity sports.

EIGHT SEMESTER RULE: No student may be eligible to participate at the high school level for a period lasting longer than eight consecutive semesters, beginning with the student's first entry into grade nine, or participation on a high school team as an overage seventh- or eighth- grade student, whichever comes first.

To retain and recruit 'the best and brightest,' members of the CCBOE approved offering a retention bonus of $1,000 for any staff member (certified & classified) who completed their employment contract during the 2021-2022 school year and continues to be employed by CCS on Dec.

CCS Rule: Students must have a 70% cumulative average for the previous semester. A student is ineligible to participate at the middle school level if he/she becomes 15 years of age on or before August 31. Sixth-grade students are automatically eligible in the fall based on their promotion from fifth grade.

Student athletes must receive a medical examination once every 395 days by a duly licensed physician, nurse practitioner, or physician's assistant. A student may not participate in any sport if his or her 19th birthday comes on or before August 31st of the current school year.