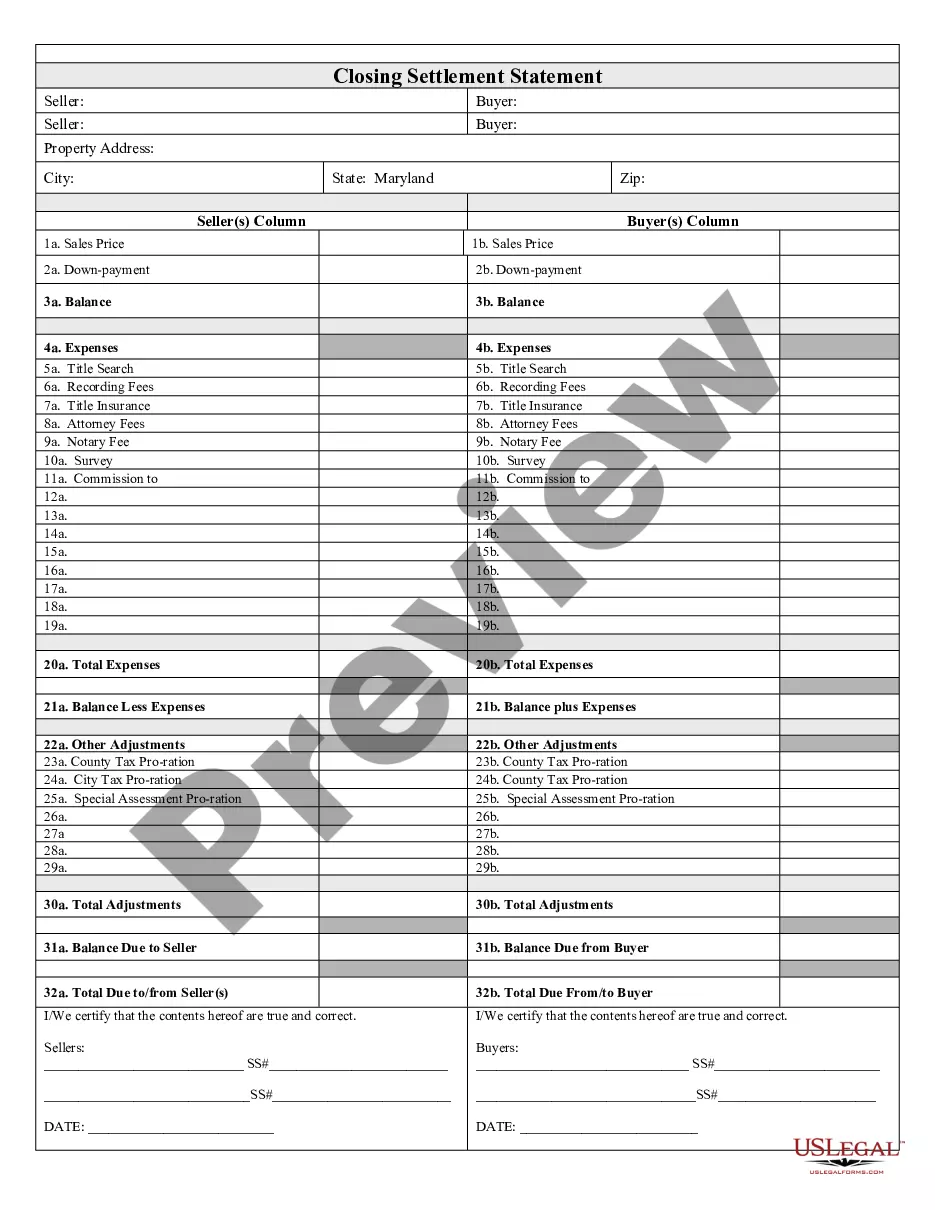

Maryland Closing Costs for Seller: A Comprehensive Guide When selling a property in Maryland, it's essential to be aware of the various closing costs that sellers are responsible for. Closing costs refer to the expenses that sellers incur during the transfer of property ownership. These costs typically include fees, taxes, and other charges that are essential to complete the real estate transaction. Let's delve into the intricacies of Maryland closing costs for sellers, highlighting the various types and their significance while incorporating relevant keywords throughout: 1. Transfer Taxes: In Maryland, sellers are subject to both state and county transfer taxes. The state transfer tax is typically 0.50% of the property's sale price, while county transfer taxes vary between counties, ranging from 0.50% to 1.50%. It is crucial to mention the county-specific transfer tax rates relevant to Baltimore City, Montgomery County, Anne Arundel County, etc., throughout the article. 2. Decoration Fees: Sellers in Maryland are responsible for paying decoration fees that accompany the recording of the property deed. These fees can vary depending on the county and the property's value. Mention specific counties' fees such as Montgomery County's flat rate of $6.90 per $500 of the property's sales price to provide localized information. 3. Reissue Rates: In cases where the seller has an existing title insurance policy, they might be eligible for a reissue rate. Reissue rates can help lower the title insurance premium for both lenders and owners. Highlighting the cost-saving opportunities can be useful and enticing to potential sellers in Maryland. 4. Escrow and Settlement Fees: Sellers in Maryland are often responsible for the fees associated with the escrow and settlement process. These costs cover the services rendered by the escrow agent or settlement company, including document preparation, title search, and ensuring a smooth closing process. Use keywords such as "escrow fees in Maryland" or "settlement fees for sellers" to enhance search engine optimization. 5. Commission Fees: When selling a property in Maryland, sellers typically engage the services of a real estate agent or broker. As part of the agreement, sellers agree to pay a commission fee, usually a percentage of the property's final sale price, to their agent. Emphasizing the significance of commission fees and their negotiability can be valuable to sellers looking to maximize their profits. 6. Home Warranty Fees: While not mandatory, sellers in Maryland may offer a home warranty to potential buyers for added peace of mind. The home warranty fees are typically paid by the seller and provide coverage for major systems and appliances within the property. Mentioning the potential benefits of offering a home warranty can be relevant for Maryland sellers seeking to enhance their listing. 7. Miscellaneous Costs: Sellers may also encounter additional costs, such as outstanding property taxes, outstanding HOA fees, or prorated utilities. These costs can vary depending on the specific circumstances of the sale and should be considered when estimating Maryland closing costs. In conclusion, selling a property in Maryland involves several closing costs that sellers need to familiarize themselves with. By understanding the various types of closing costs, including transfer taxes, decoration fees, escrow and settlement fees, commission fees, home warranty fees, and miscellaneous costs, sellers can better prepare for the financial implications of selling their property in Maryland. Keyword integration throughout this comprehensive guide will ensure maximum online visibility for individuals seeking information about Maryland closing costs for sellers.

Maryland Closing Costs For Seller

Description

How to fill out Maryland Closing Costs For Seller?

The Maryland Closing Costs For Seller you see on this page is a multi-usable legal template drafted by professional lawyers in accordance with federal and local regulations. For more than 25 years, US Legal Forms has provided individuals, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, most straightforward and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Maryland Closing Costs For Seller will take you just a few simple steps:

- Search for the document you need and review it. Look through the sample you searched and preview it or check the form description to ensure it satisfies your requirements. If it does not, make use of the search option to get the right one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Choose the format you want for your Maryland Closing Costs For Seller (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a eSignature.

- Download your papers one more time. Use the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

Have you heard about the Social Security $16,728 yearly bonus? There's really no ?bonus? that retirees can collect. The Social Security Administration (SSA) uses a specific formula based on your lifetime earnings to determine your benefit amount.

There is no specific ?bonus? retirees can collect from the Social Security Administration. For example, you're not eligible to get a $5,000 bonus check on top of your regular benefits just because you worked in a specific career. Social Security doesn't randomly award money to people.

One must either be over the age of sixty-five, blind and/or disabled. Additionally, they must have a limited income and resources as the program is need-based and aims to assist beneficiaries to cover basic costs for food and shelter.

How to Fill Out a Social Security SS-5 Form - YouTube YouTube Start of suggested clip End of suggested clip Provide your previous social security number if you had one check the appropriate boxes to chooseMoreProvide your previous social security number if you had one check the appropriate boxes to choose your ethnicity and race. If you are applying on behalf of a dependent. Child fill out the parental.

Some ways to increase your Social Security payments include: Work at least 35 years. Earn more if possible. Work until full retirement age. Delay claiming until age 70. Claim spousal payments. Include family. Know retirement earning limits. Minimize Social Security taxes.

Today, you can apply for retirement, disability, and Medicare benefits online, check the status of an application or appeal, request a replacement Social Security card (in most areas), print a benefit verification letter, and more ? from anywhere and from any of your devices!

Complete your application online. Call our toll-free telephone number 1-800-772-1213. If you are deaf or hard of hearing, you can call us at TTY 1-800-325-0778. Call or visit your local Social Security office.

Your Social Security benefits will be permanently reduced by up to 30% if you claim "early," at age 62. However, waiting until 70 years old has the opposite effect. Your monthly benefits will receive an additional 8% "bonus" for each year you delay claiming benefits past full retirement age.